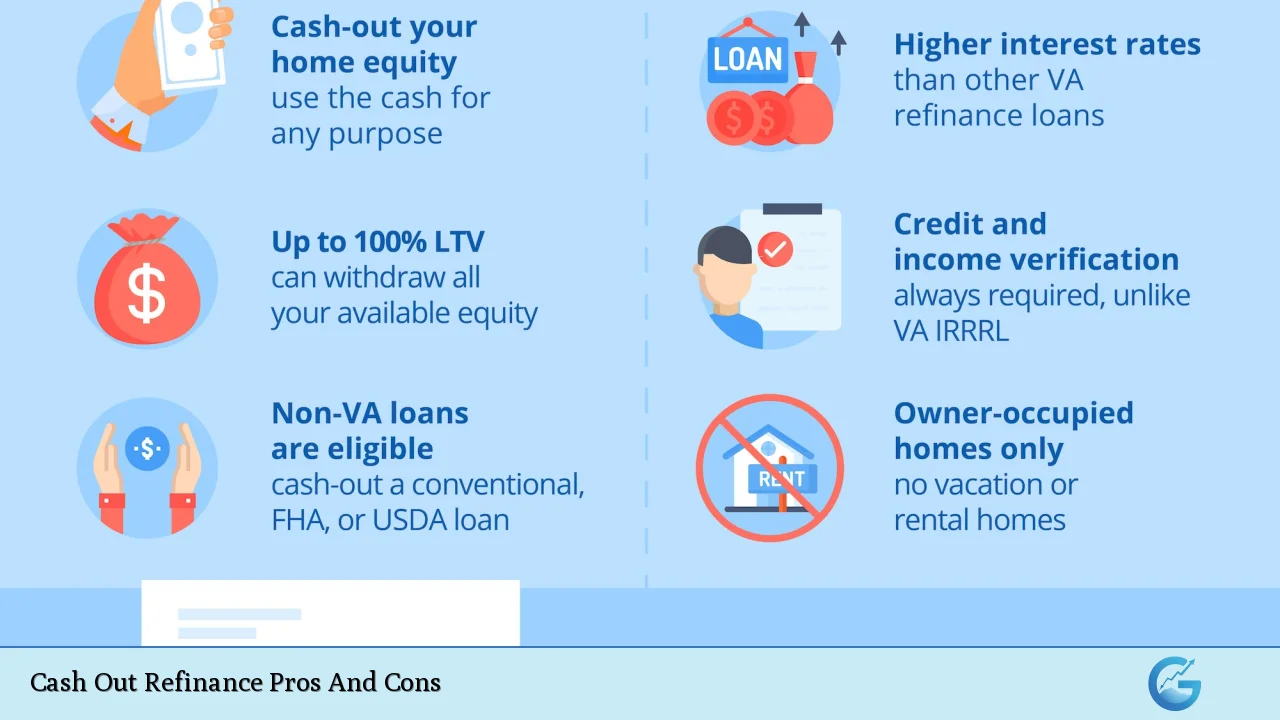

A cash-out refinance is a financial strategy that allows homeowners to tap into their home equity by refinancing their existing mortgage for a larger amount than what they owe. The difference between the new mortgage and the old mortgage is taken out in cash, which can be used for various purposes such as home improvements, debt consolidation, or other expenses. While this option can provide significant financial benefits, it also comes with its own set of risks and drawbacks. Understanding the pros and cons of cash-out refinancing is crucial for anyone considering this route.

| Pros | Cons |

|---|---|

| Access to large sums of money | Increased debt burden |

| Potentially lower interest rates | Risk of foreclosure |

| Predictable monthly payments | Higher overall interest costs |

| Possible tax deductions on interest | Closing costs associated with refinancing |

| Flexibility in using funds | Reduced home equity |

| Improvement in credit score potential | Longer repayment terms |

Access to Large Sums of Money

One of the most significant advantages of a cash-out refinance is the ability to access substantial amounts of cash. Homeowners can leverage their home equity to obtain funds for various purposes, such as:

- Home improvements: Renovating or upgrading your home can increase its value.

- Debt consolidation: Paying off high-interest debts can streamline finances and reduce monthly payments.

- Education expenses: Funding tuition or educational programs can be managed through this cash.

- Emergency funds: Building a safety net for unexpected expenses is another common use.

The ability to unlock equity in your home provides financial flexibility that other loan types may not offer.

Potentially Lower Interest Rates

Cash-out refinancing often comes with the potential for lower interest rates compared to other forms of borrowing, such as personal loans or credit cards. This can result in:

- Lower monthly payments: If the new mortgage rate is significantly lower than your previous one, you may enjoy reduced monthly payments.

- Long-term savings: A lower rate can lead to substantial savings over the life of the loan.

However, it’s essential to compare rates carefully, as market conditions fluctuate and individual circumstances vary.

Predictable Monthly Payments

When opting for a cash-out refinance, homeowners typically replace their existing mortgage with a new fixed-rate mortgage. This offers several benefits:

- Stability: Fixed-rate mortgages provide predictable monthly payments, making budgeting easier.

- Simplicity: Consolidating multiple debts into one mortgage payment reduces complexity in managing finances.

This predictability can be advantageous for those who prefer consistent financial obligations.

Possible Tax Deductions on Interest

Interest paid on a cash-out refinance may be tax-deductible if the funds are used for eligible home improvements. This potential tax benefit can make cash-out refinancing more appealing:

- Tax savings: Homeowners may reduce their taxable income by deducting interest payments.

- Consultation recommended: It’s advisable to consult a tax professional to understand specific eligibility requirements and implications.

This aspect adds another layer of financial advantage when considering a cash-out refinance.

Flexibility in Using Funds

The funds obtained through a cash-out refinance are versatile and can be used for various purposes:

- Investment opportunities: Homeowners might invest in stocks, real estate, or other ventures.

- Large purchases: The cash can facilitate significant purchases without depleting savings.

This flexibility allows homeowners to tailor their financial strategies according to their needs and goals.

Improvement in Credit Score Potential

Using a cash-out refinance to pay off high-interest debts can lead to an improvement in credit scores due to:

- Lower credit utilization ratio: Reducing outstanding credit card balances positively impacts credit scores.

- Timely payments: Consolidating debts into one manageable payment may lead to more consistent payment habits.

However, it’s crucial to address underlying spending behaviors to prevent future debt accumulation.

Increased Debt Burden

While accessing cash through refinancing has its benefits, it also increases your overall debt load. Homeowners should consider:

- Higher loan amount: The new mortgage will be larger than the previous one, increasing total debt.

- Potential financial strain: If income decreases or expenses rise unexpectedly, managing higher payments could become challenging.

It’s vital to assess personal financial situations before committing to this route.

Risk of Foreclosure

A significant risk associated with cash-out refinancing is the potential for foreclosure. Since the home serves as collateral:

- Default consequences: Failing to make payments could lead to losing your home.

- Increased responsibility: Homeowners must ensure they can manage the higher monthly payments resulting from refinancing.

Understanding this risk is crucial when weighing the decision to pursue a cash-out refinance.

Higher Overall Interest Costs

Although a cash-out refinance may offer lower initial rates, it could lead to higher overall interest costs over time due to:

- Longer loan terms: Extending repayment periods means paying interest over more years.

- Increased principal balance: A larger loan amount results in more interest accrued throughout the loan’s life.

Homeowners should calculate total costs carefully before proceeding with refinancing.

Closing Costs Associated with Refinancing

Cash-out refinances come with closing costs similar to those incurred during the original mortgage process. These costs can include:

- Appraisal fees: Required assessments of property value can add significant costs.

- Title insurance and processing fees: Additional charges may apply based on lender policies.

It’s essential to factor these costs into your decision-making process as they impact overall profitability.

Reduced Home Equity

Taking cash out through refinancing reduces the equity built up in your home. This has implications such as:

- Less available equity for future needs: Homeowners may find themselves unable to access funds later if equity is depleted.

- Impact on selling price: Selling the home could yield less profit if substantial equity has been withdrawn.

Understanding how this affects long-term financial planning is vital when considering a cash-out refinance.

Longer Repayment Terms

Opting for a cash-out refinance often means extending the repayment period of your mortgage. This results in:

- Higher lifetime interest payments: Longer terms typically mean paying more interest over time.

- Potentially larger monthly payments: Depending on how much equity is cashed out, monthly obligations may increase significantly.

Evaluating whether you are comfortable with longer terms is essential before proceeding.

In conclusion, while a cash-out refinance offers several advantages such as access to large sums of money and potentially lower interest rates, it also carries significant risks including increased debt burden and foreclosure risk. Homeowners must carefully evaluate their financial situation and long-term goals before deciding if this option aligns with their needs. As with any major financial decision, consulting with a financial advisor or mortgage professional can provide valuable insights tailored to individual circumstances.

Frequently Asked Questions About Cash Out Refinance Pros And Cons

- What is a cash-out refinance?

A cash-out refinance replaces your existing mortgage with a new one that has a higher principal balance, allowing you to take out the difference in cash. - How much equity do I need for a cash-out refinance?

Most lenders require homeowners to maintain at least 20% equity after taking cash out. - Can I use cash from a refinance for anything?

Yes, you can use it for various purposes like home improvements, debt consolidation, or education expenses. - What are the risks associated with a cash-out refinance?

The primary risks include increased debt burden and potential foreclosure if payments cannot be met. - Are there tax benefits associated with cash-out refinancing?

The interest paid on loans used for eligible home improvements may be tax-deductible. - How does closing cost affect my decision?

Closing costs can significantly impact overall expenses; it’s important to factor these into your calculations. - Will my credit score improve with a cash-out refinance?

If used wisely to pay off high-interest debts, it could improve your credit score by lowering your credit utilization ratio. - Is it possible to get lower interest rates through refinancing?

A cash-out refinance might offer lower rates compared to personal loans or credit cards but varies based on market conditions and individual circumstances.