Rent-to-own agreements have emerged as a popular alternative for individuals looking to transition into homeownership without the immediate financial burden of a traditional mortgage. This arrangement allows potential buyers to rent a property with the option to purchase it later, often providing a pathway for those who may not qualify for a mortgage due to credit issues or insufficient savings. However, like any financial decision, rent-to-own agreements come with their own set of advantages and disadvantages that must be carefully considered. This article will delve into the pros and cons of rent-to-own agreements, providing a comprehensive overview for those interested in real estate investment and financial planning.

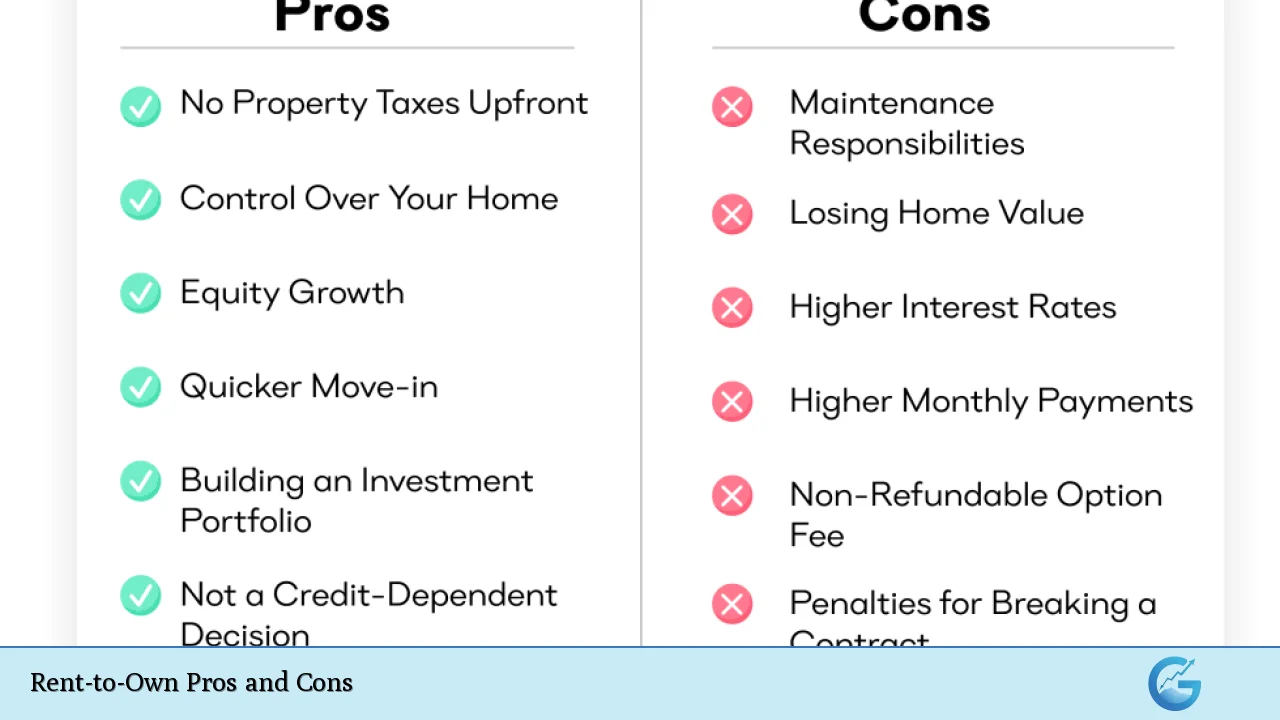

| Pros | Cons |

|---|---|

| Accessible homeownership opportunities | Higher overall costs compared to traditional buying |

| Ability to lock in purchase price | Risk of losing upfront option fees |

| Time to improve credit score | Potential for property depreciation |

| Flexibility in decision-making | Higher rental payments than market rates |

| Opportunity to test the neighborhood | Complex contracts and legal considerations |

| Build equity over time through rent credits | Difficulty in securing financing at the end of the term |

| Less hassle of moving frequently | Limited availability of rent-to-own properties |

| Shared repair responsibilities with landlords | Potential for unfavorable lease terms |

Accessible Homeownership Opportunities

One of the most significant advantages of rent-to-own agreements is that they provide accessible pathways to homeownership. For individuals with poor credit or limited savings, this arrangement allows them to live in their desired home while simultaneously working towards purchasing it.

- Credit Improvement: Rent-to-own agreements can enable tenants to improve their credit scores over time, making them more eligible for favorable mortgage rates when they decide to buy.

- No Immediate Mortgage Requirement: This option is particularly beneficial for those who may not have enough saved for a down payment or who are currently unable to qualify for a mortgage due to credit issues.

Ability to Lock in Purchase Price

Another advantage is the ability to lock in the purchase price at the beginning of the lease term. This can be particularly beneficial in a rising real estate market.

- Protection Against Market Fluctuations: By locking in a price, tenants can protect themselves from potential increases in property values that could occur during their rental period.

- Financial Stability: This predictability can provide greater financial stability and certainty regarding future costs associated with homeownership.

Time to Improve Credit Score

Rent-to-own agreements often afford tenants the time they need to improve their credit scores.

- Building Credit: By making consistent rental payments on time, tenants can enhance their credit profiles, which is crucial when applying for a mortgage later.

- Preparation for Homeownership: This period also allows tenants to educate themselves about homeownership responsibilities and financial management.

Flexibility in Decision-Making

These agreements offer significant flexibility regarding whether or not to proceed with the purchase.

- Option to Buy or Walk Away: At the end of the rental period, tenants can choose whether they want to buy the property based on their financial situation and market conditions.

- Reduced Pressure: This flexibility alleviates some pressure associated with immediate home purchases, allowing tenants time to assess their long-term goals.

Opportunity to Test the Neighborhood

Rent-to-own arrangements allow potential buyers to experience living in a neighborhood before committing fully.

- Neighborhood Assessment: Tenants can evaluate various aspects of the community, such as amenities, schools, and overall livability, which are essential factors in deciding where to settle long-term.

- Reduced Moving Hassles: If they decide not to purchase, they can move without the hassle of having already committed financially.

Build Equity Over Time Through Rent Credits

Many rent-to-own agreements include provisions that allow tenants to build equity through rent credits.

- Contributing Towards Purchase Price: A portion of each rent payment may be credited towards the eventual purchase price of the home, effectively allowing tenants to save while renting.

- Equity Growth: This arrangement helps tenants accumulate equity that will benefit them once they transition from renters to homeowners.

Higher Overall Costs Compared to Traditional Buying

Despite its benefits, one major disadvantage of rent-to-own agreements is that they often come with higher overall costs than traditional home buying methods.

- Premium Rental Rates: Rent payments are typically above market rates since they include an additional amount that goes toward the future purchase price.

- Total Financial Commitment: The total cost over time can exceed what would be paid if purchasing outright through conventional financing methods.

Risk of Losing Upfront Option Fees

Tenants usually pay an upfront option fee when entering into a rent-to-own agreement.

- Non-refundable Costs: If they ultimately decide not to buy or cannot secure financing at the end of the lease term, this fee is typically non-refundable, representing a significant financial loss.

- Financial Risk: This risk can be particularly concerning if circumstances change unexpectedly during the rental period.

Potential for Property Depreciation

While locking in a purchase price can be advantageous, there is also a risk associated with property values declining during the rental period.

- Market Volatility: If real estate prices drop significantly, tenants may find themselves obligated to pay more than what the property is worth at the time they are ready to buy.

- Financial Implications: This scenario could lead to financial strain if tenants are unable or unwilling to proceed with purchasing at an inflated price.

Higher Rental Payments Than Market Rates

Rent-to-own agreements often require higher monthly payments compared to standard rental agreements due to added costs associated with purchasing options.

- Budget Considerations: These elevated payments can strain budgets and may limit other financial opportunities for tenants during their rental period.

- Affordability Issues: As these payments are typically higher than market rates, prospective renters must ensure they can afford these costs over time without jeopardizing their financial stability.

Complex Contracts and Legal Considerations

Rent-to-own contracts can be complex and may involve various legal stipulations that require careful consideration before signing.

- Legal Obligations: Understanding all terms and conditions is essential as misinterpretations could lead to disputes or unintended consequences later on.

- Need for Professional Guidance: It may be beneficial for potential renters to consult with legal professionals or real estate experts before entering into such agreements.

Difficulty in Securing Financing at the End of the Term

At the conclusion of a rent-to-own agreement, tenants must secure financing if they wish to follow through with purchasing the property.

- Mortgage Approval Challenges: If tenants’ financial situations do not improve enough during their rental period or if market conditions change unfavorably, obtaining a mortgage may prove difficult or impossible.

- Potential Losses Incurred: Failure to secure financing could result in losing both their option fee and any accumulated rent credits towards ownership.

Limited Availability of Rent-to-Own Properties

Finding suitable properties available under rent-to-own agreements can be challenging.

- Market Limitations: Not all sellers offer this type of arrangement; thus, options may be limited depending on local real estate conditions.

- Increased Competition: In competitive markets, potential buyers may find it hard to locate desirable homes that also have favorable rent-to-own terms available.

Shared Repair Responsibilities With Landlords

In many rent-to-own scenarios, repair responsibilities are shared between landlords and tenants.

- Cost Savings on Repairs: This arrangement can alleviate some financial burdens on tenants as landlords often cover major repairs while minor issues fall on renters.

- Negotiation Complexity: However, this shared responsibility can also lead to disputes over who is responsible for what repairs if not clearly defined in the contract.

In conclusion, while rent-to-own agreements present unique opportunities for aspiring homeowners—especially those facing barriers such as credit challenges—they also come with significant risks and potential downsides. Understanding both sides is crucial before entering into such arrangements. Individuals should weigh these pros and cons carefully against their personal circumstances and long-term financial goals before deciding if this route aligns with their aspirations for homeownership.

Frequently Asked Questions About Rent-to-Own Pros and Cons

- What is a rent-to-own agreement?

A rent-to-own agreement allows individuals to rent a property with an option to purchase it later, typically involving higher-than-market rental payments that contribute toward eventual ownership. - What are some benefits of rent-to-own?

Benefits include accessible homeownership opportunities, locking in purchase prices, improving credit scores over time, and testing neighborhoods before committing. - What are common drawbacks?

Drawbacks include higher overall costs compared to traditional buying methods, risks associated with losing upfront fees, potential property depreciation during rental periods, and complexities within contracts. - Can I lose money in a rent-to-own agreement?

Yes, if you decide not to purchase after renting or cannot secure financing at the end of your lease term, you risk losing any upfront option fees paid. - How does renting affect my credit score?

If you make timely rental payments during your lease term, it can positively impact your credit score by demonstrating responsible payment behavior. - Are all properties available for rent-to-own?

No, availability varies by location; not all sellers offer this type of arrangement due to market conditions. - What happens if property values drop?

If property values decline during your rental period but you have locked in a higher purchase price, you may face challenges when deciding whether or not to buy. - Should I consult professionals before entering an agreement?

Yes! Consulting legal professionals or real estate experts is advisable due to complexities involved in these contracts.