Leasing a car with the intention to buy it later, commonly referred to as a “lease-to-buy” arrangement, has become an increasingly popular option for many individuals. This method allows consumers to drive a vehicle for a specified period while having the option to purchase it at the end of the lease term. As with any financial decision, understanding the advantages and disadvantages of lease-to-buy agreements is crucial for making an informed choice. This article delves into the pros and cons of lease-to-buy car agreements, providing a comprehensive overview for those interested in finance, crypto, forex, and money markets.

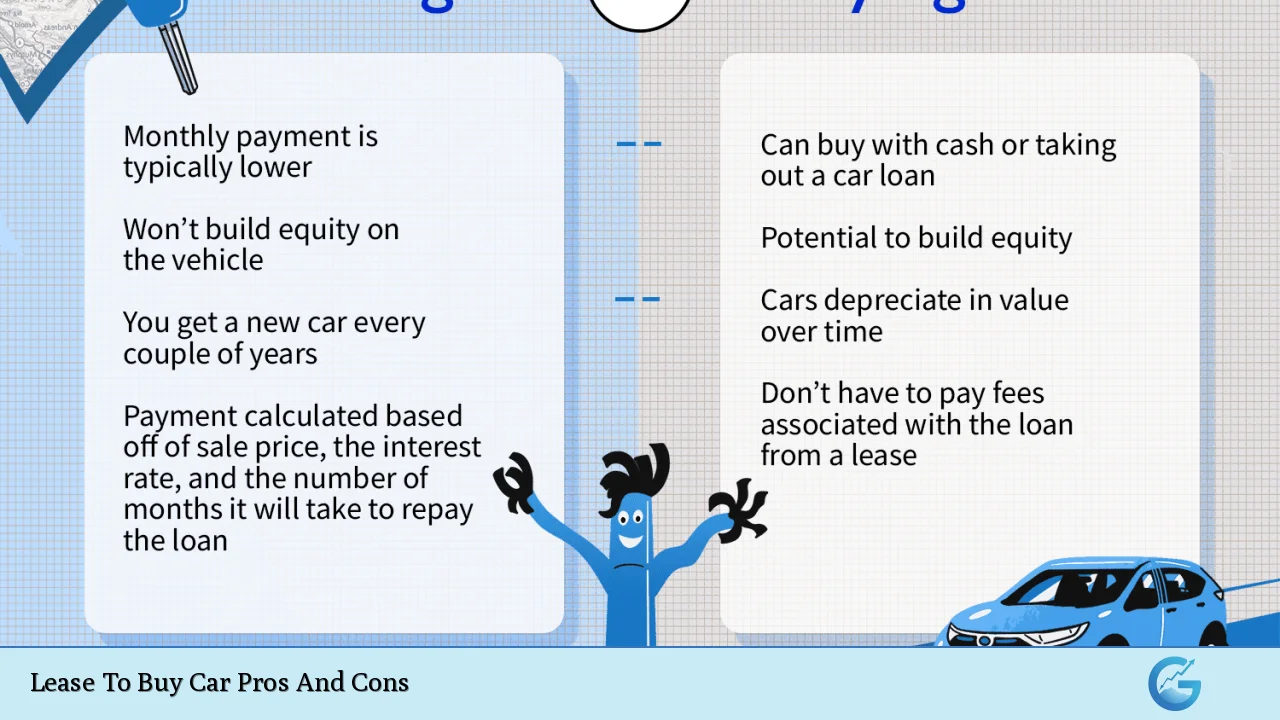

| Pros | Cons |

|---|---|

| Lower initial costs and monthly payments | No ownership until purchase is finalized |

| Flexibility to drive new vehicles frequently | Potential for high overall costs if leased long-term |

| Warranty coverage during the lease term | Restrictions on mileage and modifications |

| Opportunity to evaluate the vehicle before buying | Fees associated with excess wear and mileage overages |

| Tax benefits for business use | Complexity of lease agreements and potential hidden fees |

| Ability to negotiate purchase price at lease end | Risk of depreciation impacting final buyout price |

| No long-term commitment until purchase decision is made | May not build equity during the lease period |

Lower Initial Costs and Monthly Payments

One of the most significant advantages of leasing a car with an option to buy is the lower initial costs associated with this arrangement. Typically, leasing requires a smaller down payment compared to purchasing a vehicle outright.

- Lower Monthly Payments: Monthly payments on leased vehicles are generally lower than those for financed purchases. This affordability allows individuals to drive more expensive or luxurious cars than they might otherwise be able to afford.

- Reduced Upfront Costs: Leasing often involves fewer upfront costs, making it easier for buyers to manage their finances without a large initial outlay.

Flexibility to Drive New Vehicles Frequently

Leasing provides an excellent opportunity for consumers who enjoy driving new cars without committing to long-term ownership.

- Regular Upgrades: With lease terms usually lasting two to four years, lessees can frequently upgrade their vehicles, experiencing the latest technology and features.

- Less Commitment: The flexibility of leasing means that if circumstances change or preferences shift, individuals can easily transition to a different vehicle without the hassle of selling a car.

Warranty Coverage During the Lease Term

Most leased vehicles come with warranties that cover repairs and maintenance during the lease period.

- Peace of Mind: This coverage alleviates concerns about unexpected repair costs, allowing drivers to enjoy their vehicles without worrying about potential financial burdens.

- Lower Maintenance Costs: Since many leases last only as long as the warranty coverage, lessees often face minimal out-of-pocket expenses for repairs.

Opportunity to Evaluate the Vehicle Before Buying

Leasing allows consumers to test-drive a vehicle over an extended period before making a significant financial commitment.

- Informed Decision-Making: By leasing first, potential buyers can assess whether they truly like the vehicle’s performance, comfort, and features before deciding to purchase it.

- Flexibility in Choice: If the vehicle does not meet expectations, lessees can walk away at the end of the lease without any obligation to buy.

Tax Benefits for Business Use

For individuals using their vehicles for business purposes, leasing can offer significant tax advantages.

- Deductions on Lease Payments: Business owners may be able to deduct lease payments as business expenses, potentially reducing their taxable income.

- Depreciation Deductions: In some cases, lessees can also deduct depreciation on leased vehicles used for business purposes.

Ability to Negotiate Purchase Price at Lease End

At the end of a lease term, lessees often have the option to purchase their vehicle at a predetermined price known as the residual value.

- Negotiation Opportunities: Depending on market conditions and vehicle demand, lessees may negotiate a better purchase price than initially agreed upon.

- Control Over Final Decision: This flexibility allows individuals to make informed decisions based on their financial situation at the end of the lease term.

No Ownership Until Purchase Is Finalized

While leasing offers many benefits, one major disadvantage is that lessees do not own the vehicle until they complete the purchase process.

- Lack of Ownership Rights: Until the buyout is finalized, lessees cannot modify or customize their vehicles as they would if they owned them outright.

- Potential Loss of Investment: If circumstances change or if they decide not to purchase at lease end, all payments made during the lease term do not contribute toward ownership.

Potential for High Overall Costs if Leased Long-Term

Leasing can become expensive over time if individuals continuously choose this option rather than purchasing vehicles outright.

- Cumulative Payments: Over multiple leasing cycles, individuals may find that they have paid more in total than if they had purchased one car and kept it long-term.

- No Equity Building: Unlike traditional ownership where payments contribute toward building equity in an asset, leased vehicles do not provide this benefit until a purchase is made.

Restrictions on Mileage and Modifications

Leased vehicles typically come with restrictions that can limit usage and customization options.

- Mileage Limits: Most leases impose annual mileage limits (often between 10,000 and 15,000 miles). Exceeding these limits can result in costly penalties per extra mile driven.

- Modification Restrictions: Lessees are generally prohibited from making modifications or customizations to leased vehicles. Any alterations may incur additional fees when returning the car at lease end.

Fees Associated with Excess Wear and Mileage Overages

Returning a leased vehicle can come with unexpected costs related to wear and tear or exceeding mileage limits.

- Excess Wear Fees: Lessees may be charged for any damage deemed excessive beyond normal wear and tear. This can include scratches, dents, or interior damage that occurs during use.

- Mileage Overage Charges: If lessees exceed their agreed-upon mileage limit, they will incur additional charges that can significantly increase overall costs associated with leasing.

Complexity of Lease Agreements and Potential Hidden Fees

Lease agreements can be intricate documents filled with jargon that may confuse first-time lessees.

- Understanding Terms: It’s essential for potential lessees to fully understand all terms outlined in their lease agreements. Failure to do so could lead to unexpected charges or penalties later on.

- Hidden Fees: Some leases may include hidden fees such as acquisition fees or disposition fees that could impact overall costs. Careful review of all terms is crucial before signing any agreement.

Risk of Depreciation Impacting Final Buyout Price

The value of leased vehicles typically depreciates over time; this depreciation can affect final buyout prices at lease end.

- Market Fluctuations: If market conditions change negatively by the end of the lease term (e.g., increased supply or decreased demand), lessees might find themselves paying more than what similar vehicles are worth at that time.

- Financial Planning Required: Understanding how depreciation affects potential buyout prices is critical for effective financial planning when considering a lease-to-buy option.

May Not Build Equity During Lease Period

While leasing offers flexibility and lower payments initially, it does not allow individuals to build equity in an asset during its use.

- Long-Term Financial Impact: For those who prefer long-term investments in assets like cars, leasing may not align with their financial goals since payments do not contribute toward ownership until after purchasing occurs.

In conclusion, leasing a car with an option to buy presents both opportunities and challenges. While it offers lower initial costs and flexibility in driving new vehicles frequently, it also comes with restrictions on usage and potential long-term expenses. Individuals must carefully weigh these pros and cons against their personal financial situations and preferences before deciding whether this arrangement suits their needs.

Frequently Asked Questions About Lease To Buy Cars

- What is a lease-to-buy car agreement?

A lease-to-buy car agreement allows consumers to lease a vehicle with an option to purchase it at the end of the lease term. - What are some advantages of leasing over buying?

Leasing typically involves lower monthly payments and less upfront cost compared to buying outright. - Are there mileage restrictions in leasing?

Yes, most leases have mileage limits which can incur additional fees if exceeded. - Can I modify my leased vehicle?

No, modifications are generally prohibited in leased vehicles unless explicitly allowed by the leasing agreement. - What happens if I decide not to buy my leased car?

If you choose not to buy your leased car at term’s end, you simply return it without any further obligations. - Are there tax benefits associated with leasing?

Business owners may deduct lease payments as business expenses which could provide tax benefits. - Is leasing more cost-effective in the long run?

This depends on individual circumstances; while leasing offers short-term savings, long-term costs can accumulate if continuously leased. - How do I negotiate my purchase price at lease end?

You should review your contract’s residual value beforehand; market conditions may provide leverage for negotiation.