Consolidating student loans can be a strategic financial decision for many borrowers, particularly those juggling multiple loans with varying interest rates and repayment terms. This process involves merging several student loans into one, simplifying monthly payments and potentially altering the terms of repayment. However, while consolidation can offer several benefits, it also comes with significant drawbacks that borrowers must carefully evaluate. Understanding both sides of this financial strategy is crucial for making an informed decision.

| Pros | Cons |

|---|---|

| Simplifies repayment process | Potentially higher total interest paid |

| Lower monthly payments | Loss of borrower benefits |

| Fixed interest rate | Longer repayment period |

| Access to alternative repayment plans | Resetting progress toward forgiveness programs |

| Potential for lower interest rates with private loans | Adding unpaid interest to principal balance |

| Improved credit score potential through timely payments | Risk of predatory refinancing offers from private lenders |

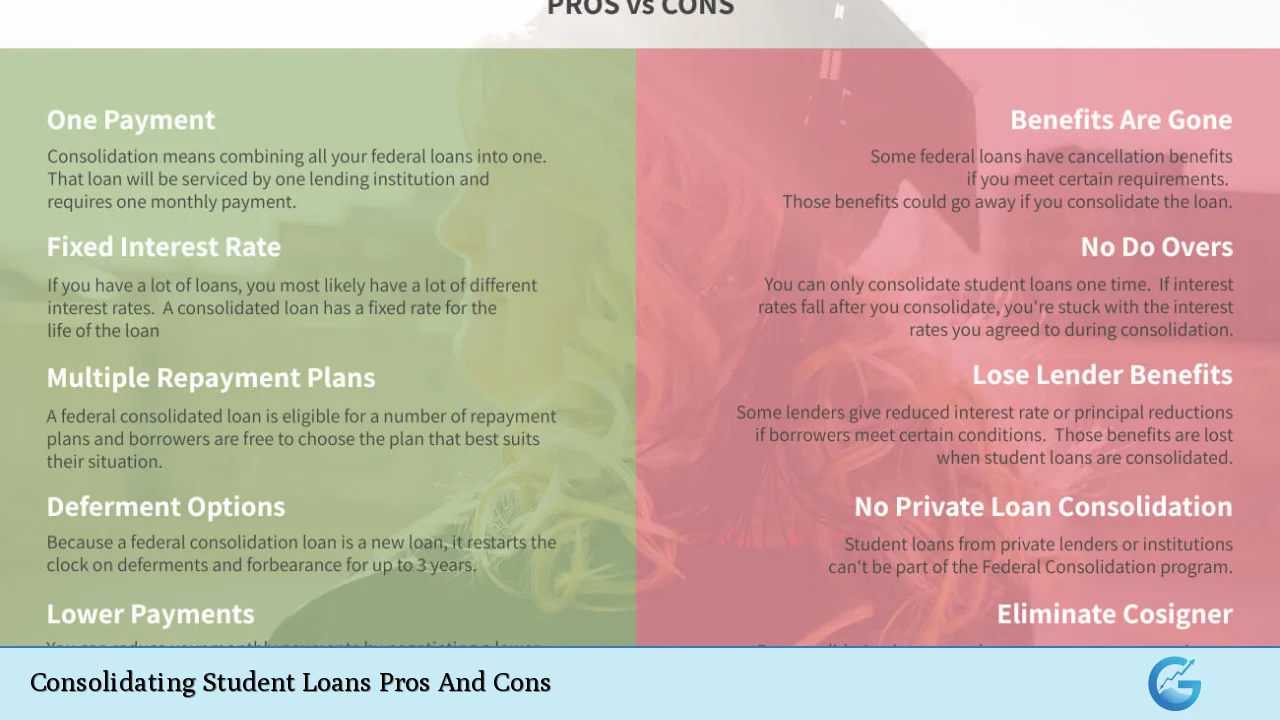

Simplifies Repayment Process

One of the most significant advantages of consolidating student loans is the simplification of the repayment process. Borrowers can merge multiple loans into a single loan, resulting in just one monthly payment rather than several. This can greatly reduce the complexity and stress associated with managing multiple due dates and servicers.

- Single Payment: A single monthly payment makes budgeting easier.

- Fewer Servicers: Dealing with only one loan servicer reduces confusion and administrative hassle.

Lower Monthly Payments

Consolidation often allows borrowers to extend their repayment term, which can result in lower monthly payments. While this can make managing finances easier in the short term, it’s essential to consider the long-term implications.

- Affordability: Lower payments can help borrowers manage their cash flow.

- Budgeting Flexibility: With reduced monthly obligations, borrowers may have more room in their budgets for other expenses.

Fixed Interest Rate

When consolidating federal student loans, borrowers receive a fixed interest rate based on the weighted average of their existing loans. This can provide stability against fluctuating interest rates in the market.

- Predictability: Fixed rates ensure that monthly payments remain consistent over time.

- Protection Against Rate Increases: Borrowers are shielded from potential increases in variable interest rates.

Access to Alternative Repayment Plans

Consolidation opens up access to various repayment plans that may not have been available previously. For instance, income-driven repayment plans can adjust monthly payments based on income levels.

- Income-Based Options: Plans like Income-Based Repayment (IBR) can make payments more manageable for those with fluctuating incomes.

- Graduated Repayment Plans: Payments start lower and increase over time, aligning with potential future income growth.

Potential for Lower Interest Rates with Private Loans

For borrowers considering private loan consolidation, there may be opportunities to secure a lower interest rate than what they currently have. This is particularly appealing for those with good credit scores.

- Competitive Rates: Private lenders often offer competitive rates that could lead to savings over time.

- Tailored Loan Options: Private lenders may provide customized loan terms that fit individual financial situations better than federal options.

Improved Credit Score Potential Through Timely Payments

By consolidating loans and making timely payments on a single loan, borrowers may see an improvement in their credit scores. Consistent payment history is a critical factor in credit scoring models.

- Credit Utilization: Reducing the number of open accounts can positively impact credit utilization ratios.

- Payment History: A strong record of on-time payments boosts overall creditworthiness.

Potentially Higher Total Interest Paid

While consolidation can lower monthly payments, it often leads to paying more interest over the life of the loan due to extended repayment terms. Borrowers should carefully calculate the total cost before proceeding.

- Longer Loan Terms: Extending repayment periods can significantly increase total interest paid.

- Interest Accumulation: More time means more opportunity for interest to accrue on the principal balance.

Loss of Borrower Benefits

One major disadvantage of consolidating federal student loans into a private loan is the potential loss of borrower benefits associated with federal loans. These benefits include deferment options, forgiveness programs, and flexible repayment plans.

- Forgiveness Programs: Borrowers may lose eligibility for programs like Public Service Loan Forgiveness (PSLF).

- Deferment Options: Federal loans typically offer more favorable deferment and forbearance options than private loans.

Longer Repayment Period

Consolidation often results in longer repayment periods, which may seem beneficial at first due to lower monthly payments but could hinder financial progress in the long run.

- Debt Duration: Being in debt longer can limit opportunities for other financial goals such as homeownership or retirement savings.

- Financial Freedom Delayed: The longer one has student debt, the longer it takes to achieve financial independence.

Resetting Progress Toward Forgiveness Programs

For borrowers who have made progress toward forgiveness programs, consolidating their loans resets this progress. This means that any qualifying payments made prior to consolidation will no longer count toward forgiveness eligibility.

- Loss of Payment History: Previous qualifying payments are wiped clean upon consolidation.

- Extended Timeframe for Forgiveness: Borrowers may need to start over with new requirements for forgiveness programs.

Adding Unpaid Interest to Principal Balance

When consolidating loans, any unpaid interest on existing loans is added to the principal balance. This practice increases the total amount owed and can lead to higher overall costs.

- Higher Principal Balance: Borrowers end up paying interest on previously unpaid interest.

- Increased Total Loan Cost: This process can significantly inflate the total cost of borrowing over time.

Risk of Predatory Refinancing Offers from Private Lenders

Borrowers considering private loan consolidation should be wary of predatory lending practices. Some lenders may offer attractive terms initially but could lead to unfavorable conditions later on.

- Hidden Fees and Terms: Some lenders might impose hidden fees or unfavorable terms that are not immediately apparent.

- Impact on Financial Health: Poor lending practices could jeopardize a borrower’s financial stability in the long run.

In conclusion, consolidating student loans presents both significant advantages and considerable disadvantages. It simplifies repayment processes and potentially lowers monthly payments while providing access to alternative repayment plans. However, borrowers must be cautious about potential pitfalls such as higher total interest costs, loss of borrower benefits, and resetting progress toward forgiveness programs.

Before deciding on consolidation, it is crucial for borrowers to evaluate their individual financial situations carefully and consider seeking advice from financial professionals if needed. Making an informed choice will help ensure that consolidation aligns with long-term financial goals rather than complicating them further.

Frequently Asked Questions About Consolidating Student Loans

- What is student loan consolidation?

Student loan consolidation is the process of combining multiple student loans into one single loan with a new servicer. - How does consolidation affect my interest rate?

The new interest rate will be a weighted average of your existing loans’ rates rounded up to the nearest one-eighth percent. - Will I lose any benefits if I consolidate my federal loans?

You may lose certain benefits such as deferment options or eligibility for forgiveness programs when consolidating federal loans. - Can I consolidate both federal and private loans together?

No, you cannot consolidate federal and private loans together; they must be consolidated separately. - How does consolidation impact my credit score?

If done responsibly with timely payments, consolidation can improve your credit score by reducing your overall number of open accounts. - Is there a downside to having a longer repayment term?

A longer repayment term lowers monthly payments but increases total interest paid over time and prolongs debt duration. - Can I consolidate my loans more than once?

No, you can typically only consolidate your student loans once; if rates drop after consolidation, you cannot redo it without refinancing. - What should I consider before consolidating my student loans?

You should evaluate your current financial situation, potential loss of benefits, total costs involved, and whether your long-term goals align with consolidation.