Investing in tax liens is a unique opportunity within the realm of real estate and finance, where investors can purchase the rights to collect unpaid property taxes from delinquent homeowners. This investment strategy can yield significant returns, often higher than traditional investments, while also presenting certain risks and challenges. Understanding the advantages and disadvantages of tax lien investing is crucial for anyone interested in diversifying their portfolio and exploring alternative investment avenues.

| Pros | Cons |

|---|---|

| Low Capital Requirement | Risk of Non-Payment |

| High Potential Returns | Complex Legal Processes |

| Diversification Opportunities | Property Maintenance Responsibilities |

| Potential Ownership of Real Estate | Market Variability |

| Secured Investment | Limited Liquidity |

Low Capital Requirement

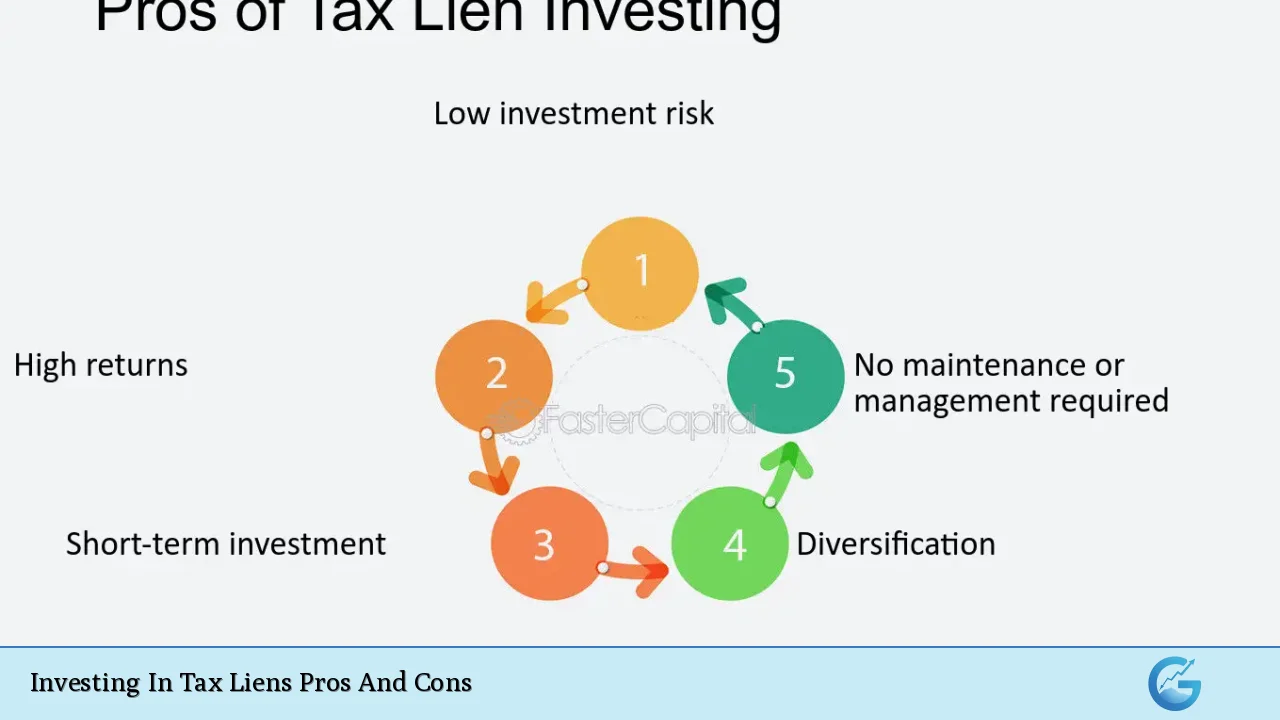

One of the most appealing aspects of tax lien investing is the low initial capital requirement. Investors can often purchase tax lien certificates for a few hundred dollars, making it accessible for individuals who may not have substantial capital to invest in traditional real estate.

- Entry Point: Investors can start with minimal funds compared to purchasing property outright.

- Bidding Flexibility: The auction process allows investors to bid on liens, often resulting in lower costs than expected.

High Potential Returns

Tax lien investments can offer high potential returns, with interest rates varying significantly by state. Some states allow interest rates as high as 36%, although typical rates range from 12% to 18%.

- Guaranteed Interest: The interest rate is typically set at the time of purchase, providing a predictable return on investment.

- Compounding Benefits: Investors can earn interest on their investments as property owners repay their debts, leading to compounded earnings over time.

Diversification Opportunities

Investing in tax liens allows individuals to diversify their portfolios without needing large amounts of capital. This diversification is particularly beneficial in volatile markets.

- Multiple Investments: Investors can purchase multiple tax liens across different jurisdictions, spreading risk.

- Real Estate Exposure: Tax lien investing provides exposure to real estate markets without the need for direct property ownership.

Potential Ownership of Real Estate

If a property owner fails to pay their taxes within a specified redemption period, the investor may have the opportunity to acquire the property through foreclosure.

- Acquisition at Low Cost: Investors can potentially acquire valuable properties for a fraction of their market value if they are willing to navigate the foreclosure process.

- Investment Growth: Foreclosure can lead to substantial growth in an investor’s portfolio if managed correctly.

Secured Investment

Tax liens are secured by the underlying real estate, meaning that if the homeowner defaults, the investor has a legal claim to the property.

- Priority Claim: Tax liens typically take precedence over other types of liens, providing a stronger position for recovery.

- Legal Backing: The investment is backed by government regulations, which adds a layer of security compared to unsecured investments.

Risk of Non-Payment

Despite the potential rewards, there are significant risks associated with tax lien investing. One major concern is the risk that homeowners will not repay their debts.

- Default Rates: If homeowners do not redeem their liens, investors may end up owning properties that are difficult to sell or maintain.

- Bankruptcy Risks: Homeowners declaring bankruptcy can complicate recovery efforts and place tax liens behind other claims against the property.

Complex Legal Processes

The legal processes involved in tax lien investing can be intricate and vary widely between jurisdictions.

- Understanding Local Laws: Each state has different regulations regarding tax lien sales and foreclosures, which requires thorough research and understanding.

- Potential Legal Fees: Navigating legal complexities may incur additional costs for investors who need professional assistance.

Property Maintenance Responsibilities

If an investor ends up owning a property through foreclosure, they inherit all responsibilities associated with that property.

- Maintenance Costs: Investors must be prepared for ongoing maintenance and repair costs that could diminish overall returns.

- Tenant Management: If the property is rented out, managing tenants becomes an additional responsibility that requires time and effort.

Market Variability

The real estate market’s fluctuations can impact the value of properties tied to tax liens.

- Property Value Risks: If the market declines, properties may be worth less than anticipated, making it difficult to recover investments through resale.

- Economic Factors: Broader economic downturns can lead to increased defaults on taxes, affecting overall investment performance.

Limited Liquidity

Tax lien investments are not as liquid as other forms of investment.

- Redemption Periods: Investors may have to wait extended periods before seeing returns, especially if they rely on property owners redeeming their debts.

- Selling Challenges: If an investor needs cash quickly, selling a tax lien certificate may not be straightforward or timely.

In conclusion, investing in tax liens presents both opportunities and challenges. While it offers low entry costs and potential high returns secured by real estate assets, investors must navigate complex legal frameworks and be prepared for risks associated with non-payment and property management. Thorough research and understanding of local laws are essential for success in this niche investment area.

Frequently Asked Questions About Investing In Tax Liens

- What is tax lien investing?

Tax lien investing involves purchasing certificates issued by local governments when property owners fail to pay their taxes. Investors earn returns through interest payments or potentially acquiring properties if debts remain unpaid. - How much capital do I need to start?

You can start investing in tax liens with as little as a few hundred dollars, depending on local auction prices. - What are typical interest rates for tax liens?

Interest rates vary by state but typically range from 12% to 18%, with some states allowing rates as high as 36%. - What happens if the homeowner does not pay?

If the homeowner fails to pay their taxes within a redemption period, you may have the right to foreclose on the property. - Are there risks involved in tax lien investing?

Yes, risks include non-payment by homeowners, complex legal processes, and potential maintenance responsibilities if you acquire a property. - Can I lose money investing in tax liens?

Yes, if homeowners do not redeem their debts or if you end up with properties that require significant repairs or have low market value. - Do I need legal assistance when investing?

It is advisable to consult with legal professionals familiar with local laws regarding tax liens and foreclosures. - Is tax lien investing suitable for everyone?

No, it requires careful research and understanding of both financial markets and real estate; it may not be suitable for inexperienced investors.