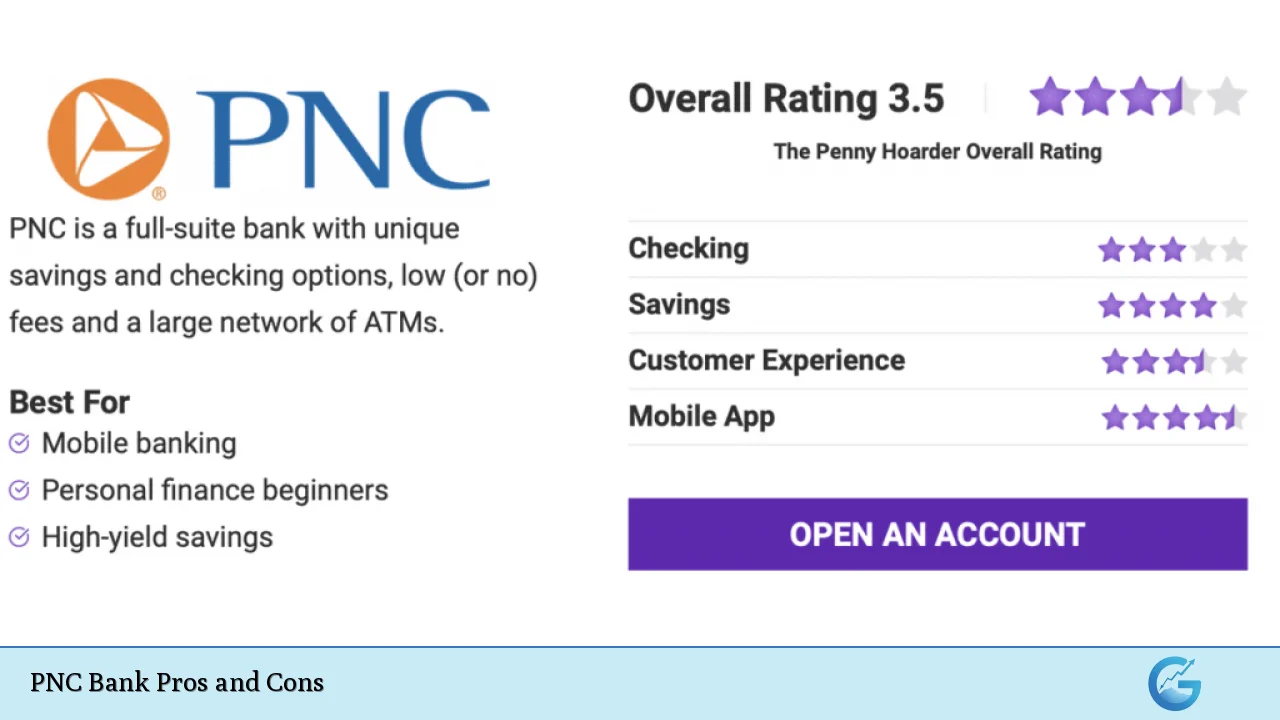

PNC Bank, one of the largest financial institutions in the United States, offers a wide range of banking products and services, including checking and savings accounts, credit cards, loans, and investment options. Established in 1845 and headquartered in Pittsburgh, Pennsylvania, PNC operates over 2,400 branches across several states. The bank is known for its innovative digital banking features, particularly the Virtual Wallet product, which combines checking and savings accounts with budgeting tools. However, like any financial institution, PNC Bank has its strengths and weaknesses. This article aims to provide a comprehensive overview of the pros and cons of banking with PNC.

| Pros | Cons |

|---|---|

| Competitive interest rates on savings accounts | High overdraft fees |

| Innovative Virtual Wallet product | Monthly maintenance fees on some accounts |

| Extensive branch and ATM network | Limited availability of certain products by region |

| Strong mobile banking app | Customer service issues reported by users |

| No minimum deposit requirement for many accounts | Complex fee structure for some services |

| Two layers of overdraft protection available | Lower interest rates on CDs compared to online banks |

Competitive Interest Rates on Savings Accounts

PNC Bank offers competitive interest rates on its savings accounts, particularly for customers who qualify for its high-yield savings options. The bank’s high-yield savings account can earn up to 4.65% APY depending on market conditions and customer location. This rate is significantly higher than what traditional banks typically offer, making it an attractive option for savers looking to maximize their returns.

- High APY: The potential to earn a competitive APY is a significant advantage for customers.

- Bundled Products: PNC’s Virtual Wallet includes a Growth account that offers higher interest rates when certain conditions are met.

Innovative Virtual Wallet Product

PNC’s Virtual Wallet is a unique offering that combines checking and savings accounts with budgeting tools. It consists of three components: Spend (checking), Reserve (interest-bearing checking), and Growth (savings). This structure allows customers to manage their finances more effectively.

- Budgeting Tools: The Virtual Wallet provides users with insights into their spending habits and helps them budget effectively.

- Low Cash Mode: This feature gives customers a grace period to avoid overdraft fees by allowing them time to deposit funds before incurring penalties.

Extensive Branch and ATM Network

With over 2,400 branches and access to around 60,000 ATMs nationwide, PNC Bank provides its customers with convenient access to banking services. This extensive network is particularly beneficial for individuals who prefer in-person banking or need access to ATMs without incurring fees.

- Convenience: Customers can easily find a branch or ATM nearby for their banking needs.

- Fee-Free ATMs: PNC offers reimbursement for third-party ATM fees up to $10 per month depending on the account type.

Strong Mobile Banking App

PNC Bank’s mobile app is highly rated for its user-friendly interface and robust features. Customers can perform various banking tasks from their smartphones, including transferring funds, paying bills, and depositing checks.

- User-Friendly Interface: The app is designed to be intuitive, making it easy for customers to navigate.

- Real-Time Alerts: Customers can receive alerts about account activity, helping them stay informed about their finances.

No Minimum Deposit Requirement for Many Accounts

Many of PNC’s accounts do not require a minimum opening deposit. This feature makes it easier for individuals who may not have significant funds available at the outset to open an account and start banking.

- Accessibility: Lower barriers to entry encourage more people to engage with traditional banking services.

- Flexible Options: Customers can choose from various account types without worrying about minimum balance requirements.

Two Layers of Overdraft Protection Available

PNC Bank provides two layers of overdraft protection through its Virtual Wallet product. This feature can help customers avoid costly overdraft fees by linking different accounts together for coverage.

- Peace of Mind: Customers can feel secure knowing they have options to prevent overdrafts.

- Flexibility: The ability to link accounts allows for more personalized financial management strategies.

High Overdraft Fees

One of the most significant drawbacks of PNC Bank is its high overdraft fees. At $36 per occurrence, these fees can quickly add up if customers are not careful with their account balances.

- Financial Burden: Frequent overdrafts can lead to substantial financial strain on customers who may already be struggling financially.

- Lack of Transparency: Some users report confusion regarding how overdraft fees are applied and when they are charged.

Monthly Maintenance Fees on Some Accounts

Although many PNC accounts do not have monthly maintenance fees, several products do impose these charges unless specific criteria are met. For example, the Virtual Wallet account may incur fees ranging from $7 to $25 if balance requirements are not maintained.

- Costly Fees: If customers fail to meet the requirements, these fees can erode any interest earned on savings.

- Potential Confusion: The various fee structures may confuse customers who do not thoroughly understand the terms associated with their accounts.

Limited Availability of Certain Products by Region

Certain high-yield savings products are only available in specific regions where PNC operates branches. Customers outside these areas may miss out on competitive rates offered by the bank’s high-yield savings account or other products.

- Geographic Restrictions: Customers living in states without branches may find themselves limited in product options compared to those in eligible markets.

- Inequality in Offerings: This limitation may lead some potential customers to seek alternatives at other banks that offer similar products nationwide.

Customer Service Issues Reported by Users

Customer service experiences at PNC Bank vary widely among users. While some report satisfactory interactions with representatives, others have expressed frustration with long wait times or unhelpful responses from staff members.

- Inconsistent Quality: Variability in customer service quality can lead to dissatisfaction among clients seeking assistance or resolution of issues.

- Impact on Reputation: Negative experiences shared by users can impact the bank’s overall reputation within the community and online forums.

Complex Fee Structure for Some Services

PNC Bank has been criticized for its complex fee structure related to various services. Understanding all potential charges associated with different account types can be challenging for new customers or those unfamiliar with banking terminology.

- Potential Surprises: Customers may encounter unexpected fees if they do not fully understand the terms associated with their accounts or services used.

- Need for Clarity: A clearer presentation of fee structures could enhance customer satisfaction and trust in the bank’s practices.

Lower Interest Rates on CDs Compared to Online Banks

While PNC offers certificates of deposit (CDs), their interest rates tend to be lower than those offered by many online banks. This discrepancy may lead savers looking for better returns elsewhere when considering long-term investments like CDs.

- Missed Opportunities: Customers seeking higher yields might find better options at online banks specializing in competitive rates without physical branch overhead costs.

- Market Comparison: Those comparing rates across institutions may find PNC’s offerings less appealing due to this gap in competitive interest rates.

In conclusion, PNC Bank presents a mix of advantages and disadvantages that potential customers should carefully consider before choosing this institution as their primary bank. Its competitive interest rates on savings accounts and innovative products like the Virtual Wallet make it an appealing option for many consumers. However, high overdraft fees, complex fee structures, and varying customer service experiences could deter some individuals from fully embracing PNC as their banking partner. As always, prospective clients should evaluate their personal financial needs against what PNC has to offer before making a decision.

Frequently Asked Questions About PNC Bank Pros and Cons

- What are the main advantages of banking with PNC?

PNC offers competitive interest rates on savings accounts, an innovative Virtual Wallet product that combines checking and savings features, a large branch network, strong mobile banking capabilities, and no minimum deposit requirements for many accounts. - What are some disadvantages associated with PNC Bank?

The main disadvantages include high overdraft fees, monthly maintenance fees on certain accounts if requirements aren’t met, limited availability of specific products based on geographical location, customer service inconsistencies, complex fee structures, and lower interest rates on CDs compared to online banks. - How does PNC’s Virtual Wallet work?

The Virtual Wallet is a bundled product that includes checking (Spend), interest-bearing checking (Reserve), and savings (Growth) accounts along with budgeting tools designed to help customers manage their finances effectively. - Are there any hidden fees at PNC Bank?

While many accounts have no monthly maintenance fees if requirements are met, certain services may incur charges that could surprise customers if they do not fully understand the terms associated with their accounts. - Can I avoid overdraft fees at PNC?

Yes, PNC offers features like Low Cash Mode that provide customers time to bring their balances positive before incurring overdraft charges. - Is customer service reliable at PNC?

The reliability of customer service at PNC varies; while some users report positive experiences, others have encountered long wait times or unhelpful responses. - How does PNC compare with online banks?

Pennsylvania National Corporation generally offers competitive rates but may lag behind online banks regarding CD interest rates due to lower yields. - What should I consider before opening an account at PNC?

You should evaluate your personal financial needs against what PNC offers while considering factors such as potential fees associated with various products and your proximity to branches.