Reverse mortgages have gained popularity as a financial tool for older homeowners, particularly in Texas, where many seniors seek ways to leverage their home equity without the need to relocate. A reverse mortgage allows homeowners aged 62 and older to convert a portion of their home equity into cash, which can be used for various purposes such as covering living expenses, healthcare costs, or home improvements. This financial product offers unique advantages and disadvantages that potential borrowers should carefully consider.

The following sections will explore the pros and cons of reverse mortgages in detail, providing insights into how they function and the implications they may have on homeowners’ finances and estates.

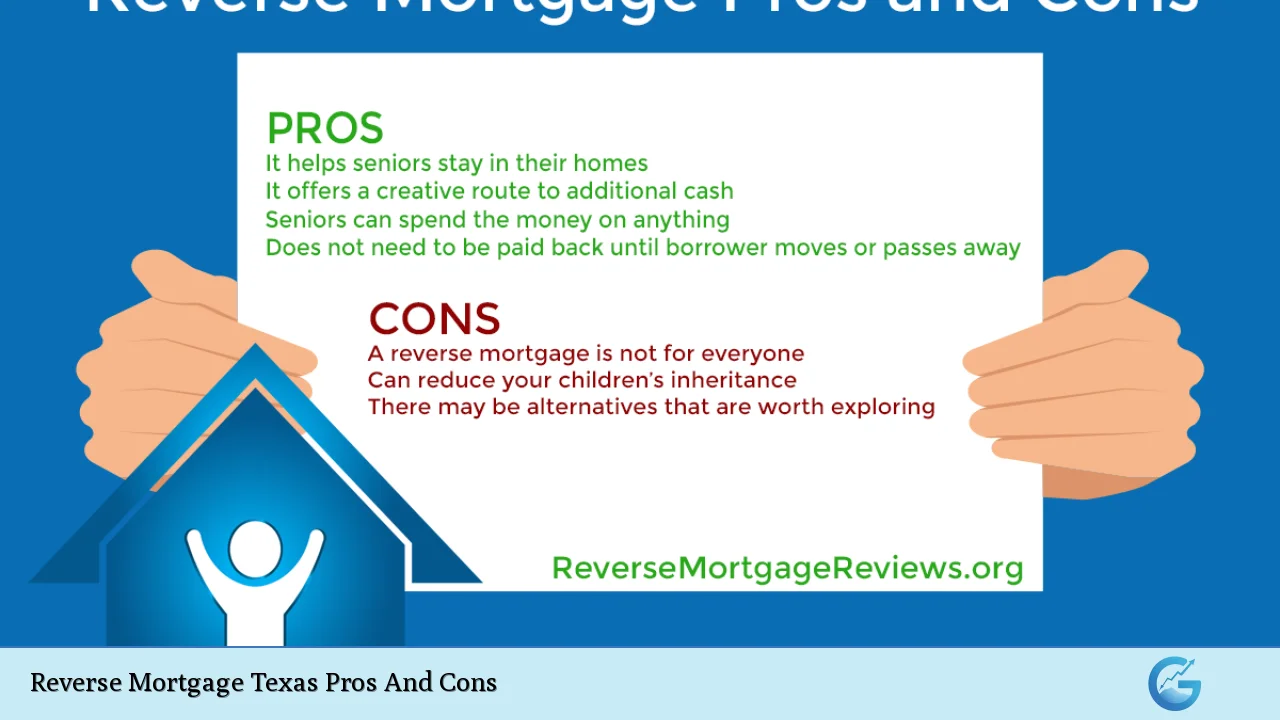

| Pros | Cons |

|---|---|

| Access to home equity without monthly payments | Higher costs compared to traditional loans |

| Ability to remain in your home | Reduction of home equity over time |

| Flexible payment options (lump sum, monthly payments, line of credit) | Complex terms and conditions |

| No income or credit score requirements | Potential impact on government benefits eligibility |

| Tax-free income from loan proceeds | Loan repayment upon death or moving out |

| Helps cover unexpected expenses in retirement | Requires ongoing property maintenance and tax payments |

| Can be used to pay off existing mortgages | Heirs may face financial burdens after the homeowner’s death |

Access to Home Equity Without Monthly Payments

One of the most significant advantages of a reverse mortgage is that it allows homeowners to access their home equity without making monthly mortgage payments. This feature can be particularly beneficial for retirees on fixed incomes who may struggle with regular payment obligations.

- Financial Relief: By eliminating monthly payments, seniors can free up cash flow for other essential expenses.

- Retain Home Ownership: Homeowners maintain the title to their property while benefiting from its equity.

Ability to Remain in Your Home

A reverse mortgage enables seniors to stay in their homes for as long as they wish, provided they meet the loan’s requirements such as paying property taxes and maintaining the property.

- Stability: This arrangement offers emotional stability and comfort, allowing seniors to age in place.

- Familiar Environment: Remaining in a familiar setting can significantly enhance quality of life during retirement.

Flexible Payment Options

Reverse mortgages offer various disbursement options, including lump sums, monthly payments, or lines of credit. This flexibility allows borrowers to tailor their financial strategy according to their needs.

- Customizable Solutions: Borrowers can choose how they want to receive funds based on their financial situation.

- Emergency Funds: A line of credit option can provide a safety net for unexpected expenses.

No Income or Credit Score Requirements

Unlike traditional loans, reverse mortgages typically do not have stringent income or credit score requirements. This accessibility can make them an attractive option for many seniors.

- Inclusivity: Seniors with limited income or poor credit history may still qualify for a reverse mortgage.

- Focus on Home Equity: The primary qualification is based on the amount of equity in the home rather than the borrower’s financial history.

Tax-Free Income from Loan Proceeds

Funds received from a reverse mortgage are generally not considered taxable income. This tax-free status can provide significant financial relief for retirees.

- Maximized Benefits: Seniors can use these funds without worrying about tax implications, allowing them to stretch their retirement savings further.

Helps Cover Unexpected Expenses in Retirement

Reverse mortgages can serve as a valuable resource for covering unforeseen costs that may arise during retirement, such as medical expenses or home repairs.

- Financial Flexibility: Accessing home equity can provide peace of mind knowing that funds are available when needed.

- Improved Quality of Life: Having extra cash on hand can help seniors maintain their lifestyle and manage health-related costs effectively.

Can Be Used to Pay Off Existing Mortgages

For homeowners with existing mortgages, a reverse mortgage can be utilized to pay off those debts. This process simplifies finances by consolidating loans into one manageable payment structure.

- Debt Elimination: Paying off an existing mortgage reduces monthly financial obligations and increases available cash flow.

- Enhanced Financial Security: Eliminating traditional mortgage payments can significantly improve overall financial stability for retirees.

Higher Costs Compared to Traditional Loans

One of the primary disadvantages of reverse mortgages is that they often come with higher fees and closing costs than traditional loans. These costs can include origination fees, mortgage insurance premiums, and closing costs that may range from $5,000 to $10,000 or more.

- Initial Financial Burden: The upfront costs can consume a substantial portion of the homeowner’s equity right away.

- Long-Term Financial Impact: Over time, these high costs can lead to reduced overall equity in the home.

Reduction of Home Equity Over Time

As homeowners draw funds from their reverse mortgage, the loan balance increases due to accrued interest. Consequently, this process gradually diminishes the homeowner’s equity in the property.

- Erosion of Wealth: The longer a reverse mortgage is held, the less equity remains for heirs or future needs.

- Potential Financial Strain: Homeowners must consider how much equity they are willing to sacrifice over time.

Complex Terms and Conditions

Reverse mortgages often involve intricate terms that may be difficult for some borrowers to fully understand. This complexity can lead to confusion regarding repayment obligations and other critical aspects of the loan.

- Need for Counseling: Borrowers are required to undergo counseling before obtaining a reverse mortgage, which highlights its complexity but may not fully clarify all nuances involved.

- Risk of Misunderstanding: Failure to comprehend loan terms could lead to unintended consequences down the line.

Potential Impact on Government Benefits Eligibility

Receiving funds from a reverse mortgage may affect eligibility for certain government assistance programs such as Medicaid or Supplemental Security Income (SSI).

- Asset Considerations: Any remaining funds after receiving a lump sum could count against asset limits for these programs.

- Need-Based Programs Risk: Seniors relying on need-based assistance must carefully manage how they utilize reverse mortgage proceeds.

Loan Repayment Upon Death or Moving Out

A significant drawback is that reverse mortgages must be repaid when the borrower dies or moves out of the home. This requirement places an additional burden on heirs who may need to sell the property or find alternative means of repayment.

- Inheritance Concerns: Heirs may inherit less wealth than anticipated due to outstanding loan balances that must be settled upon inheritance.

- Financial Pressure on Family Members: Families might face difficult decisions regarding how to handle inherited properties encumbered by reverse mortgages.

Requires Ongoing Property Maintenance and Tax Payments

Homeowners with reverse mortgages still bear responsibility for maintaining their properties and paying property taxes. Failing to meet these obligations could lead to foreclosure on the loan.

- Continued Financial Responsibility: Borrowers must ensure they have sufficient resources not just for living expenses but also for ongoing maintenance costs associated with homeownership.

- Risk of Foreclosure: Neglecting property taxes or maintenance could jeopardize ownership rights over time.

Heirs May Face Financial Burdens After the Homeowner’s Death

When a homeowner passes away with an outstanding reverse mortgage balance, heirs are responsible for settling this debt. This situation could lead heirs into complex financial scenarios involving selling the home or taking out loans themselves.

- Emotional Stress on Families: The loss of a loved one compounded by financial pressures can create significant stress during an already challenging time.

- Need for Planning: Families should discuss estate planning strategies early on if there is a reverse mortgage involved in order to mitigate potential issues later on.

In conclusion, while reverse mortgages offer several benefits such as access to cash without monthly payments and flexibility in fund usage, they also come with notable drawbacks including high costs and potential impacts on heirs. It is crucial for homeowners considering this option in Texas—or anywhere else—to weigh these pros and cons carefully against their individual circumstances and long-term financial goals. Consulting with financial advisors or housing counselors experienced in this area can provide valuable insights tailored specifically to one’s situation.

Frequently Asked Questions About Reverse Mortgage Texas Pros And Cons

- What is a reverse mortgage?

A reverse mortgage allows homeowners aged 62 and older to convert part of their home equity into cash without having monthly payments. - What are the eligibility requirements?

To qualify, you must be at least 62 years old, live in your home as your primary residence, and have sufficient equity. - How do I receive funds from a reverse mortgage?

You can receive funds as a lump sum, monthly payments, or through a line of credit based on your needs. - Are there any risks associated with reverse mortgages?

Yes, risks include high upfront costs, reduction of home equity over time, and potential impacts on government benefits. - Can I lose my house with a reverse mortgage?

If you fail to pay property taxes or maintain your home properly, you risk foreclosure. - What happens when I pass away?

The loan must be repaid upon your death; heirs will need to settle any outstanding balance either by selling the house or paying off the loan. - Is income from a reverse mortgage taxable?

No, funds received from a reverse mortgage are generally considered tax-free income. - Can I use a reverse mortgage to pay off an existing mortgage?

Yes, many homeowners use reverse mortgages specifically for this purpose.