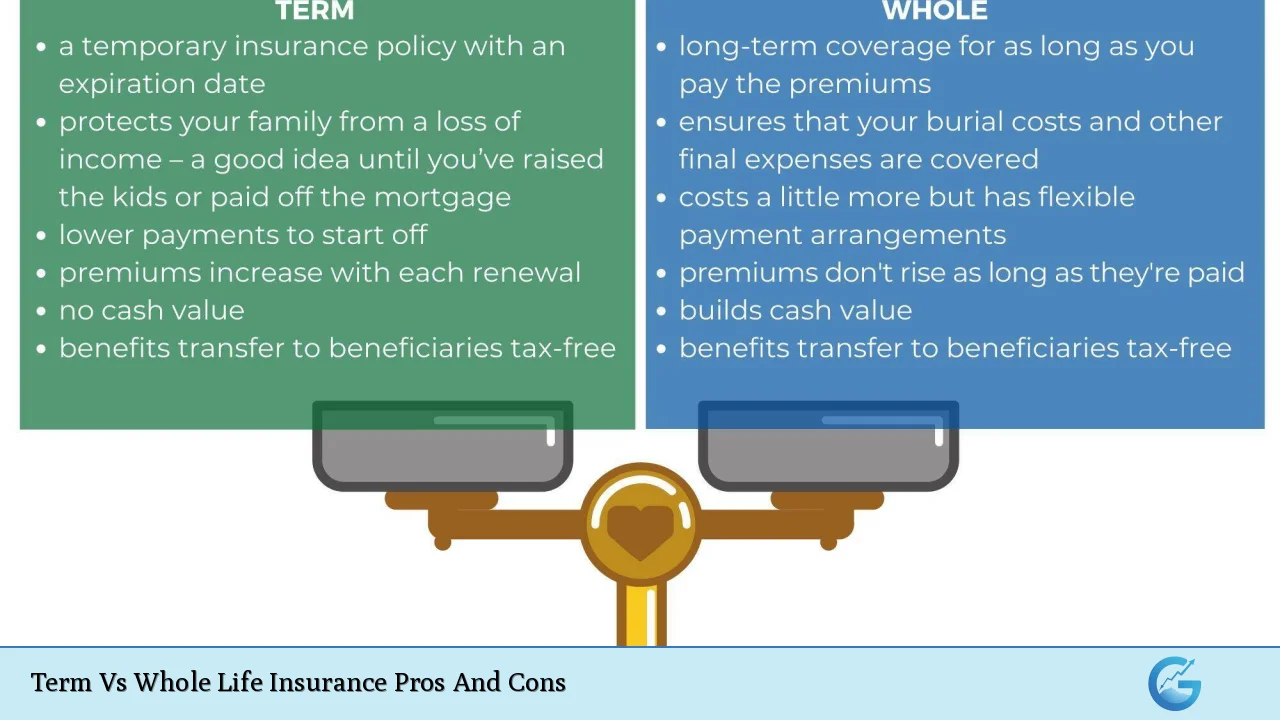

Life insurance is a crucial component of financial planning, offering protection and peace of mind for individuals and their families. When considering life insurance options, two primary types often come to the forefront: term life insurance and whole life insurance. Each has its own set of advantages and disadvantages, catering to different financial needs and goals. Understanding the pros and cons of both term and whole life insurance is essential for making an informed decision that aligns with your long-term financial strategy.

| Pros | Cons |

|---|---|

| Lower premiums for term life | Limited coverage period for term life |

| Lifelong coverage for whole life | Higher premiums for whole life |

| Cash value component in whole life | Complexity of whole life policies |

| Flexibility in term life | No cash value accumulation in term life |

| Tax advantages in whole life | Potential for lower returns in whole life |

| Simplicity of term life | Inflation risk for fixed death benefit |

Lower Premiums for Term Life Insurance

Term life insurance is renowned for its affordability, making it an attractive option for many individuals seeking substantial coverage at a lower cost. The primary reason for the lower premiums is the temporary nature of the coverage.

- Cost-effective for high coverage amounts

- Ideal for specific financial obligations (e.g., mortgage, children’s education)

- Allows for budget-friendly financial protection

Term life insurance can provide significant death benefits at a fraction of the cost of whole life insurance, making it an excellent choice for those needing maximum coverage on a limited budget.

This affordability allows individuals to allocate more of their income to other investments or savings vehicles, potentially yielding higher returns in the long run.

Lifelong Coverage for Whole Life Insurance

Whole life insurance offers the security of permanent coverage that lasts for the entirety of the policyholder’s life, provided premiums are paid. This feature addresses the concern of outliving one’s life insurance policy.

- Guaranteed death benefit regardless of when the insured passes away

- Peace of mind for lifelong financial protection

- Suitable for estate planning and legacy creation

The permanence of whole life insurance makes it particularly valuable for individuals with long-term dependents, such as children with special needs, or those who wish to leave a financial legacy.

It ensures that beneficiaries will receive the death benefit regardless of the policyholder’s age at the time of death, eliminating the risk of policy expiration that comes with term life insurance.

Cash Value Component in Whole Life Insurance

One of the distinguishing features of whole life insurance is its cash value component, which grows over time on a tax-deferred basis. This feature adds a savings element to the insurance policy, potentially making it a more comprehensive financial tool.

- Accumulates cash value that can be borrowed against

- Potential source of funds for emergencies or opportunities

- Can supplement retirement income

The cash value in a whole life policy can serve as a financial resource during the policyholder’s lifetime.

Policyholders can borrow against the cash value, often at favorable interest rates, or surrender the policy for its cash value if the insurance coverage is no longer needed.

This flexibility can be particularly advantageous in times of financial need or when other investment opportunities arise.

Flexibility in Term Life Insurance

Term life insurance offers significant flexibility, allowing policyholders to tailor their coverage to their specific needs and financial situations. This adaptability is particularly beneficial for those whose insurance needs may change over time.

- Choose from various term lengths (e.g., 10, 20, or 30 years)

- Option to convert to permanent insurance in many policies

- Ability to adjust coverage as financial needs change

The flexibility of term life insurance enables individuals to align their coverage with specific financial obligations or life stages.

For instance, a 30-year term policy can be designed to cover a mortgage, while a 20-year policy might be chosen to protect dependent children until they reach adulthood.

Additionally, many term policies offer the option to convert to permanent insurance without a medical exam, providing a pathway to lifelong coverage if needs change.

Tax Advantages in Whole Life Insurance

Whole life insurance offers several tax benefits that can make it an attractive component of a comprehensive financial strategy, especially for high-net-worth individuals or those in higher tax brackets.

- Tax-deferred growth of cash value

- Tax-free death benefit for beneficiaries

- Potential for tax-free policy loans

The cash value within a whole life policy grows on a tax-deferred basis, meaning policyholders do not pay taxes on the growth as long as the policy remains in force.

Additionally, policy loans taken against the cash value are generally not considered taxable income, provided the policy remains in effect. These tax advantages can provide significant benefits over time, especially for those looking to minimize their tax liability.

Simplicity of Term Life Insurance

The straightforward nature of term life insurance makes it an appealing option for many consumers, particularly those who prefer uncomplicated financial products or are new to life insurance.

- Easy to understand coverage and terms

- Straightforward premium structure

- Clear-cut benefits without complex features

Term life insurance operates on a simple premise: pay premiums for a set period, and if death occurs during that time, the policy pays out the death benefit.

This simplicity makes it easier for individuals to determine how much coverage they need and for how long, without the complexities associated with cash value or investment components found in whole life policies.

The straightforward nature of term insurance can lead to quicker decision-making and easier comparison shopping among different insurers.

Limited Coverage Period for Term Life Insurance

While the affordability of term life insurance is a significant advantage, its temporary nature can be a drawback for some individuals. The policy expires at the end of the term, potentially leaving the insured without coverage.

- Risk of outliving the policy

- Potential for increased premiums upon renewal

- May not address long-term insurance needs

If the insured outlives the term of the policy, there is no payout, and securing new coverage at an older age can be significantly more expensive or even impossible due to health issues.

This limitation can be particularly problematic for those who develop health conditions during the term and find themselves uninsurable or facing prohibitively high premiums when seeking new coverage.

Higher Premiums for Whole Life Insurance

One of the most significant drawbacks of whole life insurance is its cost. The premiums for whole life policies are substantially higher than those for term life insurance, often by a factor of 5 to 15 times.

- Significantly more expensive than term life insurance

- Can strain monthly budgets

- May limit ability to invest in other financial vehicles

The higher cost of whole life insurance is due to several factors, including the permanent nature of the coverage, the guaranteed death benefit, and the cash value component.

While these features provide additional benefits, the higher premiums can make whole life insurance unaffordable for many individuals, particularly those in the early stages of their careers or with significant other financial obligations.

This cost difference can lead to underinsurance if individuals opt for lower coverage amounts to manage the premiums.

Complexity of Whole Life Policies

Whole life insurance policies are inherently more complex than term life policies, which can be a disadvantage for those seeking straightforward financial products.

- Multiple components to understand (death benefit, cash value, dividends)

- Various policy options and riders to consider

- Potential for misunderstanding policy features

The complexity of whole life insurance can make it challenging for policyholders to fully grasp all aspects of their coverage.

This complexity may lead to misunderstandings about policy performance, expectations for cash value growth, or the implications of policy loans.

Additionally, the various options and riders available with whole life policies can make it difficult to compare offerings between different insurance companies accurately.

No Cash Value Accumulation in Term Life Insurance

Unlike whole life insurance, term life policies do not build cash value over time. This lack of a savings component means that term insurance functions solely as a death benefit without any living benefits.

- No accumulation of savings within the policy

- No option to borrow against the policy

- No surrender value if the policy is canceled

The absence of cash value in term life insurance means that if the policy expires or is canceled, there is no return of premiums or accumulated value.

This “use it or lose it” nature of term insurance can be seen as a disadvantage for those who want their life insurance to serve as both protection and an investment vehicle.

However, this simplicity also contributes to the lower cost of term insurance, allowing policyholders to potentially invest the difference in premiums elsewhere.

Potential for Lower Returns in Whole Life Insurance

While the cash value component of whole life insurance can be attractive, the returns on this investment portion are often lower than what could be achieved through other investment vehicles.

- Generally lower returns compared to direct market investments

- High fees and expenses can eat into cash value growth

- Limited investment options within the policy

The conservative nature of whole life insurance investments, coupled with the costs associated with providing the insurance benefit and policy administration, often results in modest returns on the cash value.

Individuals seeking higher potential returns might find that separating their insurance needs from their investment strategy by purchasing term insurance and investing the difference in premiums could yield better long-term results.

However, this approach requires discipline and a higher risk tolerance.

Inflation Risk for Fixed Death Benefit

Both term and whole life insurance policies typically offer a fixed death benefit, which can be eroded by inflation over time. This is particularly relevant for whole life policies, which are designed to last a lifetime.

- Purchasing power of the death benefit may decrease over time

- May require periodic review and adjustment of coverage

- Can lead to underinsurance in the long term

The impact of inflation can significantly reduce the real value of the death benefit over decades, potentially leaving beneficiaries with less financial protection than originally intended.

While some whole life policies offer increasing death benefits or the option to purchase additional coverage, these features often come at an additional cost. Term policies, due to their shorter duration, are less affected by long-term inflation but still require consideration of future purchasing power when determining coverage amounts.

In conclusion, both term and whole life insurance have their place in financial planning, each with distinct advantages and disadvantages. Term life insurance offers affordability and flexibility, making it an excellent choice for those seeking high coverage amounts for specific periods or financial obligations. Whole life insurance, while more expensive, provides lifelong coverage, tax advantages, and a cash value component that can serve as a financial resource during the policyholder’s lifetime.

The decision between term and whole life insurance should be based on individual financial goals, budget constraints, and long-term needs. For many, a combination of both types of insurance may provide the most comprehensive coverage. It’s crucial to carefully consider all aspects of these policies and consult with a financial advisor to determine the most appropriate life insurance strategy for your unique situation.

Frequently Asked Questions About Term Vs Whole Life Insurance Pros And Cons

- Which is better: term or whole life insurance?

The choice depends on individual needs and financial goals. Term is generally better for temporary needs and affordability, while whole life offers lifelong coverage and cash value accumulation. - Can I convert my term life policy to a whole life policy?

Many term policies offer a conversion option, allowing you to switch to whole life without a new medical exam. Check your policy details or consult your insurer for specific terms. - Is whole life insurance a good investment?

Whole life insurance can be part of a diversified financial strategy, but it’s generally not considered the best investment vehicle due to lower returns compared to other options. It’s primarily insurance with an added savings component. - How much more expensive is whole life compared to term life?

Whole life premiums can be 5 to 15 times higher than term life for the same death benefit amount. The exact difference varies based on factors like age, health, and policy features. - Can I cash out a term life insurance policy?

Generally, no. Term life insurance doesn’t accumulate cash value and can’t be cashed out. Some policies offer a return of premium rider, but this increases the cost significantly. - What happens if I outlive my term life insurance policy?

If you outlive your term policy, the coverage ends, and there’s no payout. You may have the option to renew (often at a higher rate) or convert to a permanent policy, depending on your policy terms. - Is the cash value of whole life insurance taxable?

The cash value grows tax-deferred. Withdrawals up to the amount of premiums paid are typically tax-free, but earnings may be taxable if withdrawn. Consult a tax professional for specific advice. - Can I have both term and whole life insurance policies?

Yes, many people combine both types to balance affordability with lifelong coverage. This strategy can provide high coverage during peak financial years and permanent protection for the long term.