Debt consolidation loans have become an increasingly popular financial tool for individuals seeking to manage multiple debts more effectively. This strategy involves taking out a new loan to pay off existing debts, essentially combining them into a single, more manageable monthly payment. While this approach can offer significant benefits for some borrowers, it’s crucial to understand both the advantages and potential drawbacks before making a decision.

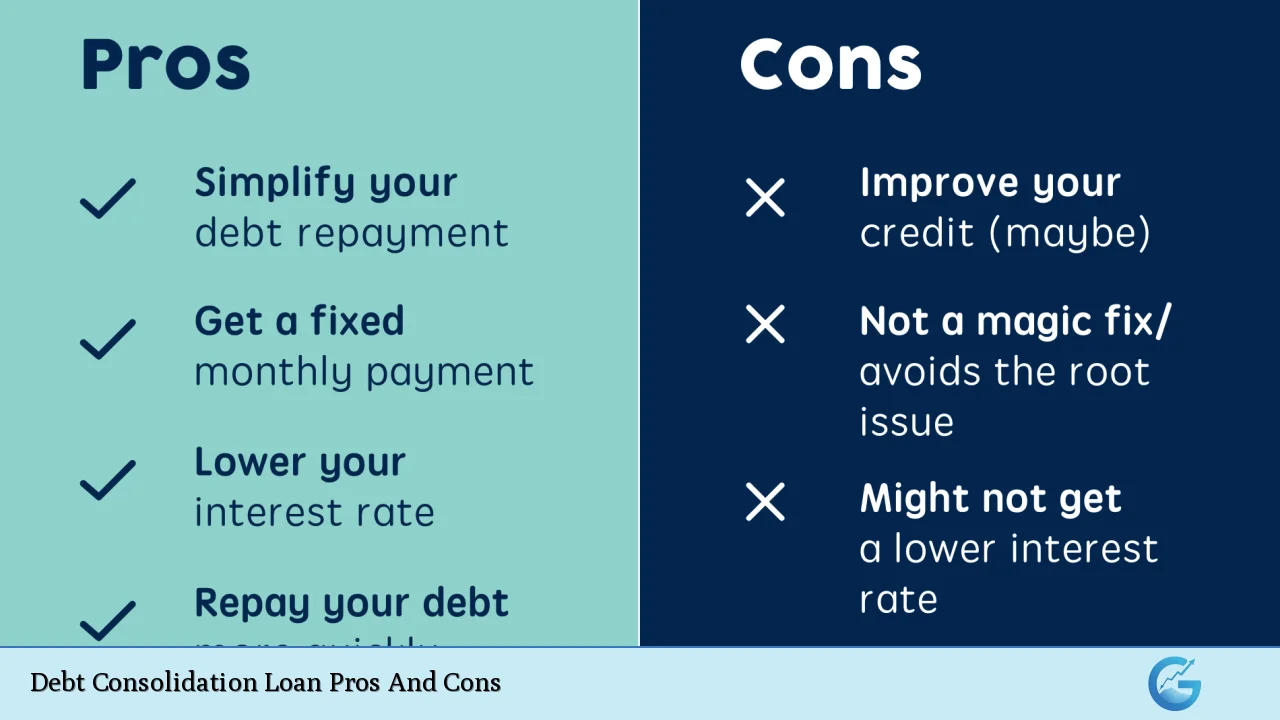

| Pros | Cons |

|---|---|

| Simplified debt management | Potential for higher overall costs |

| Lower interest rates | Risk of accumulating more debt |

| Improved credit score | Longer repayment terms |

| Fixed repayment schedule | Collateral requirements for secured loans |

| Potential savings on interest | Fees and closing costs |

| Stress reduction | Temptation to overspend |

Advantages of Debt Consolidation Loans

Simplified Debt Management

One of the most significant benefits of a debt consolidation loan is the simplification of your financial obligations.

Instead of juggling multiple payments with various due dates, you’ll only need to focus on a single monthly payment. This streamlined approach can help reduce the likelihood of missed or late payments, which can negatively impact your credit score.

- Easier budgeting with one fixed payment

- Reduced risk of missed payments

- Less time spent managing multiple accounts

Lower Interest Rates

For many borrowers, particularly those with high-interest credit card debt, a debt consolidation loan can offer a lower overall interest rate.

This reduction in interest can lead to substantial savings over the life of the loan, especially for those with good to excellent credit scores.

- Potential for significant interest savings

- Opportunity to leverage improved credit for better rates

- Competitive rates compared to credit cards and payday loans

Improved Credit Score

While initially taking out a new loan may cause a slight dip in your credit score due to the hard inquiry,

responsible management of a debt consolidation loan can lead to long-term credit score improvements.

As you make consistent, on-time payments and reduce your overall debt burden, your credit utilization ratio will decrease, potentially boosting your score.

- Positive payment history builds credit

- Lower credit utilization ratio

- Diversification of credit mix

Fixed Repayment Schedule

Many debt consolidation loans come with fixed interest rates and set repayment terms. This structure provides borrowers with a clear path to becoming debt-free, as opposed to the revolving nature of credit card debt.

- Predictable monthly payments

- Clear timeline for debt repayment

- Protection against variable interest rates

Potential Savings on Interest

By consolidating high-interest debts into a single loan with a lower rate, borrowers can potentially save thousands of dollars in interest over time.

This can be particularly beneficial for those carrying balances on multiple high-interest credit cards.

- Reduced overall interest payments

- Faster debt payoff possible with savings

- More of each payment goes towards principal

Stress Reduction

The psychological benefit of debt consolidation shouldn’t be underestimated.

Having a clear plan to eliminate debt can significantly reduce financial stress and anxiety.

- Simplified financial management reduces worry

- Progress towards debt-free status is more visible

- Improved sense of control over finances

Disadvantages of Debt Consolidation Loans

Potential for Higher Overall Costs

While a lower interest rate is appealing, it’s crucial to consider the total cost of the loan over its entire term.

In some cases, extending the repayment period can result in paying more in interest over time, even with a lower rate.

- Extended loan terms may increase total interest paid

- Need to calculate total cost comparison carefully

- Risk of paying more for smaller debts that could be paid off quickly

Risk of Accumulating More Debt

One of the most significant risks of debt consolidation is the temptation to accumulate new debt once credit cards are paid off.

Without addressing the underlying spending habits that led to the initial debt, borrowers may find themselves in a worse financial position.

- Freed-up credit limits may encourage overspending

- Psychological relief may lead to false sense of financial security

- Failure to change spending habits can lead to doubled debt

Longer Repayment Terms

While longer repayment terms can make monthly payments more manageable, they also mean being in debt for a more extended period.

This extended timeline can delay other financial goals and tie up resources that could be used for investments or savings.

- Debt payoff takes longer, delaying financial freedom

- Opportunity cost of funds tied up in debt repayment

- Psychological burden of long-term debt commitment

Collateral Requirements for Secured Loans

Some debt consolidation loans, particularly those offering the lowest interest rates, may require collateral such as a home or vehicle.

This puts valuable assets at risk if you’re unable to make payments on the loan.

- Risk of losing assets if unable to repay the loan

- Increased stakes for loan repayment

- Limited flexibility compared to unsecured debts

Fees and Closing Costs

Many debt consolidation loans come with origination fees, balance transfer fees, or closing costs.

These upfront expenses can offset the potential savings from a lower interest rate, especially for borrowers consolidating smaller amounts of debt.

- Origination fees can range from 1% to 8% of the loan amount

- Balance transfer fees on credit card consolidations

- Appraisal and closing costs for home equity loans

Temptation to Overspend

Once credit cards are paid off through consolidation, there may be a strong temptation to use them again.

This can lead to a cycle of debt that’s even more challenging to break, potentially doubling the total debt burden.

- Risk of maxing out credit cards again

- False sense of financial improvement

- Potential for spiraling debt if old habits persist

In conclusion, debt consolidation loans can be a powerful tool for managing and eliminating debt when used responsibly. They offer the potential for simplified finances, lower interest rates, and a clear path to becoming debt-free. However, it’s crucial to carefully consider the potential drawbacks, including the risk of accumulating more debt and the possibility of paying more over time due to extended loan terms.

Before deciding on a debt consolidation loan, it’s essential to thoroughly analyze your financial situation, compare loan offers, and consider seeking advice from a financial professional.

Remember that debt consolidation is not a magic solution but rather a strategy that requires discipline and a commitment to changing financial habits. By understanding both the advantages and disadvantages, you can make an informed decision about whether a debt consolidation loan is the right choice for your financial future.

Frequently Asked Questions About Debt Consolidation Loan Pros And Cons

- What credit score do I need for a debt consolidation loan?

While requirements vary by lender, generally a credit score of 650 or higher is needed for favorable terms. Some lenders may offer options for scores as low as 580, but with higher interest rates. - Can debt consolidation hurt my credit score?

Initially, there may be a small dip due to the hard inquiry and new account. However, over time, consistent payments and lower credit utilization can improve your score. - How long does it take to get approved for a debt consolidation loan?

The approval process can range from a few hours to several days, depending on the lender and your financial situation. Online lenders often offer faster approvals than traditional banks. - Is it better to get a secured or unsecured debt consolidation loan?

Secured loans typically offer lower interest rates but put your assets at risk. Unsecured loans are safer but may have higher rates. The choice depends on your financial situation and risk tolerance. - Can I consolidate all types of debt with a consolidation loan?

Most unsecured debts like credit cards, personal loans, and medical bills can be consolidated. However, secured debts like mortgages and car loans typically cannot be included. - What happens to my credit cards after debt consolidation?

The accounts remain open unless you choose to close them. It’s often advisable to keep them open to maintain credit history length, but avoid using them to prevent accumulating new debt. - Are there alternatives to debt consolidation loans?

Yes, alternatives include balance transfer credit cards, debt management plans through credit counseling agencies, and home equity loans or lines of credit for homeowners. - How do I know if a debt consolidation loan is right for me?

Consider factors like your total debt amount, current interest rates, credit score, and ability to qualify for a lower rate. If you can save money and have a plan to avoid future debt, it may be a good option.