Rent-to-own homes, also known as lease-option agreements, offer a unique pathway to homeownership for individuals who may not qualify for traditional mortgages. This arrangement allows potential buyers to rent a property for a specified period with the option to purchase it at the end of the lease term. As the real estate market continues to evolve, understanding the intricacies of rent-to-own agreements becomes crucial for those navigating the complex landscape of property acquisition.

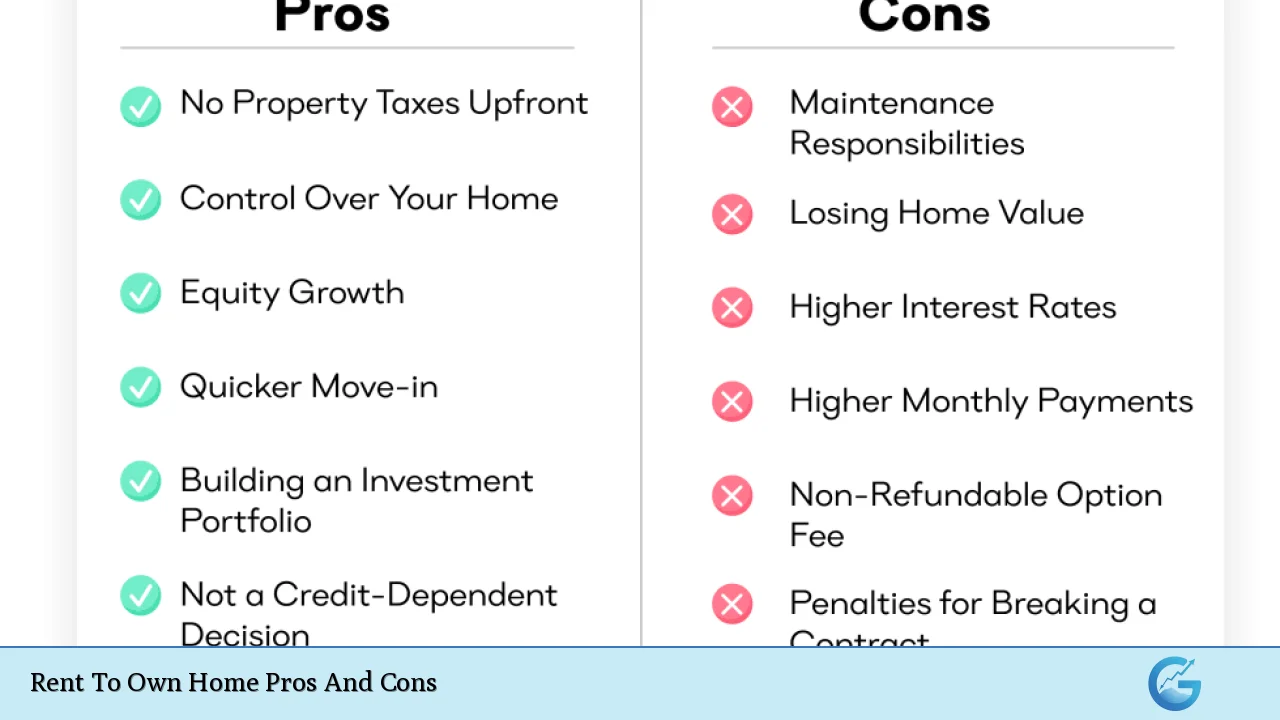

| Pros | Cons |

|---|---|

| Path to homeownership for credit-challenged buyers | Higher monthly payments compared to standard rentals |

| Opportunity to lock in purchase price | Risk of losing invested money if purchase isn’t completed |

| Time to improve credit score and save for down payment | Limited selection of available properties |

| Ability to “test drive” the home and neighborhood | Potential for unfavorable contract terms |

| Gradual transition into homeownership | Responsibility for maintenance and repairs during rental period |

| Potential for equity buildup through rent credits | Complexity of agreements requiring legal scrutiny |

Advantages of Rent-to-Own Homes

Path to Homeownership for Credit-Challenged Buyers

Rent-to-own agreements provide a viable option for individuals who struggle to qualify for traditional mortgages due to credit issues or insufficient down payments. This arrangement allows potential buyers to work towards homeownership while addressing financial obstacles. Benefits include:

- Time to repair and improve credit scores

- Opportunity to demonstrate consistent payment history

- Gradual savings accumulation for down payment and closing costs

Opportunity to Lock in Purchase Price

In a market characterized by fluctuating property values, rent-to-own agreements often include a predetermined purchase price. This feature offers several advantages:

- Protection against future price increases in rising markets

- Ability to benefit from appreciation if property values increase

- Financial planning certainty with a known future purchase amount

Time to Improve Credit Score and Save for Down Payment

The lease period in a rent-to-own agreement serves as a financial preparation phase. During this time, potential buyers can:

- Actively work on improving their credit scores

- Implement budgeting strategies to save for a substantial down payment

- Explore various mortgage options and prepare necessary documentation

Ability to “Test Drive” the Home and Neighborhood

Rent-to-own arrangements provide a unique opportunity to experience living in the property before committing to a purchase. This trial period allows potential buyers to:

- Assess the home’s suitability for long-term living

- Evaluate the neighborhood, schools, and local amenities

- Identify any potential issues with the property or location

Gradual Transition into Homeownership

The rent-to-own process offers a smoother transition from renting to owning, which can be particularly beneficial for first-time homebuyers. Advantages include:

- Familiarization with property maintenance responsibilities

- Time to adjust to the financial obligations of homeownership

- Opportunity to establish roots in the community before purchasing

Potential for Equity Buildup Through Rent Credits

Many rent-to-own agreements include a rent credit system, where a portion of monthly rent payments is applied towards the future purchase price. This arrangement offers:

- Gradual equity accumulation during the rental period

- Reduced effective purchase price at the end of the lease term

- Motivation to complete the purchase and capitalize on invested rent credits

Disadvantages of Rent-to-Own Homes

Higher Monthly Payments Compared to Standard Rentals

Rent-to-own agreements typically involve higher monthly payments than traditional rentals, which can strain budgets and limit financial flexibility. Drawbacks include:

- Increased financial burden during the lease period

- Potential difficulty in meeting other financial obligations

- Risk of defaulting on payments and losing the option to purchase

Risk of Losing Invested Money if Purchase Isn’t Completed

One of the most significant risks in rent-to-own agreements is the potential loss of invested funds if the purchase is not completed. This can occur due to:

- Inability to secure mortgage financing at the end of the lease term

- Change in financial circumstances or job loss

- Decision not to purchase the property for various reasons

Limited Selection of Available Properties

The rent-to-own market is typically smaller than the traditional real estate market, which can lead to:

- Fewer options in desired locations or property types

- Potential compromises on home features or neighborhood preferences

- Increased competition for available rent-to-own properties

Potential for Unfavorable Contract Terms

Rent-to-own agreements can be complex, and without proper scrutiny, buyers may find themselves bound by unfavorable terms. Risks include:

- Excessive option fees or non-refundable deposits

- Unrealistic purchase price escalation clauses

- Strict conditions for exercising the purchase option

Responsibility for Maintenance and Repairs During Rental Period

Unlike traditional rentals, many rent-to-own agreements place the responsibility for maintenance and repairs on the tenant. This can lead to:

- Unexpected expenses for major repairs or system replacements

- Disputes over the scope of tenant responsibilities

- Financial strain from maintaining a property not yet owned

Complexity of Agreements Requiring Legal Scrutiny

The intricacy of rent-to-own contracts necessitates careful review and often professional legal advice. Challenges include:

- Potential for misunderstanding contract terms and obligations

- Risk of entering into agreements with hidden clauses or penalties

- Need for legal expertise to negotiate fair and balanced terms

Frequently Asked Questions About Rent To Own Home Pros And Cons

Frequently Asked Questions About Rent To Own Home Pros And Cons

- What is the typical length of a rent-to-own agreement?

Rent-to-own agreements typically last 1 to 3 years, allowing tenants time to prepare for homeownership. The exact duration can be negotiated between the buyer and seller. - How much of the monthly rent payment goes towards the purchase price?

The amount varies by agreement, but typically 15% to 25% of the monthly rent is credited towards the purchase. This percentage should be clearly specified in the contract. - Can I lose my option to buy the home if I miss a rent payment?

Yes, many agreements include clauses that void the purchase option if rent payments are missed. It’s crucial to understand these terms and maintain timely payments throughout the lease period. - Is the purchase price of the home negotiable in a rent-to-own agreement?

Often, the purchase price is set at the beginning of the agreement. However, some contracts may include provisions for adjusting the price based on market conditions or appraisals at the time of purchase. - What happens if the property value decreases during the lease period?

If the property value decreases, you may be obligated to pay the predetermined price, potentially resulting in negative equity. Some agreements include clauses to address market fluctuations, so careful contract review is essential. - Are there any tax benefits to a rent-to-own arrangement?

During the rental phase, there are typically no tax benefits. However, once the purchase is completed, you may be eligible for homeownership tax deductions, such as mortgage interest and property taxes. - Can I make modifications to the home during the rental period?

This depends on the specific terms of your agreement. Some contracts allow for minor changes, while others require landlord approval for any modifications. Always consult your agreement before making changes. - What if I decide not to purchase the home at the end of the lease term?

If you choose not to buy, you typically forfeit any option fees and rent credits paid. Some agreements may include penalties for not exercising the purchase option, so review the contract carefully.

In conclusion, rent-to-own homes present a unique opportunity for aspiring homeowners to bridge the gap between renting and buying. While they offer advantages such as a path to homeownership for credit-challenged buyers and the ability to lock in purchase prices, they also come with significant risks and responsibilities. Potential buyers must carefully weigh the pros and cons, thoroughly review contract terms, and consider their long-term financial goals before entering into a rent-to-own agreement. As with any major financial decision, seeking advice from real estate professionals, financial advisors, and legal experts is crucial to navigating the complexities of rent-to-own arrangements and ensuring a successful transition to homeownership.