Investing in gold coins has long been a favored strategy among investors looking to diversify their portfolios and hedge against economic uncertainty. Gold has intrinsic value, is universally recognized, and has historically maintained its purchasing power over time. However, like any investment, it comes with its own set of advantages and disadvantages that potential investors should carefully consider. This article explores the pros and cons of investing in gold coins, providing insights for those interested in finance, cryptocurrency, forex, and money markets.

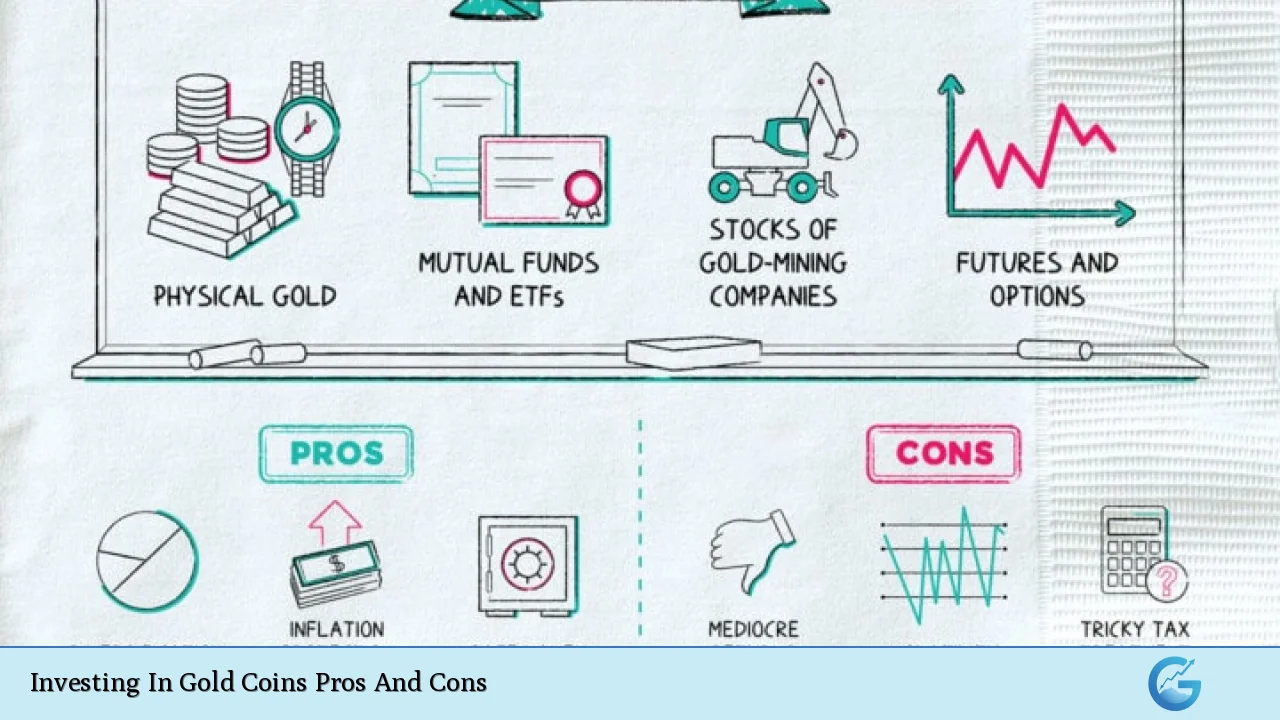

| Pros | Cons |

|---|---|

| Hedge against inflation | Does not generate passive income |

| Tangible asset with intrinsic value | Storage and insurance costs |

| Portfolio diversification | Illiquidity compared to other investments |

| Historical stability during economic downturns | Potential for price volatility |

| No counterparty risk | Capital gains tax upon sale |

| Privacy and anonymity in ownership | Risk of theft or fraud |

| Collectible value for certain coins | Market manipulation risks |

| Global acceptance as a form of currency | Dealer markups and transaction fees |

Hedge Against Inflation

One of the primary advantages of investing in gold coins is their ability to act as a hedge against inflation. As the cost of living increases, the purchasing power of fiat currencies tends to decrease. Gold has historically maintained its value during inflationary periods, making it a reliable store of value.

- Preservation of Wealth: Gold tends to rise in value when inflation is high, helping investors preserve their wealth.

- Historical Performance: Over the decades, gold has proven to be a robust asset during times of economic instability.

Tangible Asset with Intrinsic Value

Gold coins are physical assets that possess intrinsic value due to their metal content. Unlike paper assets, gold coins can be held in hand, providing a sense of security.

- Physical Ownership: Investors have complete control over their assets without reliance on third parties.

- Durability: Gold does not corrode or degrade over time, ensuring its long-term viability.

Portfolio Diversification

Including gold coins in an investment portfolio can enhance diversification. Gold often moves independently of stock and bond markets.

- Reduced Risk: By diversifying with gold, investors can mitigate risks associated with market volatility.

- Balance Against Losses: In times of market downturns, gold can provide a counterbalance to declining stock values.

Historical Stability During Economic Downturns

Gold has historically performed well during economic crises. Many investors turn to gold as a safe haven during turbulent times.

- Safe Haven Asset: During financial crises or geopolitical tensions, demand for gold typically increases.

- Proven Resilience: Historical data shows that gold prices often rise when stock markets fall.

No Counterparty Risk

Investing in physical gold coins eliminates counterparty risk—the risk that the other party in an investment will default on their obligations.

- Direct Ownership: Investors own the asset outright without reliance on financial institutions or contracts.

- Security During Crises: In financial downturns where institutions may falter, physical gold remains secure.

Privacy and Anonymity in Ownership

Gold coins offer a level of privacy that many other investments do not. Ownership can often remain confidential.

- Discreet Investment: Investors can hold significant value without public knowledge.

- Protection from Seizure: In extreme scenarios, physical assets may be less susceptible to government seizure compared to bank accounts.

Collectible Value for Certain Coins

Some gold coins are not just investments but also collectibles that can appreciate in value beyond their metal content.

- Numismatic Value: Rare or historical coins can command premiums due to their collector appeal.

- Potential for Higher Returns: Collectors may pay significantly more than the melt value for certain coins.

Global Acceptance as a Form of Currency

Gold is recognized worldwide as a form of currency and a medium of exchange.

- Universal Value: Gold can be traded globally without conversion issues.

- Liquidity Across Borders: In times of crisis or currency devaluation, gold remains a trusted form of payment.

Does Not Generate Passive Income

One significant disadvantage of investing in gold coins is that they do not produce any regular income. Unlike stocks or bonds that yield dividends or interest payments, gold relies solely on price appreciation for returns.

- No Cash Flow: Investors must wait until they sell their gold to realize any gains.

- Opportunity Cost: In times of rising interest rates, holding non-yielding assets like gold may become less attractive compared to income-generating investments.

Storage and Insurance Costs

Owning physical gold necessitates secure storage solutions and insurance coverage against theft or damage.

- Additional Expenses: Costs associated with storing and insuring gold can diminish overall returns.

- Safe Storage Requirements: Investors often need to rent safe deposit boxes or use specialized storage facilities.

Illiquidity Compared to Other Investments

Physical gold can be less liquid than stocks or bonds. Selling physical assets takes time and effort compared to pressing a button on an online trading platform.

- Time-consuming Sales Process: Converting physical gold into cash may require finding buyers or dealers.

- Market Conditions Impact Liquidity: In times of high demand or economic stress, selling may become more challenging.

Potential for Price Volatility

While gold is generally considered stable, it can still experience price fluctuations based on market sentiment and external factors.

- Market Sensitivity: Prices can be influenced by geopolitical events or changes in economic policy.

- Investment Timing Risks: Investors may face losses if they buy at peak prices before a downturn.

Capital Gains Tax Upon Sale

Investors must consider tax implications when selling gold coins. In the U.S., profits from selling physical gold are subject to capital gains tax.

- Tax Burden on Profits: The capital gains tax rate for collectibles like gold is higher than for standard investments.

- Planning Required: Investors should factor taxes into their overall investment strategy to avoid unexpected liabilities.

Risk of Theft or Fraud

Owning physical gold carries inherent risks related to theft and fraud.

- Theft Risk: Without proper security measures, physical assets are vulnerable to theft.

- Counterfeit Concerns: The market has instances of counterfeit products; buying from reputable dealers is essential.

Market Manipulation Risks

Gold prices can be subject to manipulation by large financial entities or governments aiming to influence market conditions.

- Volatility Induced by Speculation: Speculative trading can lead to rapid price changes that do not reflect true market conditions.

- Investor Vulnerability: Smaller investors may find themselves at a disadvantage during manipulated market conditions.

In conclusion, investing in gold coins presents both significant advantages and notable drawbacks. While they serve as an effective hedge against inflation, provide tangible asset ownership, and enhance portfolio diversification, they also come with challenges such as lack of passive income, storage costs, illiquidity issues, and potential risks from theft and fraud.

Investors should weigh these factors carefully based on their financial goals and risk tolerance before deciding how much capital to allocate toward this precious metal. As always, thorough research and consideration are key components of successful investing strategies.

Frequently Asked Questions About Investing In Gold Coins

- What are the best types of gold coins to invest in?

The best types typically include government-minted bullion coins like the American Gold Eagle or Canadian Maple Leaf due to their purity and liquidity. - How much should I invest in gold coins?

Financial advisors often recommend allocating 5% to 10% of your portfolio towards gold for effective diversification. - Are there any tax implications when selling gold coins?

Yes, profits from selling physical gold are subject to capital gains tax at a rate higher than standard investments. - How do I ensure my investment is secure?

You should store your coins in a safe location such as a bank safe deposit box or use professional vault services. - Can I lose money investing in gold?

Yes, while historically stable, the price of gold can fluctuate based on market conditions leading to potential losses. - Is it better to invest in physical coins or ETFs?

This depends on your investment goals; ETFs offer liquidity without storage costs but lack the tangible asset aspect. - What are the risks associated with buying counterfeit coins?

If you purchase from unverified dealers or private sellers without proper authentication methods, you risk acquiring fake products. - How does geopolitical instability affect gold prices?

Geopolitical tensions often increase demand for gold as a safe haven asset leading to price increases.