Payroll cards, also known as paycards, are a financial product that allows employers to pay their employees electronically without the need for a traditional bank account. These cards function similarly to debit cards, providing employees with immediate access to their wages upon payment. As the workforce evolves and more employees seek flexible payment options, payroll cards have gained popularity. However, like any financial tool, they come with both advantages and disadvantages.

| Pros | Cons |

|---|---|

| Convenient access to wages | Potential fees associated with usage |

| Enhanced security features | Risk of lost or stolen cards |

| Cost-effective for employers | Limited acceptance in some locations |

| Financial management tools for employees | Not all employers offer payroll cards as an option |

| Supports unbanked employees | Confusion regarding terms and conditions |

| Sustainability benefits over paper checks | Less control over funds compared to traditional accounts |

Convenient Access to Wages

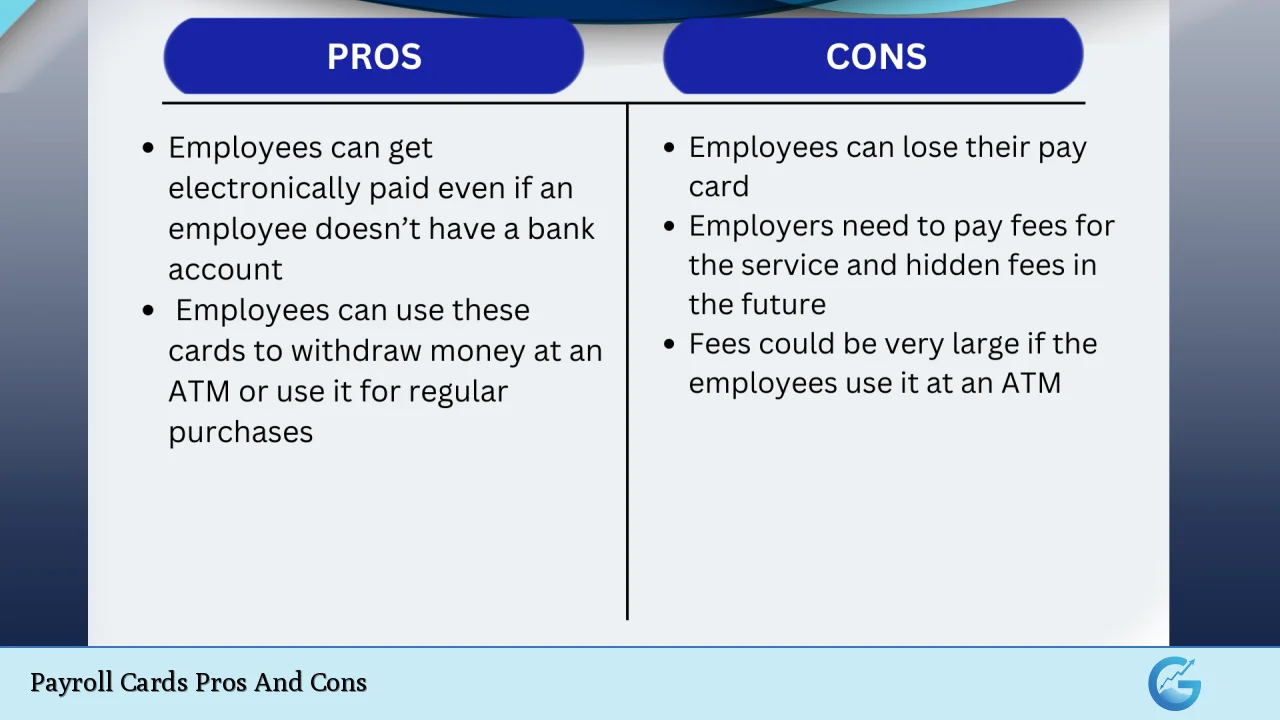

One of the primary advantages of payroll cards is the immediate access they provide to employees’ wages. Unlike traditional checks that may require time to clear or necessitate a trip to the bank, payroll cards allow employees to access their funds as soon as they are deposited.

- Employees can use payroll cards for purchases directly.

- Funds can be withdrawn from ATMs, often without waiting periods.

- This accessibility is particularly beneficial for those who may not have easy access to banking services.

Enhanced Security Features

Payroll cards come equipped with various security measures that help protect employee funds.

- Most payroll cards require a Personal Identification Number (PIN) for transactions, adding an extra layer of security.

- In case of loss or theft, employees can report the incident and receive a replacement card with the existing balance intact.

- The use of EMV chips in many payroll cards enhances protection against fraud.

Cost-Effective for Employers

Employers find payroll cards to be a cost-effective solution for disbursing wages.

- The costs associated with printing and distributing paper checks are eliminated.

- Payroll processing becomes more efficient, reducing administrative burdens.

- Employers can also benefit from lower transaction fees compared to traditional banking methods.

Financial Management Tools for Employees

Payroll cards often come with features that aid employees in managing their finances more effectively.

- Many payroll card providers offer online portals or mobile apps where users can track spending and monitor balances.

- This capability encourages better budgeting and financial planning among employees.

- Some payroll cards even offer rewards programs that incentivize responsible spending.

Supports Unbanked Employees

Payroll cards serve as an essential financial tool for unbanked individuals who may not have access to traditional banking services.

- They provide a means for these employees to receive their wages without needing a bank account.

- This inclusivity helps bridge the gap for those who are typically excluded from the financial system.

Sustainability Benefits Over Paper Checks

Using payroll cards contributes positively to environmental sustainability by reducing reliance on paper checks.

- The production and distribution of paper checks involve significant resource consumption.

- By transitioning to electronic payments via payroll cards, companies can reduce their carbon footprint.

Potential Fees Associated With Usage

Despite their many advantages, payroll cards can come with various fees that may catch users off guard.

- Employees might incur charges for ATM withdrawals outside the card issuer’s network or for balance inquiries.

- Some payroll card providers may impose monthly maintenance fees or inactivity fees if the card is not used regularly.

- Understanding the fee structure is crucial for employees to avoid unexpected costs.

Risk of Lost or Stolen Cards

The risk associated with lost or stolen payroll cards is a significant disadvantage that users must consider.

- If a card is lost, it can be used by anyone who finds it until reported stolen.

- Immediate reporting is essential; otherwise, there could be substantial financial loss before the card is blocked.

Limited Acceptance in Some Locations

While most businesses accept debit and credit cards, there are still places where payroll cards may not be recognized or accepted.

- Employees living in rural areas may find fewer merchants that accept payroll cards compared to urban settings.

- This limitation can hinder access to funds when needed most.

Not All Employers Offer Payroll Cards as an Option

Not every employer provides payroll cards as a payment method, which limits accessibility for some workers.

- Employees may have a preference for direct deposit or paper checks instead of being offered a choice between these options and payroll cards.

- Those who wish to use payroll cards must work for companies that adopt this payment method.

Confusion Regarding Terms and Conditions

The terms and conditions associated with payroll cards can sometimes be complex and confusing.

- Employees may not fully understand their rights regarding fees, usage limits, and liability in cases of fraud or loss.

- Clear communication from employers about these terms is crucial to prevent misunderstandings.

Less Control Over Funds Compared to Traditional Accounts

Using a payroll card can limit how employees manage their funds compared to having a traditional bank account.

- Payroll cardholders may not have access to certain banking features such as overdraft protection or interest accumulation on balances.

- This lack of flexibility could be problematic for individuals who prefer comprehensive banking services.

In conclusion, while payroll cards offer several advantages such as convenience, security, and cost-effectiveness for both employers and employees, they also come with notable disadvantages including potential fees, risks of loss or theft, limited acceptance, and possible confusion regarding terms. It is essential for both employers and employees to weigh these pros and cons carefully when considering the implementation or use of payroll cards as a payment method. Understanding these factors will help ensure that individuals make informed decisions about their financial tools in today’s evolving workplace landscape.

Frequently Asked Questions About Payroll Cards

- What are payroll cards?

Payroll cards are prepaid debit-like cards used by employers to electronically pay their employees’ wages. - Are there fees associated with using payroll cards?

Yes, there can be fees such as ATM withdrawal charges or monthly maintenance fees depending on the provider. - Can I lose money if my payroll card is lost or stolen?

If reported promptly after loss or theft, you typically won’t lose any funds due to liability protections. - Do all employers offer payroll cards?

No, not all employers provide this option; they must offer at least one alternative payment method. - How do I manage my funds on a payroll card?

You can manage your funds through online portals provided by your card issuer where you can track spending and balances. - Are payroll cards safe?

Yes, they include security features like PINs and EMV chips that help protect against unauthorized transactions. - Can I use my payroll card anywhere?

Generally yes; however, acceptance may vary by location and some merchants might not accept them. - What happens if I don’t use my payroll card regularly?

You may incur inactivity fees depending on your card provider’s terms.