Lifestyle Spending Accounts (LSAs) have emerged as a popular employee benefit, offering a flexible approach to wellness and personal spending. These accounts allow employees to use employer-funded money for various lifestyle-related expenses, from fitness memberships to childcare services. As companies strive to enhance their benefits packages and support employee well-being, understanding the advantages and disadvantages of LSAs becomes crucial for both employers and employees. This article delves into the pros and cons of Lifestyle Spending Accounts, providing a comprehensive overview for those interested in finance, employee benefits, and workplace culture.

| Pros | Cons |

|---|---|

| Flexibility in spending choices | Tax implications for employees |

| Increased employee engagement | Potential misuse of funds |

| Attracts and retains talent | Budget constraints for employers |

| Supports diverse employee needs | Administrative complexity |

| Enhances company culture | Limited awareness among employees |

Flexibility in Spending Choices

One of the most significant advantages of LSAs is the flexibility they offer. Employees can choose how to allocate their funds based on their personal needs and preferences. This autonomy allows for a more tailored approach to benefits, accommodating various lifestyle choices.

- Customizable categories: Employers can define what expenses are eligible, ranging from gym memberships to wellness programs.

- Personalized benefits: Employees can select options that resonate with their individual lifestyles, promoting satisfaction and well-being.

- Adaptability: As employee needs evolve, LSAs can be adjusted to reflect changing priorities, making them a dynamic component of an employee benefits package.

Increased Employee Engagement

LSAs can significantly boost employee engagement with company benefits. When employees feel they have control over how they spend their benefits, they are more likely to utilize them effectively.

- Higher participation rates: Flexible spending options often lead to increased participation in wellness programs and other initiatives.

- Improved morale: Employees who feel their personal needs are recognized tend to exhibit higher job satisfaction and loyalty.

- Proactive health management: By encouraging employees to invest in their health and well-being, LSAs promote a culture of proactive health management.

Attracts and Retains Talent

In today’s competitive job market, offering LSAs can be a powerful tool for attracting and retaining top talent. Candidates increasingly seek employers who prioritize employee well-being.

- Enhanced recruitment efforts: Companies that offer LSAs stand out in job postings, appealing to prospective employees looking for comprehensive benefits.

- Reduced turnover rates: Employees are more likely to stay with an employer that provides flexible benefits that cater to their diverse needs.

- Positive employer branding: Organizations that invest in LSAs demonstrate a commitment to employee welfare, enhancing their reputation as desirable workplaces.

Supports Diverse Employee Needs

LSAs are particularly effective at addressing the diverse needs of employees. In a workforce composed of individuals from various backgrounds and life stages, LSAs provide an inclusive solution.

- Broad eligibility criteria: Unlike traditional benefits that may only cover specific demographics, LSAs can cater to everyone from young professionals to parents or caregivers.

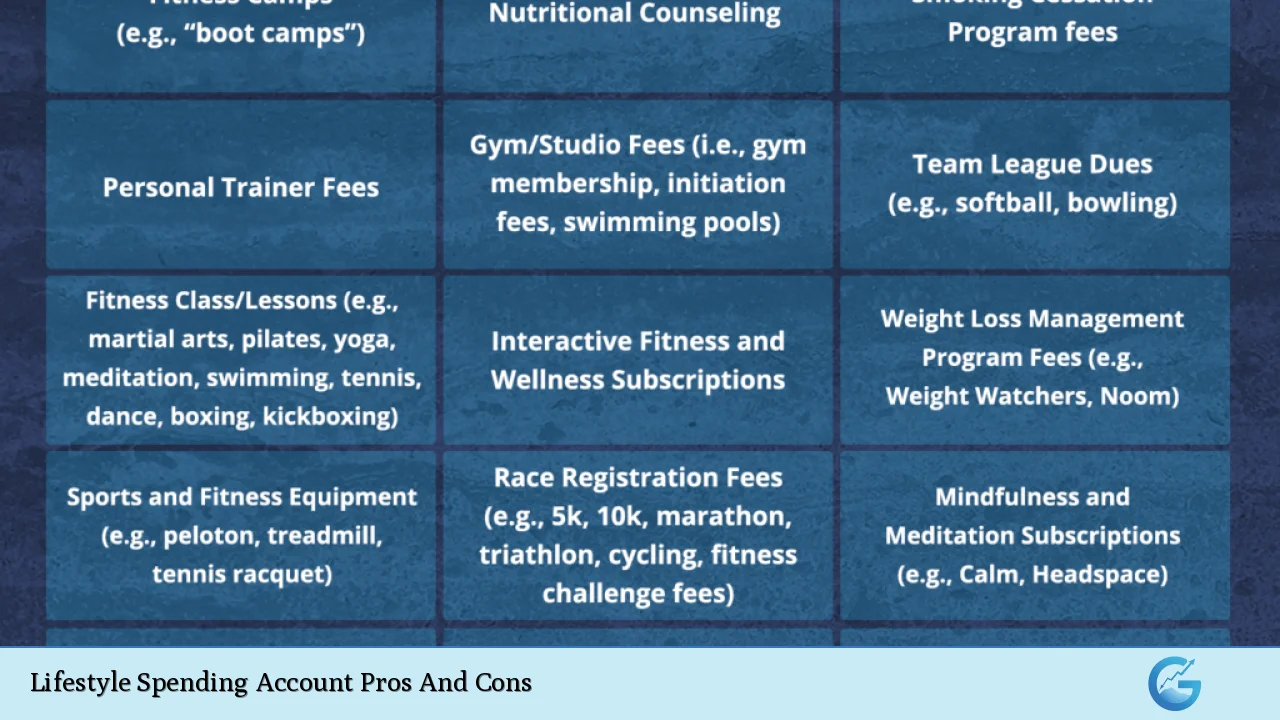

- Variety of eligible expenses: Employees can use funds for a wide range of purposes—fitness classes, childcare services, educational courses—allowing them to select what best fits their current situation.

- Cultural sensitivity: LSAs can be designed with cultural considerations in mind, ensuring that all employees feel valued and included.

Enhances Company Culture

Implementing LSAs can significantly enhance an organization’s company culture, showcasing its commitment to employee well-being.

- Demonstrates care for employees: By providing flexible spending options, employers signal that they value their employees’ health and happiness beyond just traditional compensation packages.

- Fosters community: LSAs encourage interactions among employees as they share experiences related to wellness activities or personal development initiatives funded by the account.

- Promotes work-life balance: By supporting various lifestyle choices, LSAs contribute positively to an organization’s overall work-life balance philosophy.

Tax Implications for Employees

Despite the numerous advantages, one major disadvantage of LSAs is the tax implications for employees. Unlike some other benefit accounts, funds spent from an LSA are considered taxable income.

- Increased taxable income: Employees must pay taxes on any amount spent from their LSA, which can reduce the overall financial benefit of the account.

- Complex tax reporting: Employees may need additional guidance on how to report these expenses during tax season, adding complexity to financial planning.

Potential Misuse of Funds

Another concern surrounding LSAs is the potential for misuse of funds, especially if guidelines are not clearly defined by employers.

- Lack of oversight: Without strict regulations on spending categories, employees might allocate funds toward non-essential or inappropriate expenses.

- Need for education: Employers must invest time in educating employees about eligible expenses to mitigate misuse risks effectively.

Budget Constraints for Employers

While LSAs offer flexibility and engagement opportunities, they also present challenges related to budget constraints for employers.

- Cost considerations: Funding an LSA requires a significant budget commitment from employers, which may not be feasible for all organizations.

- Balancing generosity with sustainability: Employers must carefully navigate how much funding is allocated while ensuring it aligns with overall business goals and financial health.

Administrative Complexity

Implementing and managing an LSA program can introduce notable administrative complexity, requiring careful planning and execution by employers.

- Program setup challenges: Establishing clear guidelines about eligible expenses, funding frequencies, and reimbursement processes can be time-consuming and complicated.

- Ongoing management requirements: Employers need resources dedicated to managing claims and ensuring compliance with established policies over time.

Limited Awareness Among Employees

Finally, despite the potential benefits of LSAs, there may be a general lack of awareness among employees regarding these accounts’ existence or functionality.

- Communication barriers: Employers must actively promote the LSA program through workshops or informational sessions to ensure all employees understand its value and usage guidelines.

- Engagement strategies needed: Continuous engagement strategies are essential for maintaining interest in the program over time; otherwise, participation may dwindle as new hires join or existing employees change roles within the organization.

In conclusion, Lifestyle Spending Accounts present both significant advantages and notable disadvantages. While they offer flexibility in spending choices, enhance employee engagement, attract talent, support diverse needs, and contribute positively to company culture, they also come with tax implications for employees, potential misuse risks, budget constraints for employers, administrative complexities, and limited awareness among staff.

Employers considering implementing an LSA should weigh these factors carefully against their organizational goals and workforce needs. With thoughtful planning and effective communication strategies in place, Lifestyle Spending Accounts can become a valuable addition to any comprehensive employee benefits package.

Frequently Asked Questions About Lifestyle Spending Accounts (LSA)

- What is a Lifestyle Spending Account?

A Lifestyle Spending Account (LSA) is an employer-funded benefit that allows employees to use allocated funds for various lifestyle-related expenses not typically covered by traditional health plans. - How does an LSA work?

Employers set up the account with specific parameters regarding eligible expenses. Employees then submit claims for reimbursement after purchasing approved items or services. - Are LSA funds taxable?

Yes, funds spent from an LSA are considered taxable income for employees when used. - What types of expenses can be covered by an LSA?

Eligible expenses often include fitness memberships, childcare services, professional development courses, mental health services, and other wellness-related activities. - Can unused LSA funds roll over into the next year?

This depends on the employer’s policy; some allow rollover while others may enforce a “use it or lose it” rule. - How do LSAs compare with HSAs or FSAs?

Unlike Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), LSAs do not have tax advantages but offer greater flexibility in spending categories. - What are the main challenges associated with implementing an LSA?

The primary challenges include managing budget constraints while ensuring adequate funding levels and navigating administrative complexities. - How can employers promote awareness about their LSA program?

Employers should provide clear communication through workshops or informational sessions detailing how LSAs work and their associated benefits.

By understanding both the pros and cons associated with Lifestyle Spending Accounts, stakeholders can make informed decisions that align with their financial strategies while enhancing employee satisfaction.