Certificates of Deposit (CDs) are popular financial instruments that offer a secure way to save money while earning interest. These time-bound deposits, typically offered by banks and credit unions, provide a guaranteed return on investment over a fixed period. As with any financial product, CDs come with their own set of advantages and disadvantages that investors should carefully consider before committing their funds.

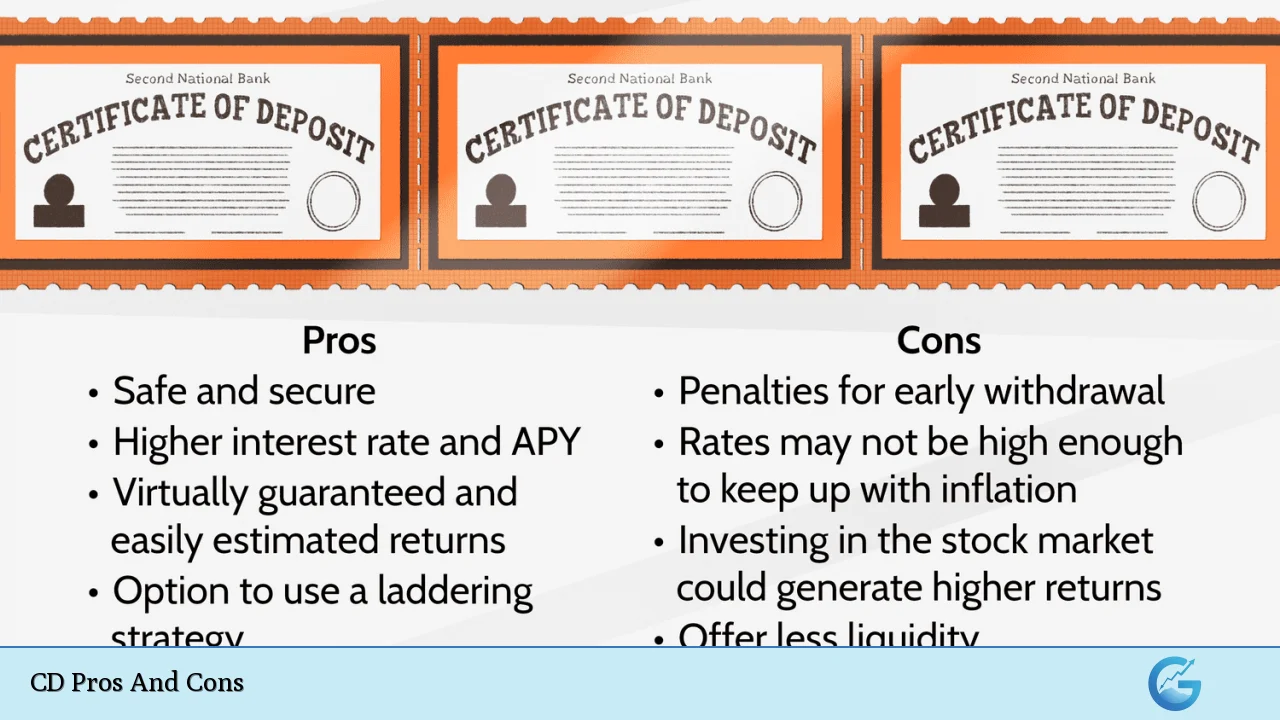

| Pros | Cons |

|---|---|

| Higher interest rates than savings accounts | Limited liquidity |

| Guaranteed returns | Early withdrawal penalties |

| FDIC insured up to $250,000 | Interest rate risk |

| Low-risk investment | Inflation risk |

| Various term options | Opportunity cost |

| Predictable earnings | Lower returns compared to other investments |

| No maintenance fees | Minimum deposit requirements |

| Laddering strategy potential | Complexity in choosing the right CD |

Advantages of Certificates of Deposit

Higher Interest Rates

CDs typically offer higher interest rates compared to traditional savings accounts or money market accounts. This makes them an attractive option for investors looking to maximize their returns on low-risk investments. The interest rates on CDs are usually tiered, with longer terms and higher deposit amounts generally yielding better rates.

- Rates can be significantly higher than standard savings accounts

- Opportunity to earn more on idle cash

- Competitive rates among different financial institutions

Guaranteed Returns

One of the most appealing aspects of CDs is the guarantee of a fixed return. When you invest in a CD, you lock in a specific interest rate for the entire term of the deposit. This predictability allows for easier financial planning and budgeting, as you know exactly how much your investment will grow over time.

- Fixed interest rate for the entire term

- Predictable earnings facilitate financial planning

- No risk of interest rate fluctuations affecting your returns

FDIC Insurance

CDs offered by banks are typically insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor, per insured bank. This insurance provides an additional layer of security, protecting your investment even in the unlikely event of bank failure. For credit unions, the National Credit Union Administration (NCUA) offers similar protection.

- Protection against bank failures

- Peace of mind for risk-averse investors

- Coverage extends to principal and accrued interest

Low-Risk Investment

CDs are considered one of the safest investment options available. The combination of guaranteed returns and FDIC insurance makes CDs an ideal choice for conservative investors or those looking to diversify their portfolio with low-risk assets. This safety feature is particularly attractive during times of economic uncertainty or market volatility.

- Minimal risk of losing principal

- Suitable for risk-averse investors

- Stable component in a diversified investment portfolio

Various Term Options

Banks and credit unions offer CDs with a wide range of maturity terms, typically ranging from a few months to several years. This flexibility allows investors to choose terms that align with their financial goals and liquidity needs. Short-term CDs can be ideal for near-term financial objectives, while longer-term CDs often offer higher interest rates for those with a more extended investment horizon.

- Terms ranging from 3 months to 5 years or more

- Ability to match CD terms with financial goals

- Option to create a CD ladder for regular access to funds

Predictable Earnings

The fixed interest rate of CDs provides a clear picture of your earnings over the investment period. This predictability is particularly valuable for investors who rely on interest income or need to plan for specific financial milestones. Unlike variable-rate investments, CDs offer a stable and consistent return throughout their term.

- Easy calculation of total returns at maturity

- Reliable income stream for budgeting purposes

- No surprises or fluctuations in earnings

No Maintenance Fees

Unlike some other banking products, CDs typically do not come with monthly maintenance fees or hidden charges. The absence of ongoing fees means that your entire deposit and earned interest remain intact, maximizing your overall returns. This feature makes CDs a cost-effective savings option, especially for those looking to avoid the fees associated with some checking or savings accounts.

- No monthly service charges

- Transparent fee structure

- Full retention of earned interest

Laddering Strategy Potential

CD laddering is a strategy that involves investing in multiple CDs with staggered maturity dates. This approach allows investors to take advantage of higher long-term rates while maintaining some liquidity and flexibility. As each CD in the ladder matures, you have the option to reinvest at current rates or access the funds if needed, providing a balance between earning potential and accessibility.

- Combines benefits of short-term and long-term CDs

- Regular access to a portion of funds

- Opportunity to capitalize on changing interest rates

Disadvantages of Certificates of Deposit

Limited Liquidity

One of the primary drawbacks of CDs is the lack of easy access to your funds. When you invest in a CD, you agree to leave your money untouched for a specific period, which can range from a few months to several years. This limited liquidity can be problematic if you unexpectedly need access to your funds before the CD matures.

- Funds are locked for the duration of the term

- Difficulty accessing money for emergencies

- Potential opportunity cost if better investment options arise

Early Withdrawal Penalties

If you need to withdraw funds from your CD before its maturity date, you’ll likely face early withdrawal penalties. These penalties can be substantial, often amounting to several months’ worth of interest or even eating into your principal in some cases. The exact penalty varies depending on the financial institution and the CD’s term, but it’s a significant consideration for investors who may need access to their funds.

- Penalties can negate interest earnings

- Potential loss of principal in severe cases

- Discourages flexibility in financial planning

Interest Rate Risk

When you invest in a CD, you’re locking in an interest rate for a set period. If interest rates rise during your CD’s term, you miss out on the opportunity to earn higher returns on your money. This interest rate risk is particularly relevant in low-interest-rate environments where rates are more likely to increase over time.

- Potential for missed opportunities if rates rise

- Fixed rate may become less attractive over time

- Difficulty in taking advantage of market improvements

Inflation Risk

While CDs offer guaranteed returns, they may not always keep pace with inflation. If the inflation rate exceeds the interest rate on your CD, the purchasing power of your money actually decreases over time, despite the nominal growth. This risk is more pronounced with longer-term CDs and in periods of high inflation.

- Real returns may be negative in high-inflation periods

- Erosion of purchasing power over time

- Long-term CDs more susceptible to inflation risk

Opportunity Cost

By locking your money into a CD, you may miss out on potentially higher-yielding investment opportunities. The stable, low-risk nature of CDs means they generally offer lower returns compared to more volatile investments like stocks or real estate. This opportunity cost can be significant, especially for investors with a higher risk tolerance or longer investment horizon.

- Potential for higher returns in other investment vehicles

- Limited growth potential compared to stocks or mutual funds

- May not be suitable for long-term wealth accumulation goals

Lower Returns Compared to Other Investments

While CDs offer higher interest rates than savings accounts, their returns are typically lower than those of other investment options. Investors seeking higher growth potential may find the returns on CDs insufficient, particularly when compared to the historical performance of stock markets or real estate investments. This makes CDs less attractive for those prioritizing capital appreciation over capital preservation.

- Limited potential for significant wealth growth

- May not outpace inflation in the long term

- Less suitable for aggressive investment strategies

Minimum Deposit Requirements

Many financial institutions impose minimum deposit requirements for opening a CD account. These minimums can range from a few hundred to several thousand dollars, potentially limiting accessibility for some investors. Higher minimum deposits are often required to access the best interest rates, which can be a barrier for those with limited funds to invest.

- Higher minimums for premium rates

- May exclude investors with smaller amounts to save

- Can limit options for diversification

Complexity in Choosing the Right CD

With various types of CDs available, including traditional, bump-up, step-up, and callable CDs, selecting the right option can be challenging. Each type comes with its own set of terms and conditions, requiring careful consideration to ensure alignment with your financial goals. The complexity increases when factoring in different maturity terms, interest rates, and early withdrawal penalties across multiple financial institutions.

- Requires research and comparison shopping

- Different CD types add complexity to decision-making

- Need to balance various factors like term, rate, and flexibility

In conclusion, Certificates of Deposit offer a unique blend of safety, predictability, and modest returns, making them an attractive option for conservative investors or those seeking to diversify their portfolio with low-risk assets. The guaranteed returns and FDIC insurance provide peace of mind, while the various term options allow for flexibility in financial planning. However, the limited liquidity, potential for early withdrawal penalties, and lower returns compared to more aggressive investments are significant drawbacks to consider.

Investors must carefully weigh these pros and cons against their financial goals, risk tolerance, and liquidity needs. For those seeking a safe haven for short to medium-term savings or a stable component in a diversified investment strategy, CDs can be an excellent choice. However, for long-term wealth accumulation or those comfortable with higher risk for potentially greater rewards, other investment vehicles may be more suitable.

Ultimately, the decision to invest in CDs should be part of a broader financial strategy, potentially incorporating a mix of different investment types to balance safety, liquidity, and growth potential. As with any financial decision, consulting with a qualified financial advisor can provide personalized guidance based on your individual circumstances and objectives.

Frequently Asked Questions About CD Pros And Cons

- How do CD interest rates compare to other savings options?

CD interest rates are typically higher than those offered by traditional savings accounts or money market accounts. However, they generally provide lower returns compared to more volatile investments like stocks or mutual funds. - Can I withdraw money from a CD before it matures?

Yes, but early withdrawals usually incur penalties. These penalties can vary by institution and CD term, often amounting to several months’ worth of interest. - Are CDs a good investment during periods of rising interest rates?

CDs can be less attractive during rising rate environments as your money is locked in at a fixed rate. However, strategies like CD laddering can help mitigate this risk. - What is CD laddering, and how does it work?

CD laddering involves investing in multiple CDs with staggered maturity dates. This strategy provides regular access to funds while potentially benefiting from higher long-term rates. - How safe are CDs compared to other investments?

CDs are considered very safe investments, especially when FDIC-insured. They offer lower risk compared to stocks or bonds but also typically provide lower returns. - What types of CDs are available besides traditional fixed-rate CDs?

Other CD types include bump-up CDs (allowing for one-time rate increase), step-up CDs (predetermined rate increases), and callable CDs (can be redeemed early by the issuer). - How does inflation affect CD investments?

If the inflation rate exceeds the CD’s interest rate, the real purchasing power of your investment decreases over time, despite nominal growth. - Are there any tax advantages to investing in CDs?

CDs don’t offer special tax advantages. Interest earned is typically taxed as ordinary income in the year it’s paid or compounded, even if you don’t withdraw the funds.