Investing in real estate through an Individual Retirement Account (IRA) can be a compelling strategy for building wealth and securing financial stability for retirement. This approach allows investors to leverage the tax advantages of IRAs while diversifying their portfolios with tangible assets. However, it also comes with its own set of challenges and risks. Understanding the pros and cons of using a Real Estate IRA is crucial for anyone considering this investment strategy.

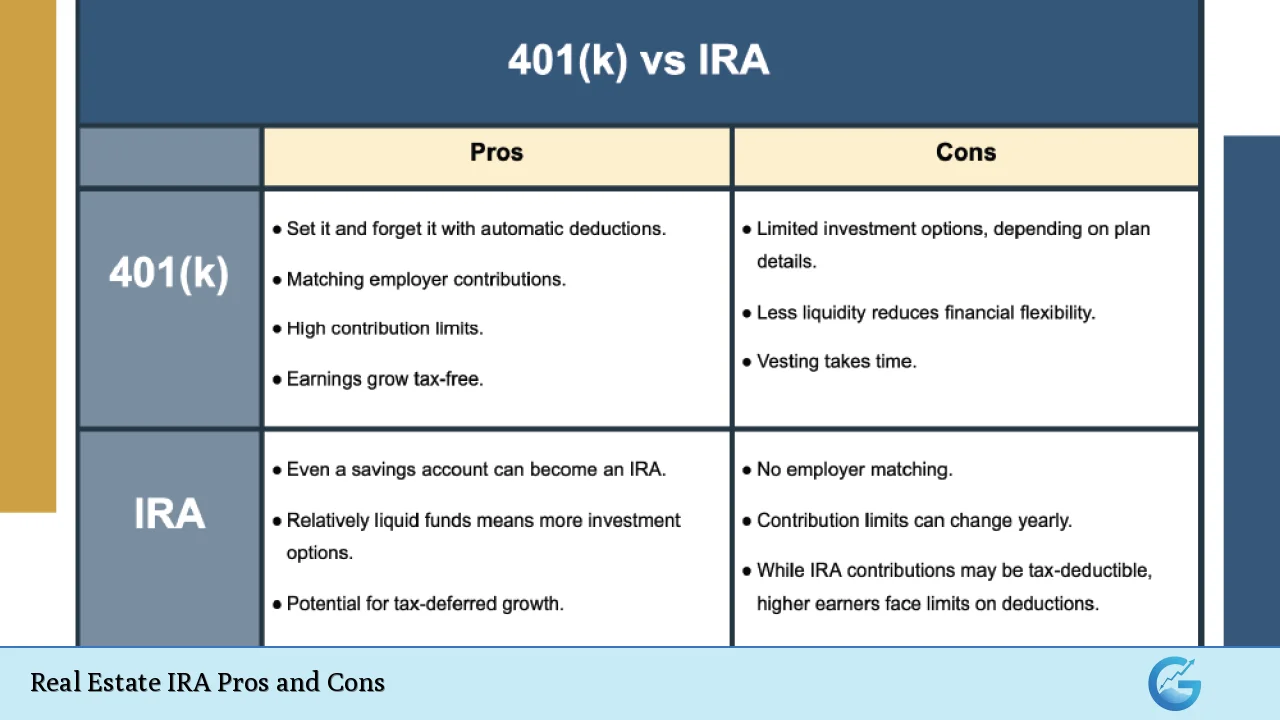

| Pros | Cons |

|---|---|

| Tax-deferred or tax-free growth potential | Loss of traditional real estate tax benefits |

| Diversification of investment portfolio | Illiquidity of real estate assets |

| Control over investment choices | Strict IRS regulations and penalties for non-compliance |

| Potential for high returns on investment | High maintenance costs and responsibilities |

| Protection from creditors in bankruptcy situations | Limited access to funds until retirement age |

| Ability to generate rental income tax-free within the IRA | Non-recourse loans can limit leverage options |

| Long-term appreciation potential of real estate assets | Market volatility can affect property values |

Tax-deferred or Tax-free Growth Potential

One of the most significant advantages of investing in real estate through an IRA is the potential for tax-deferred or tax-free growth.

- Tax Benefits: Traditional IRAs allow investments to grow tax-deferred until withdrawal, while Roth IRAs enable tax-free withdrawals after retirement age, provided certain conditions are met.

- Compounded Growth: The ability to reinvest profits without immediate tax implications can significantly enhance the growth of your retirement savings.

Loss of Traditional Real Estate Tax Benefits

While there are substantial tax advantages, investing in real estate through an IRA means losing some traditional benefits associated with direct real estate investments.

- Depreciation: Investors typically benefit from depreciation deductions, which can offset rental income. However, this benefit is not available when the property is held within an IRA.

- Capital Gains Treatment: Profits from real estate sales are usually taxed at a lower capital gains rate. In an IRA, these profits are treated as ordinary income, potentially leading to higher tax liabilities upon withdrawal.

Diversification of Investment Portfolio

Investing in real estate can provide diversification that is often lacking in traditional stock and bond portfolios.

- Asset Diversification: Real estate often behaves differently than stocks, providing a hedge against market volatility. This diversification can reduce overall portfolio risk.

- Inflation Hedge: Real estate has historically appreciated over time, making it a reliable hedge against inflation.

Illiquidity of Real Estate Assets

One major downside to investing in real estate through an IRA is the illiquidity associated with such assets.

- Difficulty in Selling: Unlike stocks, which can be sold quickly, selling real estate can take weeks or months. This lack of liquidity may pose challenges if quick access to cash is needed.

- Long-term Commitment: Investors must be prepared for a long-term commitment, as real estate investments typically require time to appreciate significantly.

Control Over Investment Choices

Self-directed IRAs provide investors with greater control over their investment choices compared to traditional IRAs managed by financial institutions.

- Investment Flexibility: Investors can choose from various types of properties—residential, commercial, or raw land—allowing them to tailor their portfolios according to their financial goals.

- Active Management: Investors have the option to actively manage their properties or hire property managers, giving them more involvement in their investments.

Strict IRS Regulations and Penalties for Non-compliance

Investing in real estate through an IRA comes with stringent IRS regulations that must be adhered to avoid penalties.

- Prohibited Transactions: Engaging in transactions that benefit the account holder personally (e.g., using the property) can lead to severe penalties, including disqualification of the entire IRA.

- Compliance Responsibility: Investors are responsible for ensuring compliance with IRS rules, which may require additional administrative work and oversight.

Potential for High Returns on Investment

Real estate has the potential for significant returns if managed effectively and chosen wisely.

- Appreciation and Rental Income: Properties can appreciate over time while generating rental income that grows tax-free within the IRA framework.

- Leverage Opportunities: Although conventional mortgages are not permitted within IRAs, non-recourse loans can still be utilized to finance property purchases, allowing investors to control larger assets with less capital upfront.

High Maintenance Costs and Responsibilities

Owning real estate involves ongoing costs and responsibilities that can impact overall returns.

- Maintenance Expenses: Property owners must cover maintenance costs, repairs, taxes, and insurance from their IRA funds. These expenses can quickly add up and diminish overall profitability.

- Management Burden: Managing properties requires time and effort, which may not suit all investors’ lifestyles or expertise levels.

Protection from Creditors in Bankruptcy Situations

Funds held within a self-directed IRA are generally protected from creditors in bankruptcy proceedings.

- Bankruptcy Protection: Under federal law, a certain amount (up to approximately $1 million) held in an IRA may be exempt from creditors during bankruptcy situations. This protection provides peace of mind for investors concerned about financial setbacks.

Limited Access to Funds Until Retirement Age

One significant drawback is that funds tied up in an IRA cannot be accessed without penalties until retirement age (59½ years).

- Withdrawal Restrictions: Early withdrawals may incur taxes and penalties, limiting liquidity during critical financial periods before retirement age.

- Long-term Focus Required: Investors must adopt a long-term perspective since accessing cash flow from rental properties before retirement age is restricted.

Non-recourse Loans Can Limit Leverage Options

While leveraging properties is a common strategy in real estate investing, using non-recourse loans within an IRA presents unique challenges.

- Higher Down Payments: Non-recourse loans typically require larger down payments compared to traditional mortgages due to the lack of personal guarantees. This requirement can limit purchasing power for some investors.

- Higher Interest Rates: Non-recourse loans often come with higher interest rates than conventional loans, potentially reducing overall investment returns.

Market Volatility Can Affect Property Values

The real estate market is subject to fluctuations influenced by various factors such as economic conditions and interest rates.

- Economic Sensitivity: Economic downturns can lead to decreased property values and rental income, impacting overall investment performance negatively.

- Regional Variability: Real estate markets vary significantly by region; thus, local economic conditions must be considered when investing through an IRA.

In conclusion, investing in real estate through an IRA offers both significant advantages and notable drawbacks. The potential for tax-deferred growth and portfolio diversification makes it appealing; however, investors must navigate complex regulations and manage ongoing costs effectively.

Understanding these pros and cons is essential for making informed decisions aligned with long-term financial goals. As always, consulting with financial advisors or tax professionals before proceeding with such investments is advisable to ensure compliance and optimize outcomes based on individual circumstances.

Frequently Asked Questions About Real Estate IRA Pros And Cons

- What types of properties can I invest in through a Real Estate IRA?

You can invest in various types of properties including residential homes, commercial buildings, raw land, and rental properties. - Are there any restrictions on using my Real Estate IRA?

Yes, you cannot use the property personally or rent it out to family members; all transactions must adhere strictly to IRS regulations. - How does taxation work when I sell property held in my Real Estate IRA?

Profits generated from selling property within an IRA are typically treated as ordinary income rather than capital gains. - Can I take out a mortgage on my Real Estate IRA?

You cannot use traditional mortgages; however, you may obtain non-recourse loans specifically designed for investment properties. - What happens if I fail to comply with IRS regulations?

If you engage in prohibited transactions or fail to comply with IRS rules, your entire IRA could be disqualified and subject to taxes. - Can I manage my own properties within my Real Estate IRA?

You can manage your own properties but must ensure that all transactions are conducted through your Self-Directed IRA. - What are the risks associated with investing in real estate through an IRA?

The primary risks include market volatility affecting property values and high maintenance costs that could impact returns. - Is it advisable to invest all my retirement funds into real estate?

Diversifying your investments across different asset classes is generally recommended rather than concentrating all funds into one type of asset.