Stock lending is an innovative financial service that allows investors to earn passive income by lending out their shares to institutions. Robinhood, a popular trading platform, has incorporated this feature to provide its users with an opportunity to generate additional revenue from their investments. However, like any financial strategy, stock lending comes with its own set of advantages and disadvantages that potential participants should carefully consider.

This article explores the pros and cons of stock lending on Robinhood, providing a comprehensive overview for investors interested in finance, crypto, forex, and money markets.

| Pros | Cons |

|---|---|

| Passive Income Generation | Loss of Voting Rights |

| Retain Ownership of Shares | Dividend Payment Complications |

| No Additional Fees | Limited Income Potential |

| Security Measures in Place | Market Risk Exposure |

| Simple Enrollment Process | Potential for Default Risk |

Passive Income Generation

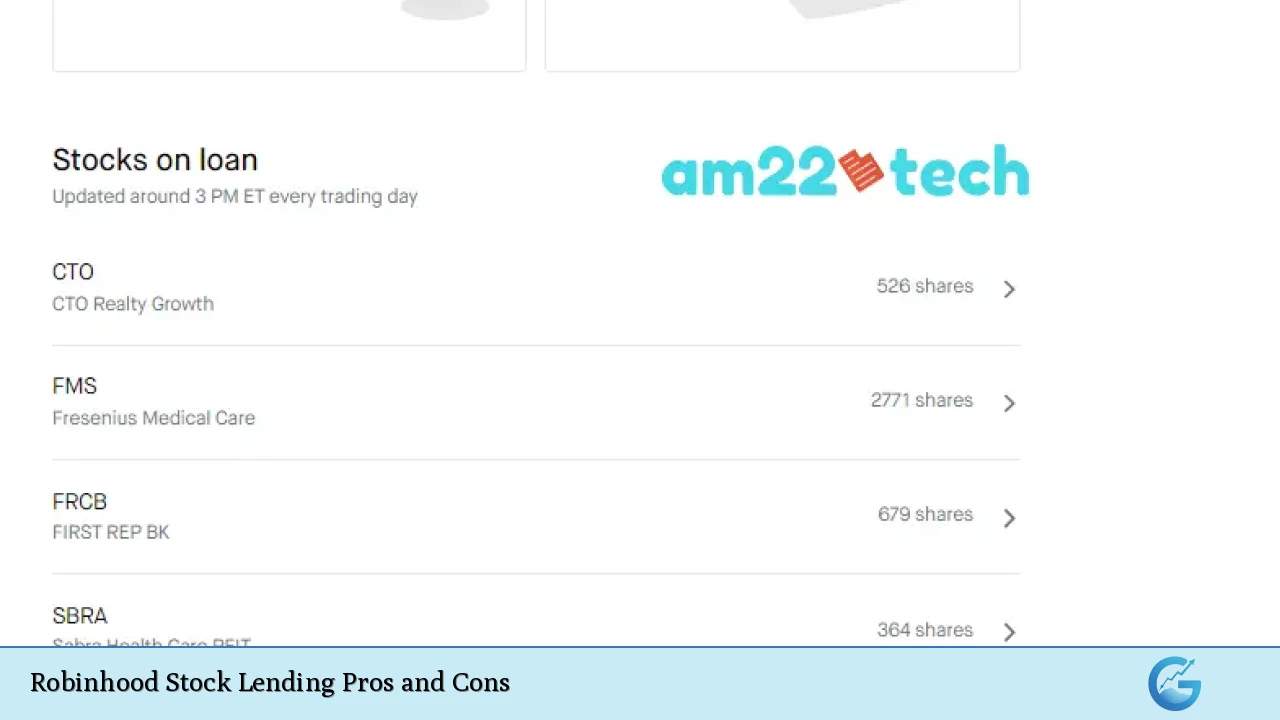

One of the most appealing aspects of stock lending through Robinhood is the ability to earn passive income. Investors can generate revenue simply by holding onto their stocks and allowing them to be lent out.

- Earnings Based on Demand: The income earned from stock lending is contingent upon the demand for the stocks being lent. When stocks are in high demand, lenders can earn a more substantial return.

- Monthly Payments: Earnings from stock lending are credited to the investor’s account on a monthly basis, providing a steady stream of income without needing to actively manage the investment.

Loss of Voting Rights

While participating in stock lending, investors relinquish their voting rights associated with the shares they lend out.

- Impact on Corporate Decisions: Losing voting rights means that investors cannot participate in important corporate decisions, such as mergers or board elections, potentially affecting their influence over the companies they invest in.

- Regaining Rights After Loan Termination: Once the loan is terminated and shares are returned, investors regain their voting rights. However, this can be a significant drawback for those who value having a say in company matters.

Retain Ownership of Shares

Despite lending out shares, investors retain ownership of their stocks throughout the process.

- Flexibility to Sell: Investors can sell their shares at any time, even if they are currently loaned out. This flexibility allows for strategic decision-making based on market conditions.

- No Loss of Capital Gains: Since ownership remains intact, investors still benefit from any capital appreciation while their shares are on loan.

Dividend Payment Complications

When stocks that pay dividends are lent out, there can be complications regarding dividend payments.

- Cash-in-Lieu Payments: Investors may receive “cash-in-lieu” payments instead of actual dividends while their shares are loaned out. These payments may be taxed differently than qualified dividends, potentially leading to a higher tax burden.

- Efforts to Mitigate Impact: Robinhood generally attempts to return shares before dividend record dates to ensure that investors receive regular dividends rather than cash equivalents. However, this is not guaranteed.

No Additional Fees

Participating in Robinhood’s stock lending program incurs no additional fees for users.

- Pure Earnings Model: The income generated from stock lending is purely upside for investors. They do not have to worry about hidden costs or fees eating into their profits.

- Transparent Earnings Structure: This straightforward approach makes it easier for investors to understand how much they can potentially earn from lending out their shares.

Limited Income Potential

While stock lending can provide passive income, the earnings may be limited compared to other investment strategies.

- Dependence on Stock Demand: The amount earned from stock lending largely depends on how in-demand the stocks are. Stocks that are not frequently borrowed may yield minimal returns.

- Not Suitable for All Investors: For those seeking significant returns or aggressive growth strategies, stock lending may not be the best option due to its generally lower earning potential.

Security Measures in Place

Robinhood implements various security measures to protect both lenders and borrowers within its stock lending program.

- Collateral Requirements: Borrowers must provide collateral equal to at least 100% of the value of the loaned stocks. This reduces the risk associated with lending out securities.

- Regulatory Compliance: The program operates under SEC regulations designed to protect investors and ensure that borrowed securities are returned as promised.

Market Risk Exposure

Engaging in stock lending exposes investors to certain market risks that should not be overlooked.

- Impact of Short Selling: The institutions borrowing shares often use them for short selling. This practice can lead to downward pressure on stock prices, which could negatively affect the value of an investor’s holdings.

- Market Volatility Risks: If market conditions shift dramatically while shares are lent out, it could impact both the value of those shares and the overall investment strategy employed by the lender.

Potential for Default Risk

There is a risk that Robinhood Securities could default on its obligations under the stock lending program.

- Risk of Non-returned Shares: In rare cases where Robinhood Securities fails to return loaned securities due to financial issues or bankruptcy, lenders may face challenges in retrieving their investments.

- SIPC Coverage Limitations: While SIPC insurance protects against losses up to $500,000 (including $250,000 for cash), it does not cover losses specifically related to stock lending defaults. Investors should be aware of this limitation when considering participation in stock lending programs.

In conclusion, Robinhood’s stock lending program offers a unique opportunity for investors looking to generate passive income from their portfolios. However, it is essential for potential participants to weigh both the advantages and disadvantages carefully.

Investors must consider factors such as loss of voting rights, potential complications with dividend payments, and market risks before enrolling in this program. By understanding these elements thoroughly, individuals can make informed decisions about whether stock lending aligns with their overall investment strategy and financial goals.

Frequently Asked Questions About Robinhood Stock Lending

- What is stock lending?

Stock lending allows investors to lend their shares to institutions in exchange for fees or interest payments. - How do I participate in Robinhood’s stock lending program?

You can enable stock lending through your account settings on the Robinhood app or website. - Will I still own my stocks if I lend them out?

Yes, you retain ownership of your shares even while they are lent out. - What happens if my loaned stocks pay dividends?

You may receive cash-in-lieu payments instead of actual dividends while your stocks are loaned out. - Aren’t there risks involved with stock lending?

Yes, there are risks such as loss of voting rights and potential default risk from borrowers. - Can I sell my stocks while they are loaned out?

You can sell your shares at any time even if they are currently on loan. - Is there a minimum account balance required for stock lending?

No specific minimum account balance is required; however, having more valuable and in-demand stocks increases your chances of earning income. - How often do I get paid for stock lending?

Earnings from stock lending are credited monthly based on demand and duration of loans.