A Traditional Individual Retirement Account (IRA) is a popular retirement savings vehicle that allows individuals to contribute pre-tax income, enabling tax-deferred growth on investments until withdrawal. This account type is designed to encourage long-term savings for retirement, offering various tax benefits that can significantly enhance an individual’s financial strategy. However, while Traditional IRAs present several advantages, they also come with notable disadvantages that potential investors should carefully consider. This article explores the pros and cons of Traditional IRAs in detail, helping you make informed decisions about your retirement planning.

| Pros | Cons |

|---|---|

| No income limits for contributions | Taxes on withdrawals during retirement |

| Tax-deductible contributions | Mandatory required minimum distributions (RMDs) |

| Tax-deferred growth of investments | Penalties for early withdrawals |

| Diverse investment options available | Potential for reduced deductibility based on income |

| Ability to use funds for certain expenses without penalties | Complex rules regarding withdrawals and taxes |

No Income Limits for Contributions

One of the most significant advantages of a Traditional IRA is that there are no income limits preventing individuals from opening or contributing to the account. Regardless of how much you earn, you can establish a Traditional IRA, making it accessible to a wide range of investors.

- Inclusivity: This feature allows high earners who may be ineligible for other retirement accounts, like Roth IRAs, to still save effectively for retirement.

- Flexibility: Individuals can contribute regardless of their employment status or income level, as long as they have earned income.

Tax-Deductible Contributions

Another compelling benefit of Traditional IRAs is the ability to deduct contributions from taxable income. This means that contributions can reduce your taxable income for the year in which they are made.

- Immediate Tax Relief: For example, if you contribute $5,000 to your Traditional IRA and fall within the 22% tax bracket, you could save $1,100 on your tax bill.

- Encourages Savings: The tax deduction incentivizes individuals to save more aggressively for retirement by providing immediate financial relief.

Tax-Deferred Growth of Investments

The growth potential of investments within a Traditional IRA is another significant advantage. Earnings on investments grow tax-deferred until withdrawal, allowing your money to compound over time without the drag of annual taxes.

- Compounding Effect: This can lead to substantial growth over decades, as you are not paying taxes on gains each year.

- Long-Term Strategy: The longer your money remains invested without being taxed, the greater the potential for wealth accumulation.

Diverse Investment Options Available

Traditional IRAs offer a wide array of investment choices. Account holders can invest in various assets, including stocks, bonds, mutual funds, ETFs, and even alternative investments like real estate or commodities.

- Customization: Investors can tailor their portfolios according to their risk tolerance and investment goals.

- Broad Market Access: This flexibility allows individuals to diversify their investments effectively, potentially reducing risk and improving returns.

Ability to Use Funds for Certain Expenses Without Penalties

Traditional IRAs allow account holders to withdraw funds for specific expenses without incurring penalties. For instance:

- Qualified Education Expenses: You can use IRA funds to pay for higher education costs without facing the typical 10% early withdrawal penalty.

- First-Time Home Purchase: Up to $10,000 can be withdrawn penalty-free for first-time homebuyers, although taxes will still apply.

Taxes on Withdrawals During Retirement

Despite the numerous benefits associated with Traditional IRAs, one notable disadvantage is that all withdrawals during retirement are subject to ordinary income tax.

- Tax Liability: When you withdraw funds after age 59½, you will pay taxes at your current income tax rate on both contributions (if deducted) and earnings.

- Potentially Higher Tax Burden: If you are in a higher tax bracket during retirement than when you made contributions, this could lead to a larger tax bill than anticipated.

Mandatory Required Minimum Distributions (RMDs)

At age 73 (as of recent legislation), account holders must begin taking required minimum distributions from their Traditional IRA accounts.

- Forced Withdrawals: This requirement can be inconvenient for those who do not need the funds immediately or wish to leave their investments untouched longer.

- Tax Implications: Failing to withdraw the required amount can result in severe penalties—up to 50% of the amount not withdrawn.

Penalties for Early Withdrawals

Withdrawing funds from a Traditional IRA before age 59½ typically incurs a 10% early withdrawal penalty in addition to regular income taxes.

- Financial Disincentive: This penalty acts as a deterrent against using retirement savings for non-retirement expenses prematurely.

- Limited Access: While there are exceptions (such as disability or certain medical expenses), many individuals may find themselves unable to access their own funds without incurring significant costs.

Potential for Reduced Deductibility Based on Income

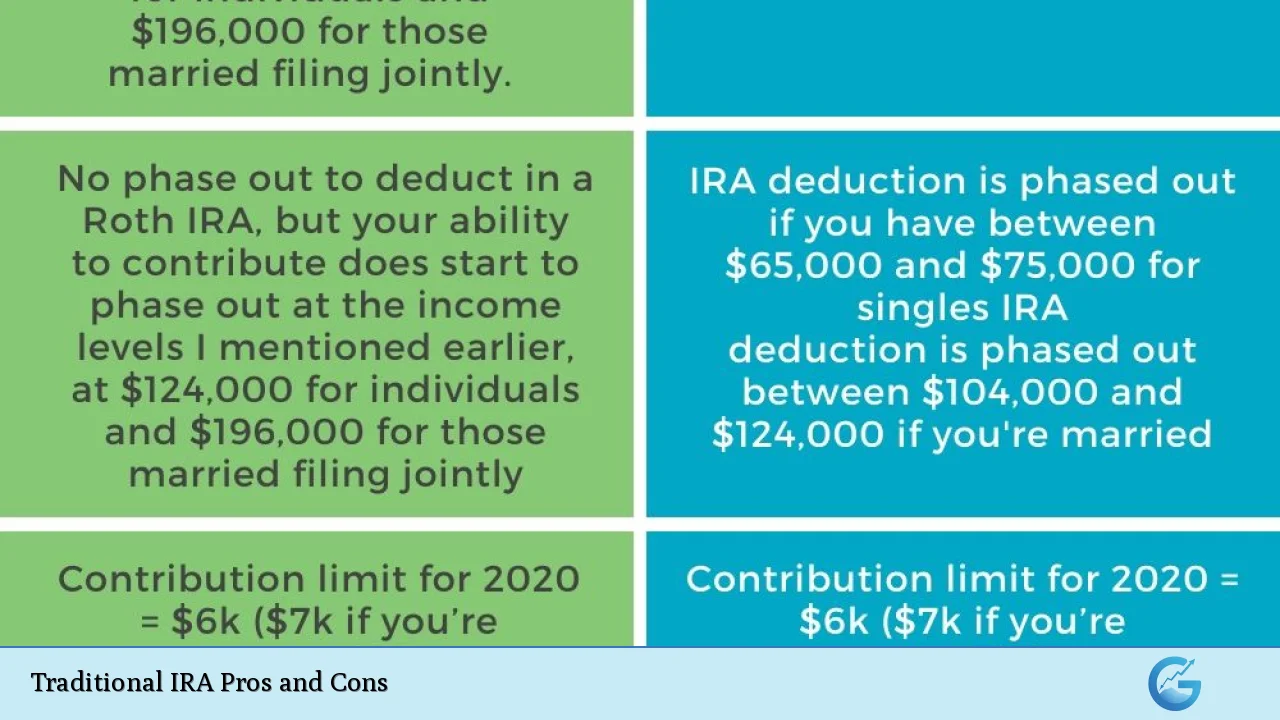

While contributions may be deductible based on your income level and whether you participate in an employer-sponsored retirement plan, high earners may face limitations.

- Income Phase-Outs: If you or your spouse has access to a workplace retirement plan and your income exceeds certain thresholds, your ability to deduct contributions may be reduced or eliminated entirely.

- Complexity in Tax Planning: This necessitates careful planning and consideration when deciding how much to contribute and whether it makes sense given potential tax implications.

Complex Rules Regarding Withdrawals and Taxes

The rules governing Traditional IRAs can be complex and often require careful navigation.

- Understanding Taxation: Knowing when and how much tax will apply upon withdrawal is crucial for effective financial planning.

- Withdrawal Strategies: Investors must develop strategies around RMDs and potential penalties associated with early withdrawals to avoid unnecessary taxation.

In conclusion, Traditional IRAs offer numerous advantages that make them an attractive option for retirement savings. However, they also come with significant drawbacks that require careful consideration. Understanding these pros and cons is essential for anyone looking to optimize their retirement strategy. By weighing these factors against personal financial goals and circumstances, investors can make informed decisions about whether a Traditional IRA aligns with their long-term objectives.

Frequently Asked Questions About Traditional IRA Pros and Cons

- What are the main benefits of a Traditional IRA?

The main benefits include tax-deductible contributions, tax-deferred growth on investments, no income limits for contributions, and diverse investment options. - What are the drawbacks of a Traditional IRA?

The drawbacks include taxes on withdrawals during retirement, mandatory required minimum distributions starting at age 73, penalties for early withdrawals before age 59½, and potential reduced deductibility based on income. - Can I contribute to both a Traditional IRA and a Roth IRA?

Yes, individuals can contribute to both types of IRAs as long as they adhere to contribution limits set by the IRS. - What happens if I don’t take my required minimum distribution?

If you fail to take your RMD by the deadline, you may face a hefty penalty equal to 50% of the amount you were required to withdraw. - Can I withdraw money from my Traditional IRA before age 59½?

You can withdraw money before age 59½; however, it will incur a 10% penalty along with regular income taxes unless it meets specific exceptions. - How does a Traditional IRA affect my taxable income?

Contributions may reduce your taxable income in the year they are made if they are deductible; however, withdrawals during retirement will increase taxable income. - Are there any fees associated with maintaining a Traditional IRA?

Fees vary by provider but may include account maintenance fees or transaction fees depending on how you manage your investments. - What types of investments can I hold in a Traditional IRA?

You can hold various investments such as stocks, bonds, mutual funds, ETFs, and some alternative assets like real estate or precious metals.

This comprehensive overview should help guide individuals interested in utilizing a Traditional IRA as part of their financial strategy while highlighting both its strengths and weaknesses.