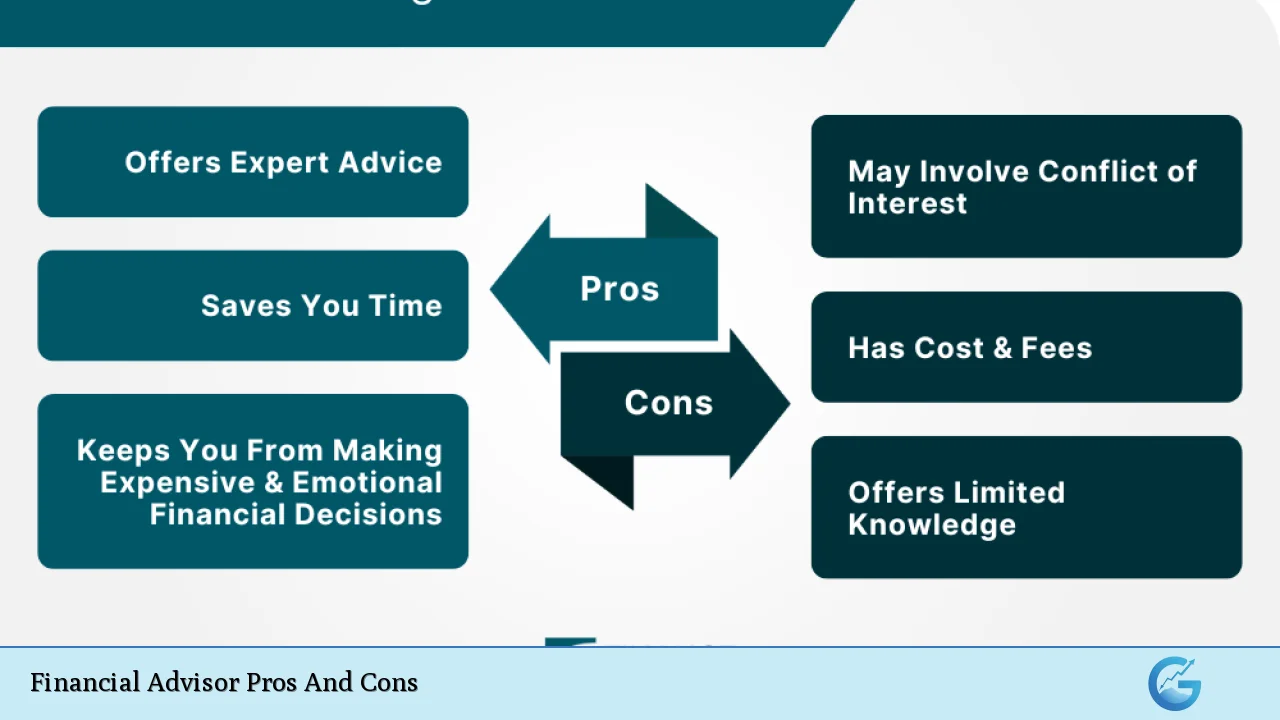

In the complex world of finance, many individuals seek the guidance of financial advisors to navigate investments, retirement planning, and wealth management. Financial advisors can provide valuable expertise and personalized advice, but their services come with both advantages and disadvantages. Understanding these pros and cons is crucial for anyone considering hiring a financial advisor, especially those interested in finance, cryptocurrency, forex, and money markets. This article explores the strengths and weaknesses of engaging a financial advisor to help you make informed decisions about your financial future.

| Pros | Cons |

|---|---|

| Access to Expertise | Costs and Fees |

| Personalized Financial Strategies | Quality of Service Varies |

| Time Savings | Potential Conflicts of Interest |

| Behavioral Coaching | Loss of Control Over Investments |

| Holistic Financial Planning | Overdependence on Advisor |

| Diversification of Portfolio | Limited Availability of Certain Investments |

| Long-term Relationship Building | Market Risks Remain |

| Accountability in Financial Decisions | Emotional Stress During Market Fluctuations |

Access to Expertise

One of the primary advantages of hiring a financial advisor is gaining access to professional expertise. Financial advisors often have extensive training and experience in various aspects of finance, including investment strategies, tax planning, and retirement savings.

- Knowledgeable Guidance: Advisors can provide insights that may not be readily available to the average investor.

- Specialization: Many advisors specialize in specific areas such as retirement planning or estate management, offering tailored advice based on your unique circumstances.

- Up-to-Date Information: They stay informed about market trends and regulatory changes that could impact your investments.

Costs and Fees

While financial advisors offer valuable services, they come at a cost. Understanding these fees is essential for evaluating whether their services are worth the investment.

- Fee Structures: Advisors may charge flat fees, hourly rates, or a percentage of assets under management. It’s important to clarify how fees are structured before engaging their services.

- Potential for High Costs: Depending on the advisor’s fee structure and the complexity of your financial situation, costs can accumulate quickly.

- Impact on Returns: High fees can potentially eat into your investment returns over time.

Personalized Financial Strategies

Financial advisors create customized financial plans that align with your goals and risk tolerance. This personalized approach can significantly enhance your financial management.

- Tailored Investment Strategies: Advisors can design investment portfolios that reflect your individual risk appetite and financial objectives.

- Comprehensive Planning: They consider all aspects of your financial life, including income, expenses, debts, and future goals.

- Adaptability: A good advisor will adjust your financial plan as your circumstances change or as market conditions evolve.

Quality of Service Varies

Not all financial advisors provide the same level of service. The quality can vary significantly based on their experience, qualifications, and business model.

- Due Diligence Required: It’s crucial to research potential advisors thoroughly to ensure they have a good reputation and relevant qualifications.

- Inconsistent Performance: Some advisors may not deliver the expected results or may lack the necessary expertise in specific areas.

- Regulatory Compliance: Ensure that any advisor you consider complies with industry regulations and maintains proper certifications.

Time Savings

Hiring a financial advisor can free up valuable time that you would otherwise spend managing your investments or researching financial options.

- Delegated Responsibilities: Advisors take on the responsibility of monitoring investments, allowing you to focus on other priorities in your life.

- Efficient Decision-Making: With their expertise, advisors can make informed decisions quickly without requiring extensive research from you.

- Stress Reduction: Offloading financial management tasks can alleviate stress and anxiety related to investment performance.

Potential Conflicts of Interest

While many advisors act in their clients’ best interests, some may face conflicts that could influence their recommendations.

- Commission-Based Models: Advisors who earn commissions on products they sell may prioritize their earnings over your best interests.

- Transparency Issues: It’s essential to ask about any potential conflicts upfront to ensure that your advisor is acting as a fiduciary—putting your interests first.

- Informed Choices: Understanding how an advisor is compensated can help you make more informed choices about which services are right for you.

Behavioral Coaching

Financial markets can be volatile, leading investors to make emotional decisions that may not align with their long-term goals. A financial advisor can help mitigate these tendencies through behavioral coaching.

- Sticking to the Plan: Advisors encourage clients to adhere to their investment strategies during market fluctuations rather than making impulsive decisions based on fear or greed.

- Emotional Support: They provide reassurance during downturns and help maintain a long-term perspective on investments.

- Goal-Oriented Focus: Advisors help keep clients focused on their broader financial goals rather than short-term market movements.

Loss of Control Over Investments

One downside of hiring a financial advisor is that it may lead to a perceived loss of control over personal finances.

- Delegated Decisions: Clients often rely heavily on advisors for decision-making, which can create dependency on their judgment rather than fostering personal investment knowledge.

- Lack of Direct Involvement: Some investors prefer being hands-on with their portfolios but may find it challenging when an advisor manages everything for them.

- Communication Gaps: If there’s insufficient communication between you and your advisor regarding investment strategies, it could lead to misunderstandings about risk levels and goals.

Holistic Financial Planning

A significant advantage of working with a financial advisor is the ability to receive comprehensive planning across various aspects of personal finance.

- Integration Across Areas: Advisors often integrate different areas such as tax planning, estate planning, and retirement savings into one cohesive strategy.

- Long-Term Vision: They help clients develop a long-term vision for their finances rather than focusing solely on immediate gains or losses.

- Proactive Adjustments: A holistic approach allows for proactive adjustments based on life changes such as marriage, children, or career shifts.

Overdependence on Advisor

While having an advisor can be beneficial, there’s a risk that clients may become overly reliant on them for decision-making.

- Reduced Financial Literacy: Relying too heavily on an advisor might hinder your ability to understand personal finance fundamentals over time.

- Limited Self-Efficacy: Clients may feel less confident in making independent investment decisions if they consistently defer to their advisor’s expertise.

- Empowerment Through Education: It’s essential for clients to engage actively in learning about their finances even while working with an advisor.

Diversification of Portfolio

Financial advisors typically emphasize the importance of diversification in investment portfolios as a way to manage risk effectively.

- Risk Mitigation Strategies: By spreading investments across various asset classes (stocks, bonds, real estate), advisors help reduce overall portfolio volatility.

- Access to Diverse Investment Options: Many advisors have access to exclusive investment opportunities not available to individual investors.

- Tailored Diversification Plans: Advisors customize diversification strategies based on individual client risk tolerance and investment goals.

Limited Availability of Certain Investments

Despite the advantages offered by financial advisors regarding portfolio diversification, there are limitations regarding certain investments they might recommend or have access to.

- Investment Restrictions: Some high-performing investments might be restricted due to regulations or firm policies that limit what an advisor can offer clients.

- Focus on Traditional Assets: Advisors may prioritize traditional asset classes (stocks/bonds) over newer alternatives like cryptocurrencies or alternative investments due to perceived risks.

- Research Limitations: Not all advisors specialize in emerging markets or innovative assets; therefore, it’s vital for clients interested in these areas to seek out specialized advice if needed.

Long-Term Relationship Building

Building a long-term relationship with a trusted financial advisor can yield significant benefits over time.

- Understanding Client Goals: A long-term relationship allows advisors to develop a deeper understanding of clients’ evolving needs and goals.

- Consistency in Advice: Continuity in advisory relationships leads to more consistent advice tailored specifically for you rather than starting fresh with each new interaction.

- Trust Development: Trust builds over time; having an established relationship fosters open communication about sensitive topics like finances.

Market Risks Remain

Even with expert guidance from a financial advisor, inherent market risks persist that could affect investment outcomes significantly.

- Volatility Exposure: Market fluctuations remain unpredictable regardless of how well an advisor manages portfolios; losses are always possible during downturns.

- Economic Factors Beyond Control: Global economic conditions (inflation rates, geopolitical tensions) can impact investments irrespective of advisory strategies employed.

- Client Responsibility for Decisions: Ultimately, clients must recognize that they share responsibility for decisions made alongside their advisors since they set overall objectives together.

Accountability in Financial Decisions

Having a financial advisor provides accountability in managing personal finances effectively while ensuring adherence towards achieving set goals over time.

- Regular Check-ins & Reviews: Advisors typically schedule periodic reviews where they assess progress against established benchmarks—keeping clients accountable towards reaching milestones.

- Structured Approach: The structured nature imposed by working with an expert helps prevent procrastination when it comes down making tough choices regarding savings/investments.

- Goal Orientation: Accountability ensures focus remains directed towards meeting long-term aspirations rather than getting sidetracked by short-term distractions or temptations along the way.

In conclusion, hiring a financial advisor comes with distinct advantages such as access to expertise, personalized strategies tailored specifically for individual needs while also providing accountability throughout one’s journey towards achieving desired outcomes financially speaking; however it does carry inherent drawbacks including costs associated with services rendered alongside potential conflicts arising from differing interests between parties involved which necessitates thorough research prior engaging any professional assistance within this realm ultimately leading towards informed decision-making processes regarding personal wealth management strategies moving forward.

Frequently Asked Questions About Financial Advisor Pros And Cons

- What are the main benefits of hiring a financial advisor?

The primary benefits include access to professional expertise, personalized strategies tailored to individual needs, time savings through delegated responsibilities, behavioral coaching during market fluctuations, and holistic planning across various aspects of finance. - What costs should I expect when hiring a financial advisor?

The costs vary depending on the fee structure chosen (flat fee vs percentage-based) but generally include management fees which could significantly impact overall returns if not understood upfront. - How do I ensure my financial advisor acts in my best interest?

Selecting fiduciary advisors who are legally obligated to prioritize client interests helps mitigate potential conflicts; always ask about compensation models before engaging services. - Can I manage my investments without hiring an advisor?

Yes! Many individuals successfully manage their own portfolios using online resources; however professional guidance often proves beneficial especially during complex situations. - What should I look for when choosing a financial advisor?

Key factors include credentials (CFP®, CFA), experience level within specific domains relevant for you (retirement planning vs tax optimization), fee transparency & client reviews. - How often should I meet with my financial advisor?

This varies based on individual preferences but typically quarterly check-ins suffice unless major life changes occur prompting additional consultations. - Are there risks associated with using a financial advisor?

Yes! Risks include potential conflicts due lack transparency regarding fees/commissions charged along with dependence created leading clients away from developing personal investing knowledge. - What happens if I’m unhappy with my current financial advisor?

If dissatisfied consider discussing concerns directly; if unresolved seek alternatives after ensuring new candidates align better with expectations outlined beforehand.