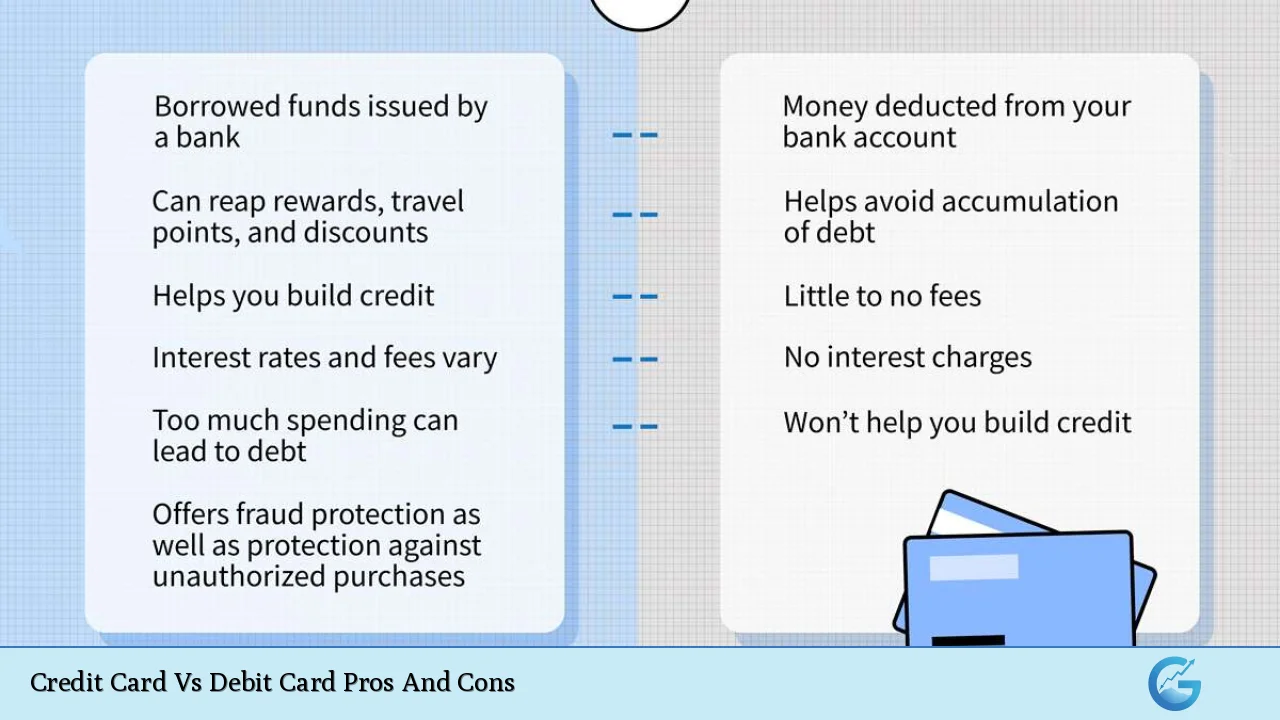

In today’s digital age, plastic money has become an integral part of our financial lives. Credit cards and debit cards are two of the most common forms of payment, each with its own set of advantages and disadvantages. Understanding the pros and cons of these financial tools is crucial for making informed decisions about personal finance, especially for those interested in investing in various markets such as forex, crypto, and traditional finance.

| Pros | Cons |

|---|---|

| Build credit history | Potential for high-interest debt |

| Rewards and cashback | Annual fees |

| Fraud protection | Overspending risk |

| Convenience for large purchases | Impact on credit score |

| Emergency fund access | Complex terms and conditions |

| No overdraft fees | Limited fraud protection |

| Direct account withdrawal | No credit building |

| Budgeting tool | Limited rewards |

Credit Cards: Advantages

- Build Credit History: Regular use and timely payments can significantly improve your credit score, which is crucial for future loans and financial opportunities.

- Rewards and Cashback: Many credit cards offer points, miles, or cash back on purchases, providing tangible benefits for everyday spending.

- Fraud Protection: Credit cards typically offer robust fraud protection, limiting your liability in case of unauthorized transactions.

- Convenience for Large Purchases: Credit cards allow for significant purchases without immediate impact on your bank account, offering flexibility in cash flow management.

- Emergency Fund Access: In financial emergencies, credit cards can serve as a temporary funding source, providing a safety net when unexpected expenses arise.

Credit Cards: Disadvantages

- Potential for High-Interest Debt: Carrying a balance can lead to substantial interest charges, potentially trapping users in a cycle of debt.

- Annual Fees: Some premium credit cards charge annual fees, which can offset rewards if not used strategically.

- Overspending Risk: The psychological disconnect between spending and immediate financial impact can lead to overspending and budget mismanagement.

- Impact on Credit Score: Misuse or late payments can negatively affect your credit score, potentially impacting future financial opportunities.

- Complex Terms and Conditions: Credit card agreements often include intricate terms that can be challenging to understand, leading to unexpected fees or penalties.

Debit Cards: Advantages

- No Overdraft Fees: Transactions are typically declined if there are insufficient funds, preventing costly overdraft charges.

- Direct Account Withdrawal: Spending is limited to available funds, promoting better budget management and reducing the risk of debt accumulation.

- Budgeting Tool: Real-time account balance updates make it easier to track spending and adhere to a budget.

- ATM Access: Debit cards often provide free ATM withdrawals, especially when used at in-network machines.

- No Interest Charges: Since you’re spending your own money, there’s no risk of accruing interest on purchases.

Debit Cards: Disadvantages

- Limited Fraud Protection: While improving, debit cards typically offer less comprehensive fraud protection compared to credit cards.

- No Credit Building: Debit card usage doesn’t contribute to building or improving your credit score.

- Limited Rewards: Most debit cards don’t offer rewards programs, missing out on potential cashback or points.

- Holds on Funds: Certain transactions, like hotel bookings or car rentals, may place holds on your account, temporarily reducing available funds.

- Potential for Overdraft Fees: If overdraft protection is enabled, you might incur fees for transactions exceeding your balance.

Credit Cards in the Context of Financial Markets

For those involved in finance, crypto, forex, and money markets, credit cards can play a significant role beyond everyday purchases. Many credit cards offer benefits tailored to investors and frequent travelers, such as airport lounge access, travel insurance, and enhanced rewards on financial service purchases. These perks can be particularly valuable for those who frequently engage in international transactions or travel for investment purposes.

Moreover, some credit cards offer features that align well with market activities:

- Currency Conversion: Cards with no foreign transaction fees can be advantageous for forex traders or international investors.

- Purchase Protection: This feature can be crucial when making large purchases related to trading equipment or financial services.

- Extended Warranties: Useful for protecting high-value electronics often used in trading and market analysis.

- Concierge Services: Can assist with travel arrangements for financial conferences or meetings.

Debit Cards in Financial Markets

While debit cards may seem less advantageous in the context of financial markets, they still have their place:

- Risk Management: Using a debit card for market-related expenses can help traders stick to predetermined budgets, reducing the risk of overspending on trading activities.

- Immediate Fund Access: For time-sensitive market opportunities, debit cards provide quick access to available funds without the need for credit approval.

- Cryptocurrency Purchases: Some exchanges prefer or only accept debit card transactions for crypto purchases, viewing them as less risky than credit card transactions.

Choosing Between Credit and Debit Cards for Market Activities

When deciding between credit and debit cards for finance-related activities, consider the following:

- Transaction Volume: If you’re making frequent transactions, a rewards credit card might offer significant benefits.

- Cash Flow Management: Credit cards can provide a buffer for large purchases, while debit cards ensure you’re only spending available funds.

- International Use: Look for cards with favorable foreign transaction fees and exchange rates.

- Security: For large online transactions, credit cards generally offer better protection.

- Rewards Alignment: Choose a card whose rewards program aligns with your spending patterns in financial markets.

Risks and Concerns

It’s crucial to be aware of the risks associated with using both credit and debit cards in financial market activities:

- Market Volatility: Using credit for investments can amplify losses in volatile markets.

- Fraud Risk: Online transactions in less secure environments can expose card details to potential theft.

- Debt Accumulation: The ease of credit card use can lead to unsustainable debt levels if not managed properly.

- Fee Awareness: Both credit and debit cards may incur fees for certain types of financial transactions, impacting overall returns.

In conclusion, both credit and debit cards have their place in the toolkit of finance enthusiasts and market participants. The key is to understand the strengths and weaknesses of each and use them strategically to maximize benefits while minimizing risks. As with any financial tool, responsible use is paramount, especially when engaging in high-stakes activities like trading and investing.

Frequently Asked Questions About Credit Card Vs Debit Card Pros And Cons

- Which is safer for online transactions, credit or debit cards?

Credit cards generally offer better protection for online transactions. They typically have stronger fraud protection policies and don’t directly access your bank account. - Can using a credit card help in building a credit score for better investment opportunities?

Yes, responsible credit card use can help build a strong credit score. This can lead to better terms on loans for investment properties or businesses. - Are there any advantages to using debit cards for cryptocurrency purchases?

Some crypto exchanges prefer debit cards as they represent immediate fund transfers. Additionally, using a debit card can help manage spending and avoid debt accumulation in volatile markets. - How do rewards programs differ between credit and debit cards for frequent travelers in finance?

Credit cards typically offer more robust travel rewards, including points for airfare, hotel stays, and travel insurance. Debit card rewards are usually more limited, if available at all. - Can credit card debt affect my ability to participate in certain financial markets?

High credit card debt can negatively impact your credit score, potentially limiting your ability to obtain margin accounts or loans for investment purposes. - Are there any specific credit cards designed for forex or crypto traders?

Some credit cards offer enhanced rewards for foreign transactions or technology purchases, which can benefit forex and crypto traders. However, cards specifically for these markets are limited. - How do credit and debit cards compare in terms of daily spending limits for large market transactions?

Credit cards often have higher daily spending limits compared to debit cards, making them more suitable for large market transactions. However, these limits can vary based on the individual’s creditworthiness and bank policies. - Is it possible to use both credit and debit cards strategically in financial market activities?

Yes, using both can be advantageous. Credit cards can be used for large purchases and to earn rewards, while debit cards can help with budgeting and immediate fund access for time-sensitive opportunities.