Deciding whether to lease or buy a car is a significant financial decision that can impact your budget, lifestyle, and long-term financial health. Each option has its unique advantages and disadvantages, making it essential to understand the implications of your choice. This article will provide a comprehensive analysis of the pros and cons of leasing versus buying a car, helping you make an informed decision based on your personal circumstances and financial goals.

| Pros | Cons |

|---|---|

| Lower monthly payments compared to buying. | No ownership or equity buildup in the vehicle. |

| Ability to drive a new car every few years. | Mileage restrictions with penalties for exceeding limits. |

| Includes warranty coverage during the lease term. | Continuous monthly payments without asset ownership. |

| Potentially lower upfront costs. | Fees for early termination or excessive wear and tear. |

| Access to higher-end vehicles at a lower cost. | No customization options allowed on leased vehicles. |

| Predictable monthly expenses with included maintenance packages. | Higher insurance costs due to comprehensive coverage requirements. |

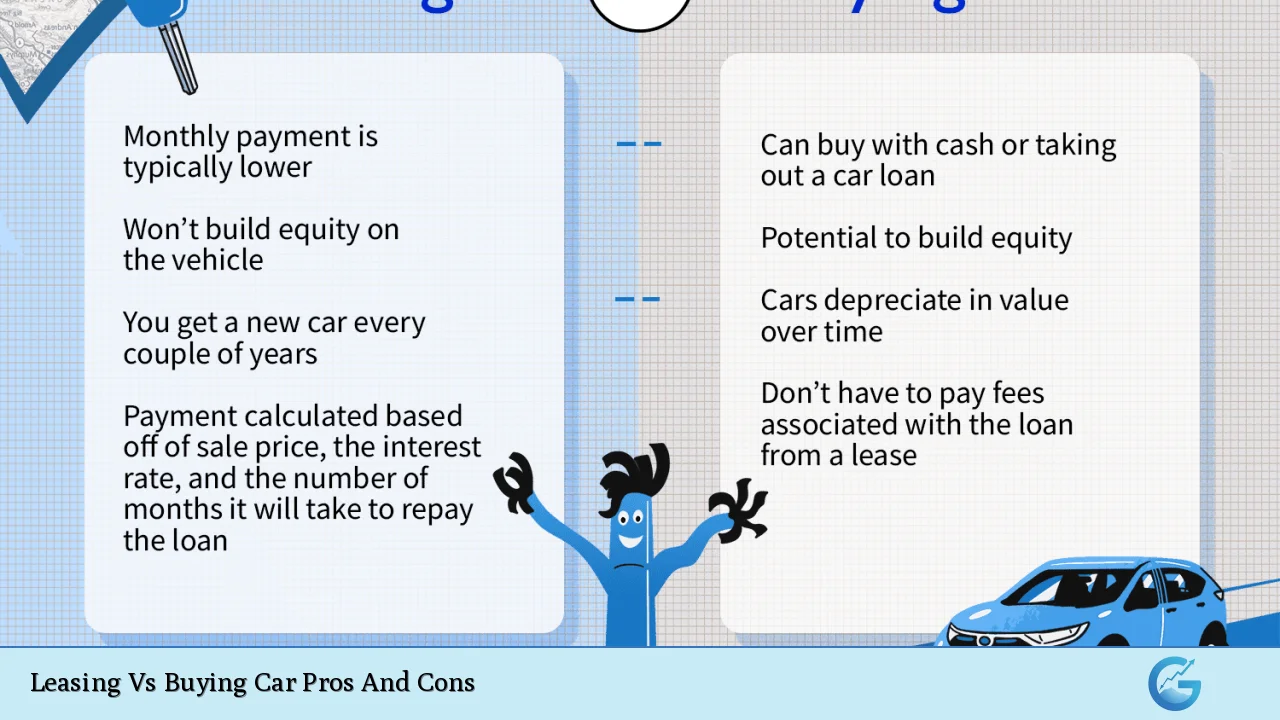

Advantages of Leasing a Car

Leasing a car can be an attractive option for many individuals, particularly those who prefer lower monthly payments and the ability to drive newer models. Here are some key advantages:

Lower Monthly Payments

Leasing typically results in lower monthly payments compared to financing a purchase. This is because lease payments are based on the vehicle’s depreciation during the lease term rather than its full purchase price. For individuals on a tight budget, this can make leasing more appealing.

Access to Newer Models

Leasing allows drivers to enjoy new cars every few years without the long-term commitment of ownership. This can be particularly beneficial for those who want the latest technology and safety features that come with newer models.

Warranty Coverage

Most leases last for two to three years, which usually coincides with the manufacturer’s warranty period. This means that major repairs are often covered, reducing unexpected expenses related to vehicle maintenance.

Lower Upfront Costs

Leases often require little or no down payment, making it easier for individuals to drive away in a new vehicle without significant upfront costs. This can be particularly advantageous for those who may not have substantial savings available.

Predictable Expenses

Leasing can provide predictable monthly expenses, as many leases include maintenance packages that cover routine services. This predictability can help with budgeting and financial planning.

Disadvantages of Leasing a Car

While leasing has its benefits, it also comes with several drawbacks that potential lessees should consider:

No Ownership or Equity Buildup

One of the most significant disadvantages of leasing is that you do not build equity in the vehicle. At the end of the lease term, you must return the car without any ownership rights or resale value.

Mileage Restrictions

Leases typically come with mileage limits (usually between 10,000 and 15,000 miles per year). Exceeding these limits can result in costly penalties, making leasing less suitable for individuals who drive long distances regularly.

Continuous Payments

Leasing means you will always have car payments as long as you continue to lease vehicles. In contrast, when you buy a car and pay off your loan, you eventually own the vehicle outright and can drive it payment-free.

Fees for Wear and Tear

Lease agreements often include stipulations regarding wear and tear on the vehicle. If you return the car with damages beyond normal use, you may face additional fees that can add up quickly.

Limited Customization Options

When leasing a vehicle, modifications or customizations are generally not allowed. This limitation may be frustrating for individuals who enjoy personalizing their cars.

Advantages of Buying a Car

Buying a car is another viable option that offers its own set of advantages:

Ownership and Equity Buildup

When you buy a car, you own it outright once your payments are complete. This means you have an asset that can be sold or traded in at any time, providing potential financial returns down the line.

No Mileage Restrictions

Ownership allows you to drive as much as you want without worrying about mileage penalties. This flexibility is ideal for those who commute long distances or enjoy road trips.

Customization Freedom

Car owners have complete freedom to modify their vehicles as they see fit. Whether it’s adding new features or changing the exterior appearance, customization options are unlimited.

Potential Cost Savings Over Time

While buying may involve higher initial costs and monthly payments compared to leasing, it can be more cost-effective in the long run if you keep the vehicle for several years after paying off your loan.

Tax Benefits for Business Use

If you use your vehicle for business purposes, owning it may offer tax deductions related to depreciation and interest on auto loans, providing potential savings during tax season.

Disadvantages of Buying a Car

Despite its advantages, buying a car also comes with certain drawbacks:

Higher Upfront Costs

Purchasing typically requires a larger down payment compared to leasing. For those with limited savings, this upfront cost can be a barrier to ownership.

Depreciation Concerns

New cars lose value quickly; they can depreciate by 15%–25% within the first few years. This rapid depreciation means that if you decide to sell shortly after buying, you may not recover your investment fully.

Maintenance Responsibilities

As an owner, you’re responsible for all maintenance and repair costs once any warranties expire. Depending on the age and condition of the vehicle, these costs can add up significantly over time.

Longer Commitment Required

Buying often involves a longer-term commitment compared to leasing. If your financial situation changes or your needs evolve, selling or trading in a purchased vehicle may not be as straightforward as returning a leased one.

Conclusion

The decision between leasing and buying a car ultimately depends on individual preferences, financial situations, and driving habits. Leasing offers lower payments and access to newer models but lacks ownership benefits and comes with restrictions. On the other hand, buying provides equity buildup and flexibility but requires higher upfront costs and maintenance responsibilities.

Carefully evaluating your personal circumstances—such as budget constraints, driving habits, and long-term financial goals—will help guide your decision-making process. Whether you choose to lease or buy, understanding both options’ strengths and weaknesses will empower you to make an informed choice that aligns with your lifestyle and financial objectives.

Frequently Asked Questions About Leasing Vs Buying Car Pros And Cons

- What is more cost-effective: leasing or buying?

The cost-effectiveness depends on how long you plan to keep the vehicle; buying is generally cheaper over time if kept long enough. - Are there mileage limits when leasing?

Yes, most leases have mileage restrictions which can lead to penalties if exceeded. - Can I customize my leased vehicle?

No, leased vehicles typically cannot be modified; customization is only allowed when owning a car. - What happens at the end of my lease?

You must return the vehicle unless there’s an option to purchase it at lease end. - Do I build equity when I lease?

No, leasing does not allow for equity buildup; payments go towards usage rather than ownership. - Can I deduct expenses if I buy my car for business use?

Yes, owning a vehicle used for business can provide tax deductions related to depreciation and interest. - What are typical lease terms?

Lease terms usually range from 24 to 36 months but can vary based on agreements. - Is insurance more expensive for leased vehicles?

Yes, insurance premiums may be higher due to required comprehensive coverage on leased cars.