Income annuities are financial products designed to provide a steady stream of income, typically during retirement. They are essentially contracts between an individual and an insurance company, where the individual pays a lump sum upfront in exchange for guaranteed payments over a specified period, which can be for life or a set number of years. As with any financial instrument, income annuities come with their own set of advantages and disadvantages that potential investors should carefully consider before making a commitment.

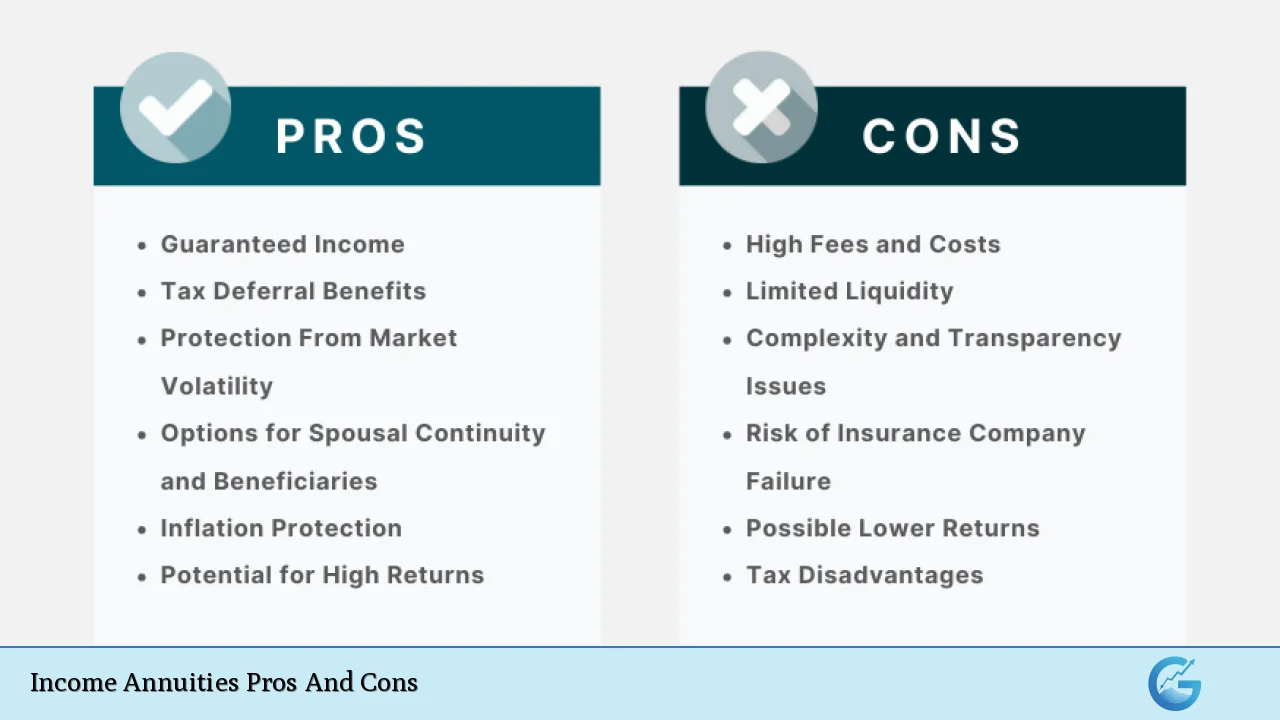

| Pros | Cons |

|---|---|

| Guaranteed income for life | Loss of control over principal |

| Protection against market volatility | Limited growth potential |

| Tax-deferred growth | High fees and commissions |

| Customizable features (e.g., inflation protection) | Difficult to exit contracts |

| No contribution limits on non-qualified annuities | Potential for lower returns compared to other investments |

| Can provide financial security for dependents | Complexity and lack of transparency in terms |

Guaranteed Income for Life

One of the most significant advantages of income annuities is the provision of guaranteed income for life. This feature is particularly appealing to retirees who seek financial stability and predictability in their cash flow.

- Steady cash flow: Income annuities ensure that you receive regular payments, which can help cover essential living expenses.

- Peace of mind: Knowing that you have a reliable source of income can alleviate anxiety about outliving your savings.

- Longevity risk mitigation: With people living longer, having a guaranteed income stream can protect against the risk of depleting retirement savings.

Protection Against Market Volatility

Income annuities provide a buffer against the fluctuations of the stock market.

- Stable returns: Unlike investments in stocks or bonds, where returns can vary significantly, annuities offer fixed payments regardless of market conditions.

- Risk aversion: For individuals who are risk-averse or uncomfortable with market volatility, income annuities present a safer alternative.

Tax-Deferred Growth

Another compelling advantage is the tax treatment associated with income annuities.

- Tax deferral: Earnings on the investments within the annuity grow tax-deferred until withdrawals begin, allowing for potentially greater accumulation over time.

- Tax efficiency: This feature is particularly beneficial for high-income earners looking to minimize their current tax liabilities while saving for retirement.

Customizable Features

Many income annuities offer various options that can be tailored to meet specific needs and preferences.

- Inflation protection: Some products allow you to include features that adjust payouts based on inflation, helping maintain purchasing power over time.

- Death benefits: Certain annuities provide options for beneficiaries to receive payments after the annuitant’s death, ensuring financial support for loved ones.

No Contribution Limits on Non-Qualified Annuities

Unlike retirement accounts such as IRAs or 401(k)s, non-qualified annuities do not have annual contribution limits.

- Flexibility in contributions: Investors can contribute as much as they want, which can be particularly advantageous for those looking to invest substantial sums outside traditional retirement accounts.

Loss of Control Over Principal

While there are many benefits to income annuities, one significant drawback is the loss of control over your principal investment.

- Illiquidity: Once you purchase an income annuity, accessing your principal becomes challenging. Most contracts do not allow lump-sum withdrawals after payments begin.

- Commitment: This lack of liquidity means that investors must be certain about their decision before committing funds to an annuity.

Limited Growth Potential

Income annuities often have capped growth potential compared to other investment options.

- Fixed returns: The returns on many types of annuities are fixed or tied to conservative investments, which may not keep pace with inflation over time.

- Opportunity cost: By locking funds into an annuity, investors may miss out on potentially higher returns from stocks or real estate investments.

High Fees and Commissions

Annuities can come with high costs that may erode overall returns.

- Sales commissions: Financial advisors often earn substantial commissions (up to 10% or more) when selling annuities, which can lead to conflicts of interest and higher costs for investors.

- Ongoing fees: Many income annuities carry annual fees that can diminish returns over time. These fees might include administrative costs and charges for optional features or riders.

Difficult to Exit Contracts

Exiting an income annuity contract is often fraught with penalties and challenges.

- Surrender charges: If you need to withdraw funds early, surrender charges can be steep—sometimes exceeding 10%—and these penalties typically decrease over time but can last several years.

- Complex exit terms: The complexity of many contracts makes it difficult for investors to understand their options if they wish to exit early or modify their agreements.

Potential for Lower Returns Compared to Other Investments

Investors may find that income annuities do not perform as well as other investment vehicles over time.

- Conservative nature: Annuity payouts are often based on conservative investment strategies that prioritize safety over growth, which may lead to lower overall returns compared to stocks or mutual funds.

- Market performance dependency: In a rising market environment, the fixed nature of many income annuities may result in missed opportunities for higher gains available through more aggressive investments.

Complexity and Lack of Transparency in Terms

Income annuities can be complicated financial products that require careful scrutiny before purchase.

- Understanding terms: The language used in contracts can be technical and difficult for average investors to understand fully. This complexity may lead to misunderstandings regarding fees and benefits.

- Need for professional advice: Given their intricacies, potential buyers should consider consulting with a financial advisor who specializes in retirement planning before investing in an income annuity.

In conclusion, while income annuities offer several compelling advantages such as guaranteed lifetime income, protection against market volatility, tax-deferred growth, and customizable features, they also come with significant drawbacks including loss of control over principal, limited growth potential, high fees, and complex exit strategies.

Individuals considering this investment should weigh these pros and cons carefully against their personal financial situation and retirement goals. Consulting with a qualified financial advisor is highly recommended to navigate this complex landscape effectively and make informed decisions tailored to individual needs.

Frequently Asked Questions About Income Annuities

- What is an income annuity?

An income annuity is a contract with an insurance company where you pay a lump sum upfront in exchange for guaranteed payments over time. - How does an income annuity work?

You make an initial payment (or series of payments), and in return, the insurer provides regular payments either immediately or at a future date. - What are the tax implications of income annuities?

Earnings grow tax-deferred until withdrawal; only the earnings portion is taxable upon distribution. - Can I access my money if I need it?

Accessing principal funds is typically restricted; early withdrawals may incur significant surrender charges. - Are there different types of income annuities?

Yes, there are immediate and deferred income annuities, fixed and variable options among others. - What happens if I die before receiving all my payments?

This depends on your contract terms; some offer death benefits or guarantee periods that provide payouts to beneficiaries. - How do I choose the right income annuity?

Consider factors like your age, financial goals, risk tolerance, and consult with a financial advisor. - Are there any risks associated with income annuities?

Yes, risks include loss of liquidity, inflation risk if not indexed properly, and reliance on the insurer’s financial strength.