In an era of digital financial transactions, paper paychecks remain a persistent element in the American workforce. Despite the widespread adoption of direct deposit and electronic payment methods, some employers and employees continue to rely on this traditional form of wage distribution. This comprehensive analysis delves into the advantages and disadvantages of paper paychecks, providing insights for both employers and employees navigating the complex landscape of payroll management and personal finance.

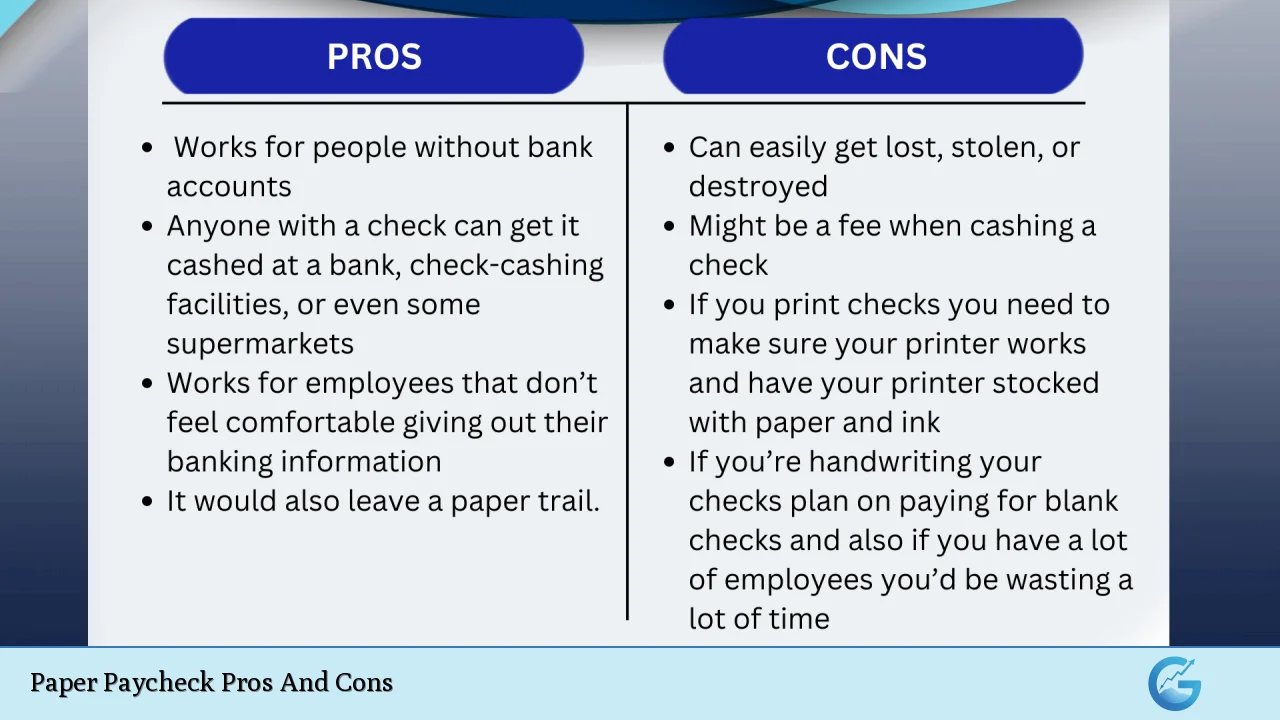

| Pros | Cons |

|---|---|

| Privacy and control | Inconvenience and delay |

| No bank account required | Risk of loss or theft |

| Tangible proof of payment | Additional costs for employers |

| Flexibility in cashing options | Environmental impact |

| Easier budgeting for some | Potential for fraud |

| No technology dependence | Administrative burden |

Advantages of Paper Paychecks

Privacy and Control

Paper paychecks offer a level of privacy that electronic payments may not provide. For employees who are concerned about sharing their banking information with employers, paper checks can be a preferable option. This method allows workers to maintain control over their financial data and decide how and where to deposit or cash their earnings.

- Employees can keep banking information private

- Greater control over the timing of deposits

- Reduced risk of electronic data breaches

No Bank Account Required

Paper checks are accessible to individuals without bank accounts, a demographic known as the “unbanked” population. According to the Federal Deposit Insurance Corporation (FDIC), approximately 5.4% of U.S. households were unbanked in 2019. For these individuals, paper checks provide a means to receive wages without the need for a traditional banking relationship.

- Inclusive payment method for unbanked workers

- Allows employees to avoid bank fees and minimum balance requirements

- Provides payment options for those with poor credit history

Tangible Proof of Payment

Paper checks serve as physical evidence of payment, which can be beneficial in various situations. This tangibility can be particularly useful for record-keeping, dispute resolution, and providing proof of income for loans or other financial purposes.

- Immediate physical record of earnings

- Useful for personal financial documentation

- Can serve as evidence in legal or financial disputes

Flexibility in Cashing Options

Recipients of paper checks have multiple options for accessing their funds, which can be advantageous depending on individual circumstances. They can deposit the check at their bank, use mobile deposit features, or cash the check at various locations, including check-cashing services, grocery stores, or the issuing bank.

- Choice of deposit or cashing methods

- Ability to split funds between cash and deposit

- Option to use check-cashing services for immediate access to funds

Easier Budgeting for Some

For individuals who prefer a hands-on approach to budgeting, paper checks can provide a psychological advantage. The act of physically depositing a check can make the income feel more tangible and may encourage more thoughtful spending habits.

- Visual representation of earnings

- May promote more conscious financial decisions

- Aligns with cash-based budgeting methods

No Technology Dependence

Paper checks do not rely on electronic systems or internet connectivity, which can be beneficial during technological outages or for those living in areas with limited digital infrastructure.

- Immune to electronic payment system failures

- Accessible in regions with poor internet connectivity

- Suitable for employees uncomfortable with digital banking

Disadvantages of Paper Paychecks

Inconvenience and Delay

One of the most significant drawbacks of paper paychecks is the delay between receiving the check and having access to the funds. Unlike direct deposit, which typically makes funds available immediately on payday, paper checks require additional steps and time for processing.

- Potential waiting period for check clearance

- Need to physically deposit or cash the check

- Possible delays due to mail delivery or distribution issues

Risk of Loss or Theft

Physical checks are vulnerable to being lost, stolen, or damaged. This risk can lead to significant inconvenience and potential financial loss for the employee, as well as additional administrative work for the employer to cancel and reissue payments.

- Higher risk of misplacement or theft compared to electronic payments

- Potential for checks to be damaged or destroyed

- Time and effort required to replace lost or stolen checks

Additional Costs for Employers

Issuing paper paychecks incurs various expenses for employers, including the cost of check stock, printing, envelopes, and postage for mailed checks. These costs can add up significantly, especially for larger organizations or those with frequent pay periods.

- Ongoing expenses for check materials and printing

- Potential for overnight shipping costs for urgent payments

- Increased labor costs for check preparation and distribution

Environmental Impact

The production and distribution of paper checks contribute to environmental concerns, including deforestation and increased carbon emissions from transportation. As businesses and individuals become more environmentally conscious, the ecological footprint of paper checks becomes an increasingly relevant consideration.

- Consumption of paper resources

- Energy use in check production and transportation

- Contribution to waste in landfills

Potential for Fraud

Paper checks are more susceptible to various forms of fraud compared to electronic payment methods. Check washing, forgery, and counterfeiting are ongoing concerns that can result in financial losses for both employers and employees.

- Vulnerability to check alteration techniques

- Risk of check forgery or unauthorized duplication

- Potential for identity theft through stolen check information

Administrative Burden

Managing paper paychecks requires significant administrative effort from employers. This includes not only the preparation and distribution of checks but also the reconciliation of cashed checks and handling of unclaimed or returned payments.

- Time-consuming process of check preparation and signing

- Need for secure storage and distribution methods

- Complexity in tracking and reconciling cashed checks

In conclusion, while paper paychecks offer certain advantages in terms of privacy, accessibility, and tangibility, they also present significant challenges in today’s fast-paced, technology-driven financial landscape. The decision to use paper checks versus electronic payment methods should be carefully considered, taking into account the specific needs of both employers and employees, as well as the broader implications for efficiency, security, and environmental impact. As financial technologies continue to evolve, it’s likely that the role of paper paychecks will further diminish, but they may continue to serve niche purposes in certain sectors or for specific populations.

Frequently Asked Questions About Paper Paycheck Pros And Cons

- Are paper paychecks still legal in the United States?

Yes, paper paychecks are still legal and widely used in the U.S. However, some states have laws that allow employers to mandate direct deposit under certain conditions. - Can an employer refuse to offer paper paychecks?

In many states, employers can require direct deposit, but they often must provide an alternative for employees who don’t have bank accounts. Specific regulations vary by state. - How long does it typically take for a paper paycheck to clear?

The clearing time for a paper paycheck can vary, but it generally takes 2-5 business days. Some banks may offer faster availability for certain customers or check amounts. - Are there any fees associated with cashing a paper paycheck?

Fees can vary depending on where you cash the check. Banks typically don’t charge account holders, but check-cashing services and some retailers may charge a fee. - Is it safer to receive a paper paycheck or direct deposit?

Direct deposit is generally considered safer as it eliminates the risks of loss, theft, or damage associated with paper checks. It also reduces the potential for fraud. - Can paper paychecks be deposited via mobile banking apps?

Yes, most major banks offer mobile check deposit features in their apps, allowing users to deposit paper paychecks by taking a photo of the check. - How long should I keep my paper paychecks for tax purposes?

The IRS recommends keeping pay stubs for at least one year, or until you can confirm the information matches your W-2 form. For tax records, keep documents for at least three years. - What happens if my paper paycheck is lost or stolen?

If your paycheck is lost or stolen, immediately notify your employer. They can place a stop payment on the original check and issue a replacement, though this process may take some time.