High-yield savings accounts (HYSAs) have gained significant popularity in recent years as a financial product that offers higher interest rates compared to traditional savings accounts. These accounts are particularly appealing to individuals looking to maximize their savings while minimizing risk. However, like any financial instrument, high-yield savings accounts come with their own set of advantages and disadvantages. This article will explore the pros and cons of HYSAs in detail, providing a comprehensive overview for those interested in finance, cryptocurrency, forex, and money markets.

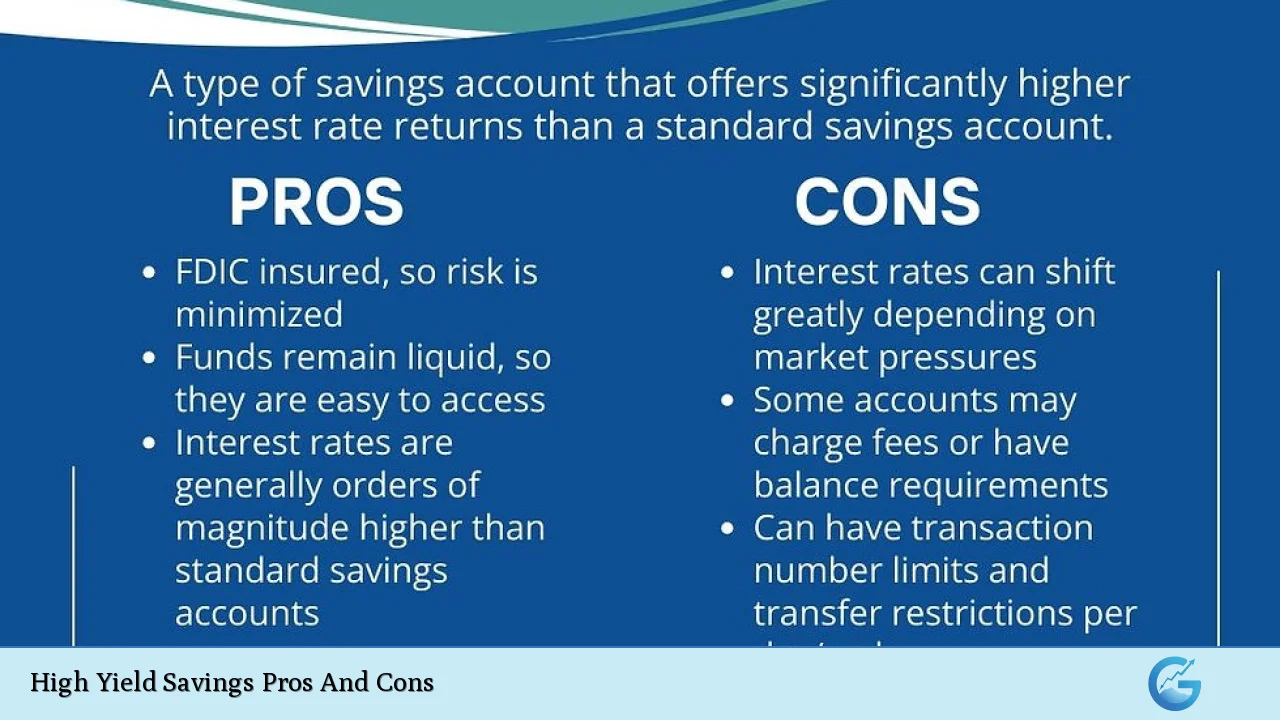

| Pros | Cons |

|---|---|

| Higher interest rates compared to traditional savings accounts. | Interest rates are variable and can decrease. |

| FDIC insurance protects deposits up to $250,000. | May require a higher minimum balance or initial deposit. |

| Easy access to funds through online banking. | Limited withdrawal transactions may apply. |

| Low risk compared to stock market investments. | Some accounts may charge maintenance fees. |

| Helps in achieving short-term financial goals faster. | Not suitable for long-term wealth growth. |

Higher Interest Rates Compared to Traditional Savings Accounts

One of the most significant advantages of high-yield savings accounts is their ability to offer much higher interest rates than traditional savings accounts.

- Current Trends: As of early 2024, while traditional savings accounts might yield around 0.46% APY, many high-yield accounts offer rates ranging from 4% to 5% APY.

- Compounding Interest: Many HYSAs compound interest daily or monthly, allowing your money to grow faster over time.

- Inflation Hedge: Given the current inflation rates, earning a higher interest rate can help preserve the purchasing power of your savings.

FDIC Insurance Protects Deposits Up to $250,000

Another key benefit of high-yield savings accounts is that they are typically insured by the Federal Deposit Insurance Corporation (FDIC).

- Safety Net: This insurance protects your deposits up to $250,000 per depositor per institution, providing peace of mind that your money is secure.

- Low Risk: Unlike investments in stocks or cryptocurrencies, which can be volatile and risky, HYSAs provide a stable place for your funds.

Easy Access to Funds Through Online Banking

High-yield savings accounts often come with the convenience of online banking.

- 24/7 Access: Most HYSAs allow you to manage your account online or via mobile apps, making it easy to deposit or withdraw funds whenever needed.

- User-Friendly Tools: Many banks offer budgeting tools and financial management features that can help you keep track of your savings goals.

Low Risk Compared to Stock Market Investments

For individuals who are risk-averse or new to investing, high-yield savings accounts present a low-risk option for growing their funds.

- Stable Returns: While they do not offer the potential for high returns like stocks or cryptocurrencies, HYSAs provide a reliable way to earn interest without the risk of losing principal.

- Ideal for Short-Term Goals: These accounts are particularly suitable for saving for short-term goals such as vacations, emergency funds, or down payments on homes.

Helps in Achieving Short-Term Financial Goals Faster

The combination of higher interest rates and low risk makes HYSAs an effective tool for achieving short-term financial objectives.

- Goal-Oriented Saving: Whether you’re saving for a wedding, a new car, or an emergency fund, the higher yields can help you reach your targets more quickly than traditional savings options.

- Flexibility: Unlike certificates of deposit (CDs), which lock your money away for a set period, HYSAs allow you to access your funds without penalties if necessary.

Interest Rates Are Variable and Can Decrease

While high-yield savings accounts offer attractive interest rates, it’s crucial to understand that these rates are not fixed.

- Market Fluctuations: The interest rate on a HYSA can fluctuate based on market conditions and decisions made by the Federal Reserve. This means that while you may start with a high rate, it could decrease over time.

- Potential Lower Returns: If market conditions change negatively, the returns on your account may not be as favorable as initially expected.

May Require a Higher Minimum Balance or Initial Deposit

Many high-yield savings accounts come with specific requirements regarding minimum balances or initial deposits.

- Accessibility Issues: Some banks may require you to maintain a minimum balance (often several thousand dollars) to earn the advertised interest rate or avoid fees.

- Initial Investment: The need for a substantial initial deposit can be a barrier for some individuals looking to open an account.

Limited Withdrawal Transactions May Apply

High-yield savings accounts often have restrictions on how many withdrawals you can make within a month.

- Transaction Limits: While federal regulations limiting withdrawals were relaxed during the pandemic, many banks still impose their own limits on transfers and withdrawals from HYSAs.

- Potential Fees: Exceeding these limits may result in fees or restrictions on your account access, which could deter some users from utilizing their funds when needed.

Some Accounts May Charge Maintenance Fees

Although many high-yield savings accounts boast low fees compared to traditional banks, some may still charge maintenance fees.

- Fee Structures Vary: It’s essential to read the fine print when selecting an account. Some institutions waive fees if certain balance requirements are met; others do not.

- Impact on Earnings: Maintenance fees can significantly reduce your overall earnings from interest if you’re not careful about maintaining required balances.

Not Suitable for Long-Term Wealth Growth

While HYSAs are excellent for saving money safely and earning interest, they are not ideal for long-term investment strategies aimed at wealth accumulation.

- Lower Potential Returns: Compared to stocks or mutual funds that have historically provided higher returns over extended periods, HYSAs fall short in terms of growth potential.

- Inflation Risk: If the interest earned does not keep pace with inflation over time, the real value of your savings could diminish despite earning interest.

In conclusion, high-yield savings accounts offer several compelling advantages such as higher interest rates, FDIC insurance protection, and easy access through online banking. However, they also come with disadvantages including variable interest rates, potential fees, and limitations on withdrawals.

For individuals interested in finance and looking for safe ways to grow their money while achieving short-term financial goals, HYSAs can be an excellent choice. However, it is essential to weigh these pros and cons carefully against personal financial objectives before deciding whether a high-yield savings account aligns with one’s overall investment strategy.

Frequently Asked Questions About High Yield Savings Pros And Cons

- What is a high-yield savings account?

A high-yield savings account is a type of deposit account that offers significantly higher interest rates than traditional savings accounts. - Are high-yield savings accounts safe?

Yes, most high-yield savings accounts are insured by the FDIC up to $250,000 per depositor per institution. - Can I lose money in a high-yield savings account?

No, as long as your deposits are within FDIC insurance limits; however, inflation may erode purchasing power over time. - What factors affect the interest rate on my HYSA?

The interest rate on your HYSA can fluctuate based on market conditions and monetary policy decisions made by the Federal Reserve. - Are there any fees associated with high-yield savings accounts?

Some banks charge maintenance fees; however, many waive these fees if you maintain a certain balance. - How often do I earn interest on my HYSA?

Interest is typically compounded either daily or monthly depending on the bank’s policy. - What should I consider before opening a HYSA?

You should consider factors such as minimum balance requirements, withdrawal limits, and any applicable fees before opening an account. - Is a HYSA suitable for long-term investments?

No; while they provide safety and liquidity for short-term goals, they are not designed for long-term wealth growth compared to other investment vehicles.