In the world of personal finance, choosing the right financial institution is crucial for managing your money effectively. Two primary options stand out: credit unions and banks. While both offer similar services, they operate under different models and philosophies, each with its own set of advantages and disadvantages. This comprehensive analysis will delve into the pros and cons of credit unions versus banks, providing valuable insights for individuals looking to make informed decisions about their financial partnerships.

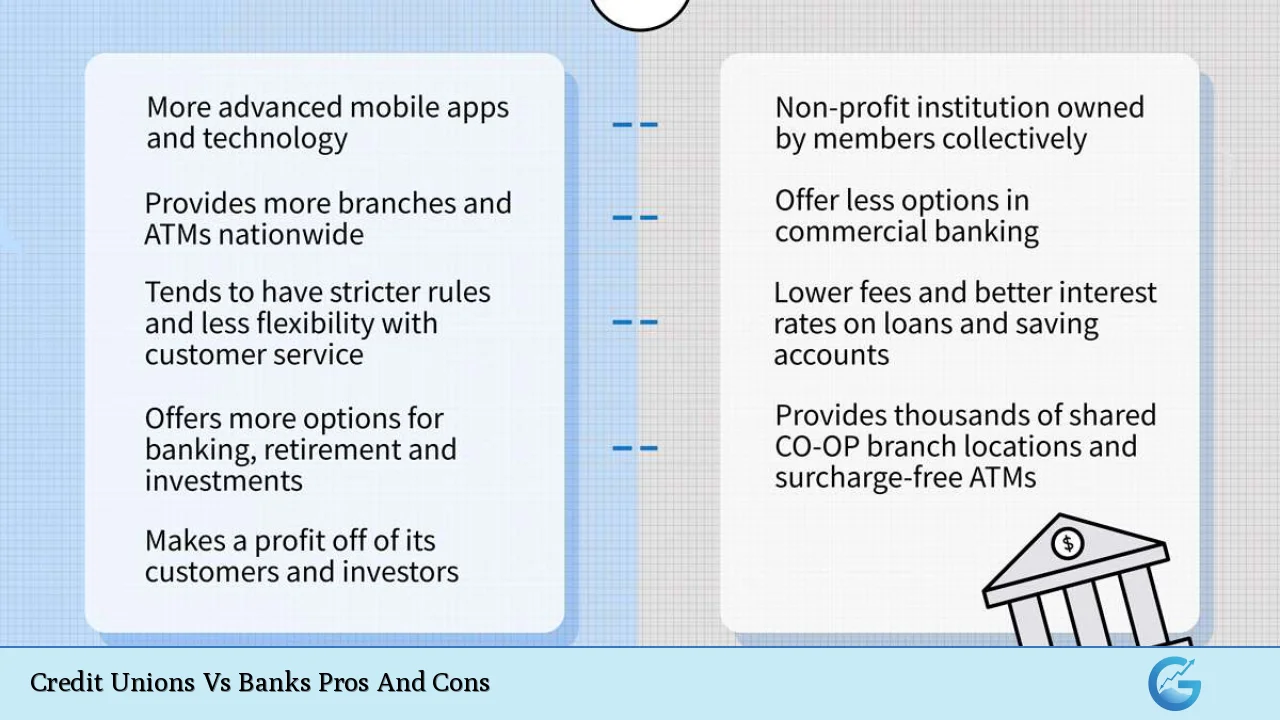

| Pros | Cons |

|---|---|

| Higher interest rates on savings | Limited membership |

| Lower fees | Fewer branches and ATMs |

| Personalized customer service | Limited product offerings |

| Lower loan rates | Less advanced technology |

| Member-owned structure | Smaller asset base |

| Focus on financial education | Geographic limitations |

| Community involvement | Potential for merger or acquisition |

Advantages of Credit Unions

Higher Interest Rates on Savings

Credit unions typically offer higher interest rates on savings accounts, certificates of deposit (CDs), and other deposit products compared to traditional banks. This advantage stems from their not-for-profit status, which allows them to return profits to members in the form of better rates. For instance, while a large national bank might offer a 0.01% annual percentage yield (APY) on a standard savings account, a credit union could provide rates of 1% or higher.

Lower Fees

Credit unions are known for their consumer-friendly fee structures. They often charge lower fees for services such as:

- Account maintenance

- Overdraft protection

- ATM usage

- Wire transfers

- Loan origination

This fee structure can result in significant savings for members over time, especially for those who frequently use various banking services.

Personalized Customer Service

Credit unions pride themselves on providing personalized, community-oriented customer service. Due to their smaller size and local focus, credit union staff often develop more personal relationships with members. This can lead to:

- More flexible decision-making on loans

- Tailored financial advice

- Quicker resolution of issues

- A more welcoming atmosphere for in-person banking

Lower Loan Rates

One of the most significant advantages of credit unions is their ability to offer lower interest rates on various types of loans, including:

- Mortgages

- Auto loans

- Personal loans

- Credit cards

These lower rates can translate to substantial savings over the life of a loan, making credit unions an attractive option for borrowers.

Member-Owned Structure

Credit unions operate under a unique member-owned structure, where account holders are also partial owners of the institution. This structure offers several benefits:

- Voting rights on major decisions

- Eligibility for board positions

- Alignment of the institution’s goals with member interests

- Potential for dividend payments based on the credit union’s performance

Focus on Financial Education

Many credit unions place a strong emphasis on financial literacy and education for their members. They often provide:

- Free financial workshops

- Online resources and tools

- One-on-one financial counseling

- Youth-focused programs to teach money management skills

This focus on education can help members make more informed financial decisions and improve their overall financial well-being.

Community Involvement

Credit unions are deeply rooted in their local communities and often engage in various community support initiatives, such as:

- Sponsoring local events

- Providing scholarships

- Supporting local charities

- Offering specialized products for community development

This involvement can create a sense of belonging and purpose for members who value community engagement.

Disadvantages of Credit Unions

Limited Membership

One of the primary drawbacks of credit unions is their restricted membership criteria. Unlike banks that are open to anyone, credit unions typically require members to meet specific eligibility requirements, such as:

- Living in a particular geographic area

- Working for a certain employer

- Belonging to a specific organization or group

This limitation can make it challenging for some individuals to join their preferred credit union.

Fewer Branches and ATMs

Compared to large national banks, credit unions generally have a more limited network of branches and ATMs. This can be inconvenient for members who:

- Travel frequently

- Live in areas with few credit union locations

- Prefer in-person banking services

While many credit unions participate in shared branching networks to mitigate this issue, the coverage is still often less extensive than that of major banks.

Limited Product Offerings

Credit unions, especially smaller ones, may offer a more limited range of financial products and services compared to large banks. This can include:

- Fewer investment options

- Limited business banking services

- Less variety in credit card offerings

- Fewer specialized account types

For individuals or businesses with complex financial needs, this limitation could be a significant drawback.

Less Advanced Technology

While many credit unions have made strides in improving their digital offerings, they often lag behind large banks in terms of technological advancements. This can manifest in:

- Less sophisticated mobile banking apps

- Fewer online banking features

- Limited integration with fintech services

- Slower adoption of emerging technologies like blockchain or AI-driven financial tools

For tech-savvy consumers or those who rely heavily on digital banking, this could be a notable disadvantage.

Smaller Asset Base

Credit unions typically have a smaller asset base compared to large banks. This can lead to:

- Lower lending limits for large loans

- Less capacity to absorb economic shocks

- Potential difficulties in offering certain high-value services

For high-net-worth individuals or businesses seeking substantial loans, this limitation could be problematic.

Geographic Limitations

Many credit unions operate within specific geographic regions, which can be inconvenient for members who:

- Relocate frequently

- Need banking services in multiple states or countries

- Prefer a financial institution with a national or global presence

This regional focus can limit the credit union’s ability to serve members who have geographically diverse financial needs.

Potential for Merger or Acquisition

Smaller credit unions may be more susceptible to mergers or acquisitions, which could lead to:

- Changes in policies and procedures

- Alterations to product offerings

- Shifts in customer service approach

- Potential loss of the local, community-focused feel

While mergers can sometimes bring benefits, they can also disrupt the member experience and alter the credit union’s original mission.

In conclusion, the choice between a credit union and a bank depends on individual financial needs, preferences, and circumstances. Credit unions offer compelling advantages in terms of rates, fees, and personalized service, making them an excellent choice for many consumers. However, their limitations in technology, product range, and geographical reach may make banks a better option for others, particularly those with complex financial needs or those who prioritize convenience and cutting-edge digital services.

When making a decision, it’s crucial to carefully evaluate your financial goals, banking habits, and the specific offerings of the institutions you’re considering. Remember that it’s also possible to maintain accounts at both a credit union and a bank to leverage the strengths of each. Ultimately, the best choice is the one that aligns most closely with your financial objectives and lifestyle needs.

Frequently Asked Questions About Credit Unions Vs Banks Pros And Cons

- Are credit unions safer than banks?

Both credit unions and banks offer similar levels of safety for deposits. Credit unions are insured by the National Credit Union Administration (NCUA), while banks are insured by the Federal Deposit Insurance Corporation (FDIC), both for up to $250,000 per depositor. - Can I join any credit union I want?

No, credit unions have specific membership requirements. These may be based on your employer, geographic location, family ties to existing members, or membership in certain organizations. - Do credit unions offer better rates than banks?

Generally, credit unions offer higher interest rates on savings and lower rates on loans compared to traditional banks. However, rates can vary, so it’s important to compare specific offers. - Are there any downsides to using a credit union instead of a bank?

Potential downsides include fewer branch locations, limited ATM networks, fewer product offerings, and sometimes less advanced online and mobile banking technology compared to large banks. - Can businesses use credit unions?

Yes, many credit unions offer business banking services. However, their offerings may be more limited compared to large commercial banks, especially for complex business needs. - Do credit unions have the same level of online banking as banks?

While many credit unions offer robust online banking, larger banks often have more advanced digital platforms and mobile apps. The level of online services can vary significantly between institutions. - Are credit union loans easier to get than bank loans?

Credit unions may have more flexible lending criteria and may be more willing to work with members who have less-than-perfect credit. However, loan approval still depends on individual circumstances and the credit union’s policies. - Can I use my credit union account if I move to another state?

Yes, you can typically continue using your credit union account if you move. However, you may face challenges with in-person services if your credit union doesn’t have branches in your new location or participate in shared branching networks.