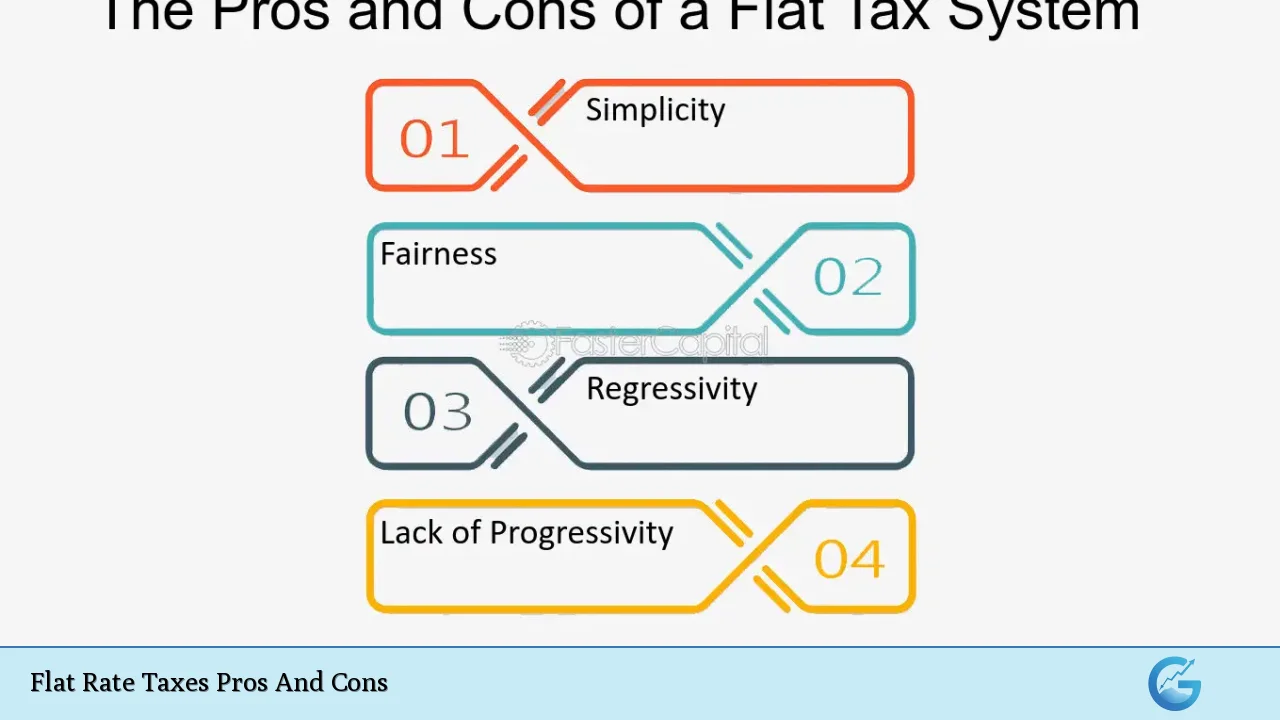

The concept of flat rate taxes has gained significant attention in recent years, particularly in discussions surrounding tax reform and economic policy. A flat rate tax system is characterized by a single tax rate applied uniformly to all taxpayers, regardless of their income level. This system contrasts sharply with progressive tax structures, where tax rates increase as income rises. Advocates argue that flat taxes simplify the tax code, promote fairness, and stimulate economic growth. However, critics contend that they disproportionately burden lower-income individuals and can lead to increased income inequality. In this article, we will explore the pros and cons of flat rate taxes in detail, providing a comprehensive overview for those interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

| Simplicity and ease of understanding | Regressive nature that disproportionately affects low-income earners |

| Encouragement of economic growth through increased disposable income | Potential loss of government revenue affecting public services |

| Reduction in tax evasion and avoidance | Lack of progressivity and fairness in taxation |

| Greater transparency in tax obligations | Limited ability to address income inequality |

| Lower administrative costs for taxpayers and government | Risk of over-simplification leading to inadequate funding for social programs |

Simplicity and Ease of Understanding

One of the most significant advantages of a flat rate tax system is its simplicity. Taxpayers benefit from a straightforward calculation process where a single rate applies to all income levels. This ease of understanding can lead to:

- Reduced confusion: Taxpayers do not need to navigate multiple tax brackets or complex calculations.

- Fewer errors: Simplified calculations reduce the likelihood of mistakes when filing taxes.

- Streamlined compliance: Taxpayers may find it easier to comply with tax laws, potentially increasing overall compliance rates.

Encouragement of Economic Growth Through Increased Disposable Income

Flat rate taxes can stimulate economic growth by allowing individuals and businesses to retain more of their income. This increase in disposable income can lead to:

- Higher consumer spending: With more money in hand, consumers are likely to spend more, boosting demand for goods and services.

- Increased investment: Businesses may invest additional funds into growth opportunities, leading to job creation and innovation.

- Entrepreneurial incentives: Lower tax burdens can encourage individuals to start their own businesses or invest in new ventures.

Reduction in Tax Evasion and Avoidance

A flat rate tax system may help reduce instances of tax evasion and avoidance due to its straightforward nature. Key points include:

- Elimination of loopholes: By minimizing deductions and exemptions, there are fewer opportunities for taxpayers to exploit the system.

- Increased transparency: A uniform tax rate can enhance public trust in the tax system as it appears fairer and less susceptible to manipulation.

- Lower administrative burden: Simplified reporting requirements can reduce the resources spent on compliance by both taxpayers and government agencies.

Greater Transparency in Tax Obligations

Flat rate taxes promote greater transparency regarding tax obligations. This clarity can lead to:

- Enhanced public confidence: When taxpayers understand their obligations clearly, they may be more willing to participate in the system.

- Simplified comparisons: A uniform rate allows for easier comparisons across different income levels and jurisdictions.

Lower Administrative Costs for Taxpayers and Government

Implementing a flat rate tax system can result in lower administrative costs for both taxpayers and government entities. Benefits include:

- Reduced processing time: Fewer forms and simpler calculations can streamline the filing process.

- Cost savings: Governments may save money on enforcement and compliance efforts due to reduced complexity.

Regressive Nature That Disproportionately Affects Low-Income Earners

Despite its advantages, a flat rate tax system has notable drawbacks, particularly its regressive nature. This characteristic means that:

- Higher relative burden on low-income individuals: Since everyone pays the same percentage regardless of income, lower-income earners pay a larger portion of their earnings compared to wealthier individuals.

- Potential increase in poverty levels: The financial strain on lower-income households can exacerbate existing socioeconomic disparities.

Potential Loss of Government Revenue Affecting Public Services

Another significant concern regarding flat rate taxes is the potential loss of government revenue. This issue arises from several factors:

- Lower overall rates: A single lower rate may not generate sufficient funds to support essential public services such as education, healthcare, and infrastructure.

- Impact during economic downturns: In times of recession, reduced revenues could lead to budget cuts or increased deficits.

Lack of Progressivity and Fairness in Taxation

Critics argue that flat rates lack fairness because they do not account for an individual’s ability to pay. The implications include:

- Widening income inequality: By taxing everyone at the same rate, wealth disparities may grow as high-income earners retain more wealth relative to their lower-income counterparts.

- Limited support for social programs: Without progressive taxation mechanisms that fund social safety nets, vulnerable populations may suffer from inadequate support.

Limited Ability to Address Income Inequality

Flat rate taxes often fail to address systemic issues related to income inequality effectively. This limitation manifests through:

- Insufficient redistribution mechanisms: Unlike progressive systems that redistribute wealth through higher rates on the wealthy, flat taxes do not provide similar benefits.

- Challenges in funding social initiatives: Programs aimed at reducing poverty or supporting education may struggle without adequate funding from higher earners.

Risk of Over-Simplification Leading to Inadequate Funding for Social Programs

While simplicity is an advantage, it can also lead to oversights that affect critical funding areas:

- Neglecting essential services: Simplified tax structures may overlook necessary funding channels for vital public services.

- Long-term economic consequences: Insufficient investment in social programs could hinder economic mobility and growth over time.

In conclusion, while flat rate taxes offer several compelling advantages such as simplicity, transparency, and potential economic growth stimulation, they also present significant challenges including regressivity, potential revenue loss, and inadequate support for social equity measures. As policymakers consider reforms within the context of broader economic goals, understanding these dynamics becomes crucial for fostering a fairer taxation system that meets the needs of all citizens.

Frequently Asked Questions About Flat Rate Taxes

- What is a flat rate tax?

A flat rate tax is a taxation system where all taxpayers pay the same percentage of their income regardless of how much they earn. - What are the main advantages of flat rate taxes?

The main advantages include simplicity in calculations, encouragement of economic growth through increased disposable income, reduction in tax evasion, greater transparency in obligations, and lower administrative costs. - What are the main disadvantages?

The primary disadvantages are its regressive nature affecting low-income earners disproportionately, potential loss of government revenue impacting public services, lack of progressivity leading to increased income inequality, and risks associated with oversimplification. - How does a flat tax compare with a progressive tax?

A flat tax applies one uniform rate across all incomes while a progressive tax increases rates as incomes rise, aiming for greater equity among taxpayers. - Can flat taxes stimulate economic growth?

Supporters argue that by allowing individuals and businesses to keep more income after taxes, flat taxes can stimulate spending and investment. - Are there any countries using flat rate taxes?

Yes, several countries have implemented flat rate taxes or modified versions thereof as part of their fiscal policies. - How might a flat tax affect social programs?

The potential reduction in government revenue could limit funding for essential social programs aimed at supporting low-income populations. - Is there any flexibility within a flat rate tax system?

Some proposals include minimal deductions or exemptions; however, these variations still maintain a general uniformity across incomes.