Jenius Bank is a digital banking division of SMBC MANUBANK, offering a unique blend of modern financial services with the backing of a well-established banking group. As a relatively new player in the digital banking space, Jenius Bank has quickly gained attention for its high-yield savings account and personal loan offerings. However, like any financial institution, it comes with its own set of advantages and disadvantages that potential customers should carefully consider.

| Pros | Cons |

|---|---|

| High-yield savings account with competitive APY | Limited product offerings |

| No monthly maintenance fees | No ATM access or debit card |

| No minimum balance requirements | Slow fund transfer process |

| FDIC-insured | No physical branches |

| 24/7 customer support | Limited availability in some states |

| User-friendly mobile app | No checking account option |

| Personal loan offerings | Relatively new bank with limited track record |

| Backed by established SMBC Group | No cash deposit options |

High-Yield Savings Account with Competitive APY

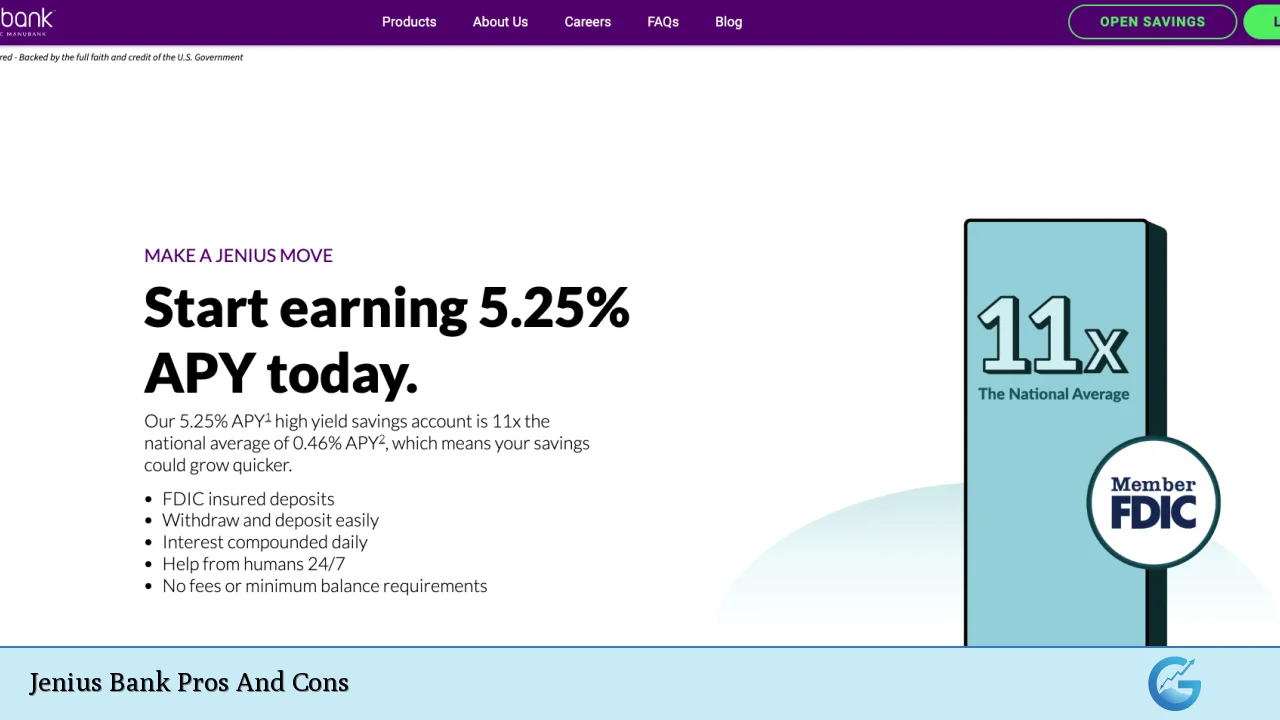

One of the most significant advantages of Jenius Bank is its high-yield savings account, which offers an impressive Annual Percentage Yield (APY) that consistently ranks among the top in the market.

As of December 2024, the Jenius Savings account boasts an APY of 5.25%, which is substantially higher than the national average. This competitive rate allows customers to grow their savings more quickly compared to traditional brick-and-mortar banks.

- Interest compounds daily, maximizing earning potential

- Rate is applied to all balance tiers, with no minimum balance required to earn the high APY

- Consistently competitive rates, often adjusting to stay at the top of the market

However, it’s important to note that while the high APY is attractive, interest rates are subject to change based on market conditions and Federal Reserve policies. Potential customers should always compare rates across multiple institutions before making a decision.

No Monthly Maintenance Fees

In an era where many banks charge monthly maintenance fees for their accounts, Jenius Bank stands out by offering fee-free banking. This approach aligns well with the needs of cost-conscious consumers who want to maximize their savings without worrying about their balance being eroded by fees.

- Zero monthly maintenance fees for savings accounts

- No withdrawal fees or excessive transaction fees

- Allows customers to keep more of their money and earn more interest

The absence of fees is particularly beneficial for those who may not always maintain high balances or who make frequent transactions. It provides a level of financial flexibility that can be especially appealing to younger savers or those just starting to build their nest egg.

No Minimum Balance Requirements

Jenius Bank’s policy of no minimum balance requirements for its savings account is another significant advantage. This feature makes the account accessible to a wide range of customers, regardless of their financial situation.

- Open an account with as little as $0

- Earn the high APY on any balance amount

- No risk of incurring fees for falling below a minimum balance threshold

This lack of minimum balance requirement is particularly beneficial for:

- New savers just starting to build their emergency fund

- Those who prefer to keep their savings spread across multiple accounts

- Customers who may need to occasionally dip into their savings

FDIC-Insured

As a member of the FDIC, Jenius Bank provides the same level of deposit insurance as traditional banks. This federal backing offers peace of mind to customers, knowing that their funds are protected up to the standard insurance limits.

- Deposits insured up to $250,000 per depositor

- Provides security in the event of bank failure

- Adds credibility to the digital banking platform

The FDIC insurance is a crucial feature, especially for an online-only bank, as it assures customers that their money is as safe as it would be in a traditional brick-and-mortar institution.

24/7 Customer Support

In the digital banking world, accessible customer support is crucial. Jenius Bank addresses this need by offering round-the-clock customer service, ensuring that help is always available when needed.

- Support available 24 hours a day, 7 days a week

- Multiple contact methods, including phone and email

- Assistance with account issues, transfers, and general inquiries

This level of support can be particularly reassuring for customers who are new to digital banking or those who may need assistance outside of regular business hours.

User-Friendly Mobile App

While Jenius Bank’s mobile app is relatively new, it has been designed with user experience in mind. The app provides a streamlined interface for managing accounts, making transfers, and monitoring savings growth.

- Intuitive design for easy navigation

- Secure login options, including biometric authentication

- Real-time account balance and transaction history

However, as a newer offering, the app may not have all the features of more established banking apps. Users should expect ongoing updates and improvements as Jenius Bank continues to develop its digital platform.

Personal Loan Offerings

In addition to its savings account, Jenius Bank offers personal loans, providing customers with borrowing options for various needs. This diversification of products allows customers to potentially consolidate their banking and borrowing needs under one institution.

- Loan amounts ranging from $5,000 to $50,000

- Competitive interest rates for qualified borrowers

- Potential for quick approval and funding

It’s worth noting that personal loan applications are not directly accessible through Jenius Bank but are offered through partnerships with platforms like Credit Karma. This indirect application process may be seen as a drawback for some potential borrowers.

Backed by Established SMBC Group

Jenius Bank’s association with the Sumitomo Mitsui Banking Corporation (SMBC) Group provides a strong foundation of financial expertise and stability. This backing by a well-established global financial institution adds credibility to Jenius Bank’s operations.

- Access to extensive financial resources and expertise

- Potential for long-term stability and growth

- Combines startup agility with established banking experience

The SMBC Group’s 400-year history in banking provides a reassuring backdrop for customers who might be hesitant about entrusting their money to a newer digital bank.

Limited Product Offerings

One of the most significant drawbacks of Jenius Bank is its limited range of products. Currently, the bank primarily focuses on its high-yield savings account and personal loans, which may not meet all the banking needs of potential customers.

- No checking account options

- Lack of credit card offerings

- No certificates of deposit (CDs) or money market accounts

This limited product line means that customers may need to maintain accounts with other institutions for their full range of banking needs, potentially complicating their financial management.

No ATM Access or Debit Card

The absence of ATM access and debit cards is a notable disadvantage for Jenius Bank customers. This limitation can make it challenging to access funds quickly or make purchases directly from the savings account.

- No option for cash withdrawals from ATMs

- Unable to make point-of-sale transactions

- Requires transferring funds to an external account for spending

For customers who prefer having immediate access to their funds or who frequently use cash, this lack of ATM and debit card functionality could be a significant inconvenience.

Slow Fund Transfer Process

Jenius Bank’s fund transfer process has been reported to be slower compared to some other online banks. This can be frustrating for customers who need quick access to their money or who are used to faster transfer times with other institutions.

- ACH transfers can take up to 5 business days to complete

- Limits on the number of external accounts that can be linked

- Potential delays in accessing deposited funds

These transfer limitations and delays could be problematic for customers who frequently move money between accounts or who rely on quick access to their savings.

No Physical Branches

As an online-only bank, Jenius Bank does not have any physical branch locations. While this is common for digital banks and allows for lower overhead costs (which can translate to better rates for customers), it can be a disadvantage for those who prefer face-to-face banking services.

- No in-person customer service or account management

- Unable to deposit cash directly into accounts

- May be challenging for customers who are not comfortable with digital banking

The lack of physical branches can be particularly problematic for complex transactions or situations that may require in-person assistance.

Limited Availability in Some States

Jenius Bank is not available to residents of all U.S. states, which limits its potential customer base. As of the latest information, residents of Hawaii and New Mexico cannot open accounts with Jenius Bank, and there may be restrictions on certain services for residents of other states.

- Not available in Hawaii and New Mexico

- Potential limitations on services in other states

- May exclude some customers based on geographic location

This limited availability could be frustrating for potential customers who are attracted to Jenius Bank’s offerings but are unable to access them due to their location.

No Checking Account Option

The absence of a checking account option is a significant limitation for Jenius Bank. Many customers prefer to have their savings and checking accounts with the same institution for easier fund management and transfers.

- Unable to write checks or make direct bill payments

- No option for a comprehensive banking relationship

- May require maintaining accounts at multiple institutions

This lack of a checking account option means that Jenius Bank cannot serve as a primary bank for most customers, potentially limiting its appeal to those seeking a one-stop banking solution.

Relatively New Bank with Limited Track Record

As a newer entrant in the digital banking space, Jenius Bank has a limited operational history compared to more established banks. This shorter track record may cause some potential customers to hesitate before entrusting their finances to the institution.

- Less historical data on customer satisfaction and service quality

- Potential for growing pains and operational adjustments

- May not have the same level of brand recognition as larger banks

While Jenius Bank’s association with the SMBC Group provides some reassurance, its own track record as a digital bank is still developing.

No Cash Deposit Options

The inability to deposit cash directly into Jenius Bank accounts can be a significant drawback for some customers. This limitation is common among online-only banks but can be inconvenient for those who regularly receive cash payments or prefer to deposit cash savings.

- No option to deposit cash at ATMs or branches

- Requires using a third-party bank or money order for cash deposits

- May be problematic for customers who work in cash-heavy industries

This lack of cash deposit options could necessitate maintaining an account with another bank that offers this service, adding complexity to personal financial management.

In conclusion, Jenius Bank offers a compelling high-yield savings option with attractive rates and fee-free banking. Its backing by the established SMBC Group and 24/7 customer support provide additional layers of credibility and service. However, the limited product offerings, lack of physical branches, and restrictions on cash handling and quick fund access may not suit all banking needs. Potential customers should carefully weigh these pros and cons against their personal financial requirements and preferences before deciding to bank with Jenius.

Frequently Asked Questions About Jenius Bank Pros And Cons

- Is Jenius Bank FDIC insured?

Yes, Jenius Bank is FDIC insured. Deposits are protected up to $250,000 per depositor. - Can I withdraw money from an ATM with a Jenius Bank account?

No, Jenius Bank does not offer ATM access or debit cards. You’ll need to transfer funds to an external account for withdrawals. - What is the minimum balance required for a Jenius Bank savings account?

There is no minimum balance requirement for Jenius Bank’s savings account. You can open an account with $0 and earn the advertised APY on any balance. - Does Jenius Bank offer checking accounts?

No, Jenius Bank currently does not offer checking accounts. Their primary products are a high-yield savings account and personal loans. - How long does it take to transfer money in and out of a Jenius Bank account?

Transfers can take up to 5 business days to complete, which is longer than some other online banks. This applies to both incoming and outgoing transfers. - Can I open a Jenius Bank account if I live in any state?

No, Jenius Bank is not available in all states. Notably, residents of Hawaii and New Mexico cannot open accounts, and there may be restrictions in other states. - Does Jenius Bank have a mobile app?

Yes, Jenius Bank offers a mobile app for account management. It provides features like balance checking, transfers, and account monitoring. - How does Jenius Bank’s savings account APY compare to other banks?

Jenius Bank typically offers a highly competitive APY on its savings account, often ranking among the top rates in the market. However, rates can change, so it’s always best to compare current offers.