A reverse mortgage line of credit (RMLOC) is a financial product designed primarily for homeowners aged 62 and older, allowing them to convert a portion of their home equity into cash without having to sell their home or make monthly mortgage payments. This type of loan can be particularly attractive to retirees seeking additional income to support their lifestyle or cover unexpected expenses. However, while RMLOCs offer various benefits, they also come with significant drawbacks that potential borrowers must carefully consider.

The following sections will explore the advantages and disadvantages of reverse mortgage lines of credit in detail, providing insights for individuals interested in finance, investment, and retirement planning.

| Pros | Cons |

|---|---|

| Flexibility in accessing funds | Higher initial costs compared to traditional loans |

| No monthly mortgage payments required | Accumulating interest increases loan balance over time |

| Tax-free access to home equity | Impact on inheritance for heirs |

| Protection against market fluctuations | Eligibility restrictions may apply |

| Ability to stay in your home while accessing funds | Potential impact on government benefits eligibility |

| Line of credit can grow over time | Complexity and confusion regarding terms and conditions |

| Non-recourse loan feature protects borrowers and heirs | Property must remain your primary residence |

Flexibility in Accessing Funds

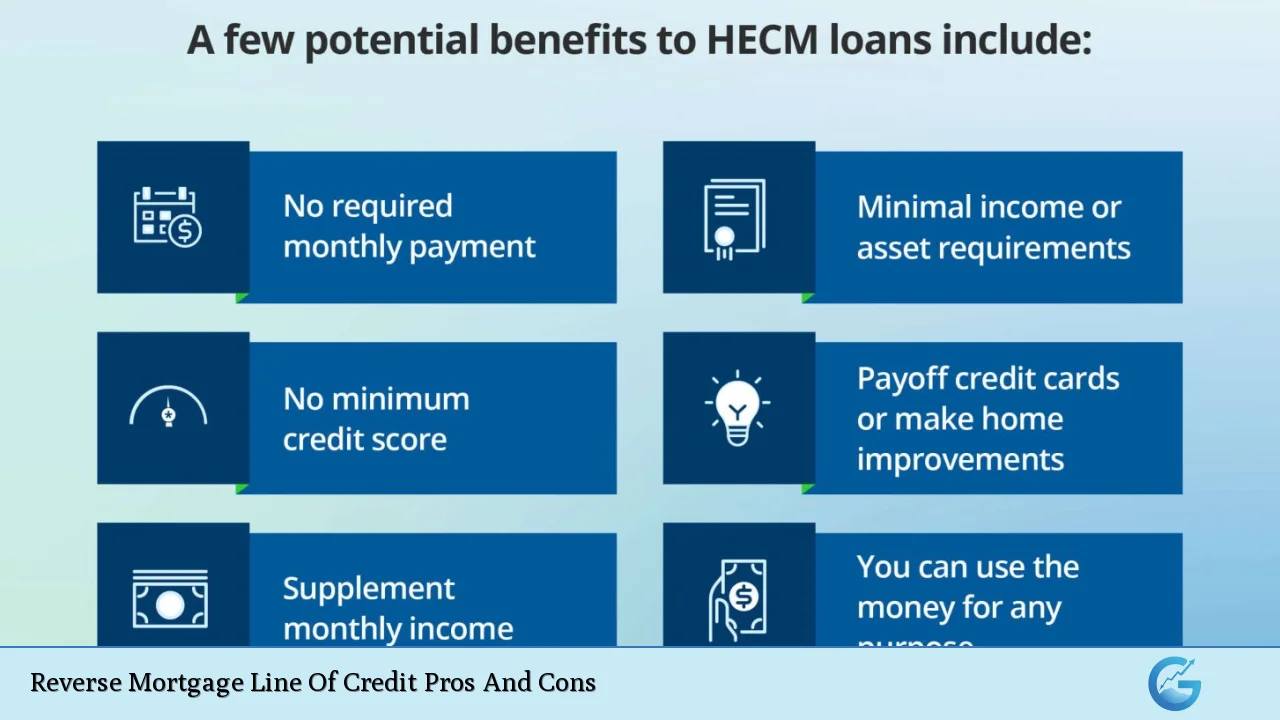

One of the most significant advantages of a reverse mortgage line of credit is the flexibility it provides in accessing funds. Borrowers can choose how much money to withdraw and when, allowing them to tailor their financial strategy according to their needs.

- Variable withdrawal amounts: Borrowers can take out a lump sum, set up monthly payments, or maintain a line of credit for future use.

- Diverse uses: The funds can be used for various purposes, including home improvements, healthcare expenses, or supplementing retirement income.

No Monthly Mortgage Payments Required

Another key benefit is that reverse mortgages eliminate the need for monthly mortgage payments. This feature can significantly alleviate financial pressure for retirees living on fixed incomes.

- Cash flow improvement: Without the burden of monthly payments, retirees can allocate their income toward other essential expenses or savings.

- Long-term financial strategy: Many borrowers use RMLOCs as part of a broader retirement strategy, allowing them to manage their cash flow more effectively.

Tax-Free Access to Home Equity

Funds obtained through a reverse mortgage are not considered taxable income. This aspect makes RMLOCs an attractive option for retirees looking to access their home equity without incurring tax liabilities.

- Financial efficiency: Since the proceeds are tax-free, retirees can utilize these funds without worrying about tax implications.

- Better budgeting: Knowing that the money received will not affect taxable income allows for better financial planning.

Protection Against Market Fluctuations

Unlike traditional home equity lines of credit (HELOCs), RMLOCs offer protection against market fluctuations. This means that borrowers do not have to worry about their line of credit being frozen or reduced due to changes in home values.

- Guaranteed access: As long as the borrower meets the loan obligations, they will have access to the line of credit regardless of market conditions.

- Peace of mind: This feature provides a sense of security for homeowners who may rely on these funds during retirement.

Ability to Stay in Your Home While Accessing Funds

A reverse mortgage allows homeowners to tap into their equity while continuing to live in their homes. This benefit is crucial for many seniors who wish to age in place.

- Retain ownership: Borrowers maintain ownership of their homes throughout the loan term as long as they comply with the loan requirements.

- Community ties: Staying in familiar surroundings can enhance quality of life for retirees who have deep connections to their communities.

Line of Credit Can Grow Over Time

Another unique feature of RMLOCs is that the unused portion of the line of credit grows over time. This growth is based on current interest rates plus mortgage insurance premiums.

- Increased borrowing capacity: As the line of credit grows, borrowers may have access to more funds in the future if needed.

- Strategic financial planning: This feature allows homeowners to plan for unexpected expenses down the road while maintaining flexibility.

Non-Recourse Loan Feature Protects Borrowers and Heirs

Reverse mortgages are classified as non-recourse loans, meaning that borrowers (and their heirs) are not personally liable for any amount exceeding the home’s value when the loan becomes due.

- Protection from debt: If property values decline, borrowers will not owe more than what the house is worth at the time of repayment.

- Inheritance assurance: Heirs can sell the property without being responsible for any remaining debt beyond its value.

Higher Initial Costs Compared to Traditional Loans

Despite their advantages, reverse mortgages often come with higher initial costs than traditional loans. These costs can include origination fees, closing costs, and mortgage insurance premiums.

- Upfront expenses: Borrowers need to be prepared for significant upfront costs that might strain finances initially.

- Long-term impact: These costs are typically added to the loan balance, which could affect overall financial health over time.

Accumulating Interest Increases Loan Balance Over Time

While reverse mortgages eliminate monthly payments, they do accumulate interest over time. This growing debt can lead to a significant increase in the total amount owed when repayment becomes necessary.

- Debt growth: The longer borrowers keep the loan without making payments, the larger their debt becomes due to accumulating interest.

- Financial planning necessity: Homeowners must consider how this growing debt will affect their estate and financial future.

Impact on Inheritance for Heirs

Another disadvantage is that reverse mortgages can reduce the amount of inheritance left for heirs. As equity is drawn down through withdrawals or accumulated interest, less value remains in the property upon sale or transfer after death.

- Reduced estate value: Heirs may inherit less than expected if significant equity has been accessed through an RMLOC.

- Potential family disputes: Concerns about inheritance may lead to family tensions if expectations are not clearly communicated beforehand.

Eligibility Restrictions May Apply

To qualify for a reverse mortgage line of credit, borrowers must meet specific eligibility criteria. These restrictions can limit access for some potential applicants.

- Age requirement: Borrowers must be at least 62 years old and own their homes outright or have a low remaining mortgage balance.

- Financial assessment: Lenders conduct assessments to ensure borrowers can meet ongoing obligations such as property taxes and insurance payments.

Potential Impact on Government Benefits Eligibility

Using a reverse mortgage may affect eligibility for certain government assistance programs like Medicaid or Supplemental Security Income (SSI). This impact is crucial for seniors relying on these benefits for healthcare or living expenses.

- Asset limitations: Funds from a reverse mortgage could count as assets when determining eligibility for needs-based programs.

- Consultation recommended: It’s advisable for potential borrowers to consult with financial advisors regarding how an RMLOC might affect government benefits before proceeding.

Complexity and Confusion Regarding Terms and Conditions

The terms associated with reverse mortgages can be complex and confusing. Many potential borrowers struggle to understand all aspects before committing.

- Counseling requirement: To ensure borrowers fully understand their options and obligations, counseling sessions are often mandated prior to taking out an RMLOC.

- Risk of misunderstanding: Misunderstanding terms could lead borrowers into unfavorable situations if they are unaware of specific requirements or implications associated with the loan structure.

Property Must Remain Your Primary Residence

Finally, one critical requirement is that properties financed through a reverse mortgage must remain primary residences. This stipulation limits flexibility regarding moving or renting out properties after securing an RMLOC.

- Restrictions on relocation: If homeowners wish to move out or rent their homes, they must pay off the reverse mortgage first.

- Lifestyle considerations: Seniors considering relocation should weigh this limitation against their long-term plans before opting for an RMLOC.

In conclusion, a reverse mortgage line of credit offers both compelling advantages and significant disadvantages that require careful consideration by potential borrowers. While it provides flexibility in accessing home equity without monthly payments and offers protection against market fluctuations, it also comes with higher initial costs and potential impacts on inheritance and government benefits eligibility.

Individuals interested in finance should conduct thorough research and consult with professionals before deciding whether an RMLOC aligns with their financial goals and retirement plans.

Frequently Asked Questions About Reverse Mortgage Line Of Credit Pros And Cons

- What is a reverse mortgage line of credit?

A reverse mortgage line of credit allows homeowners aged 62 and older to convert part of their home equity into cash without selling their home. - How does a reverse mortgage differ from a traditional loan?

A reverse mortgage does not require monthly payments; instead, it accumulates interest over time until repayment is triggered by selling the home or upon death. - Can I use a reverse mortgage line of credit as my only source of income?

While it can supplement income, relying solely on it may not be advisable due to accumulating debt. - What happens if I move out of my home?

If you move out or no longer occupy your home as your primary residence, you must repay the loan. - Are there any tax implications with a reverse mortgage?

No; proceeds from a reverse mortgage are typically tax-free since they are considered loans against your home equity. - Will my heirs be responsible for paying back the loan?

No; heirs will not owe more than the home’s value at repayment due date due to non-recourse loan protections. - How does a reverse mortgage affect my eligibility for government benefits?

The funds from a reverse mortgage could impact your eligibility for needs-based programs like Medicaid or SSI. - Is it possible to refinance an existing mortgage with a reverse mortgage?

Yes; many people use reverse mortgages specifically to pay off existing traditional mortgages.