When it comes to real estate investments, one of the most critical decisions property owners face is whether to rent out their property or sell it outright. This choice can have significant implications for your financial future, tax obligations, and overall investment strategy. Let’s delve into the intricacies of renting versus selling to help you make an informed decision that aligns with your financial goals and personal circumstances.

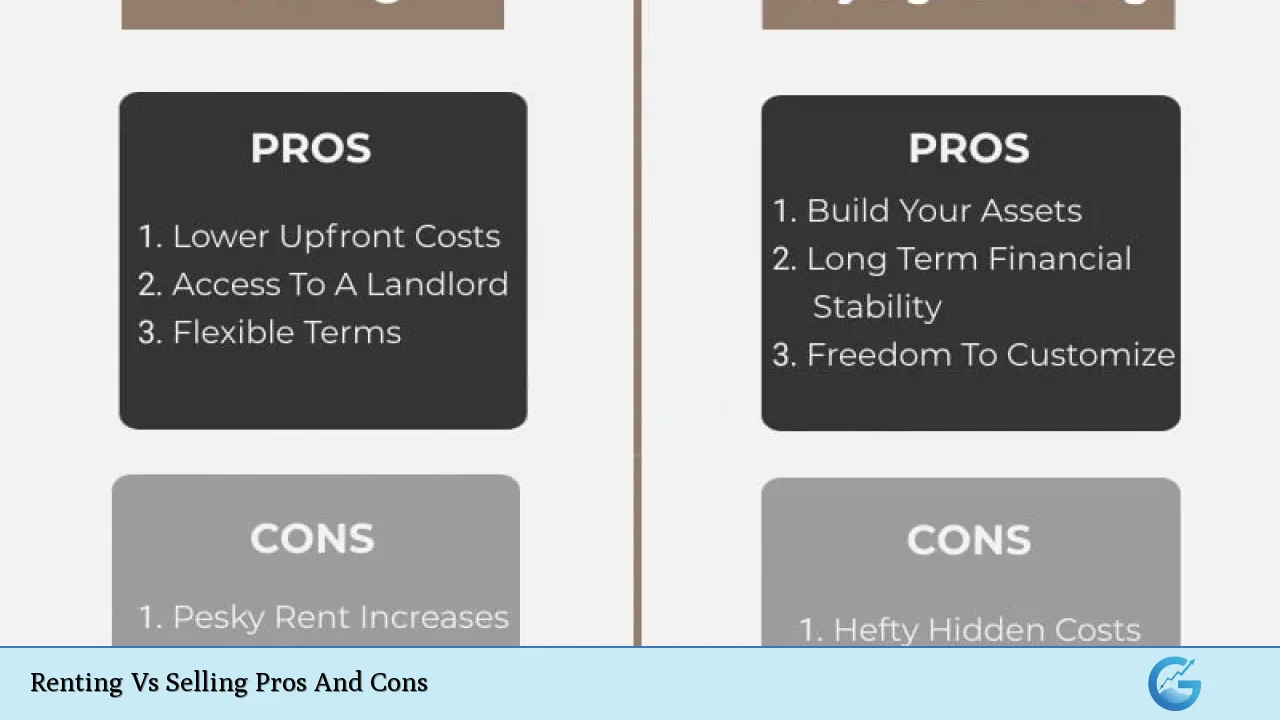

| Pros | Cons |

|---|---|

| Steady passive income stream | Ongoing maintenance and repair costs |

| Potential for long-term appreciation | Property management responsibilities |

| Tax benefits and deductions | Potential for difficult tenants |

| Flexibility to sell later | Vacancy periods affecting cash flow |

| Immediate access to equity | Potential capital gains tax |

| Simplified financial portfolio | Missing out on future appreciation |

| Opportunity to diversify investments | Market timing risks |

| Reduced property-related stress | Potential for selling below market value |

Advantages of Renting Out Your Property

Steady Passive Income Stream

Renting out your property can provide a consistent monthly cash flow, which can be particularly attractive in areas with strong rental markets. This regular income can help offset mortgage payments, property taxes, and other related expenses. In some cases, the rental income may even exceed these costs, resulting in positive cash flow that can supplement your primary income or fund other investments.

- Potential for higher returns in high-demand rental markets

- Income stability during economic downturns

- Opportunity to cover property-related expenses

Long-Term Appreciation Potential

By holding onto your property and renting it out, you maintain ownership of an asset that has the potential to appreciate over time. Real estate has historically been a solid long-term investment, often outpacing inflation and providing substantial returns. As property values increase, your equity grows, potentially setting you up for a more significant profit when you eventually decide to sell.

- Benefit from market appreciation without immediate sale

- Compound growth of property value over time

- Increased equity can be leveraged for future investments

Tax Benefits and Deductions

Rental properties come with a variety of tax advantages that can significantly reduce your overall tax burden. As a landlord, you can deduct numerous expenses related to your rental property, including:

- Mortgage interest payments

- Property taxes and insurance

- Maintenance and repair costs

- Depreciation of the property

- Professional fees (property management, legal, accounting)

These deductions can often offset a substantial portion of your rental income, potentially lowering your taxable income and resulting in tax savings.

Flexibility for Future Decisions

Renting out your property keeps your options open. If market conditions improve or your personal circumstances change, you can always decide to sell the property later. This flexibility allows you to capitalize on future market upswings or adapt to changing life situations without feeling pressured to make an immediate decision.

- Ability to move back into the property if needed

- Option to sell when market conditions are more favorable

- Opportunity to build a real estate portfolio over time

Disadvantages of Renting Out Your Property

Ongoing Maintenance and Repair Costs

As a landlord, you’re responsible for maintaining the property and addressing any repairs or issues that arise. These costs can be unpredictable and potentially significant, especially for older properties or those in areas prone to natural disasters. Regular maintenance, emergency repairs, and periodic upgrades can eat into your rental income and overall profitability.

- Unexpected repair expenses can disrupt cash flow

- Need for a financial buffer to cover maintenance costs

- Time and effort required to manage repairs and upgrades

Property Management Responsibilities

Managing a rental property requires time, effort, and expertise. As a landlord, you’ll need to handle tasks such as:

- Finding and screening tenants

- Collecting rent and managing late payments

- Addressing tenant complaints and concerns

- Ensuring compliance with local rental laws and regulations

- Coordinating maintenance and repairs

These responsibilities can be particularly challenging if you’re managing the property from a distance or have a full-time job. While hiring a property management company can alleviate these burdens, it also comes with additional costs that will impact your bottom line.

Potential for Difficult Tenants

One of the most significant risks of being a landlord is dealing with problematic tenants. Issues can range from late rent payments to property damage or even illegal activities on the premises. Evicting a tenant can be a lengthy, costly, and stressful process, potentially resulting in lost rental income and legal fees.

- Risk of property damage beyond normal wear and tear

- Potential for extended periods of unpaid rent

- Legal complexities and costs associated with evictions

Vacancy Periods Affecting Cash Flow

Rental properties don’t always generate income consistently. Periods between tenants, known as vacancy periods, can significantly impact your cash flow. During these times, you’ll still be responsible for mortgage payments, property taxes, and other expenses without the benefit of rental income to offset these costs.

- Need for financial reserves to cover expenses during vacancies

- Potential for extended vacancy in slow rental markets

- Costs associated with preparing the property for new tenants

Advantages of Selling Your Property

Immediate Access to Equity

Selling your property provides immediate access to the equity you’ve built up over time. This lump sum can be used for various purposes, such as:

- Purchasing a new primary residence

- Investing in other asset classes (stocks, bonds, cryptocurrencies)

- Funding a major life event or expense (education, starting a business)

- Paying off high-interest debts

The ability to quickly liquidate your real estate asset can provide financial flexibility and opportunities that may not be available when renting out the property.

Simplified Financial Portfolio

Selling your property can simplify your financial portfolio and reduce the complexities associated with property ownership. This simplification can be particularly beneficial if you’re looking to:

- Reduce your overall debt load

- Minimize ongoing financial obligations

- Streamline your investment strategy

- Reduce stress associated with property management

Opportunity to Diversify Investments

By selling your property, you free up capital that can be reinvested across a broader range of asset classes. This diversification can help spread risk and potentially increase overall returns. Consider opportunities such as:

- Investing in a diversified stock portfolio

- Exploring alternative investments like REITs or crowdfunding platforms

- Allocating funds to emerging markets or sectors

- Investing in personal development or business ventures

Reduced Property-Related Stress

Selling your property eliminates the ongoing responsibilities and potential stressors associated with being a landlord. You no longer have to worry about:

- Tenant-related issues

- Maintenance and repair costs

- Property tax increases

- Changes in local rental regulations

- Natural disasters or property damage

This reduction in stress can lead to improved quality of life and allow you to focus on other personal or professional pursuits.

Disadvantages of Selling Your Property

Potential Capital Gains Tax

One of the most significant financial considerations when selling a property is the potential for capital gains tax. If your property has appreciated significantly since you purchased it, you may be liable for taxes on the profit. While there are exemptions for primary residences, investment properties are generally subject to capital gains tax, which can take a substantial bite out of your profits.

- Tax implications can vary based on holding period and property use

- Need for careful tax planning to minimize liability

- Potential impact on overall investment returns

Missing Out on Future Appreciation

By selling your property, you forfeit the opportunity to benefit from any future appreciation in value. Real estate markets can be cyclical, and selling during a downturn or before a significant upswing could mean missing out on substantial gains. This opportunity cost should be carefully weighed against the immediate benefits of selling.

- Risk of selling before a market upswing

- Loss of potential long-term wealth accumulation

- Missed opportunity for leveraging appreciation for future investments

Market Timing Risks

Timing the real estate market perfectly is challenging, even for experienced investors. Selling your property requires careful consideration of current market conditions, which can be influenced by factors such as:

- Local economic trends

- Interest rates and mortgage availability

- Supply and demand dynamics in your area

- Seasonal fluctuations in buyer activity

Selling at the wrong time could result in a lower sale price or a longer time on the market, potentially impacting your financial goals.

Potential for Selling Below Market Value

Various circumstances may lead to selling your property below its true market value. These situations could include:

- Urgent need for liquidity

- Pressure to sell quickly due to personal circumstances

- Lack of proper marketing or exposure to potential buyers

- Unfavorable local market conditions

Selling below market value not only reduces your immediate returns but also impacts your long-term wealth-building potential.

Conclusion

The decision to rent or sell your property is highly personal and depends on various factors, including your financial goals, market conditions, and personal circumstances. Renting offers the potential for ongoing income and long-term appreciation but comes with the responsibilities of being a landlord. Selling provides immediate access to equity and simplifies your financial portfolio but may mean missing out on future gains.

Carefully consider your long-term financial objectives, risk tolerance, and personal preferences when making this decision. It may be helpful to consult with financial advisors, real estate professionals, and tax experts to fully understand the implications of each option. Remember that real estate markets can vary significantly by location, so local trends and conditions should play a crucial role in your decision-making process.

Ultimately, the choice between renting and selling should align with your overall investment strategy and life goals. By thoroughly evaluating the pros and cons outlined in this article, you’ll be better equipped to make an informed decision that sets you up for financial success in the long run.

Frequently Asked Questions About Renting Vs Selling Pros And Cons

- How do I determine if my property will be profitable as a rental?

Calculate potential rental income against expenses like mortgage, taxes, insurance, and maintenance. Research local rental rates and occupancy levels to estimate your cash flow potential. - What are the tax implications of selling a rental property?

Selling a rental property may trigger capital gains tax on the profit. However, strategies like 1031 exchanges can defer taxes if you reinvest in another property. - Is it better to sell or rent in a declining market?

In a declining market, renting may be preferable to preserve equity and wait for market recovery. However, if you anticipate further declines, selling quickly might be the better option. - How does renting affect my ability to purchase another property?

Rental income can be considered when applying for a new mortgage, potentially increasing your borrowing capacity. However, the existing mortgage may also impact your debt-to-income ratio. - What are the risks of becoming an accidental landlord?

Accidental landlords may face challenges like unfamiliarity with landlord-tenant laws, difficulty managing from afar, and unexpected costs. Proper education and possibly hiring a property manager can mitigate these risks. - How does the decision to rent or sell impact my investment diversification?

Selling allows for immediate diversification into other asset classes, while renting maintains your real estate exposure. Consider your overall portfolio balance when making this decision. - What are the long-term financial implications of renting vs. selling?

Renting can provide ongoing income and potential appreciation, while selling offers a lump sum for reinvestment. Consider your long-term financial goals, retirement plans, and risk tolerance. - How do I decide between managing the property myself or hiring a property manager?

Consider your time availability, distance from the property, and landlord experience. Property managers typically charge 8-12% of rent but can save time and reduce stress, especially for remote or multiple property owners.