Immediate annuities are financial products that provide a guaranteed income stream in exchange for a lump sum payment. These annuities begin paying out almost immediately after purchase, making them an attractive option for retirees or those seeking a steady income source. However, like any financial instrument, immediate annuities come with their own set of advantages and disadvantages that potential investors should carefully consider.

| Pros | Cons |

|---|---|

| Guaranteed income stream | Loss of liquidity |

| Protection against market volatility | Inflation risk |

| Longevity protection | Lower potential returns |

| Simplicity and predictability | Irrevocable decision |

| Potential tax advantages | Counterparty risk |

| Customizable payout options | Opportunity cost |

| Peace of mind | Complexity of some products |

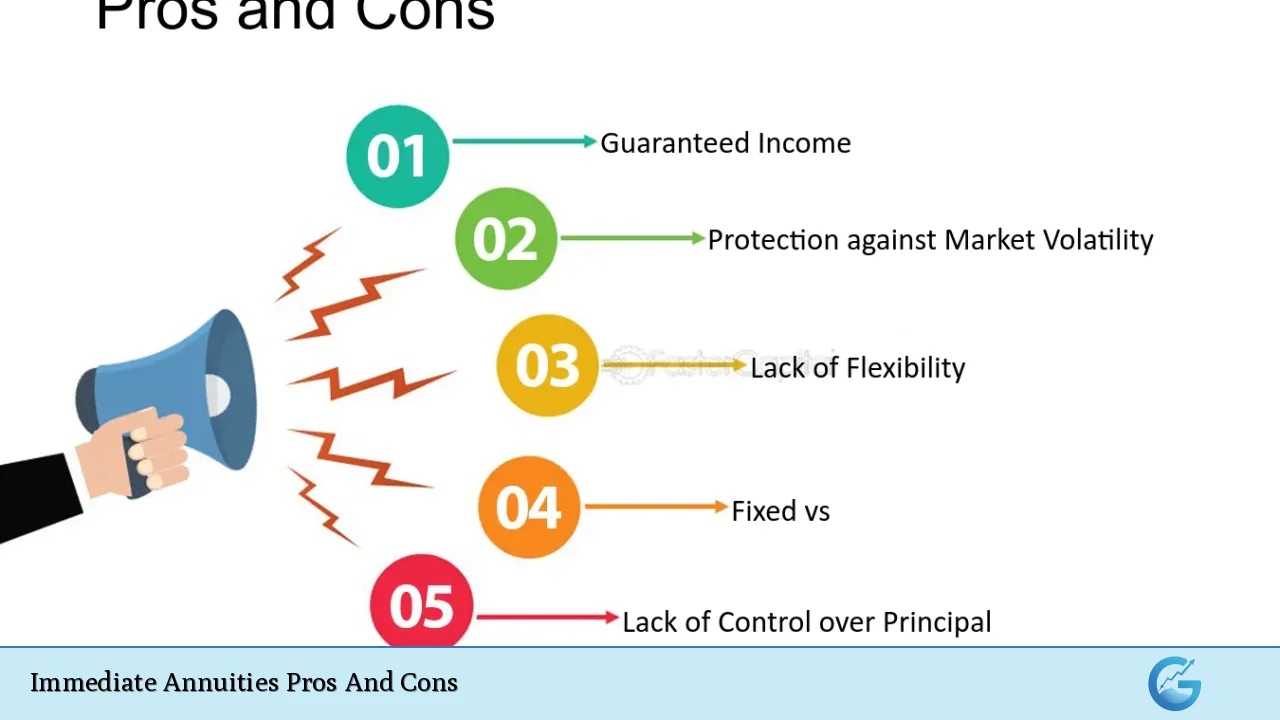

Advantages of Immediate Annuities

Guaranteed Income Stream

Immediate annuities provide a reliable and consistent income stream, which can be particularly valuable for retirees. This guaranteed payout can help cover essential living expenses and provide financial stability throughout retirement. Unlike other investment vehicles that may fluctuate based on market conditions, immediate annuities offer a fixed income that you can count on, regardless of economic uncertainties.

- Predictable monthly, quarterly, or annual payments

- Income guaranteed for a specified period or lifetime

- Helps in budgeting and financial planning

Protection Against Market Volatility

In an era of economic uncertainty, immediate annuities offer a haven from market fluctuations. Your income is not tied to stock market performance, providing a buffer against economic downturns. This feature is especially appealing to risk-averse investors or those nearing retirement who want to safeguard a portion of their nest egg.

- Insulation from stock market crashes

- Stable income regardless of economic conditions

- Reduced stress from market watching

Longevity Protection

One of the most significant risks in retirement planning is outliving one’s savings. Immediate annuities address this concern by providing income that can last for the entirety of one’s life. This longevity protection ensures that you won’t run out of money, even if you live well beyond your life expectancy.

- Lifetime income options available

- Mitigates the risk of depleting retirement savings

- Can be structured to cover both spouses in a joint life annuity

Simplicity and Predictability

Immediate annuities are straightforward financial products that don’t require ongoing management or decision-making. Once purchased, the annuity operates on autopilot, delivering payments according to the agreed-upon schedule. This simplicity can be a relief for those who don’t want the stress of managing complex investment portfolios in retirement.

- No need for active management

- Clear understanding of income amount and frequency

- Reduces cognitive load in financial planning

Potential Tax Advantages

While immediate annuities are not tax-free, they can offer some tax benefits. A portion of each payment is considered a return of principal and is therefore not taxable. This can result in a lower overall tax burden compared to some other forms of retirement income.

- Part of the income may be tax-free

- Can help in tax-efficient retirement planning

- Potential for lower overall tax liability in retirement

Customizable Payout Options

Immediate annuities offer flexibility in how you receive your payments. You can choose from various payout options to suit your specific needs and circumstances. These options can include lifetime payments, payments for a specific period, or even increasing payments to help combat inflation.

- Single life or joint life payout options

- Period certain guarantees

- Inflation-adjusted payment options available

Peace of Mind

For many retirees, the psychological benefit of having a guaranteed income cannot be overstated. Knowing that a portion of your expenses will be covered regardless of what happens in the financial markets can provide significant peace of mind. This security can allow retirees to enjoy their golden years without constant worry about their financial situation.

- Reduces anxiety about market performance

- Provides a financial safety net

- Allows for better enjoyment of retirement

Disadvantages of Immediate Annuities

Loss of Liquidity

One of the most significant drawbacks of immediate annuities is the loss of access to your principal investment. Once you purchase an immediate annuity, you typically cannot withdraw large sums or cancel the contract without incurring substantial penalties. This lack of liquidity can be problematic if you face unexpected expenses or financial emergencies.

- Limited or no access to lump-sum withdrawals

- High surrender charges for early termination

- Reduced financial flexibility

Inflation Risk

While immediate annuities provide a steady income stream, most standard contracts do not adjust for inflation. Over time, the purchasing power of your fixed payments may decrease as the cost of living increases. This erosion of buying power can be particularly detrimental for retirees on a fixed income over a long period.

- Fixed payments may lose value over time

- Cost of living increases not accounted for in standard contracts

- Potential for reduced standard of living in later years

Lower Potential Returns

Compared to other investment options like stocks or real estate, immediate annuities typically offer lower returns. The trade-off for guaranteed income is often a reduced potential for capital appreciation. In a bull market or period of high economic growth, annuity holders may miss out on significant gains available through other investment vehicles.

- Limited upside potential

- No benefit from market rallies

- Opportunity cost of not investing in growth assets

Irrevocable Decision

Purchasing an immediate annuity is typically an irrevocable decision. Once you’ve committed your funds, there’s usually no going back. This permanence can be daunting, especially if your financial situation or needs change unexpectedly.

- No option to change your mind after the cooling-off period

- Cannot adjust to changing financial circumstances

- Potential for buyer’s remorse

Counterparty Risk

The guaranteed income from an immediate annuity is only as secure as the insurance company providing it. While insurance companies are generally stable and regulated, there is always a risk, however small, of company insolvency. It’s crucial to consider the financial strength and ratings of the insurer before purchasing an annuity.

- Dependence on the financial health of the insurance company

- Limited government guarantees compared to bank products

- Need for due diligence in selecting an annuity provider

Opportunity Cost

By locking funds into an immediate annuity, you forgo the opportunity to invest that money in potentially higher-yielding assets. This opportunity cost can be significant, especially during periods of economic growth or in a low-interest-rate environment where annuity rates may be less attractive.

- Missed potential for higher returns in other investments

- Inability to take advantage of market opportunities

- Funds not available for other financial strategies

Complexity of Some Products

While basic immediate annuities are straightforward, some variants can be complex. Features like inflation adjustment, death benefits, or variable components can make these products difficult to understand fully. This complexity can lead to misunderstandings about the product’s features and limitations.

- Difficulty in comparing different annuity products

- Risk of misunderstanding contract terms

- Potential for making suboptimal choices due to product complexity

Immediate annuities can play a valuable role in retirement planning, offering a guaranteed income stream and peace of mind. However, they also come with significant trade-offs, including loss of liquidity and potentially lower returns. Prospective buyers should carefully weigh these pros and cons against their financial goals, risk tolerance, and overall retirement strategy. Consulting with a financial advisor can help in making an informed decision about whether an immediate annuity is the right choice for your specific circumstances.

Frequently Asked Questions About Immediate Annuities Pros And Cons

- What is the main advantage of an immediate annuity?

The primary advantage is the guaranteed income stream it provides, offering financial security and peace of mind in retirement. - Can I withdraw my money from an immediate annuity if I need it?

Generally, no. Immediate annuities typically do not allow for lump-sum withdrawals without significant penalties, resulting in a loss of liquidity. - How does an immediate annuity protect against longevity risk?

Immediate annuities can be structured to provide payments for life, ensuring you don’t outlive your savings regardless of how long you live. - Are immediate annuity payments adjusted for inflation?

Standard immediate annuities do not adjust for inflation, but some offer inflation-adjusted payment options at a higher cost or lower initial payout. - What happens to my immediate annuity if the insurance company goes bankrupt?

While rare, insurance company failures are possible. Most states have guaranty associations that provide some protection, but coverage limits vary. - Can I leave my immediate annuity to my heirs?

It depends on the contract. Some immediate annuities offer death benefit options, while others cease payments upon the annuitant’s death. - How do immediate annuities compare to other retirement investments?

Immediate annuities offer guaranteed income but typically provide lower returns compared to stocks or bonds, and lack the growth potential and liquidity of other investments. - Is an immediate annuity right for everyone?

No, it’s not suitable for everyone. It’s best for those seeking guaranteed income and willing to trade liquidity and potential higher returns for security.