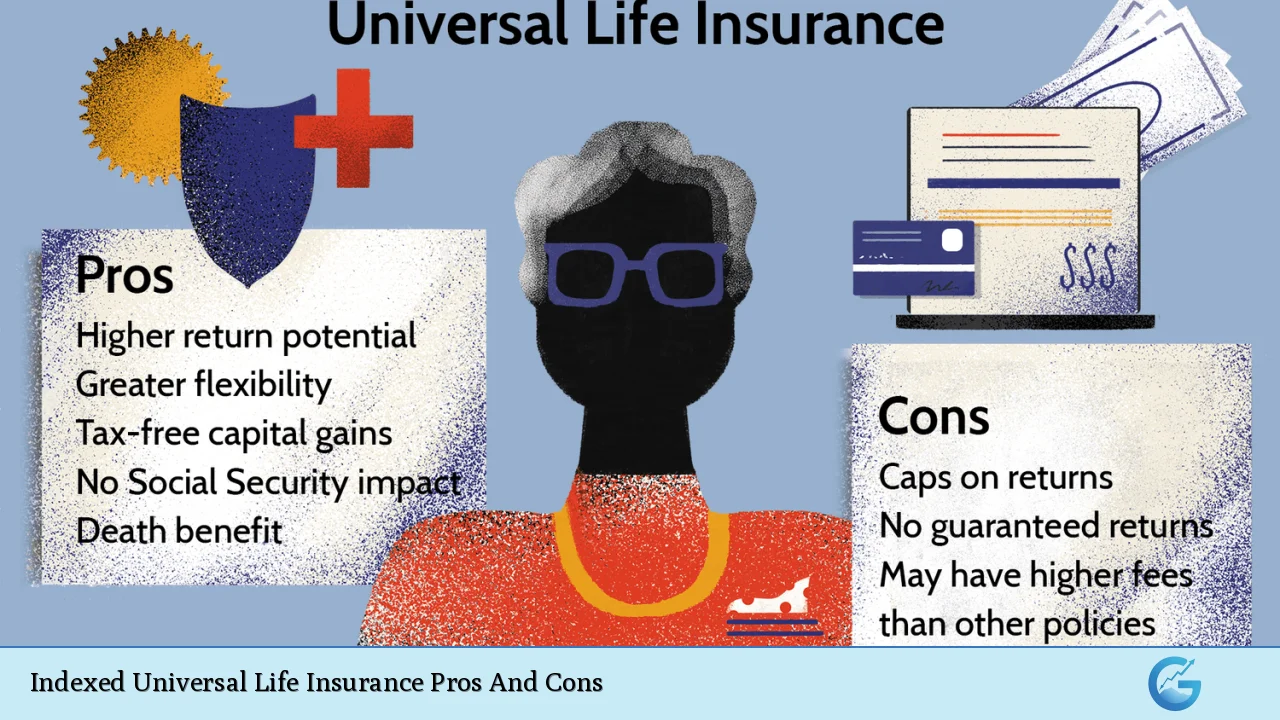

Indexed Universal Life (IUL) insurance is a complex financial product that combines life insurance coverage with a cash value component linked to stock market index performance. This innovative policy type has gained popularity among investors seeking both protection and growth potential. However, like any financial instrument, IUL comes with its own set of advantages and disadvantages that warrant careful consideration.

| Pros | Cons |

|---|---|

| Potential for higher returns | Market volatility risk |

| Downside protection | Capped returns |

| Tax-deferred growth | Complex structure |

| Flexible premiums | Higher fees and costs |

| Death benefit protection | No guaranteed returns |

| Access to cash value | Potential for policy lapse |

| No impact on Social Security benefits | Requires active management |

Potential for Higher Returns

One of the most attractive features of IUL policies is the potential for higher returns compared to traditional life insurance products. The cash value component of an IUL is tied to the performance of a stock market index, such as the S&P 500, allowing policyholders to benefit from market gains.

- Opportunity to participate in market upswings

- Potential for greater cash value accumulation over time

- Possibility of outperforming fixed-rate policies in bullish markets

It’s important to note that while IUL offers the potential for higher returns, these returns are not guaranteed and can fluctuate based on market performance.

Downside Protection

IUL policies typically include a floor or minimum guaranteed interest rate, which protects the policyholder’s cash value from market downturns. This feature provides a safety net during periods of poor market performance.

- Protection against negative returns

- Preservation of accumulated cash value

- Peace of mind during market volatility

The downside protection feature makes IUL an attractive option for risk-averse investors who want to participate in market gains while limiting potential losses.

Tax-Deferred Growth

One of the significant advantages of IUL policies is the tax-deferred growth of the cash value component. This means that policyholders can accumulate wealth without paying taxes on the gains until they withdraw funds from the policy.

- Potential for compound growth over time

- Flexibility in timing withdrawals for tax efficiency

- Opportunity for tax-free loans against the policy’s cash value

The tax-deferred growth feature can be particularly beneficial for high-income earners looking to minimize their current tax liability while building long-term wealth.

Flexible Premiums

Unlike traditional whole life insurance policies with fixed premiums, IUL offers flexibility in premium payments. Policyholders can adjust their premium amounts within certain limits based on their financial situation and goals.

- Ability to increase or decrease premium payments

- Option to skip premiums if sufficient cash value is available

- Potential to overfund the policy for increased cash value growth

This flexibility can be advantageous for individuals with fluctuating incomes or those who want to align their premium payments with their changing financial circumstances.

Death Benefit Protection

At its core, an IUL policy provides a death benefit to the policyholder’s beneficiaries. This feature ensures that loved ones are financially protected in the event of the insured’s death.

- Guaranteed payout to beneficiaries

- Option to increase or decrease death benefit over time

- Potential for tax-free transfer of wealth to heirs

The death benefit protection offered by IUL policies can be an essential component of a comprehensive financial plan, providing peace of mind and financial security for families.

Access to Cash Value

IUL policies allow policyholders to access the accumulated cash value through loans or withdrawals. This feature provides a source of liquidity that can be used for various purposes, such as supplementing retirement income or covering unexpected expenses.

- Ability to borrow against the policy’s cash value

- Option for tax-free withdrawals up to the policy basis

- Flexibility to use funds for any purpose without restrictions

While access to cash value can be beneficial, it’s crucial to understand that loans and withdrawals may reduce the policy’s death benefit and could potentially lead to a policy lapse if not managed properly.

No Impact on Social Security Benefits

Unlike some retirement accounts, withdrawals from IUL policies do not affect Social Security benefits. This can be advantageous for retirees looking to maximize their income sources without jeopardizing their government benefits.

- Ability to supplement retirement income without reducing Social Security payments

- Flexibility in managing overall retirement strategy

- Potential for tax-efficient income planning in retirement

The non-impact on Social Security benefits makes IUL an attractive option for individuals seeking to optimize their retirement income streams.

Market Volatility Risk

While IUL policies offer the potential for higher returns, they are also subject to market volatility risk. The cash value growth is tied to the performance of the chosen index, which can fluctuate significantly over time.

- Possibility of lower returns during market downturns

- Uncertainty in year-to-year performance

- Potential for underperformance compared to direct market investments

Policyholders must be prepared for fluctuations in their policy’s cash value and understand that past performance does not guarantee future results.

Capped Returns

Most IUL policies impose caps or participation rates on the returns credited to the cash value. These limits can restrict the policyholder’s ability to fully benefit from strong market performance.

- Limitation on potential gains during bull markets

- Reduced upside compared to direct market investments

- Possibility of underperforming other investment vehicles in strong market conditions

The presence of caps on returns is a trade-off for the downside protection offered by IUL policies and should be carefully considered when evaluating the potential growth of the cash value.

Complex Structure

IUL policies are often more complex than traditional life insurance products, with various moving parts and features that can be difficult for the average consumer to understand fully.

- Multiple index options and crediting methods

- Intricate fee structures and policy charges

- Complicated illustrations and projections

The complexity of IUL policies underscores the importance of working with a knowledgeable financial advisor who can explain the nuances and help make informed decisions.

Higher Fees and Costs

IUL policies typically come with higher fees and costs compared to term life insurance or even some traditional permanent life insurance options. These expenses can erode the policy’s cash value over time.

- Cost of insurance charges

- Administrative fees and policy maintenance costs

- Potential surrender charges for early policy termination

Policyholders must carefully review and understand the fee structure of an IUL policy to assess its long-term viability and cost-effectiveness.

No Guaranteed Returns

Unlike whole life insurance policies that offer guaranteed cash value growth, IUL policies do not provide guaranteed returns beyond the minimum interest rate or floor.

- Uncertainty in long-term policy performance

- Possibility of lower-than-expected cash value accumulation

- Risk of not meeting projected policy values

The lack of guaranteed returns means that policyholders must be comfortable with a degree of uncertainty regarding their policy’s future value.

Potential for Policy Lapse

If the policy’s cash value becomes insufficient to cover the cost of insurance and other charges, there is a risk of policy lapse. This can result in the loss of coverage and potential tax consequences.

- Need for ongoing monitoring of policy performance

- Possibility of increased premium requirements to maintain coverage

- Risk of losing life insurance protection if cash value is depleted

Policyholders must be vigilant in managing their IUL policies to ensure they remain in force and continue to meet their financial objectives.

Requires Active Management

To maximize the benefits of an IUL policy, active management and regular review are often necessary. This can be time-consuming and may require ongoing professional guidance.

- Need for periodic policy reviews and adjustments

- Importance of understanding and adapting to market conditions

- Potential requirement for professional assistance in policy management

The active management aspect of IUL policies may not be suitable for individuals who prefer a more hands-off approach to their life insurance and investments.

In conclusion, Indexed Universal Life Insurance offers a unique combination of life insurance protection and potential for cash value growth tied to market performance. While it presents opportunities for higher returns and financial flexibility, it also comes with complexities and risks that must be carefully considered. Prospective policyholders should thoroughly evaluate their financial goals, risk tolerance, and long-term objectives before deciding if an IUL policy is the right choice for their needs. Consulting with a qualified financial advisor can provide valuable insights and help navigate the intricacies of this sophisticated insurance product.

Frequently Asked Questions About Indexed Universal Life Insurance Pros And Cons

- How does the cash value growth in an IUL policy differ from other life insurance products?

IUL cash value growth is linked to stock market index performance, offering potential for higher returns than traditional policies. However, growth is typically capped, and there’s no guarantee of positive returns. - Can I lose money in an IUL policy?

While IUL policies have a minimum guaranteed interest rate, poor market performance and high fees can result in lower-than-expected cash value growth. In extreme cases, the policy could lapse if cash value becomes insufficient to cover costs. - Are IUL policies suitable for everyone?

IUL policies are generally best suited for individuals with a higher risk tolerance and a long-term financial perspective. They may not be appropriate for those seeking guaranteed returns or simple, low-cost life insurance coverage. - How do taxes work with IUL policies?

Cash value growth in IUL policies is tax-deferred. Withdrawals up to the policy basis are typically tax-free, and loans can be taken tax-free as long as the policy remains in force. - What happens if I can’t pay the premiums on my IUL policy?

IUL policies offer premium flexibility, allowing you to adjust or skip payments if sufficient cash value is available. However, consistently underfunding the policy can lead to a lapse in coverage. - How do IUL policies compare to 401(k)s or IRAs for retirement savings?

IUL policies offer tax advantages and potential for market-linked growth, similar to retirement accounts. However, they typically have higher fees and may offer lower overall returns compared to dedicated retirement investment vehicles. - Can I change the death benefit amount in an IUL policy?

Yes, most IUL policies allow you to increase or decrease the death benefit amount, subject to certain conditions and underwriting requirements. - What happens to the cash value of an IUL policy when the insured person dies?

Typically, only the death benefit is paid out to beneficiaries upon the insured’s death. The accumulated cash value usually reverts to the insurance company, unless specific riders or policy features state otherwise.