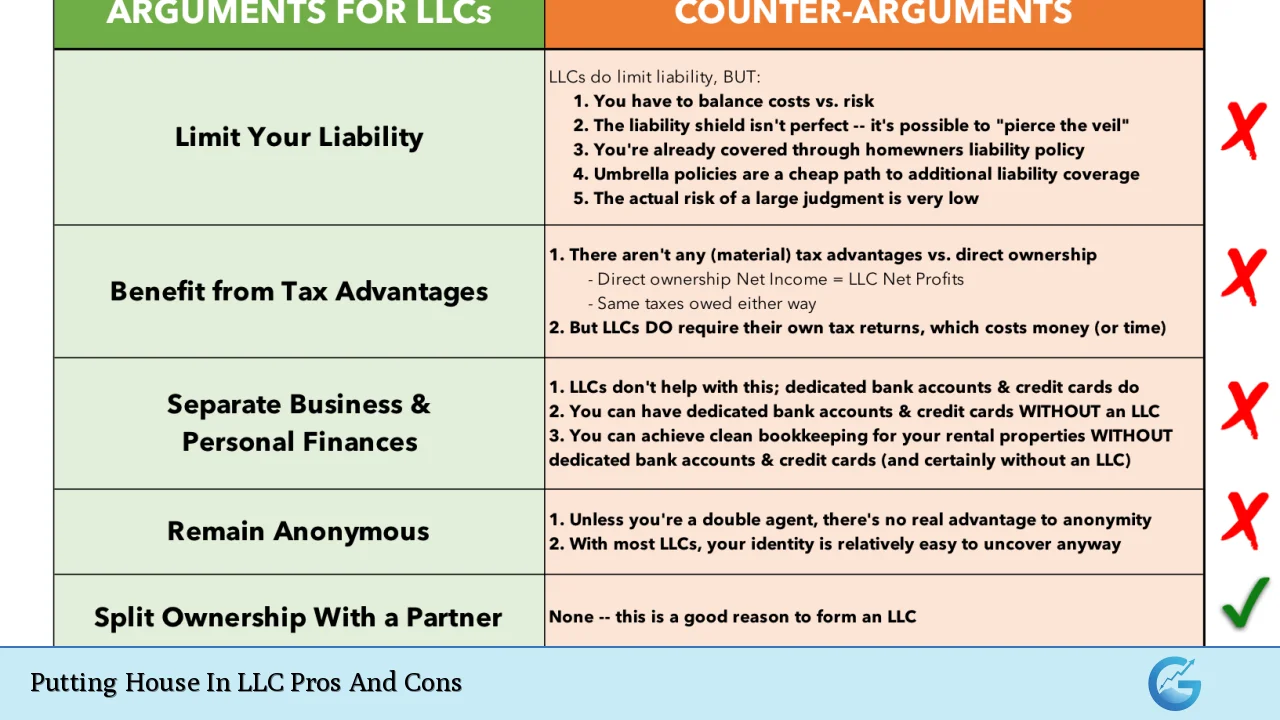

When considering real estate investments, one of the most strategic decisions an investor can make is whether to place their property within a Limited Liability Company (LLC). An LLC is a legal entity that provides certain protections and benefits to its owners while also imposing specific obligations. This article explores the advantages and disadvantages of putting a house in an LLC, offering insights for individuals interested in finance, real estate, and investment strategies.

| Pros | Cons |

|---|---|

| Limited liability protection | Increased complexity and administrative burden |

| Tax benefits including pass-through taxation | Higher costs associated with formation and maintenance |

| Privacy and anonymity | Challenges in securing financing |

| Asset protection from lawsuits | Potential loss of capital gains tax benefits |

| Flexibility in ownership structure | Limited liability may not cover personal guarantees |

| Professional appearance and credibility | State-specific regulations and compliance requirements |

| Easier transfer of ownership interests | Risk of “piercing the corporate veil” |

| Separation of personal and business assets | Additional tax filings may be required |

Limited Liability Protection

One of the primary advantages of placing a house in an LLC is the limited liability protection it affords its owners. This means that if the LLC faces legal action, only the assets within the LLC are at risk. Personal assets, such as your home or savings, are generally protected from creditors or lawsuits related to the LLC’s activities. This is particularly beneficial for landlords who may encounter tenant-related lawsuits.

- Protection from personal liability: If a tenant sues for an injury sustained on the property, they can only pursue claims against the LLC, not the individual members.

- Asset separation: Each property can be placed in its own LLC, further isolating risks associated with each investment.

Tax Benefits Including Pass-Through Taxation

LLCs offer significant tax advantages, particularly through pass-through taxation. This means profits and losses pass directly to the owners without being taxed at both the corporate and personal levels.

- Avoiding double taxation: Unlike corporations that face double taxation on profits, LLCs allow members to report income on their personal tax returns.

- Deductions for expenses: Owners can deduct various expenses related to property management, including repairs, maintenance, and even travel costs associated with managing properties.

Privacy and Anonymity

Buying a house through an LLC can provide a layer of privacy. The property is owned by the LLC rather than an individual, which can help keep personal information out of public records.

- Anonymity for high-profile individuals: Celebrities or public figures often use LLCs to maintain privacy regarding their real estate holdings.

- Reduced risk of targeted lawsuits: By concealing ownership details, individuals may reduce their exposure to lawsuits stemming from their wealth or status.

Asset Protection from Lawsuits

An LLC acts as a shield against legal claims. If someone files a lawsuit related to an incident on your rental property, only the assets held within that LLC are typically at risk.

- Mitigating exposure: This separation helps protect personal wealth from business-related liabilities.

- Strategic asset management: Investors can create multiple LLCs for different properties to further isolate risks.

Flexibility in Ownership Structure

LLCs provide flexibility in how ownership is structured. This is particularly advantageous for investors looking to pool resources or share ownership among multiple parties.

- Multiple members allowed: An LLC can have one or more members, facilitating joint ventures or partnerships.

- Easier transfer of ownership interests: Selling shares in an LLC can often be done without incurring transfer taxes that would apply if selling real estate directly.

Professional Appearance and Credibility

Operating under an LLC can enhance your professional image when dealing with tenants, vendors, or lenders.

- Credibility with tenants: An LLC structure may convey professionalism and reliability compared to individual landlords.

- Attracting investors: A formal business structure can make it easier to attract partners or investors interested in joint ventures.

Easier Transfer of Ownership Interests

Transferring ownership within an LLC is generally more straightforward than transferring real estate directly.

- Reduced tax implications: Transfers between members typically do not trigger capital gains taxes.

- Streamlined processes: The operating agreement can dictate terms for transferring interests without needing extensive legal documentation each time.

Increased Complexity and Administrative Burden

While there are numerous advantages to using an LLC for property ownership, it also introduces complexity.

- Administrative tasks: Owners must maintain records, file annual reports, and comply with state regulations.

- Need for separate bank accounts: To preserve limited liability status, personal and business finances must remain distinct.

Higher Costs Associated with Formation and Maintenance

Establishing and maintaining an LLC incurs costs that can add up over time.

- Formation fees: Setting up an LLC typically involves initial filing fees ranging from $50 to several hundred dollars depending on the state.

- Ongoing expenses: Annual fees for maintaining the LLC can also vary significantly by jurisdiction.

Challenges in Securing Financing

Financing a property through an LLC may pose challenges compared to traditional home buying methods.

- Higher down payments required: Lenders often require larger down payments when financing properties owned by an LLC.

- Limited loan options: Conventional loans may not be available for properties owned by an LLC; alternative financing solutions might come with higher interest rates.

Potential Loss of Capital Gains Tax Benefits

If you purchase your primary residence through an LLC, you could lose certain tax benefits available to individual homeowners.

- Capital gains exclusion loss: Homeowners may exclude up to $250,000 ($500,000 for married couples) in capital gains when selling their primary residence if certain conditions are met; this benefit does not apply if the home is owned by an LLC.

Limited Liability May Not Cover Personal Guarantees

In some cases, lenders may require personal guarantees on loans taken out by an LLC.

- Risk exposure remains: If you personally guarantee a loan and default, your personal assets could still be at risk despite having placed your house in an LLC.

- Legal complexities arise: Understanding when personal guarantees apply is crucial for protecting personal wealth while leveraging business structures effectively.

State-Specific Regulations and Compliance Requirements

Each state has its own laws governing LLCs which can complicate matters for real estate investors operating across state lines.

- Varying fees and requirements: The cost and complexity of forming an LLC differ significantly from one state to another.

- Compliance issues: Investors must ensure they adhere to local regulations regarding property management under an LLC structure.

Risk of “Piercing the Corporate Veil”

While limited liability protects personal assets under normal circumstances, there are scenarios where courts might disregard this protection.

- Fraudulent behavior or negligence: If members engage in fraudulent activities or fail to adhere to corporate formalities, courts may hold them personally liable.

- Maintaining proper records: Keeping accurate financial records and following legal protocols is essential to uphold limited liability protections.

Additional Tax Filings May Be Required

LLCs often require additional tax filings compared to individual ownership structures.

- Complexity in tax reporting: Depending on how many members are involved or how income is generated, filing taxes for an LLC can be more intricate than filing as an individual.

- Potential self-employment taxes: Members receiving compensation from the LLC may also face self-employment taxes on earnings drawn from the entity.

In conclusion, placing a house in an LLC offers numerous advantages such as limited liability protection, tax benefits, privacy, asset protection from lawsuits, flexibility in ownership structure, professional credibility, and easier transferability of ownership interests. However, these benefits come with significant drawbacks including increased complexity, higher costs associated with formation and maintenance, challenges in securing financing, potential loss of capital gains benefits, risks associated with personal guarantees, state-specific regulatory compliance issues, risks of piercing the corporate veil, and additional tax filing requirements.

Investors should carefully weigh these pros and cons against their specific circumstances before deciding whether placing their house in an LLC aligns with their financial goals.

Frequently Asked Questions About Putting House In LLC Pros And Cons

- What is the primary benefit of putting my house into an LLC?

The main advantage is limited liability protection which shields your personal assets from potential lawsuits related to the property. - Are there tax benefits associated with using an LLC?

Yes, owners can benefit from pass-through taxation which avoids double taxation on profits. - Will I lose capital gains tax benefits if I put my primary residence in an LLC?

Yes, placing your primary residence in an LLC could disqualify you from capital gains exclusions available under IRS rules. - What are some common challenges when financing a home through an LLC?

Lenders often require higher down payments and offer fewer financing options compared to traditional mortgages. - Is privacy a significant advantage when using an LLC?

Yes, purchasing property through an LLC helps maintain anonymity as it keeps your name off public records. - Can I easily transfer ownership interests within my LLC?

Yes, transferring interests typically incurs fewer tax implications compared to direct property sales. - What happens if I personally guarantee a loan taken out by my LLC?

If you default on that loan despite having placed your house in an LLC, your personal assets could still be at risk. - Do I need legal assistance when forming an LLC?

While it’s possible to form one independently, consulting with a lawyer ensures compliance with all regulations specific to your state.