Cryptocurrency, a digital or virtual form of currency that uses cryptography for security, has gained significant attention in recent years. Its decentralized nature, reliance on blockchain technology, and potential for high returns have attracted both investors and technologists. However, alongside its advantages, cryptocurrencies also present various challenges and risks. This article explores the pros and cons of cryptocurrency, providing a comprehensive overview for individuals interested in finance, crypto, forex, and money markets.

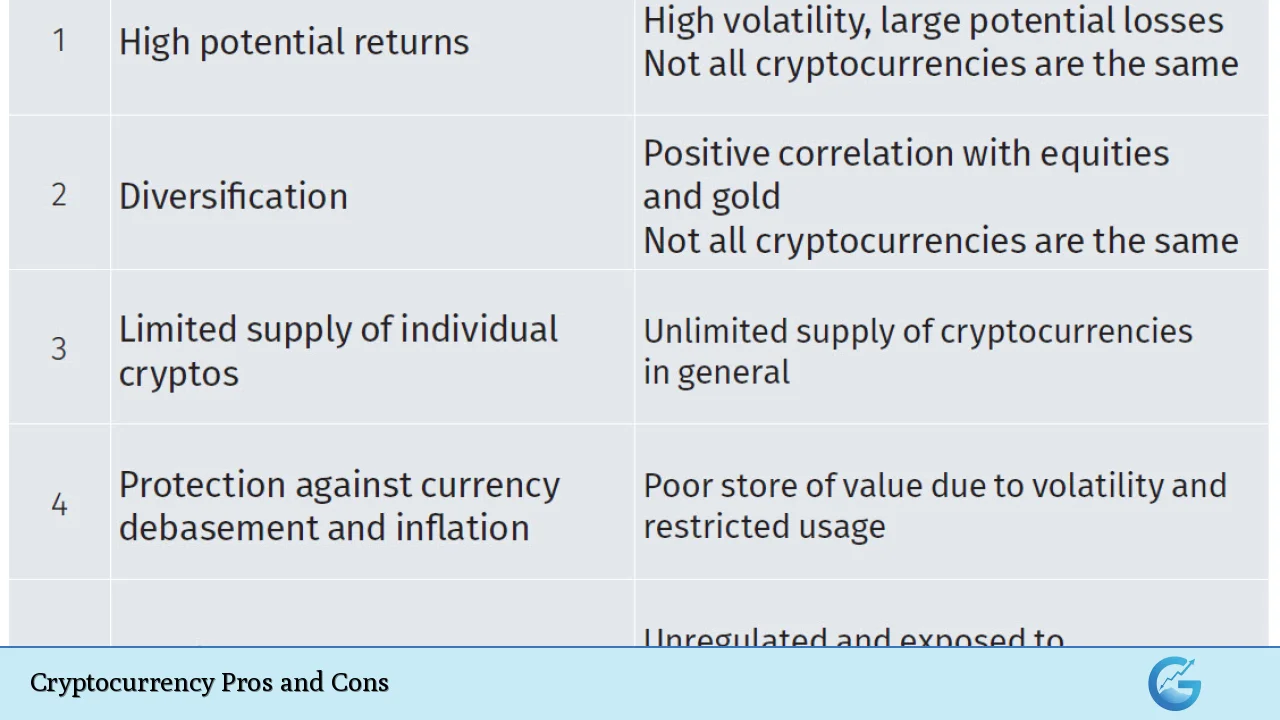

| Pros | Cons |

|---|---|

| Decentralization | High volatility |

| Lower transaction fees | Lack of regulation |

| Potential for high returns | Security risks |

| Accessibility and inclusivity | Technical complexity |

| Inflation protection | Risk of scams and frauds |

| Privacy and anonymity | Environmental concerns |

| Global transactions without intermediaries | No recourse for lost funds |

| Potential for innovation in financial services | Market manipulation risks |

Decentralization

One of the most significant advantages of cryptocurrency is its decentralized nature. Unlike traditional currencies that are controlled by central banks or governments, cryptocurrencies operate on a peer-to-peer network. This decentralization reduces the risk of government interference or manipulation, providing a more stable financial environment.

- Freedom from central authorities: Users have control over their funds without needing a bank or financial institution.

- Resilience against censorship: Transactions cannot be easily blocked or reversed by any authority.

High Volatility

While decentralization offers several benefits, it also leads to high volatility in cryptocurrency markets. Prices can fluctuate dramatically within short periods, making it a risky investment.

- Rapid price changes: Cryptocurrencies can experience significant price swings based on market sentiment, news events, or regulatory changes.

- Potential for large losses: Investors may face substantial financial losses if they buy at a peak and sell at a trough.

Lower Transaction Fees

Cryptocurrencies often have lower transaction fees compared to traditional banking systems or credit card transactions. This cost-effectiveness is particularly beneficial for international transfers.

- Reduced costs: Transactions can occur with minimal fees, especially in cross-border payments.

- No intermediaries: The elimination of banks and payment processors further reduces costs.

Lack of Regulation

The lack of regulation in the cryptocurrency space poses significant risks to investors. While some view this as an advantage due to increased freedom, it also means there are fewer protections in place.

- Increased risk of fraud: Without regulatory oversight, scams and fraudulent schemes are more prevalent.

- Market manipulation: The absence of regulations allows for potential manipulation by large players in the market.

Potential for High Returns

Many investors are drawn to cryptocurrencies due to their potential for high returns. The rapid appreciation of assets like Bitcoin has created numerous success stories.

- Investment opportunities: Early adopters of cryptocurrencies have seen substantial gains on their investments.

- Diverse investment options: The growing number of cryptocurrencies provides various opportunities for diversification.

Security Risks

Despite the robust security features of blockchain technology, cryptocurrencies are not immune to security risks.

- Hacking threats: Cryptocurrency exchanges and wallets can be vulnerable to hacking attempts, leading to significant financial losses.

- Loss of private keys: If users lose access to their private keys, they may permanently lose their funds without any recourse.

Accessibility and Inclusivity

Cryptocurrencies provide an opportunity for individuals who may not have access to traditional banking services.

- Financial inclusion: People in underbanked regions can participate in the global economy through cryptocurrencies.

- Easy access: Anyone with an internet connection can buy or trade cryptocurrencies without needing a bank account.

Technical Complexity

Investing in cryptocurrency requires a certain level of technical knowledge that can be daunting for newcomers.

- Steep learning curve: Understanding how wallets work, how to trade securely, and how blockchain technology functions can be challenging.

- Risk of mistakes: New users may make errors that result in loss of funds due to lack of understanding.

Inflation Protection

Cryptocurrencies like Bitcoin are often viewed as a hedge against inflation due to their limited supply.

- Deflationary nature: Many cryptocurrencies have capped supplies (e.g., Bitcoin’s 21 million coins), which can protect against currency devaluation over time.

- Store of value: Investors may use cryptocurrencies as a way to preserve wealth during economic instability.

Risk of Scams and Frauds

The cryptocurrency market has been marred by numerous scams that target unsuspecting investors.

- Ponzi schemes and ICO scams: Many fraudulent projects have exploited the hype around cryptocurrencies to defraud investors.

- Lack of accountability: In many cases, victims have little recourse to recover lost funds due to the pseudonymous nature of transactions.

Privacy and Anonymity

Cryptocurrencies offer varying levels of privacy compared to traditional financial systems.

- Pseudonymous transactions: While transactions are recorded on public ledgers, users’ identities are not directly tied to their wallet addresses.

- Enhanced privacy options: Some cryptocurrencies focus on providing greater anonymity (e.g., Monero).

Environmental Concerns

The environmental impact of cryptocurrency mining, particularly Bitcoin mining, has raised significant concerns.

- High energy consumption: Mining operations require vast amounts of electricity, contributing to carbon emissions and environmental degradation.

- Sustainability issues: The reliance on fossil fuels for mining operations poses long-term sustainability challenges for the industry.

Global Transactions Without Intermediaries

Cryptocurrencies facilitate global transactions without the need for intermediaries like banks or payment processors.

- Faster transactions: Cross-border payments can be processed quickly without traditional delays associated with banking systems.

- Lower barriers to entry: Individuals can send money internationally with minimal fees and without needing permission from financial institutions.

No Recourse for Lost Funds

One major downside is that cryptocurrency transactions are irreversible; once completed, they cannot be undone.

- Irrecoverable mistakes: If funds are sent to the wrong address or lost due to hacking, there is no way to retrieve them.

- Lack of consumer protection: Unlike traditional banking systems that offer fraud protection or chargebacks, cryptocurrencies do not provide such safety nets.

Potential for Innovation in Financial Services

The rise of cryptocurrencies has spurred innovation within the financial sector.

- New business models: Decentralized finance (DeFi) platforms offer alternatives to traditional banking services such as lending and borrowing without intermediaries.

- Smart contracts: Blockchain technology enables automated contracts that execute when predefined conditions are met, streamlining various processes across industries.

In conclusion, while cryptocurrencies present numerous advantages such as decentralization, lower transaction fees, and potential high returns, they also come with significant risks including volatility, security concerns, and lack of regulation. As the market continues to evolve, understanding these pros and cons is essential for anyone looking to invest in this dynamic asset class.

Frequently Asked Questions About Cryptocurrency Pros and Cons

- What is the biggest advantage of cryptocurrency?

The biggest advantage is its decentralization which provides users with control over their funds without reliance on central authorities. - What makes cryptocurrency investments risky?

The high volatility in prices combined with security risks such as hacking makes cryptocurrency investments particularly risky. - Are there any protections against fraud in cryptocurrency?

No comprehensive protections exist; investors must conduct thorough research before investing. - How does cryptocurrency protect against inflation?

Many cryptocurrencies have capped supplies which help maintain value during inflationary periods. - Can I recover lost cryptocurrency?

No; once lost due to hacking or sending it to an incorrect address, there is typically no way to recover it. - What are the environmental impacts of cryptocurrency?

The energy-intensive mining processes contribute significantly to carbon emissions and environmental degradation. - How accessible is cryptocurrency?

Cryptocurrency is highly accessible; anyone with an internet connection can buy or trade it without needing a bank account. - Is cryptocurrency regulated?

The lack of regulation increases risks associated with fraud and market manipulation.