Discover credit cards have become increasingly popular among consumers seeking rewards, cash back, and other perks. As a major player in the credit card industry, Discover offers a range of products tailored to different spending habits and financial goals. However, like any financial product, Discover cards come with their own set of advantages and disadvantages. This comprehensive analysis will delve into the pros and cons of Discover credit cards, providing valuable insights for those considering adding one to their wallet.

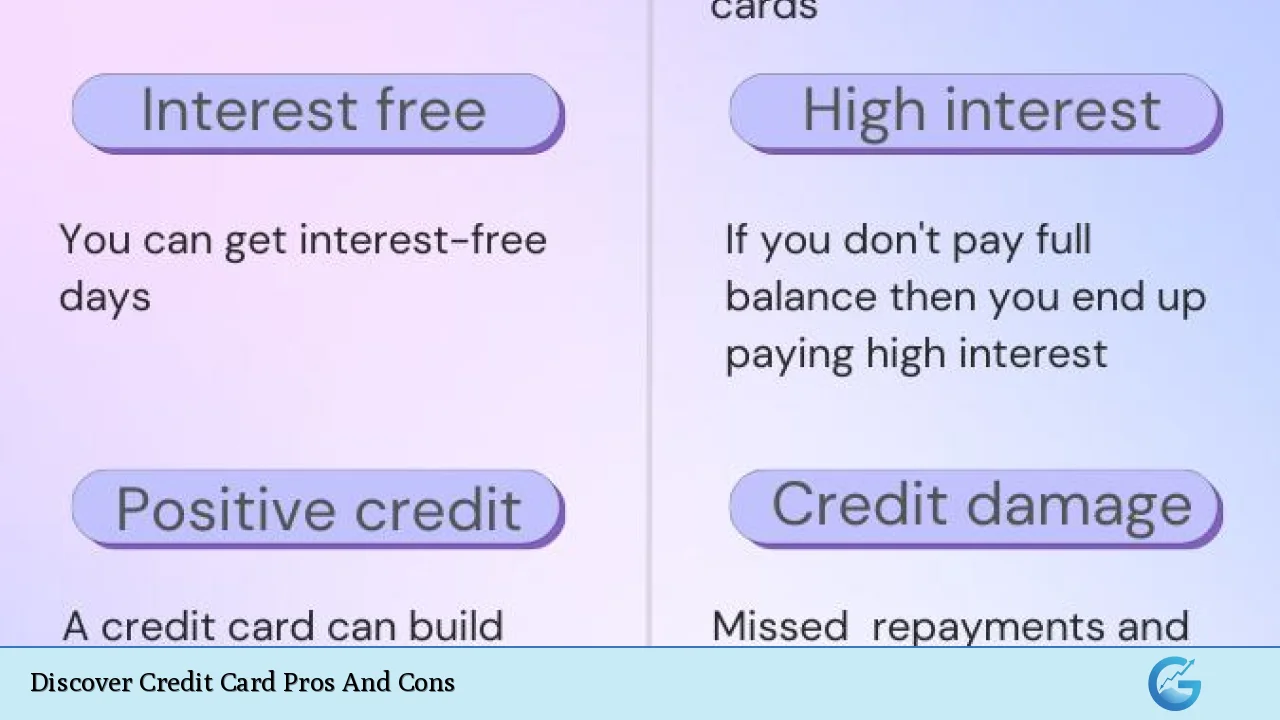

| Pros | Cons |

|---|---|

| Generous cash back rewards | Limited international acceptance |

| No annual fee on most cards | Rotating categories require activation |

| Cashback Match for new cardholders | Higher APRs for some cardholders |

| 0% intro APR offers | Fewer premium card options |

| No foreign transaction fees | Limited travel perks compared to competitors |

| Excellent customer service | Potentially lower credit limits |

| Free FICO score access | No luxury benefits like airport lounge access |

| Flexible redemption options | Fewer co-branded card partnerships |

Advantages of Discover Credit Cards

Generous Cash Back Rewards

One of the most compelling reasons to consider a Discover credit card is its robust cash back program. The Discover it® Cash Back card, for instance, offers 5% cash back on rotating quarterly categories, up to a quarterly maximum when activated. These categories often include popular spending areas such as groceries, gas stations, restaurants, and online shopping. This high earn rate can significantly boost rewards for cardholders who align their spending with the bonus categories.

Additionally, all purchases outside the bonus categories earn a standard 1% cash back, ensuring that every transaction contributes to your rewards balance. For those who prefer a more straightforward approach, the Discover it® Chrome offers 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter, with 1% back on all other purchases.

No Annual Fee on Most Cards

In an era where many premium rewards cards come with hefty annual fees, Discover stands out by offering most of its cards with no annual fee. This feature allows cardholders to enjoy the benefits and rewards without the pressure of having to justify a yearly cost. The absence of an annual fee makes Discover cards an attractive option for budget-conscious consumers and those new to credit cards.

Cashback Match for New Cardholders

Discover’s unique welcome offer, the Cashback Match program, is a significant advantage for new cardholders. Unlike traditional sign-up bonuses that require meeting a specific spending threshold, Discover automatically matches all the cash back earned by new cardmembers at the end of their first year. This innovative approach means that the more you use your card and earn rewards, the bigger your bonus will be, with no cap on the match amount.

For example, if you earn $300 in cash back during your first year, Discover will match it with another $300, effectively doubling your rewards. This program can be particularly lucrative for those who maximize their 5% bonus categories throughout the year.

0% Intro APR Offers

Many Discover cards come with attractive introductory 0% APR periods on both purchases and balance transfers. These offers typically range from 12 to 15 months, providing cardholders with an opportunity to finance large purchases or consolidate high-interest debt without accruing interest charges. This feature can result in significant savings for those who need to carry a balance temporarily or are looking to pay down existing credit card debt.

No Foreign Transaction Fees

For travelers or those who frequently make international purchases, Discover’s policy of no foreign transaction fees on any of its cards is a valuable benefit. Many credit cards charge a fee of 3% or more on transactions made abroad, which can quickly add up during international trips or when shopping from overseas merchants. By eliminating these fees, Discover helps cardholders save money on their global spending.

Excellent Customer Service

Discover has built a reputation for providing top-notch customer service, consistently ranking high in J.D. Power’s Credit Card Satisfaction Study. The company offers 24/7 U.S.-based customer support, ensuring that cardholders can get assistance whenever they need it. This commitment to service quality can be particularly reassuring for those who value responsive and helpful support for their financial products.

Free FICO Score Access

All Discover cardholders receive free access to their FICO credit score, updated monthly. This feature allows users to monitor their credit health and track changes over time without having to pay for a credit monitoring service. Regular access to one’s credit score can be invaluable for those working to improve their creditworthiness or maintain a strong credit profile.

Flexible Redemption Options

Discover offers a variety of ways to redeem cash back rewards, catering to different preferences and needs. Cardholders can opt for statement credits, direct deposits to a bank account, or even use their rewards to shop directly on Amazon.com or PayPal. The flexibility to choose how to use rewards, with no minimum redemption amount for most options, adds to the overall value proposition of Discover cards.

Disadvantages of Discover Credit Cards

Limited International Acceptance

While Discover has been expanding its global reach, its cards are still not as widely accepted internationally as Visa or Mastercard. This limitation can be problematic for frequent international travelers or those making purchases from foreign merchants. Cardholders may need to carry a backup payment method when traveling abroad to ensure they can make purchases in all locations.

Rotating Categories Require Activation

For cards like the Discover it® Cash Back, which offer 5% cash back in rotating quarterly categories, cardholders must remember to activate these categories each quarter to earn the bonus rate. Failure to activate means missing out on the higher rewards rate for that period. This requirement adds an extra step that some users may find inconvenient or easy to forget.

Higher APRs for Some Cardholders

While Discover offers competitive APRs to many applicants, some cardholders may receive higher interest rates compared to other premium cards in the market. This can be particularly disadvantageous for those who occasionally carry a balance, as the higher APRs can lead to more substantial interest charges over time. It’s crucial for potential applicants to carefully review the APR ranges and compare them with other card offers.

Fewer Premium Card Options

Discover’s credit card lineup, while solid, lacks the variety of premium and ultra-premium options offered by some competitors. For high-spending consumers or those seeking luxury travel perks, Discover’s offerings may fall short. The absence of cards with features like airport lounge access, concierge services, or high-end travel insurance may push some potential customers towards other issuers.

Limited Travel Perks Compared to Competitors

While Discover cards offer some travel benefits, such as no foreign transaction fees, they generally lag behind competitors in terms of comprehensive travel perks. Many travel enthusiasts may find the lack of features like travel credits, airport lounge access, or robust travel insurance coverage to be a significant drawback. This limitation makes Discover cards less appealing for those who prioritize travel rewards and benefits in their credit card choices.

Potentially Lower Credit Limits

Some users report receiving lower credit limits on their Discover cards compared to those offered by other major issuers. Lower credit limits can impact a cardholder’s credit utilization ratio, an important factor in credit scoring. Additionally, it may restrict the ability to make large purchases or fully take advantage of rewards on higher spending levels.

No Luxury Benefits Like Airport Lounge Access

Unlike some premium cards from other issuers, Discover does not offer luxury perks such as complimentary airport lounge access or elite status with hotel chains or car rental companies. For consumers who value these high-end benefits and are willing to pay annual fees to access them, Discover’s offerings may seem limited in comparison.

Fewer Co-Branded Card Partnerships

Discover has fewer co-branded card partnerships compared to issuers like American Express, Chase, or Citi. This means fewer options for consumers looking to earn rewards specific to their favorite airlines, hotels, or retailers. The lack of diverse co-branded offerings may limit the appeal of Discover cards for those seeking to maximize rewards in particular spending categories or with specific brands.

In conclusion, Discover credit cards offer a compelling mix of benefits, particularly for those who value cash back rewards, no annual fees, and excellent customer service. The Cashback Match program for new cardholders and the rotating 5% categories can provide substantial value for savvy spenders. However, the limitations in international acceptance, fewer premium options, and less comprehensive travel perks may make Discover cards less suitable for frequent travelers or those seeking luxury card benefits.

Ultimately, the decision to choose a Discover card depends on individual financial goals, spending habits, and preferences for rewards and benefits. For many consumers, especially those focused on domestic spending and cash back rewards, Discover cards can offer excellent value. However, those prioritizing travel perks or seeking a wider array of premium card options may need to look elsewhere to fully meet their needs.

Frequently Asked Questions About Discover Credit Card Pros And Cons

- How does Discover’s Cashback Match program work?

Discover automatically matches all the cash back new cardmembers earn at the end of their first year. There’s no limit to how much they’ll match, effectively doubling your first year’s rewards. - Are Discover cards widely accepted internationally?

While acceptance is growing, Discover cards are not as widely accepted internationally as Visa or Mastercard. It’s advisable to carry an alternative payment method when traveling abroad. - Do all Discover cards offer rotating 5% cash back categories?

No, only specific cards like the Discover it® Cash Back offer rotating 5% categories. Other Discover cards have different reward structures, such as flat-rate cash back on all purchases. - How does Discover’s customer service compare to other credit card issuers?

Discover consistently ranks high in customer satisfaction surveys, often outperforming other major credit card issuers. They offer 24/7 U.S.-based customer support. - Can I use my Discover card rewards on travel bookings?

Yes, you can redeem Discover rewards for travel bookings through their travel portal. However, Discover doesn’t offer as many travel-specific perks as some competitor cards. - Is there a minimum credit score required for a Discover card?

While Discover doesn’t publish a minimum credit score requirement, most of their cards typically require good to excellent credit (generally 670 or higher FICO score) for approval. - Do Discover cards charge foreign transaction fees?

No, Discover does not charge foreign transaction fees on any of their credit cards, which can save money on international purchases. - How often do the 5% cash back categories change on eligible Discover cards?

The 5% cash back categories on cards like Discover it® Cash Back rotate quarterly (every three months). Cardholders need to activate these categories each quarter to earn the bonus rate.