The FHA Cash-Out Refinance program is a financial option that allows homeowners to leverage the equity in their homes to access cash for various purposes. This type of refinancing is particularly appealing to those looking to consolidate debt, finance home improvements, or cover unexpected expenses. However, while there are numerous advantages to this approach, there are also significant drawbacks that potential borrowers should carefully consider. This article will explore the pros and cons of the FHA Cash-Out Refinance, providing a comprehensive overview for individuals interested in finance, real estate, and investment opportunities.

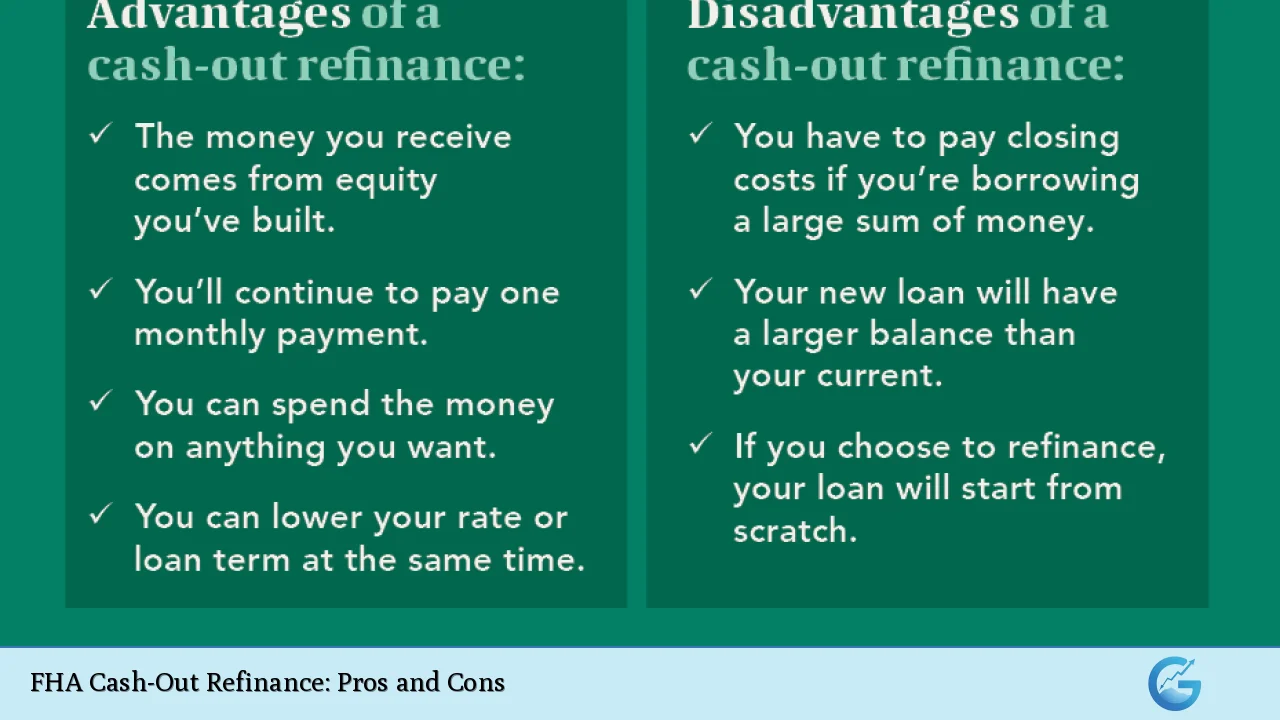

| Pros | Cons |

|---|---|

| Access to cash for various needs | Increased monthly mortgage payments |

| Lower credit score requirements | Higher mortgage insurance premiums |

| Potentially lower interest rates | Limitations on cash-out amounts |

| Ability to consolidate debt | Risk of foreclosure if unable to repay |

| Flexible use of funds | Requires primary residence as collateral |

Access to Cash for Various Needs

One of the primary advantages of an FHA Cash-Out Refinance is the ability to access cash for a variety of purposes. Homeowners can use the funds for:

- Home renovations or improvements

- Debt consolidation

- Education expenses

- Emergency funds

This flexibility allows homeowners to address pressing financial needs without resorting to high-interest loans or credit cards.

Lower Credit Score Requirements

FHA loans are known for their lenient credit requirements compared to conventional loans. Borrowers with credit scores as low as 500 may still qualify for an FHA Cash-Out Refinance, although most lenders prefer scores above 580. This accessibility makes it easier for individuals with less-than-perfect credit histories to tap into their home equity.

Potentially Lower Interest Rates

FHA loans often come with lower interest rates than conventional loans, particularly for borrowers with lower credit scores. This can result in significant savings over time, especially when considering the long-term nature of mortgage payments.

Ability to Consolidate Debt

Using an FHA Cash-Out Refinance can be an effective strategy for consolidating high-interest debts. By paying off credit cards or other loans with higher interest rates using the cash obtained from refinancing, homeowners can simplify their finances and potentially save money on interest payments.

Flexible Use of Funds

Unlike some loan types that restrict how borrowed funds can be used, FHA Cash-Out Refinances allow homeowners to use the cash however they see fit. This flexibility can be particularly beneficial in managing unexpected expenses or funding large purchases.

Increased Monthly Mortgage Payments

A significant disadvantage of the FHA Cash-Out Refinance is that it typically results in higher monthly mortgage payments. Since borrowers are taking out a larger loan than their existing mortgage, they need to be prepared for increased financial obligations. This can strain budgets and lead to financial hardship if not managed carefully.

Higher Mortgage Insurance Premiums

FHA loans require borrowers to pay mortgage insurance premiums (MIP), which can be significantly higher than private mortgage insurance (PMI) associated with conventional loans. These costs can add up over time and reduce the overall financial benefit of refinancing.

Limitations on Cash-Out Amounts

While FHA Cash-Out Refinances allow homeowners to access a portion of their home equity, there are limits. Borrowers can typically only cash out up to 80% of their home’s appraised value after accounting for existing mortgage balances. This limitation may not meet all financial needs.

Risk of Foreclosure if Unable to Repay

Taking on additional debt through an FHA Cash-Out Refinance carries inherent risks. If homeowners struggle to make their new mortgage payments, they could face foreclosure, putting their home at risk. This potential outcome underscores the importance of assessing one’s financial situation before proceeding with this option.

Requires Primary Residence as Collateral

FHA Cash-Out Refinances are only available for primary residences, which means that investment properties or second homes do not qualify. This requirement limits options for those looking to leverage equity in non-primary properties.

Closing Thoughts

In summary, the FHA Cash-Out Refinance presents both significant advantages and notable disadvantages. It offers homeowners a valuable tool for accessing cash and managing financial obligations but comes with risks that must be carefully weighed. Individuals considering this option should conduct thorough research and possibly consult with a financial advisor to ensure it aligns with their long-term financial goals.

Frequently Asked Questions About FHA Cash-Out Refinance

- What is an FHA Cash-Out Refinance?

An FHA Cash-Out Refinance allows homeowners to refinance their existing mortgage for more than they owe and receive the difference in cash. - Who qualifies for an FHA Cash-Out Refinance?

Homeowners must meet certain criteria including having sufficient equity in their home and being current on mortgage payments. - What can I use the cash from an FHA Cash-Out Refinance for?

The funds can be used for any purpose such as home improvements, debt consolidation, or personal expenses. - Are there limits on how much cash I can take out?

Yes, you can typically cash out up to 80% of your home’s appraised value minus any existing mortgage balance. - How does an FHA Cash-Out Refinance affect my credit score?

Taking on additional debt may impact your credit score if you increase your debt-to-income ratio significantly. - What are the risks associated with an FHA Cash-Out Refinance?

The primary risks include increased monthly payments and potential foreclosure if unable to meet payment obligations. - Can I refinance an investment property with an FHA Cash-Out?

No, this option is only available for primary residences. - How long does it take to process an FHA Cash-Out Refinance?

The timeline varies but typically takes 30-45 days from application to closing.