Variable Universal Life (VUL) insurance is a sophisticated financial product that combines the death benefit of traditional life insurance with the potential for investment growth. This type of policy offers policyholders the flexibility to adjust their premium payments and death benefits, while also providing an opportunity to invest in a variety of subaccounts, similar to mutual funds. As with any complex financial instrument, VUL insurance comes with its own set of advantages and disadvantages that potential investors should carefully consider.

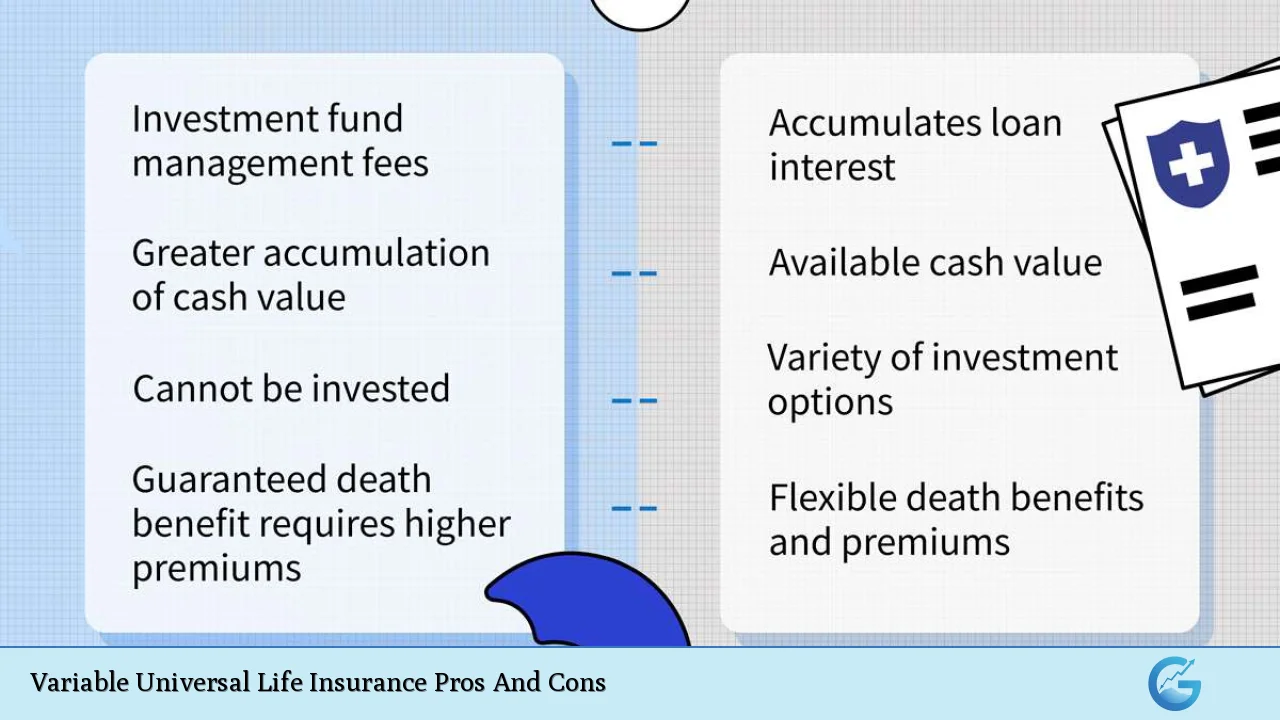

| Pros | Cons |

|---|---|

| Flexible premium payments | Market risk exposure |

| Investment growth potential | Higher fees and expenses |

| Tax-deferred growth | Complex product structure |

| Adjustable death benefit | Potential for policy lapse |

| Access to cash value | No guaranteed returns |

| Diverse investment options | Requires active management |

| Permanent life coverage | Higher initial costs |

| Estate planning benefits | Surrender charges |

Advantages of Variable Universal Life Insurance

Flexible Premium Payments

One of the most attractive features of VUL insurance is the flexibility it offers in terms of premium payments. Unlike traditional whole life insurance policies that require fixed premium payments, VUL allows policyholders to adjust their premium amounts within certain limits. This flexibility can be particularly beneficial for individuals with fluctuating incomes or those who want to align their insurance costs with their current financial situation.

- Ability to increase or decrease premium payments

- Option to skip payments if sufficient cash value exists

- Potential to pay additional premiums to boost investment component

It’s important to note that while premium flexibility is advantageous, policyholders must ensure that the cash value remains sufficient to cover ongoing insurance costs to prevent policy lapse.

Investment Growth Potential

VUL policies offer the opportunity for potentially higher returns compared to traditional life insurance products. Policyholders can allocate their cash value among various investment subaccounts, which may include stocks, bonds, and money market funds. This investment component allows for the possibility of substantial cash value growth over time, especially in bullish market conditions.

- Access to a range of investment options

- Potential for higher returns than traditional life insurance

- Opportunity to benefit from market upswings

The investment potential of VUL can be particularly appealing to those with a long-term investment horizon and a higher risk tolerance.

Tax-Deferred Growth

One of the significant tax advantages of VUL insurance is the tax-deferred growth of the cash value component. As long as the policy remains in force, the investment gains within the policy are not subject to current income tax. This tax-deferred status can lead to more substantial compound growth over time compared to taxable investment accounts.

- No taxes on investment gains while in the policy

- Potential for higher long-term growth due to tax deferral

- Tax-free transfers between subaccounts

The tax-deferred nature of VUL can be a powerful tool for wealth accumulation, especially for high-income individuals in higher tax brackets.

Adjustable Death Benefit

VUL policies typically offer the flexibility to adjust the death benefit as the policyholder’s needs change over time. This feature allows individuals to increase or decrease their coverage without the need to purchase a new policy, subject to certain conditions and potential underwriting requirements.

- Option to increase coverage for growing financial obligations

- Ability to decrease coverage as debts are paid off

- Potential to change from level to increasing death benefit, or vice versa

The adjustable death benefit feature can be particularly valuable for individuals experiencing significant life changes, such as marriage, the birth of children, or retirement.

Access to Cash Value

VUL policies provide policyholders with access to the accumulated cash value through loans or withdrawals. This liquidity can serve as a source of funds for various financial needs, such as supplementing retirement income, funding education expenses, or covering unexpected costs.

- Option to take policy loans at competitive interest rates

- Ability to make partial withdrawals from cash value

- Potential source of tax-free income if managed properly

While access to cash value provides financial flexibility, it’s crucial to understand that loans and withdrawals can reduce the death benefit and may have tax implications if not handled correctly.

Diverse Investment Options

VUL policies typically offer a wide array of investment subaccounts, allowing policyholders to create a diversified portfolio within their insurance policy. These subaccounts often mirror various mutual fund strategies, providing exposure to different asset classes, sectors, and geographic regions.

- Choice of equity, fixed income, and money market subaccounts

- Ability to invest in domestic and international markets

- Option to select from various investment styles and strategies

The diverse investment options in VUL policies enable policyholders to tailor their investment allocation to match their risk tolerance and financial goals.

Permanent Life Coverage

Unlike term life insurance, VUL provides permanent life coverage that can last for the insured’s entire lifetime, as long as the policy remains in force. This permanent nature of coverage can be particularly valuable for estate planning purposes or for individuals with long-term financial obligations.

- Lifelong protection for beneficiaries

- No need to renew or requalify for coverage

- Potential for increasing death benefit over time

The permanent coverage offered by VUL can provide peace of mind for those seeking long-term financial protection for their loved ones.

Estate Planning Benefits

VUL insurance can be an effective tool for estate planning, particularly for high-net-worth individuals. The death benefit is generally paid out tax-free to beneficiaries and can be structured to help cover estate taxes or provide a legacy for heirs.

- Tax-free death benefit for beneficiaries

- Potential to reduce estate tax liability

- Option to create an irrevocable life insurance trust (ILIT) for additional estate planning benefits

When properly structured, VUL can play a crucial role in preserving wealth and ensuring a smooth transfer of assets to the next generation.

Disadvantages of Variable Universal Life Insurance

Market Risk Exposure

One of the primary drawbacks of VUL insurance is the exposure to market risk. Unlike traditional life insurance products that offer guaranteed cash value growth, the performance of VUL policies is directly tied to the underlying investment subaccounts. This means that policyholders bear the risk of potential losses if the chosen investments underperform.

- Cash value can decrease during market downturns

- No guarantees on investment returns

- Potential for negative returns in volatile market conditions

The market risk associated with VUL policies makes them unsuitable for individuals with low risk tolerance or those who require guaranteed returns.

Higher Fees and Expenses

VUL policies typically come with higher fees and expenses compared to other types of life insurance. These costs can include mortality and expense charges, administrative fees, fund management fees for the subaccounts, and potential surrender charges.

- Higher cost of insurance charges

- Investment management fees for subaccounts

- Potential for additional rider fees

The cumulative effect of these higher fees can significantly impact the policy’s cash value growth over time, potentially reducing the overall returns.

Complex Product Structure

VUL insurance is a complex financial product that combines life insurance with investment components. This complexity can make it challenging for many individuals to fully understand the policy’s features, risks, and potential outcomes.

- Difficult to compare with other insurance products

- Requires ongoing monitoring and management

- May necessitate professional advice for optimal use

The intricate nature of VUL policies can lead to misunderstandings and potential misuse if policyholders are not well-informed about the product’s mechanics.

Potential for Policy Lapse

If the cash value of a VUL policy becomes insufficient to cover the ongoing cost of insurance and other policy charges, there is a risk of policy lapse. This situation can occur if investment performance is poor, if premiums are not paid consistently, or if excessive loans or withdrawals are taken from the policy.

- Risk of losing coverage if cash value depletes

- Potential need for additional premium payments to keep policy in force

- Possibility of triggering taxable events if policy lapses with outstanding loans

The risk of policy lapse underscores the importance of careful management and regular review of VUL policies to ensure they remain adequately funded.

No Guaranteed Returns

Unlike some traditional life insurance products that offer guaranteed minimum interest rates, VUL policies do not provide guaranteed returns on the investment component. The performance of the policy’s cash value is entirely dependent on the chosen subaccounts’ performance.

- Cash value growth not guaranteed

- Possibility of negative returns in poor market conditions

- No minimum interest rate guarantees

The lack of guaranteed returns makes VUL policies less predictable and potentially riskier than other types of permanent life insurance.

Requires Active Management

To maximize the benefits of a VUL policy, policyholders need to actively manage their investment allocations and monitor the policy’s performance. This ongoing management requirement can be time-consuming and may necessitate a level of financial sophistication that not all policyholders possess.

- Need for regular review and rebalancing of subaccounts

- Importance of adjusting premiums based on policy performance

- Requirement to stay informed about market trends and economic conditions

The active management aspect of VUL policies can be burdensome for individuals who prefer a more hands-off approach to their insurance and investments.

Higher Initial Costs

VUL policies often have higher initial costs compared to term life insurance or even some other forms of permanent life insurance. These higher upfront expenses can impact the policy’s early cash value accumulation and may make VUL less attractive for individuals seeking immediate cash value growth.

- Higher first-year expenses and commissions

- Slower initial cash value accumulation

- Potential for negative cash value in early years

The higher initial costs of VUL policies can make them less suitable for individuals with short-term financial goals or those seeking immediate liquidity from their life insurance.

Surrender Charges

Most VUL policies come with surrender charges, which are fees imposed if the policyholder cancels the policy or withdraws a significant portion of the cash value within a specified period (often 10-15 years). These charges can substantially reduce the amount of cash value available if the policy is terminated early.

- Significant financial penalties for early policy termination

- Reduced liquidity in the early years of the policy

- Potential for surrender charges on large withdrawals

The presence of surrender charges emphasizes the long-term nature of VUL policies and the importance of careful consideration before committing to this type of insurance.

In conclusion, Variable Universal Life Insurance offers a unique combination of life insurance protection and investment potential, making it an attractive option for certain individuals with specific financial goals and risk tolerances. The flexibility in premium payments, potential for investment growth, and tax advantages can make VUL a powerful tool for wealth accumulation and estate planning. However, these benefits come with significant risks and complexities that require careful consideration.

The market risk exposure, higher fees, and active management requirements of VUL policies make them unsuitable for risk-averse individuals or those seeking guaranteed returns. Additionally, the potential for policy lapse and the impact of surrender charges highlight the importance of long-term commitment and careful financial planning when considering a VUL policy.

Ultimately, the decision to purchase a Variable Universal Life Insurance policy should be made after thorough analysis of one’s financial situation, long-term goals, and risk tolerance. Consulting with a qualified financial advisor or insurance professional can help potential policyholders navigate the complexities of VUL and determine if it aligns with their overall financial strategy.

Frequently Asked Questions About Variable Universal Life Insurance Pros And Cons

- How does Variable Universal Life Insurance differ from other types of life insurance?

VUL combines permanent life insurance with investment options, allowing policyholders to allocate cash value to various subaccounts. It offers more flexibility in premiums and death benefits compared to traditional whole life insurance, but comes with market risk unlike term or whole life policies. - What types of investors are best suited for Variable Universal Life Insurance?

VUL is typically best for high-income individuals with a long-term investment horizon and higher risk tolerance. It can be suitable for those who have maxed out other tax-advantaged investment options and seek additional ways to grow wealth tax-deferred. - Can I lose money in a Variable Universal Life Insurance policy?

Yes, it’s possible to lose money in a VUL policy. The cash value is invested in market-based subaccounts, which can decrease in value during market downturns. Additionally, high fees and poor performance can erode cash value over time. - How do the tax benefits of Variable Universal Life Insurance work?

VUL offers tax-deferred growth on the cash value, tax-free transfers between subaccounts, and a tax-free death benefit. Loans and withdrawals can potentially provide tax-free income if managed correctly, but improper handling can lead to taxable events. - What happens if I can’t pay the premiums on my Variable Universal Life Insurance policy?

If premiums are not paid, the policy may use the cash value to cover costs. However, if the cash value becomes insufficient to cover ongoing charges, the policy could lapse, potentially resulting in loss of coverage and tax consequences. - Are there any guarantees in a Variable Universal Life Insurance policy?

VUL policies typically do not offer guarantees on cash value growth or investment returns. The death benefit is generally guaranteed as long as the policy remains in force, but its value can fluctuate based on policy performance and any loans or withdrawals taken. - How often should I review my Variable Universal Life Insurance policy?

It’s recommended to review your VUL policy at least annually. This review should include assessing the performance of your chosen subaccounts, evaluating your premium payments, and ensuring the policy aligns with your current financial goals and risk tolerance. - Can I change my investment options in a Variable Universal Life Insurance policy?

Yes, most VUL policies allow you to change your investment allocations among the available subaccounts. This flexibility enables you to adjust your investment strategy in response to market conditions or changes in your financial situation.