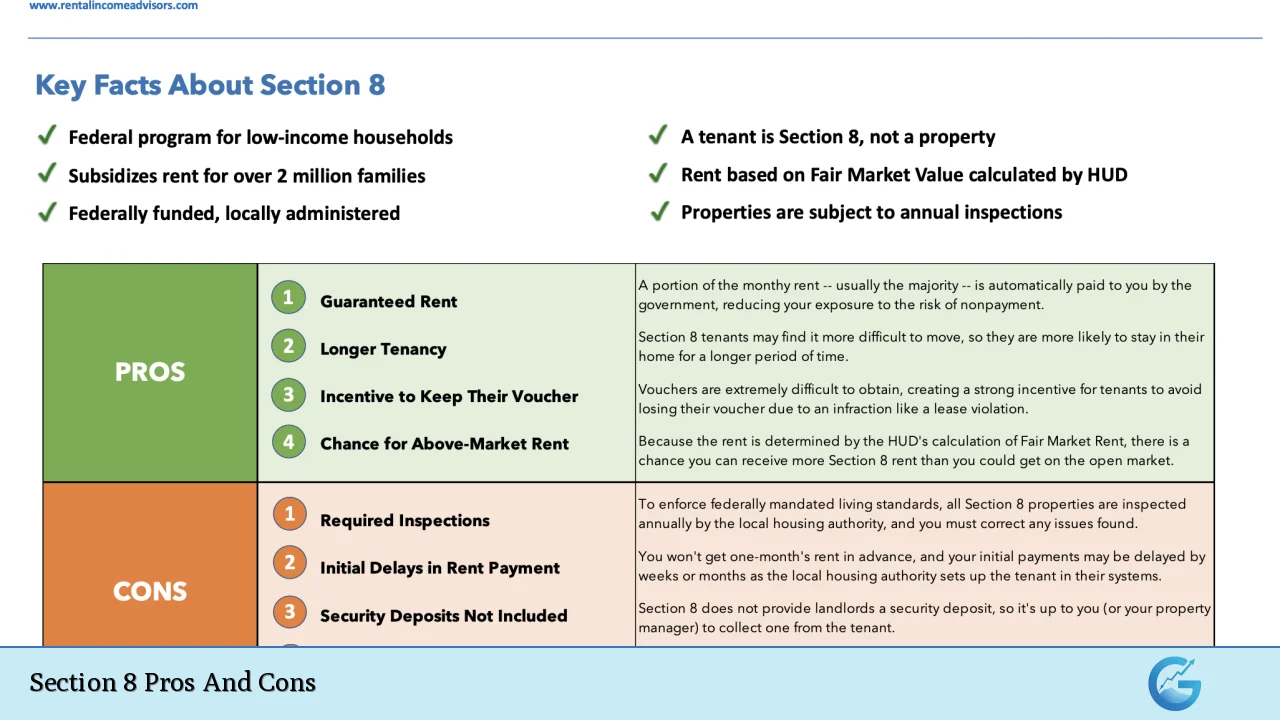

The Section 8 program, officially known as the Housing Choice Voucher Program, is a federal initiative designed to assist low-income families, the elderly, and individuals with disabilities in affording decent, safe, and sanitary housing. By providing rental assistance, this program enables participants to pay a portion of their rent while the government covers the remainder. For landlords, renting to Section 8 tenants can present both opportunities and challenges. This article explores the various advantages and disadvantages of engaging with Section 8 tenants, providing a comprehensive overview for potential landlords and investors in the real estate market.

| Pros | Cons |

|---|---|

| Stable and guaranteed rental income | Increased scrutiny and inspections |

| Larger pool of potential tenants | Potential stigma attached to Section 8 properties |

| Longer tenancy durations | Limited control over rent increases |

| Government support for property maintenance standards | Initial delays in receiving rental payments |

| Access to specialized marketing platforms for vacancies | Complexity in compliance with federal regulations |

Stable and Guaranteed Rental Income

One of the most significant advantages of renting to Section 8 tenants is the stable and guaranteed rental income provided through government subsidies. Typically, Section 8 tenants pay about 30% of their income towards rent, while the government covers the remaining balance directly to the landlord. This arrangement significantly reduces the risk of late or missed payments compared to traditional rental agreements.

- Reliable payments: Landlords receive consistent payments from the government, which can be more dependable than private tenants.

- Financial security: The assurance of regular income can enhance cash flow management for property owners.

Larger Pool of Potential Tenants

By accepting Section 8 vouchers, landlords tap into a larger pool of potential tenants. With many families on waiting lists for affordable housing, landlords can fill vacancies more quickly than if they were only targeting traditional renters.

- High demand: Many areas have limited options for low-income families, making Section 8 properties appealing.

- Reduced vacancy rates: Properties that accept Section 8 vouchers often experience lower vacancy rates due to the high demand from eligible tenants.

Longer Tenancy Durations

Section 8 tenants tend to stay longer in their rentals compared to traditional renters. This is primarily because moving is complicated for them; they must find another landlord willing to accept their voucher and undergo inspections.

- Stability: Longer tenancy reduces turnover costs associated with finding new tenants.

- Predictable income: A stable tenant base contributes to predictable cash flow over time.

Government Support for Property Maintenance Standards

The Section 8 program mandates that properties meet specific health and safety standards. This requirement ensures that landlords maintain their properties adequately.

- Incentives for upkeep: Landlords are motivated to keep their properties in good condition due to inspection requirements.

- Quality assurance: Regular inspections help ensure that properties remain safe and habitable for tenants.

Access to Specialized Marketing Platforms for Vacancies

Landlords who accept Section 8 vouchers benefit from access to specialized marketing platforms designed specifically for this demographic. Websites like GoSection8 and WeTakeSection8 allow landlords to list their properties where potential tenants are actively searching.

- Targeted outreach: These platforms help landlords reach a specific audience looking for affordable housing options.

- Enhanced visibility: Listings on these sites can lead to quicker placements compared to conventional rental listings.

Increased Scrutiny and Inspections

While there are many benefits to renting to Section 8 tenants, one notable disadvantage is the increased scrutiny and inspections required by the program. Before a property can be rented under Section 8 guidelines, it must pass a thorough inspection conducted by local housing authorities.

- Regulatory compliance: Landlords must ensure their properties meet strict health and safety standards set by HUD.

- Potential costs: Preparing a property for inspection may require additional time and financial investment.

Potential Stigma Attached to Section 8 Properties

Renting to Section 8 tenants can sometimes carry a stigma. Many people associate these properties with lower quality or undesirable neighborhoods, which may deter potential renters who do not have housing vouchers.

- Perception issues: Some landlords may find it challenging to attract non-Section 8 tenants due to negative perceptions.

- Marketability concerns: Maintaining high standards in property management becomes essential to counteract these biases.

Limited Control Over Rent Increases

Landlords participating in the Section 8 program face restrictions regarding how much they can increase rent annually. The government sets fair market rents (FMR) based on local economic conditions, which limits landlords’ ability to adjust rents according to market demands.

- Capped increases: Rent increases are often limited to a certain percentage (typically around 5-8% annually).

- Market fluctuations: Landlords may find themselves unable to raise rents in line with rising property values or inflation.

Initial Delays in Receiving Rental Payments

When first engaging with Section 8 tenants, landlords may experience initial delays in receiving rental payments while applications are processed. This delay can impact cash flow during the transition period.

- Processing time: It often takes several weeks for housing authorities to approve vouchers and initiate payments.

- Financial planning: Landlords need to account for this potential delay when budgeting for expenses.

Complexity in Compliance with Federal Regulations

Navigating the complexities of federal regulations related to the Section 8 program can be daunting for some landlords. Compliance requires understanding various rules governing tenant eligibility, property standards, and reporting requirements.

- Regulatory burden: The need for meticulous record-keeping can add administrative overhead.

- Legal implications: Non-compliance can result in penalties or loss of participation in the program.

In conclusion, renting to Section 8 tenants presents both significant advantages and notable challenges. The stability of guaranteed rental income, access to a larger tenant pool, and longer tenancy durations are compelling reasons for landlords considering this option. However, they must also weigh these benefits against increased scrutiny from inspections, potential stigma associated with Section 8 properties, limited control over rent increases, initial payment delays, and compliance complexities.

Engaging with this program can be rewarding but requires careful consideration and preparation. Landlords should conduct thorough research and possibly consult with experienced peers or professionals before making decisions regarding participation in the Section 8 program.

Frequently Asked Questions About Section 8 Pros And Cons

- What is Section 8?

The Housing Choice Voucher Program (Section 8) provides rental assistance to low-income individuals by subsidizing their rent payments. - How does renting to Section 8 tenants benefit landlords?

Landlords benefit from stable income through guaranteed government payments and access to a larger pool of prospective tenants. - Are there any risks associated with renting to Section 8 tenants?

Yes, risks include increased property inspections, potential stigma from other renters, and limited control over rent increases. - How do I qualify as a landlord for Section 8?

You must apply through your local public housing authority (PHA) and ensure your property meets HUD’s Housing Quality Standards. - Can I refuse a tenant with a Section 8 voucher?

Generally yes; however, some states have laws prohibiting discrimination based on source of income. - What happens if a tenant fails to pay their portion of rent?

If a tenant does not pay their share of rent, they are subject to eviction just like any other tenant. - How often are rent increases allowed under Section 8?

Rent increases are typically capped at around 5-8% annually based on fair market rent assessments. - What should I do if my property fails an inspection?

You will need to address any issues identified during the inspection before reapplying or renting under the program again.