PTO (Paid Time Off) cash out is a growing trend in many workplaces, allowing employees to convert their accrued but unused vacation days into cash. This option can provide immediate financial relief, especially in times of need, but it also comes with potential drawbacks that can affect both employees and employers. Understanding the pros and cons of PTO cash out is essential for individuals considering this option and for organizations looking to implement or refine their PTO policies.

| Pros | Cons |

|---|---|

| Provides immediate financial relief | Reduces available time off |

| Prevents loss of unused PTO | Potential for employee burnout |

| Offers flexibility in financial planning | Tax implications on cash payouts |

| Can help manage unexpected expenses | May encourage unhealthy work habits |

| Enhances employee satisfaction for some | Complexity in policy administration |

| Can improve cash flow for employees | Risk of creating inequities among staff |

Provides Immediate Financial Relief

One of the most significant advantages of PTO cash out is the immediate financial benefit it offers employees.

- Cash Flow: Employees can access funds that they may need urgently, such as for medical emergencies or unexpected bills.

- Budgeting: This option allows individuals to better manage their finances by converting unused vacation days into cash, which can be particularly beneficial during tough economic times.

Reduces Available Time Off

While cashing out PTO can provide immediate benefits, it also reduces the amount of time off available to employees in the future.

- Future Planning: Employees who opt for cash out may find themselves with fewer days off when they need a break, potentially leading to dissatisfaction later.

- Work-Life Balance: The trade-off between cash and time off can disrupt work-life balance, as employees might prioritize short-term financial gain over long-term well-being.

Prevents Loss of Unused PTO

Many companies operate under “use-it-or-lose-it” policies where unused vacation days expire at the end of the year.

- Security: Cashing out allows employees to avoid losing accrued days, ensuring that they receive compensation for their hard-earned time off.

- Flexibility: This flexibility can be particularly appealing for those who may not have the opportunity to take extended vacations due to personal or professional commitments.

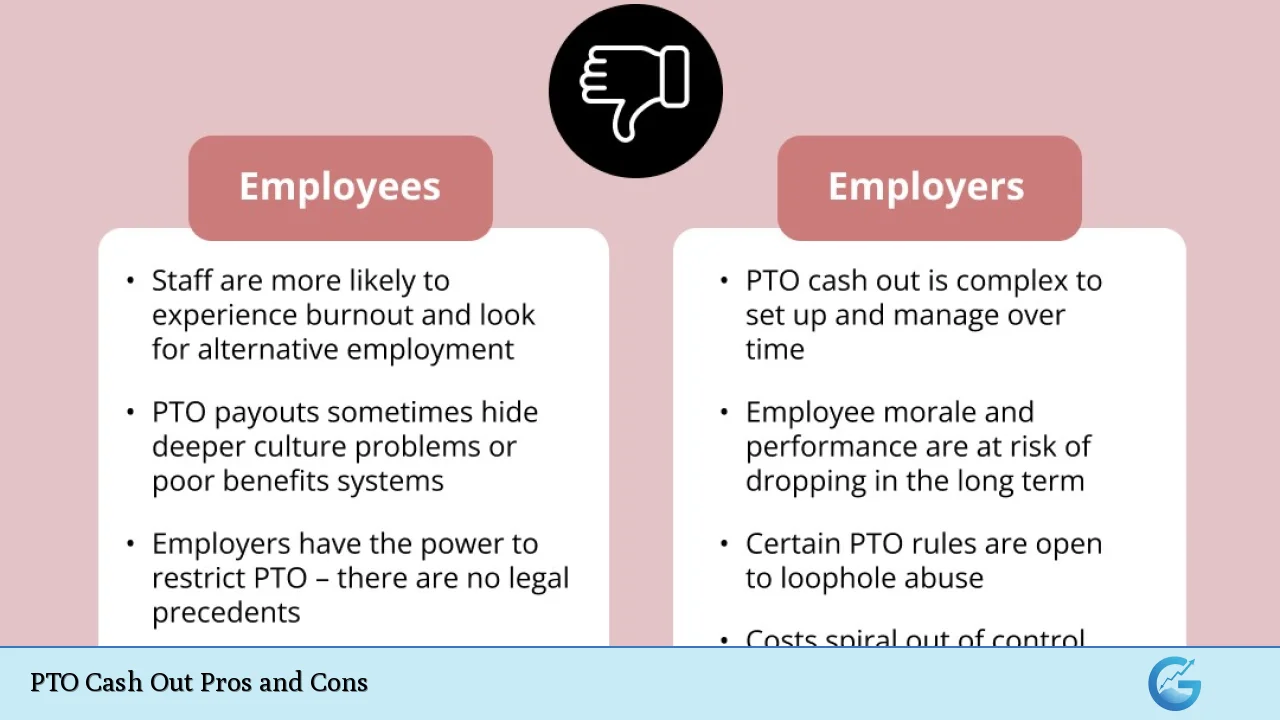

Potential for Employee Burnout

Cashing out PTO can inadvertently contribute to employee burnout.

- Reduced Rest: Employees who frequently cash out may neglect taking necessary breaks, leading to increased stress and decreased productivity over time.

- Long-Term Health Risks: The lack of downtime can affect mental and physical health, resulting in higher turnover rates and lower morale within teams.

Offers Flexibility in Financial Planning

The ability to convert PTO into cash provides employees with more options regarding their finances.

- Financial Management: Employees can choose when to cash out based on their financial needs, allowing them to prioritize expenses effectively.

- Emergency Fund: This option can serve as a way to bolster savings or pay down debts, contributing positively to an employee’s overall financial health.

Tax Implications on Cash Payouts

Employees must consider the tax implications associated with cashing out their PTO.

- Supplemental Income Taxation: Cash payouts are typically taxed as supplemental income, which may result in a higher tax rate than regular wages.

- Financial Planning: Understanding these tax consequences is crucial for employees when deciding whether to cash out or take time off.

Can Help Manage Unexpected Expenses

Cashing out PTO can provide a financial cushion during unforeseen circumstances.

- Emergency Situations: For instance, if an employee faces unexpected medical expenses or urgent home repairs, having access to cash from PTO can alleviate stress.

- Short-Term Solutions: This option serves as a temporary fix that can help employees navigate through tough financial situations without resorting to loans or credit cards.

May Encourage Unhealthy Work Habits

The availability of a cash-out option might lead some employees to prioritize work over personal health.

- Work Culture Impact: Employees might feel pressured to work continuously without taking breaks, fearing they will miss out on financial benefits if they utilize their PTO.

- Long-Term Consequences: Such behaviors can lead to chronic stress and health issues, ultimately affecting overall workplace productivity and morale.

Enhances Employee Satisfaction for Some

For certain employees, the ability to cash out PTO enhances job satisfaction.

- Personal Choice: Employees appreciate having options that align with their personal circumstances and financial needs.

- Retention Tool: Offering PTO cash-out options can be seen as a progressive benefit that attracts talent and retains existing staff by meeting diverse needs.

Complexity in Policy Administration

Implementing a PTO cash-out policy requires careful consideration and management by employers.

- Policy Clarity: Employers must clearly communicate the terms and conditions of the cash-out option to avoid confusion among employees.

- Legal Compliance: Companies must navigate complex tax regulations and ensure compliance with state laws regarding PTO payouts, which may vary significantly across jurisdictions.

Risk of Creating Inequities Among Staff

PTO cash-out policies can lead to perceived inequities among employees.

- Different Needs: Employees with varying financial situations may view the option differently; some may need the extra income while others prioritize time off.

- Morale Issues: If not managed properly, these disparities could create tension within teams and affect overall workplace harmony.

In conclusion, while PTO cash-out options present several advantages such as immediate financial relief and flexibility in managing personal finances, they also carry significant disadvantages including potential burnout and tax implications. Organizations must weigh these factors carefully when considering implementing such policies. Ultimately, fostering a culture that encourages taking time off while offering flexible options like PTO cash outs could lead to healthier work environments and improved employee satisfaction.

Frequently Asked Questions About PTO Cash Out

- What is PTO cash out?

PTO cash out allows employees to convert unused paid time off into a lump sum payment instead of taking time off. - Are there tax implications when I cash out my PTO?

Yes, payouts are typically taxed as supplemental income, which may result in higher withholding rates. - How does PTO cash out affect my work-life balance?

Cashing out may reduce your available vacation days, potentially leading to increased stress if not managed properly. - Can all companies offer PTO cash-out options?

No, it depends on company policy; not all organizations allow this practice. - Is it better to take time off or cash out my PTO?

This depends on individual circumstances; consider your financial needs versus your need for rest. - What happens if I leave my job before using my accrued PTO?

If your company has a payout policy, you will typically receive compensation for any unused PTO upon leaving. - Can I choose how much PTO I want to cash out?

This varies by employer; some allow partial cash-outs while others may have set limits. - Does taking a cash-out affect my future accrual of PTO?

Cashing out does not typically affect future accrual rates unless specified by company policy.