Indexed Universal Life (IUL) insurance is a unique financial product that combines life insurance with investment opportunities. It offers policyholders the potential for cash value growth linked to a stock market index, while also providing a death benefit. This dual functionality makes IUL appealing to individuals looking for both financial protection and investment growth. However, like any financial instrument, it comes with its own set of advantages and disadvantages. This article will delve into the pros and cons of Indexed Universal Life insurance, providing a comprehensive understanding for those interested in finance, investments, and wealth management.

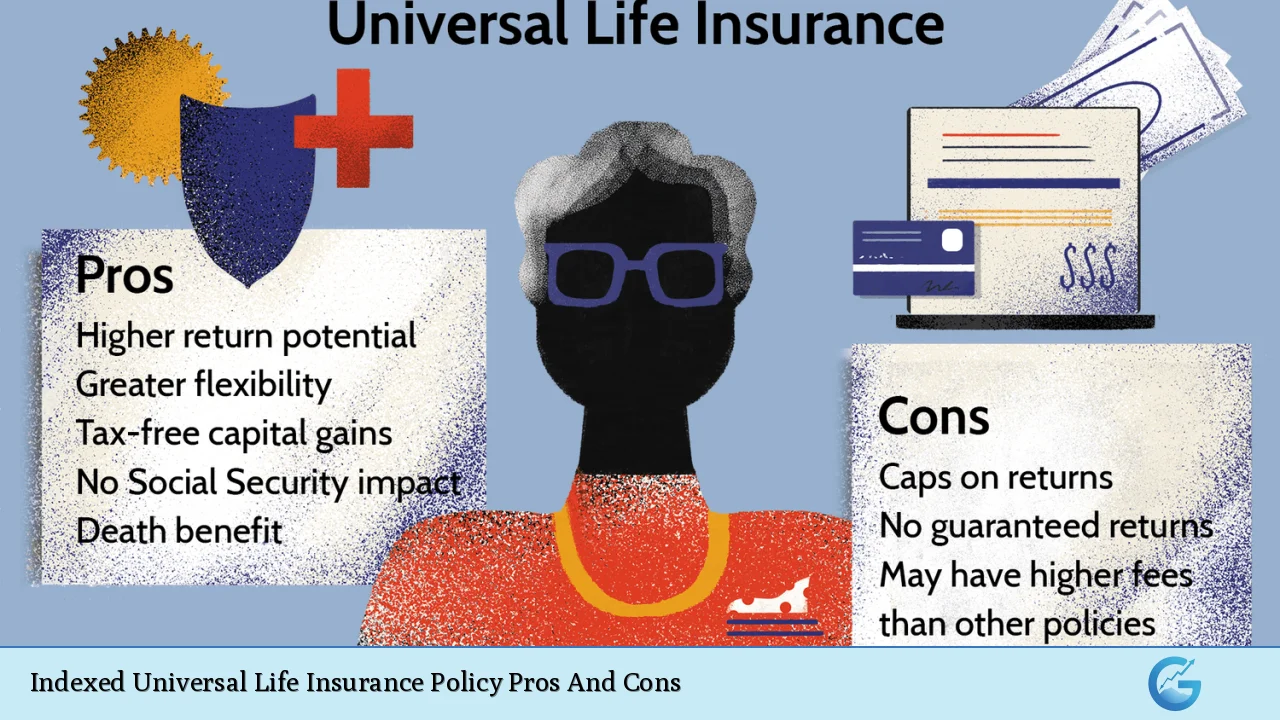

| Pros | Cons |

|---|---|

| Potential for higher returns than traditional life insurance policies | Caps on returns limit growth potential |

| Flexible premiums and death benefits | No guaranteed returns on cash value growth |

| Tax-deferred growth of cash value | Complexity in understanding policy mechanics |

| Access to cash value through loans or withdrawals | Fees can reduce overall returns |

| Protection against market downturns with a guaranteed floor | Risk of policy lapse if premiums are not maintained |

| No impact on Social Security benefits from withdrawals | Potentially high cost of insurance as the policyholder ages |

Potential for Higher Returns Than Traditional Life Insurance Policies

One of the most significant advantages of Indexed Universal Life insurance is its potential for higher returns compared to traditional life insurance products.

- Market-Linked Growth: The cash value component of an IUL policy grows based on the performance of a selected stock market index, such as the S&P 500. This mechanism allows policyholders to benefit from market upswings without directly investing in stocks.

- Crediting Floor: Most IUL policies have a minimum interest rate guarantee (often 0% or 1%), ensuring that the cash value does not decrease during market downturns. This feature provides a safety net that traditional investments do not offer.

Caps on Returns Limit Growth Potential

While IUL policies offer the potential for higher returns, they also come with limitations.

- Return Caps: Insurance companies typically impose caps on the maximum return that can be credited to the cash value. For instance, if the cap is set at 12% and the index gains 15%, the policyholder would only receive credit for 12%.

- Dilution of Gains: The use of options to hedge against market risks can dilute potential gains, meaning that even in favorable market conditions, the actual returns may fall short of expectations.

Flexible Premiums and Death Benefits

IUL policies are designed with flexibility in mind, making them suitable for individuals with varying financial situations.

- Adjustable Premiums: Policyholders can adjust their premium payments within certain limits based on their financial circumstances. This flexibility allows individuals to manage their cash flow more effectively.

- Customizable Death Benefits: The death benefit can often be adjusted according to the policyholder’s needs, providing peace of mind that coverage can adapt over time.

No Guaranteed Returns on Cash Value Growth

A notable disadvantage of IUL policies is the lack of guaranteed returns.

- Market Dependency: The growth of cash value is tied to market performance, which means there is no assurance of how much it will grow each year.

- Investment Risks: If the chosen index performs poorly over an extended period, the cash value may grow at a rate lower than expected or even stagnate.

Tax-Deferred Growth of Cash Value

IUL policies offer tax advantages that can enhance overall wealth accumulation.

- Tax Benefits: The cash value grows on a tax-deferred basis, meaning that policyholders do not pay taxes on gains until they are withdrawn.

- Tax-Free Loans: Policyholders can borrow against their cash value without incurring tax liabilities, provided that the policy remains in force.

Complexity in Understanding Policy Mechanics

The structure and functioning of IUL policies can be complex.

- Understanding Cap and Floor Rates: Grasping how cap and floor rates work requires careful consideration and understanding of financial principles. Many consumers may find it challenging to navigate these complexities without professional guidance.

- Ongoing Management Required: Policyholders need to actively manage their IUL to ensure it meets their financial goals, which may require regular consultations with financial advisors.

Access to Cash Value Through Loans or Withdrawals

IUL policies provide liquidity options that can be beneficial during emergencies or retirement planning.

- Loan Access: Policyholders can access their accumulated cash value through loans or withdrawals, offering financial flexibility when needed most.

- Supplemental Income: This feature can serve as a source of supplemental income during retirement, allowing individuals to maintain their lifestyle without depleting other assets.

Fees Can Reduce Overall Returns

While IUL policies offer various benefits, they also come with associated costs that can impact overall profitability.

- Administrative Fees: Policies often include various fees such as administrative costs and cost-of-insurance charges that can erode the growth potential of the cash value.

- Complex Fee Structures: Understanding these fees is crucial because they vary significantly among different insurers and can affect long-term outcomes.

Protection Against Market Downturns With a Guaranteed Floor

The structure of IUL provides a unique safety feature against market volatility.

- Downside Protection: With a guaranteed floor on returns, policyholders are protected from losing money during market downturns. This aspect makes IUL an attractive option for risk-averse investors seeking some exposure to equity markets without direct investment risks.

Risk of Policy Lapse If Premiums Are Not Maintained

Maintaining an IUL policy requires careful financial planning to avoid lapses.

- Premium Payment Obligations: If premium payments are insufficient or missed entirely, there is a risk that the policy could lapse, resulting in loss of coverage and accumulated cash value.

- Financial Discipline Required: Policyholders must ensure consistent contributions to keep their policies active and effective over time.

No Impact on Social Security Benefits From Withdrawals

IUL withdrawals do not affect Social Security benefits, making them an appealing option for retirees.

- Retirement Strategy Integration: This characteristic allows retirees to withdraw funds from their IUL without jeopardizing their Social Security income, providing additional financial security during retirement years.

Potentially High Cost of Insurance as the Policyholder Ages

As individuals age, the costs associated with maintaining an IUL policy can increase significantly.

- Rising Costs: The cost per unit of death benefit typically rises as the insured ages, which may lead to higher premium payments over time.

- Financial Planning Necessity: It is essential for policyholders to consider these rising costs when planning their long-term financial strategies and ensure they have adequate resources to cover future premiums.

In conclusion, Indexed Universal Life insurance presents both compelling advantages and notable drawbacks. Its potential for higher returns coupled with tax-deferred growth makes it an attractive option for many investors looking for flexible life insurance solutions. However, complexities surrounding fees, caps on returns, and ongoing management requirements necessitate careful consideration before committing to such policies. Individuals should consult with knowledgeable financial advisors to fully understand how an IUL fits into their broader financial strategy and whether it aligns with their long-term goals.

Frequently Asked Questions About Indexed Universal Life Insurance

- What is Indexed Universal Life Insurance?

IUL is a permanent life insurance policy that combines a death benefit with a cash value component linked to stock market index performance. - How does cash value grow in an IUL?

The cash value grows based on changes in a selected stock market index while having a guaranteed minimum interest rate. - Are there risks associated with Indexed Universal Life Insurance?

Yes, risks include caps on returns, complex fee structures, and potential lapses if premiums are not maintained. - Can I access my cash value while alive?

Yes, policyholders can borrow against or withdraw from their accumulated cash value. - Is there any tax advantage with IUL?

The cash value grows tax-deferred and loans taken against it are generally tax-free. - What happens if I stop paying premiums?

If premiums are not maintained, there is a risk that the policy may lapse. - Can withdrawals affect my Social Security benefits?

No, withdrawals from an IUL do not impact Social Security benefits. - How do I choose an appropriate index for my IUL?

You should consider factors like historical performance and your risk tolerance when selecting an index.