Long-term health care insurance is a specialized insurance product designed to cover the costs associated with extended care services that are not typically covered by regular health insurance. As individuals age, the likelihood of needing long-term care increases, making this type of insurance an important consideration for financial planning. This article explores the advantages and disadvantages of long-term health care insurance, providing a comprehensive overview for those interested in finance and investment.

| Pros | Cons |

|---|---|

| Protects assets from high long-term care costs | High premiums can be burdensome |

| Offers flexibility in care options | Uncertainty about usage may lead to wasted premiums |

| Provides peace of mind for policyholders and families | Policies often have limitations and exclusions |

| Tax advantages may apply to premiums and benefits | Eligibility requirements can be strict |

| Inflation protection ensures benefits keep pace with rising costs | Premiums can increase over time, impacting affordability |

| Can cover a variety of care settings, including home care | Complex policies can be difficult to understand |

| May reduce the burden on family caregivers | Not all policies cover every type of care needed |

| Can enhance quality of care through better facilities | Payouts may not be sufficient for extensive needs |

Protects Assets from High Long-Term Care Costs

One of the primary advantages of long-term health care insurance is its ability to protect your assets from the potentially exorbitant costs associated with long-term care. Without this coverage, individuals may find themselves depleting their savings or selling off assets to pay for necessary services.

- Financial Security: Long-term care can cost hundreds of thousands of dollars, especially in facilities like nursing homes. Insurance helps ensure that your savings remain intact.

- Government Assistance: Many people rely on Medicaid once their assets are depleted. Having insurance allows you to avoid spending down your assets to qualify for government aid.

Offers Flexibility in Care Options

Long-term health care insurance provides policyholders with a range of options regarding where and how they receive care.

- Home Care: Many policies cover in-home services, allowing individuals to stay in their homes longer while receiving necessary assistance.

- Facility Choices: Policyholders can often choose between various types of facilities, including assisted living and nursing homes, ensuring they find a setting that meets their preferences.

Provides Peace of Mind for Policyholders and Families

Knowing that you have coverage for potential long-term care needs can significantly reduce anxiety about the future.

- Emotional Relief: Having a plan in place helps alleviate stress for both the policyholder and their family members, who might otherwise face difficult decisions about care.

- Family Support: With insurance coverage, family members are less likely to bear the financial burden or caregiving responsibilities that can arise when a loved one requires extensive care.

Tax Advantages May Apply to Premiums and Benefits

Long-term health care insurance can offer several tax-related benefits that make it more appealing.

- Tax Deductions: Premiums paid for long-term care insurance may be deductible on federal and state taxes, depending on the taxpayer’s situation.

- Tax-Free Benefits: Benefits received from long-term care insurance policies are generally not taxable, providing additional financial relief when funds are needed for care.

Inflation Protection Ensures Benefits Keep Pace with Rising Costs

Many long-term health care policies include inflation protection, which adjusts benefit amounts over time.

- Cost-of-Living Adjustments: This feature helps ensure that the benefits provided by the policy remain adequate as healthcare costs rise due to inflation.

- Future Planning: Knowing that your coverage will grow over time allows for better financial planning as you age.

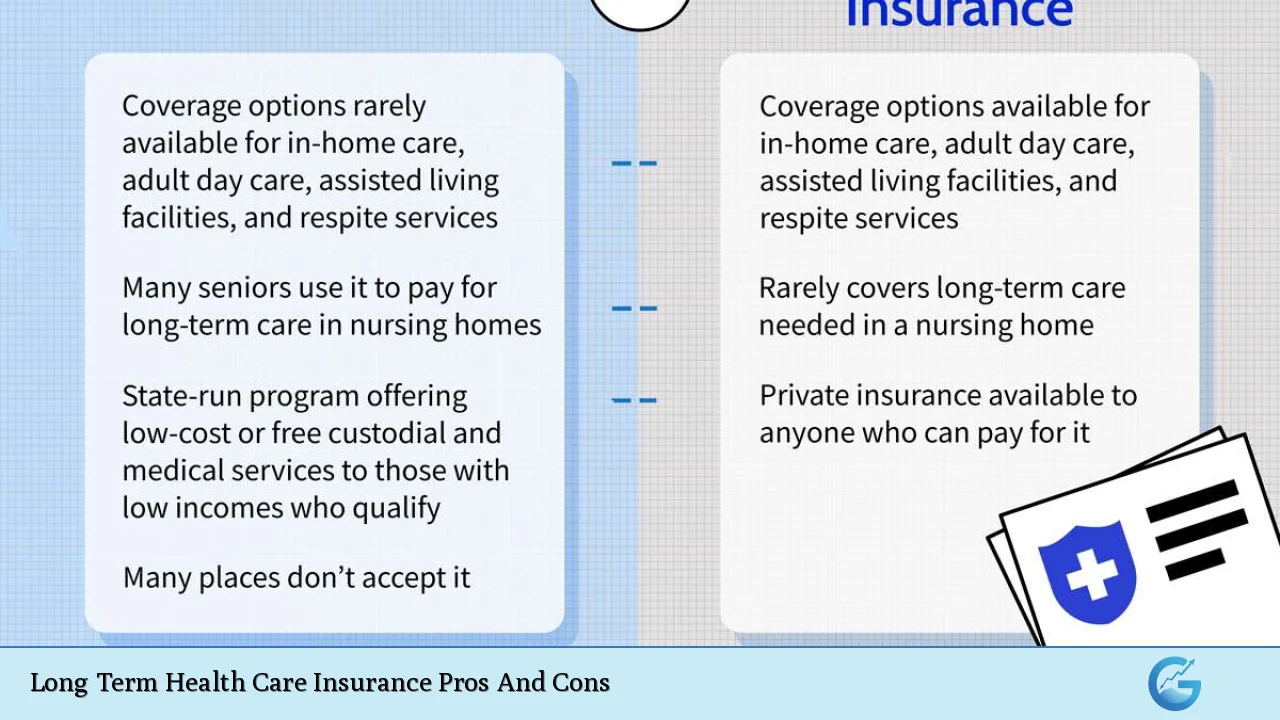

Can Cover a Variety of Care Settings

Long-term health care insurance is versatile in terms of the types of services it covers.

- Diverse Options: Coverage often includes various settings such as nursing homes, assisted living facilities, adult day care centers, and home health services.

- Comprehensive Care: This flexibility allows individuals to receive the type of care they need based on their personal circumstances and preferences.

May Reduce the Burden on Family Caregivers

Having long-term health care insurance can alleviate some pressure from family members who might otherwise have to provide extensive caregiving themselves.

- Less Strain on Relationships: Family dynamics can be strained when one member becomes a primary caregiver. Insurance helps mitigate this issue by providing professional assistance.

- Support Services: Many policies also include respite care options, giving family caregivers a much-needed break while ensuring their loved ones receive proper attention.

High Premiums Can Be Burdensome

Despite its many advantages, one significant downside of long-term health care insurance is its cost.

- Affordability Issues: Premiums can be quite high, especially as individuals age or if they have pre-existing conditions. This expense may deter some from purchasing coverage altogether.

- Budget Constraints: For many families, allocating funds for these premiums can strain budgets, especially if other financial priorities exist.

Uncertainty About Usage May Lead to Wasted Premiums

Another concern is the uncertainty surrounding whether policyholders will ever need to use their long-term care insurance benefits.

- Potential Waste: Many people pay premiums for years without ever needing long-term care. This reality can lead to frustration over what feels like wasted money if no claims are made.

- Planning Challenges: The unpredictability of health needs complicates financial planning. Individuals must weigh the risk of needing coverage against the certainty of premium payments.

Policies Often Have Limitations and Exclusions

Long-term health care policies frequently come with various limitations that potential buyers should carefully consider before purchasing.

- Coverage Gaps: Some policies may not cover certain types of facilities or specific services required by policyholders as their needs evolve over time.

- Waiting Periods: Many plans have elimination periods—waiting times before benefits kick in—which can delay access to necessary funds when they are most needed.

Eligibility Requirements Can Be Strict

To qualify for long-term health care insurance, applicants often face stringent eligibility criteria that can complicate access to coverage.

- Health Assessments: Most insurers require medical underwriting, meaning applicants must undergo health evaluations. Those with pre-existing conditions may find it challenging to secure affordable coverage or may be denied altogether.

- Age Considerations: Younger individuals generally pay lower premiums but may not feel an immediate need for coverage. Conversely, older applicants face higher rates and stricter underwriting guidelines.

Premiums Can Increase Over Time, Impacting Affordability

While premiums start at a certain level, they are not guaranteed to stay there throughout the life of the policyholder.

- Rising Costs: Insurers may raise premiums based on factors like age or changes in healthcare costs. This unpredictability can make budgeting difficult for policyholders as they age.

- Financial Strain: Unexpected premium increases could lead some individuals to reconsider or even drop their coverage when they need it most, leaving them vulnerable without any safety net.

Complex Policies Can Be Difficult to Understand

Navigating the details of long-term health care insurance policies can be challenging due to their complexity and variability among providers.

- Policy Confusion: Understanding what is covered under different plans requires careful reading and sometimes professional guidance. Misunderstandings about coverage could lead to unmet expectations when claims are filed.

- Need for Professional Advice: Engaging with an experienced agent or financial advisor is often necessary but adds another layer of complexity and potential cost to obtaining coverage.

Not All Policies Cover Every Type of Care Needed

While many policies offer broad coverage options, gaps still exist that consumers should be aware of before making a decision.

- Service Limitations: Some essential services might not be covered under certain plans—such as specific therapies or alternative treatments—leading individuals to pay out-of-pocket despite having insurance coverage.

- Policy Variability: The specifics vary widely between different insurers and plans; thus it’s crucial for consumers to thoroughly compare options before committing financially.

In conclusion, long-term health care insurance presents both significant advantages and notable disadvantages. It offers protection against high costs associated with extended healthcare needs while providing peace of mind and flexibility in choosing how one receives that care. However, potential buyers must also consider high premiums, uncertainty regarding usage, strict eligibility requirements, and complex policy details that could complicate their decision-making process.

Ultimately, individuals should assess their unique circumstances—financial situation, family dynamics, and potential healthcare needs—when deciding whether investing in long-term health care insurance aligns with their overall financial strategy.

Frequently Asked Questions About Long Term Health Care Insurance

- What is long term health care insurance?

Long term health care insurance covers services needed when an individual cannot perform daily activities due to chronic illness or disability. - Who should consider purchasing this type of insurance?

This insurance is ideal for those concerned about future healthcare costs as they age or those with family histories indicating potential future needs. - What types of services does it typically cover?

The policy usually covers home health aide services, nursing home stays, assisted living facilities, and sometimes adult day-care programs. - Are there tax benefits associated with these policies?

Yes, premium payments may be tax-deductible under certain conditions, and benefits received are generally tax-free. - How do I determine how much coverage I need?

Your required coverage depends on your financial situation and projected healthcare needs; consulting with a financial advisor can help clarify this. - Can I customize my policy?

Many insurers allow customization options regarding benefit amounts and waiting periods; however, this may affect your premium rates. - What happens if I never use my policy?

If you never file a claim during your lifetime, those premium payments may feel wasted; however, having coverage provides peace of mind against unforeseen circumstances. - Is it too late to buy if I am already older?

No; however, older applicants might face higher premiums or stricter eligibility requirements based on their current health status.