Investing in real estate can be a lucrative venture, and one popular option among investors is purchasing a duplex. A duplex is a residential building that contains two separate living units, typically sharing a common wall. This property type offers unique opportunities for generating income while also presenting specific challenges. Understanding the pros and cons of duplex investment is crucial for anyone considering this path, especially those interested in finance, crypto, forex, and money markets. This article delves into the advantages and disadvantages of owning a duplex, providing insights that can help inform your investment decisions.

| Pros | Cons |

|---|---|

| Potential for dual rental income | Higher maintenance costs |

| Ability to live in one unit while renting the other | Possible tenant-related issues |

| Lower entry price compared to multi-family properties | Market saturation risks |

| Tax benefits and depreciation opportunities | Financing challenges and higher interest rates |

| Increased property value over time in desirable locations | Lack of privacy between units |

| Flexibility in property use (rental or owner-occupied) | Potential for difficult neighbor relationships |

| Access to favorable financing options for owner-occupants | Complexity of property management |

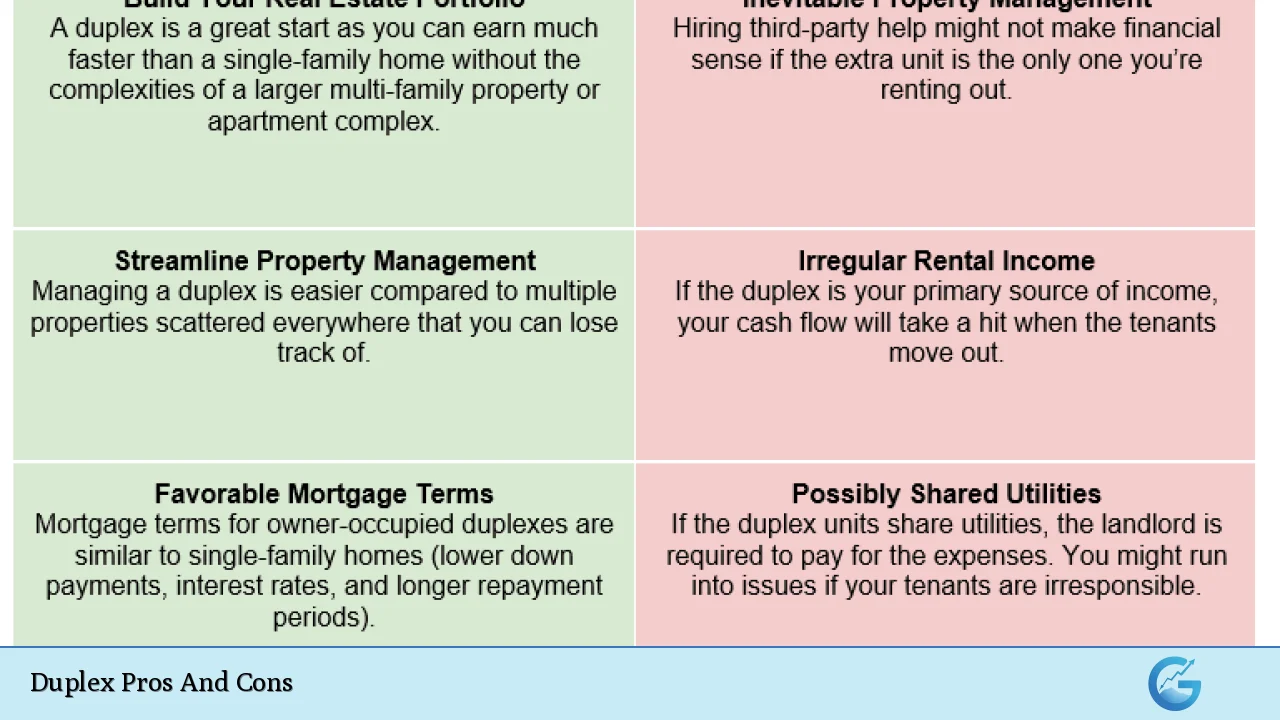

Potential for Dual Rental Income

One of the most significant advantages of investing in a duplex is the potential for dual rental income. By renting out both units, investors can maximize their cash flow, often covering mortgage payments and generating profit.

- Increased Cash Flow: With two units generating rental income, the overall cash flow can be substantial.

- Financial Security: If one unit becomes vacant, the other can still provide income, reducing financial strain.

Ability to Live in One Unit While Renting the Other

Another appealing aspect of duplex ownership is the option to live in one unit while renting out the other. This arrangement allows investors to benefit from rental income without having to manage a completely separate property.

- Reduced Living Expenses: The rental income can significantly offset living costs, making homeownership more affordable.

- Hands-On Management: Living on-site allows for easier management of tenants and property maintenance.

Lower Entry Price Compared to Multi-Family Properties

Duplexes typically have a lower purchase price compared to larger multi-family properties. This makes them an attractive option for first-time investors or those with limited capital.

- Accessibility: The lower cost barrier makes it easier for new investors to enter the real estate market.

- Potential for Value Appreciation: As property values increase over time, duplexes can appreciate similarly to single-family homes.

Tax Benefits and Depreciation Opportunities

Investing in a duplex comes with various tax benefits that can enhance overall returns.

- Depreciation Deductions: Owners can depreciate the value of the building over time, reducing taxable income.

- Expense Deductions: Many expenses related to property management, maintenance, and repairs can be deducted from taxable income.

Increased Property Value Over Time in Desirable Locations

Duplexes located in high-demand areas often experience significant appreciation over time.

- Market Trends: As urban areas grow and housing demand increases, duplexes can become more valuable.

- Investment Growth: A well-located duplex can yield substantial returns when sold or refinanced.

Flexibility in Property Use (Rental or Owner-Occupied)

Duplexes offer flexibility in how they are utilized. Investors can choose to rent out both units or occupy one while renting the other.

- Adaptability: This flexibility allows owners to adjust their strategy based on market conditions or personal circumstances.

- Long-Term Planning: Owners may plan to live in one unit long-term while benefiting from rental income in the short term.

Access to Favorable Financing Options for Owner-Occupants

For those who plan to live in one unit of their duplex, financing options are often more favorable than those available for pure investment properties.

- Lower Down Payments: Owner-occupants may qualify for loans with lower down payments through programs like FHA loans.

- Better Interest Rates: Lenders often offer better rates for owner-occupied properties compared to investment-only properties.

Higher Maintenance Costs

Despite their advantages, duplexes come with higher maintenance costs compared to single-family homes.

- Shared Expenses: Although costs are shared between two units, maintenance responsibilities can still be significant due to two separate living spaces.

- Increased Wear and Tear: More occupants mean more wear on common areas and systems like plumbing and HVAC.

Possible Tenant-Related Issues

Managing tenants can be challenging, especially if issues arise between neighbors sharing a wall.

- Disputes Over Noise or Privacy: Conflicts may occur regarding noise levels or shared spaces.

- Eviction Risks: If tenants fail to pay rent or cause damage, eviction processes can be complicated and costly.

Market Saturation Risks

Investing in duplexes may pose risks if there is an oversupply of similar properties in the area.

- Decreased Demand: An abundance of duplexes could lead to lower rental prices and increased vacancies.

- Property Value Depreciation: Market saturation may negatively impact property values over time.

Financing Challenges and Higher Interest Rates

Obtaining financing for a duplex can be more challenging than securing a loan for a single-family home.

- Higher Down Payments Required: Investors may need larger down payments compared to owner-occupied loans.

- Stricter Lending Criteria: Lenders often impose stricter requirements on investment properties, making approval difficult.

Lack of Privacy Between Units

Living next door to tenants means sacrificing some privacy that comes with owning a standalone home.

- Noise Concerns: Shared walls mean that sounds from one unit can easily disturb the other.

- Personal Space Intrusion: Tenants may feel uncomfortable with their landlord living nearby, potentially affecting landlord-tenant relationships.

Potential for Difficult Neighbor Relationships

The relationship between owners and tenants is crucial; however, it may not always be harmonious.

- Tenant Behavior Issues: Difficult tenants can create stress and impact overall enjoyment of the property.

- Shared Responsibilities Complications: Maintenance issues affecting both units may lead to disputes over responsibilities and costs.

Complexity of Property Management

Owning a duplex requires effective property management skills that some new investors may lack.

- Time Commitment: Managing two units demands more time than managing a single-family home.

- Legal Knowledge Requirements: Investors must understand local laws regarding tenant rights and landlord responsibilities.

In conclusion, investing in a duplex presents both opportunities and challenges. The potential for dual rental income, tax benefits, and flexibility make it an attractive option for many investors. However, higher maintenance costs, tenant-related issues, and financing challenges should not be overlooked.

Understanding these pros and cons is essential for making informed decisions about your investment strategy. Whether you are looking to generate passive income or build equity over time, careful consideration of these factors will aid you in navigating the complexities of duplex ownership effectively.

Frequently Asked Questions About Duplex Pros And Cons

- What are the financial benefits of owning a duplex?

Owning a duplex allows you to earn rental income from one or both units while benefiting from tax deductions related to property expenses. - Can I live in one unit while renting out the other?

Yes, many investors choose this strategy known as house hacking, which helps reduce living expenses significantly. - What are common maintenance issues with duplexes?

Common issues include plumbing problems affecting both units and shared roof maintenance responsibilities. - How do I finance a duplex?

You can finance a duplex through conventional loans or government-backed loans like FHA loans if you plan on occupying one unit. - What risks should I consider before buying a duplex?

You should consider tenant-related issues, market saturation risks, and potential difficulties with financing. - Is it harder to manage tenants in a duplex?

The complexity increases since you must manage relationships with multiple tenants sharing close quarters. - Do duplexes appreciate at similar rates as single-family homes?

This depends on location; well-located duplexes often appreciate similarly or even outperform single-family homes. - What should I look for when purchasing a duplex?

You should assess location demand, condition of the property, potential rental income, and local regulations regarding multi-family housing.