Life insurance with a long-term care (LTC) rider is an increasingly popular financial product that combines the benefits of life insurance with the ability to access funds for long-term care needs. As the population ages and healthcare costs rise, many individuals are looking for ways to secure their financial future while ensuring they have the necessary resources for potential long-term care. This article explores the advantages and disadvantages of life insurance with an LTC rider, providing a comprehensive overview for those interested in finance, investment strategies, and personal financial planning.

| Pros | Cons |

|---|---|

| Dual-purpose coverage: Provides both life insurance and long-term care benefits. | Reduction of death benefit: Using LTC benefits decreases the amount available to beneficiaries. |

| Cost-effective: Generally more affordable than purchasing separate life and LTC insurance policies. | Higher premiums: Adding an LTC rider increases overall policy costs. |

| Flexibility in care options: Funds can be used for various types of long-term care services. | Limited coverage: Benefits may not cover all long-term care expenses. |

| Tax advantages: Potential tax benefits on premiums and payouts. | Eligibility restrictions: Must meet specific criteria to access benefits. |

| Simplified underwriting process: Easier to add a rider than to obtain standalone LTC insurance. | No inflation protection: Benefits may not keep pace with rising healthcare costs. |

Dual-Purpose Coverage

One of the most significant advantages of a life insurance policy with an LTC rider is its dual-purpose nature. This combination allows policyholders to secure a death benefit for their beneficiaries while also providing access to funds for long-term care needs if necessary.

- Financial Security: Policyholders can ensure that their loved ones receive a financial legacy while also preparing for potential healthcare expenses.

- Peace of Mind: Knowing that both life insurance and long-term care needs are addressed can alleviate anxiety about future financial burdens.

Reduction of Death Benefit

Despite the benefits, one major drawback is that utilizing the LTC rider reduces the death benefit available to beneficiaries.

- Impact on Legacy: If a significant portion of the death benefit is used for long-term care expenses, heirs may receive less or even nothing.

- Financial Planning Considerations: Individuals focused on leaving a substantial inheritance should carefully evaluate how much they might need to draw from the policy for long-term care.

Cost-Effectiveness

Life insurance policies with LTC riders are often more cost-effective compared to purchasing separate policies for life insurance and long-term care.

- Budget-Friendly Option: For many, bundling these coverages can lead to lower overall costs than buying standalone policies.

- Convenience: Managing one policy instead of multiple products simplifies financial planning.

Higher Premiums

While cost-effective compared to separate policies, adding an LTC rider does increase overall premiums.

- Budget Constraints: Individuals must consider whether they can afford the higher premiums associated with adding this rider.

- Long-Term Financial Planning: It’s essential to assess whether the added cost aligns with overall financial goals and budget constraints.

Flexibility in Care Options

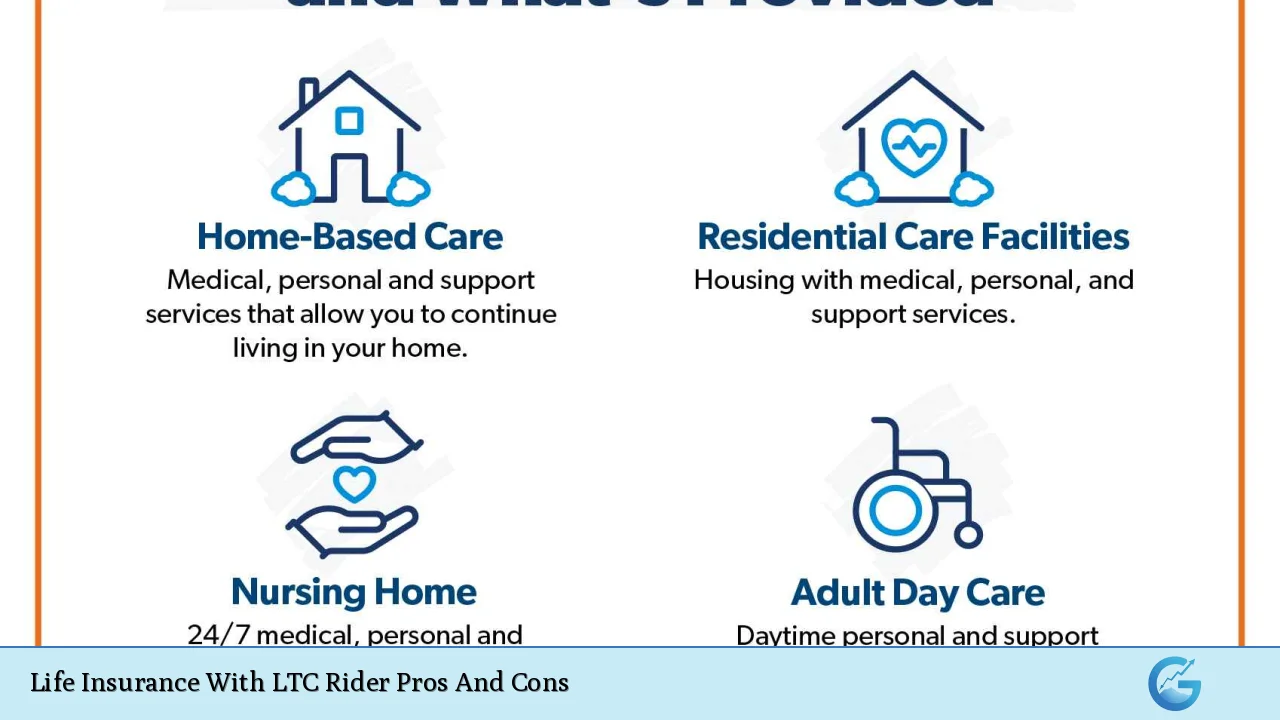

Another advantage is the flexibility in how benefits can be utilized. The funds accessed through an LTC rider can typically be used for various types of long-term care services.

- Choice of Care: Policyholders can choose between home health care, assisted living, or nursing home facilities based on their needs and preferences.

- Personalized Care Plans: This flexibility allows individuals to create personalized care plans that suit their unique situations.

Limited Coverage

On the downside, there may be limitations in coverage compared to standalone long-term care insurance policies.

- Potential Gaps in Coverage: Some policies may not cover all types of long-term care services or might have caps on benefits that could leave policyholders underinsured.

- Need for Additional Insurance: Depending on individual circumstances, additional long-term care insurance may still be necessary to ensure comprehensive coverage.

Tax Advantages

Life insurance with an LTC rider may offer tax advantages that can enhance its appeal.

- Tax-Deductible Premiums: In some cases, premiums paid for these policies may be tax-deductible, providing immediate financial relief.

- Tax-Free Benefits: Benefits received from an LTC rider are typically tax-free, which means more funds are available for actual care expenses without tax implications.

Eligibility Restrictions

Accessing benefits from an LTC rider comes with specific eligibility requirements that must be met.

- Health Assessments Required: To qualify for benefits, a healthcare professional must certify that the policyholder cannot perform at least two activities of daily living (ADLs).

- Potential Delays in Accessing Funds: The need for medical assessments and documentation can delay access to needed funds during critical times.

Simplified Underwriting Process

Adding an LTC rider can often involve a more straightforward underwriting process compared to applying for standalone long-term care insurance.

- Less Hassle: This simplified process can make it easier for individuals who may have health issues that complicate obtaining traditional coverage.

- Streamlined Financial Planning: For those already considering life insurance, adding a rider can streamline their financial planning efforts without extensive additional paperwork.

No Inflation Protection

A significant concern with life insurance policies featuring LTC riders is the lack of inflation protection.

- Rising Healthcare Costs: As healthcare costs continue to rise, the value of benefits accessed through an LTC rider may diminish over time if not adjusted for inflation.

- Long-Term Financial Planning Risks: Policyholders should consider how inflation could affect their future care needs when evaluating this option.

In conclusion, life insurance with a long-term care rider offers a unique blend of benefits that cater to individuals seeking both life insurance protection and potential funding for future healthcare needs. However, it is essential to weigh these advantages against the disadvantages carefully.

Individuals should assess their personal health needs, financial situation, and family dynamics when considering whether this type of policy is appropriate. Consulting with financial advisors or insurance professionals can provide valuable insights tailored to individual circumstances and help ensure informed decision-making regarding this complex product.

Frequently Asked Questions About Life Insurance With LTC Rider

- What is a long-term care rider?

A long-term care rider allows you to access part of your life insurance policy’s death benefit while alive if you require assistance with daily living activities due to chronic illness or disability. - How does using an LTC rider affect my beneficiaries?

If you use your LTC rider, it will reduce the death benefit available to your beneficiaries when you pass away. - Are there tax benefits associated with life insurance policies that include an LTC rider?

Yes, premiums may be tax-deductible, and benefits received from the policy are typically tax-free. - What types of services can I pay for using my LTC rider?

You can use your LTC rider benefits for various services like home health care, assisted living facilities, or nursing home expenses. - What are the eligibility requirements for accessing my LTC rider benefits?

You must be certified by a healthcare professional as unable to perform at least two activities of daily living (ADLs) or have significant cognitive impairment. - Is it more cost-effective than standalone long-term care insurance?

Generally, yes; combining life insurance with an LTC rider tends to be more affordable than purchasing separate policies. - Can I add an LTC rider after purchasing my life insurance policy?

This typically depends on your insurer’s rules; many require you to choose this option at the time of purchase. - What happens if I don’t use my LTC rider?

If you do not utilize your LTC benefits during your lifetime, your beneficiaries will receive the full death benefit minus any outstanding loans against the policy.

This comprehensive overview should assist individuals in making informed decisions regarding life insurance policies with long-term care riders while considering their broader financial goals and healthcare planning needs.