Social Security, a cornerstone of the United States’ social welfare system, has been a subject of intense debate since its inception in 1935. This comprehensive program, designed to provide financial support to retirees, disabled individuals, and their dependents, has far-reaching implications for the economy and society at large. As we delve into the advantages and disadvantages of Social Security, it’s crucial to understand its complex nature and the various factors that influence its effectiveness and sustainability.

| Pros | Cons |

|---|---|

| Guaranteed Income for Retirees | Potential Insolvency |

| Disability and Survivor Benefits | Demographic Challenges |

| Inflation Protection | Limited Investment Returns |

| Reduction of Elderly Poverty | Intergenerational Wealth Transfer |

| Universal Coverage | Work Disincentives |

| Progressive Benefit Structure | Administrative Costs |

Guaranteed Income for Retirees

One of the most significant advantages of Social Security is the provision of a guaranteed income stream for retirees. This safety net ensures that individuals have a basic level of financial support in their golden years, regardless of their personal savings or investment performance.

- Provides a stable foundation for retirement planning

- Reduces the risk of elderly poverty

- Offers peace of mind for workers throughout their careers

The guaranteed nature of Social Security benefits is particularly valuable in times of economic uncertainty or market volatility, providing a reliable income source that is not subject to the whims of the stock market.

Potential Insolvency

Despite its benefits, Social Security faces significant challenges, with the most pressing being the potential for insolvency. The program’s pay-as-you-go structure, combined with demographic shifts, has led to concerns about its long-term sustainability.

- Trust fund reserves projected to be depleted by 2035

- Potential for benefit reductions or tax increases

- Political gridlock complicating reform efforts

The looming insolvency of Social Security poses a serious threat to future retirees and may require substantial changes to the program’s structure or funding mechanisms to ensure its continued viability.

Disability and Survivor Benefits

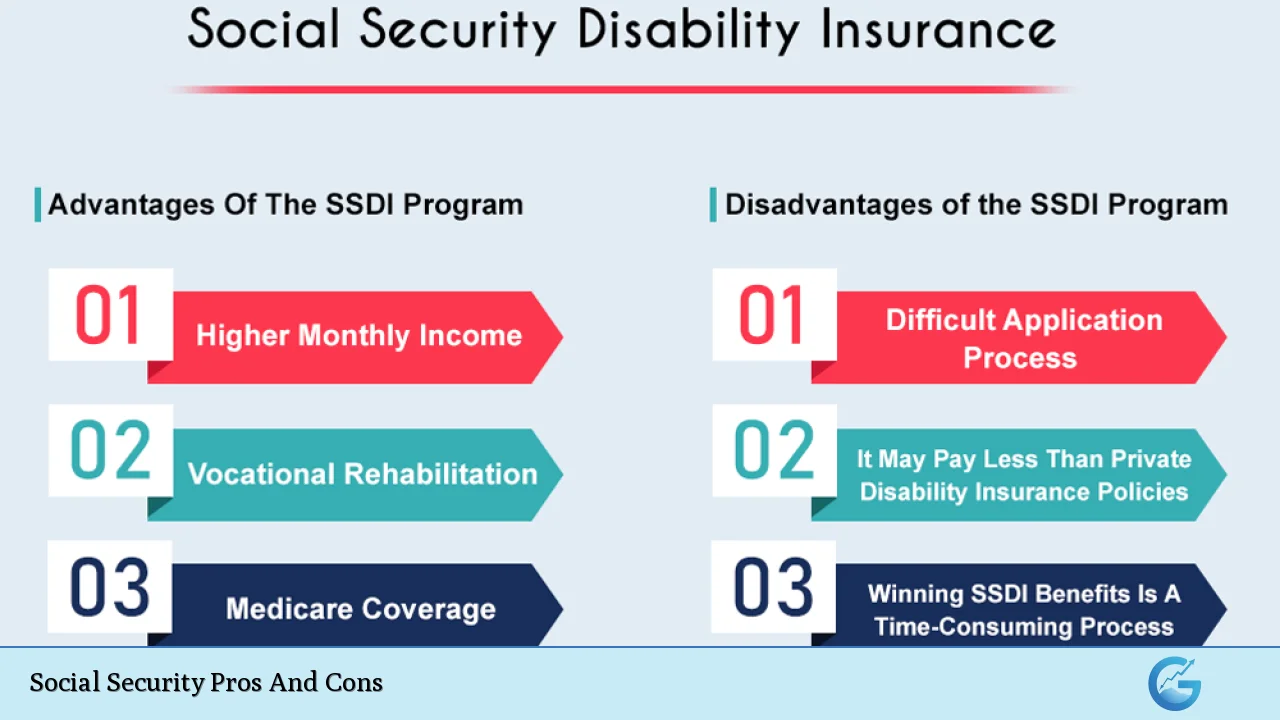

Social Security extends beyond retirement benefits, offering crucial support for disabled workers and the families of deceased beneficiaries. These additional protections provide a safety net for millions of Americans who might otherwise face severe financial hardship.

- Disability Insurance (DI) supports workers who become disabled before retirement age

- Survivor benefits protect families in the event of a breadwinner’s death

- Comprehensive coverage that private insurance may not match

The disability and survivor benefits offered by Social Security play a vital role in maintaining financial stability for vulnerable populations, often serving as a lifeline during challenging times.

Demographic Challenges

The changing demographics of the United States pose a significant challenge to the Social Security system. As the baby boomer generation retires and life expectancy increases, the ratio of workers to beneficiaries is shifting, putting strain on the program’s finances.

- Fewer workers supporting more retirees

- Increased longevity leading to longer benefit payout periods

- Potential for reduced benefits or increased taxes on future generations

The demographic shift underway in the United States threatens the long-term viability of Social Security, potentially requiring significant adjustments to benefit levels or tax rates to maintain the program’s solvency.

Inflation Protection

A key feature of Social Security is its built-in protection against inflation through annual cost-of-living adjustments (COLAs). This ensures that the purchasing power of benefits is maintained over time, providing crucial protection for retirees on fixed incomes.

- Annual adjustments based on the Consumer Price Index (CPI)

- Helps beneficiaries keep pace with rising costs of goods and services

- Unique advantage over many private pension plans

The inflation protection offered by Social Security is a critical safeguard for retirees, helping to preserve the real value of their benefits in the face of rising prices and economic changes.

Limited Investment Returns

While Social Security provides a guaranteed benefit, it offers limited potential for investment returns compared to private retirement accounts. The program’s conservative investment approach, focused on government securities, may result in lower overall returns for beneficiaries.

- Lower potential returns compared to diversified investment portfolios

- Opportunity cost of foregone investment in higher-yielding assets

- Reduced ability to build substantial wealth through the program

The conservative investment strategy of Social Security, while ensuring stability, may result in lower overall returns for beneficiaries compared to more aggressive private investment approaches.

Reduction of Elderly Poverty

Social Security has played a significant role in reducing poverty rates among the elderly population. By providing a baseline of income support, the program has helped millions of seniors maintain a basic standard of living in retirement.

- Dramatic decrease in elderly poverty rates since the program’s inception

- Provides a financial foundation for those with limited savings or pensions

- Supports economic stability and consumer spending among retirees

The impact of Social Security on elderly poverty rates has been substantial, serving as a crucial safety net for millions of Americans and contributing to improved quality of life for seniors.

Intergenerational Wealth Transfer

The pay-as-you-go structure of Social Security results in a significant intergenerational transfer of wealth, with current workers funding the benefits of current retirees. This system can create tensions between generations and raise questions of fairness and sustainability.

- Younger workers may receive less in benefits than they contribute in taxes

- Potential for resentment as demographic shifts increase the burden on workers

- Challenges in balancing the needs of different generations

The intergenerational wealth transfer inherent in Social Security’s structure raises important questions about equity and sustainability, particularly as demographic shifts alter the balance between workers and retirees.

Universal Coverage

Social Security’s universal coverage ensures that nearly all American workers are included in the system, providing a broad base of protection and promoting social cohesion.

- Covers the vast majority of workers, regardless of income or industry

- Promotes a sense of shared responsibility and social solidarity

- Simplifies retirement planning by providing a baseline of support for all

The universal nature of Social Security coverage is a key strength of the program, ensuring widespread protection and fostering a sense of collective responsibility for retirement security.

Work Disincentives

Critics argue that Social Security can create disincentives to work, particularly for older individuals nearing retirement age. The structure of benefits and earnings limits may discourage continued employment or part-time work in retirement.

- Earnings limits for early retirees may discourage part-time work

- Benefit structure may incentivize early retirement for some workers

- Potential loss of productivity and tax revenue from reduced labor force participation

The potential work disincentives created by Social Security’s benefit structure and earnings limits may have broader economic implications, affecting labor force participation and productivity among older workers.

Progressive Benefit Structure

Social Security’s benefit formula is designed to be progressive, providing proportionally higher benefits to lower-income workers relative to their contributions. This structure helps to address income inequality and provide greater support to those most in need.

- Higher replacement rates for low-income workers

- Helps to mitigate the impact of income disparities in retirement

- Supports the program’s role as a social insurance mechanism

The progressive nature of Social Security’s benefit structure aligns with its mission as a social insurance program, providing greater relative support to lower-income workers and helping to address retirement income inequality.

Administrative Costs

While Social Security is generally considered efficient in terms of administrative costs, the program still incurs significant expenses in managing benefits for millions of Americans. These costs, while relatively low compared to private alternatives, represent a substantial allocation of resources.

- Administrative expenses, while low as a percentage, total billions of dollars annually

- Costs associated with fraud prevention and program integrity

- Ongoing challenges in modernizing and maintaining IT systems

The administrative costs of Social Security, while comparatively low, still represent a significant expenditure of public resources and highlight the challenges of managing a program of such scale and complexity.

In conclusion, Social Security remains a cornerstone of retirement planning and social welfare in the United States, offering crucial benefits to millions of Americans. However, the program faces significant challenges that threaten its long-term sustainability. As policymakers grapple with these issues, it’s essential for individuals to understand both the advantages and limitations of Social Security in the context of their overall financial planning. By recognizing the pros and cons of the system, we can work towards solutions that preserve its strengths while addressing its weaknesses, ensuring that Social Security continues to provide vital support for generations to come.

Frequently Asked Questions About Social Security Pros And Cons

- How does Social Security impact the overall economy?

Social Security influences the economy by providing income to retirees, supporting consumer spending, and affecting national savings rates. It also impacts labor market decisions and plays a role in reducing elderly poverty. - Can Social Security be privatized to address its financial challenges?

Privatization proposals have been debated, suggesting individual investment accounts. However, such changes would involve significant transition costs and potential risks, and remain highly controversial. - How does Social Security compare to private retirement savings?

Social Security offers guaranteed, inflation-adjusted benefits and broader coverage, but typically provides lower returns than diversified private investments. It’s generally viewed as a foundation to be supplemented by personal savings and pensions. - What reforms are being considered to address Social Security’s solvency issues?

Proposed reforms include raising the retirement age, increasing payroll taxes, adjusting the benefit formula, and changing the cost-of-living adjustment method. Each option has different impacts on workers, retirees, and program finances. - How does Social Security affect different income groups?

Social Security’s progressive benefit structure provides higher replacement rates for lower-income workers. However, lifetime benefits can vary based on factors like longevity, which often correlates with income levels. - What role does Social Security play in disability protection?

Social Security Disability Insurance (SSDI) provides crucial income support for workers who become disabled. This component of Social Security offers protection that many workers might not otherwise have. - How does Social Security impact retirement decisions?

Social Security influences when people choose to retire through its early and full retirement age provisions. The program’s structure can incentivize delayed retirement for some, while potentially encouraging earlier retirement for others. - What are the implications of Social Security for intergenerational equity?

The pay-as-you-go system raises questions about fairness between generations, especially as demographic shifts occur. Younger workers may face higher taxes or reduced benefits compared to current retirees, sparking debates about intergenerational equity.