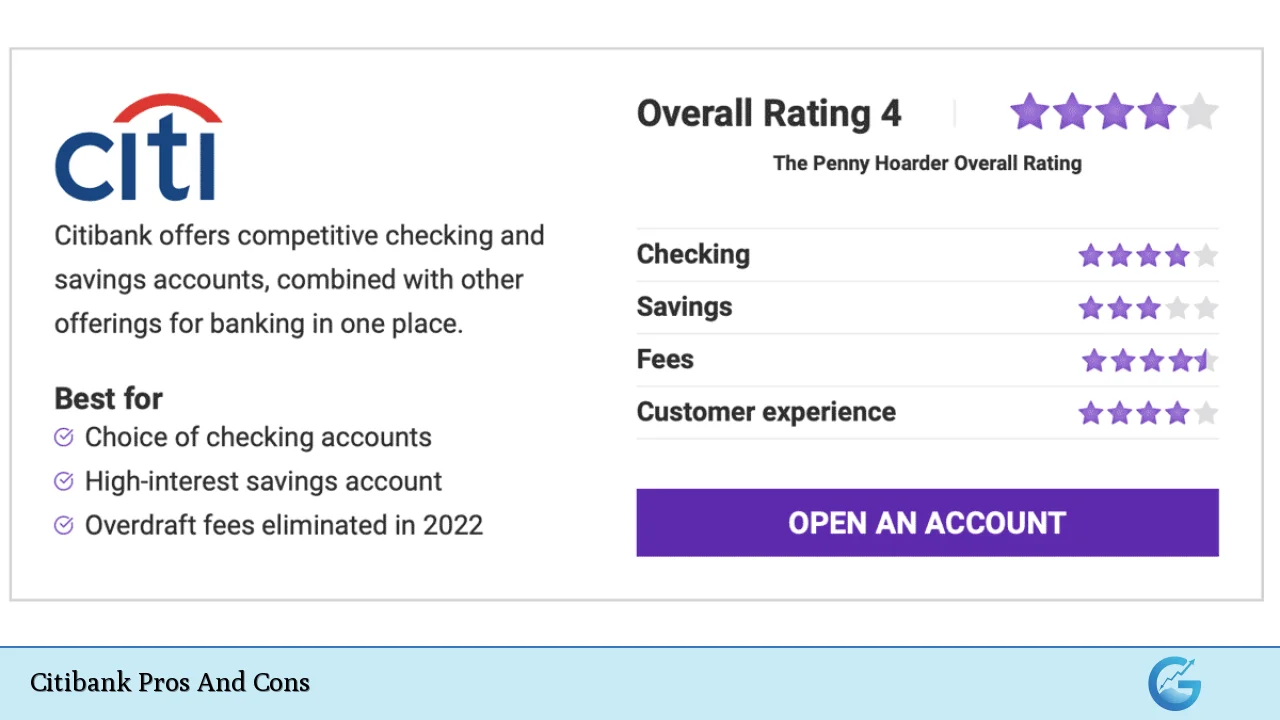

Citibank, one of the largest financial institutions in the world, offers a wide range of banking products and services, including checking and savings accounts, credit cards, loans, and investment options. With a presence in over 180 countries, it caters to both individual and corporate clients. However, like any financial institution, Citibank has its strengths and weaknesses. This article delves into the pros and cons of banking with Citibank, providing a comprehensive overview for potential customers, particularly those interested in finance, crypto, forex, and money markets.

| Pros | Cons |

|---|---|

| Extensive ATM network with over 65,000 locations | High monthly fees for some account types |

| No overdraft fees on checking accounts | Low interest rates on savings accounts compared to online banks |

| Wide range of financial products and services | Limited branch availability in some regions |

| Robust mobile banking app with high ratings | Complex fee structure that can be confusing for customers |

| Strong customer service support options | Recent controversies regarding regulatory compliance and data management |

| No foreign transaction fees when using Citibank debit cards abroad | Limited access to high-yield savings accounts in certain areas |

| Competitive rates on CDs and investment products for high-net-worth individuals | Inconsistent customer service experiences reported by users |

| Innovative offerings in digital finance and asset tokenization | Higher minimum balance requirements for premium account tiers |

Extensive ATM Network

Citibank boasts an extensive network of over 65,000 ATMs across the United States. This vast reach allows customers to access their funds conveniently without incurring out-of-network ATM fees.

- Convenience: Customers can easily find nearby ATMs.

- Fee Waivers: Many accounts allow for fee waivers when using non-Citibank ATMs.

This extensive network is particularly beneficial for frequent travelers or those living in urban areas.

No Overdraft Fees

One of the significant advantages of Citibank’s checking accounts is the absence of overdraft fees. This policy helps customers avoid unexpected charges that can occur when they inadvertently spend more than their available balance.

- Financial Management: This feature encourages better budgeting practices among customers.

- Peace of Mind: Customers can spend without the fear of incurring excessive fees.

This policy is especially advantageous for individuals who may not always have a consistent income.

Wide Range of Financial Products

Citibank offers a comprehensive suite of financial products designed to meet various customer needs. These include:

- Checking and Savings Accounts: Multiple options catering to different financial situations.

- Credit Cards: A variety of rewards programs tailored to different spending habits.

- Loans and Mortgages: Competitive rates for personal loans and mortgages.

This diversity allows customers to manage all their financial needs within one institution.

Robust Mobile Banking App

Citibank’s mobile banking app is highly rated and offers a user-friendly interface that allows customers to manage their accounts efficiently.

- Features: The app includes features like mobile check deposit, bill payment, and account alerts.

- Accessibility: Customers can access their accounts anytime and anywhere.

The convenience of mobile banking is crucial in today’s fast-paced environment.

Strong Customer Service Support

Citibank provides multiple channels for customer support, including phone support, online chat, and in-app messaging.

- Availability: Customer service representatives are generally available 24/7.

- Knowledgeable Staff: Many users report positive experiences when seeking assistance.

This commitment to customer service enhances the overall banking experience.

No Foreign Transaction Fees

For customers who travel internationally or conduct transactions in foreign currencies, Citibank does not charge foreign transaction fees on its debit cards.

- Cost Savings: This can lead to significant savings when using debit cards abroad.

- Convenience: Simplifies international transactions without worrying about additional costs.

This feature is particularly appealing for frequent travelers or expatriates.

Competitive Rates on CDs

Citibank offers competitive rates on certificates of deposit (CDs), especially beneficial for high-net-worth individuals looking to invest their funds securely while earning interest.

- Investment Options: Various terms are available to suit different investment strategies.

- Safety: CDs are considered low-risk investments compared to stocks or mutual funds.

This makes Citibank an attractive option for conservative investors seeking stability.

High Monthly Fees

Despite its numerous advantages, Citibank imposes relatively high monthly fees on some account types.

- Cost Concerns: Monthly maintenance fees can reach up to $30 depending on the account type.

- Waiver Conditions: While these fees can often be waived by meeting certain criteria (like maintaining a minimum balance), not all customers may meet these requirements.

This fee structure can be a deterrent for individuals with lower balances or irregular income streams.

Low Interest Rates on Savings Accounts

Citibank’s savings accounts typically offer lower interest rates compared to online-only banks or credit unions.

- Opportunity Cost: Customers may miss out on higher yields available elsewhere.

- Inflation Impact: Low interest rates may not keep pace with inflation, diminishing purchasing power over time.

This aspect may lead savers to consider alternative banking options that provide better returns on deposits.

Limited Branch Availability

While Citibank has a significant presence in major metropolitan areas, its branch network is limited compared to some competitors like Bank of America or Wells Fargo.

- Accessibility Issues: Customers in rural areas may find it challenging to access physical branches.

- Dependence on Digital Services: Users may need to rely heavily on online banking services without local support.

This limitation could be a disadvantage for clients who prefer face-to-face interactions with banking professionals.

Complex Fee Structure

Citibank’s fee structure can be complex and difficult for customers to navigate.

- Confusion: Different account types have varying fee schedules that may not be immediately clear.

- Potential Hidden Fees: Customers might encounter unexpected charges if they do not fully understand the terms associated with their accounts.

This complexity could lead to dissatisfaction among users who prefer straightforward banking solutions.

Recent Controversies

Citibank has faced scrutiny regarding its regulatory compliance and data management practices.

- Fines Imposed: The bank has been fined multiple times by federal agencies due to lapses in risk management protocols.

- Customer Trust Issues: Such controversies may lead potential customers to question the bank’s reliability and commitment to protecting sensitive information.

These concerns highlight the importance of conducting thorough research before choosing a banking partner.

Limited Access to High-Yield Savings Accounts

Citibank’s high-yield savings account options are only available in select markets.

- Geographic Limitations: Customers outside these regions may miss out on competitive interest rates.

- Comparison Shopping Needed: Individuals interested in high-yield savings must explore other banks that offer broader access.

This limitation could discourage potential clients from considering Citibank as their primary banking institution.

Inconsistent Customer Service Experiences

While many users report positive experiences with Citibank’s customer service, there are also accounts of inconsistent support quality.

- Variable Experiences: Some customers have encountered difficulties resolving issues or receiving timely assistance.

- Reputation Concerns: Negative reviews regarding customer service could impact the bank’s overall reputation among potential clients.

Such variability emphasizes the need for potential customers to weigh personal experiences against general perceptions when selecting a bank.

Higher Minimum Balance Requirements

For premium account tiers like Citigold or Citigold Private Client accounts, Citibank requires maintaining higher minimum balances.

- Accessibility Issues: These requirements may exclude lower-income individuals from accessing premium benefits.

- Financial Pressure: Clients may feel pressured to maintain higher balances than they are comfortable with just to avoid fees or gain benefits.

This aspect could deter potential clients who do not have substantial funds available for banking purposes.

In conclusion, while Citibank offers numerous advantages such as an extensive ATM network, no overdraft fees, a wide range of financial products, and strong customer service support, it also presents several drawbacks including high monthly fees, low interest rates on savings accounts, limited branch availability, complex fee structures, recent controversies regarding compliance issues, inconsistent customer service experiences, limited access to high-yield savings accounts in certain regions, and higher minimum balance requirements for premium tiers.

Individuals considering Citibank should carefully evaluate these pros and cons based on their unique financial needs and preferences before making a decision about banking with this institution.

Frequently Asked Questions About Citibank Pros And Cons

- What are the main advantages of using Citibank?

The main advantages include an extensive ATM network, no overdraft fees on checking accounts, a wide range of financial products, robust mobile banking capabilities, strong customer service support options, no foreign transaction fees on debit cards abroad, competitive rates on CDs for high-net-worth individuals. - What are the key disadvantages associated with Citibank?

The key disadvantages include high monthly fees for some accounts, low interest rates on savings compared to online banks, limited branch availability in certain regions, complex fee structures that can confuse customers. - Are there any recent controversies involving Citibank?

Yes, Citibank has faced scrutiny regarding regulatory compliance issues leading to fines imposed by federal agencies due to lapses in risk management practices. - How does Citibank compare with other banks?

While Citibank offers competitive features like an extensive ATM network and no overdraft fees compared to some banks like Chase or Bank of America; it may fall short in terms of branch accessibility and higher monthly fees. - Is Citibank suitable for everyone?

No; while it offers many benefits suitable for frequent travelers or those needing diverse financial services; individuals seeking higher interest rates on savings might find better options elsewhere. - Can I avoid monthly fees at Citibank?

Yes; monthly maintenance fees can typically be waived by meeting specific criteria such as maintaining a minimum balance across eligible accounts. - What should I consider before opening an account with Citibank?

You should evaluate your personal financial situation against the bank’s fee structure; consider whether you will meet minimum balance requirements; assess your need for physical branches versus online services. - Are there better alternatives than Citibank?

Depending on your needs; online banks often provide higher interest rates on savings; credit unions might offer lower fees; it’s essential to shop around based on your specific requirements.