When it comes to retirement planning, choosing the right type of Individual Retirement Account (IRA) is crucial. Two popular options are the Traditional IRA and the Roth IRA. Each has its unique features, benefits, and drawbacks that can significantly impact your financial future. Understanding these differences is essential for making informed decisions about your retirement savings strategy.

Both IRAs offer tax advantages, but they differ in terms of when you pay taxes, how contributions are treated, and withdrawal rules. This article delves into the pros and cons of each account type, helping you navigate the complexities of retirement planning.

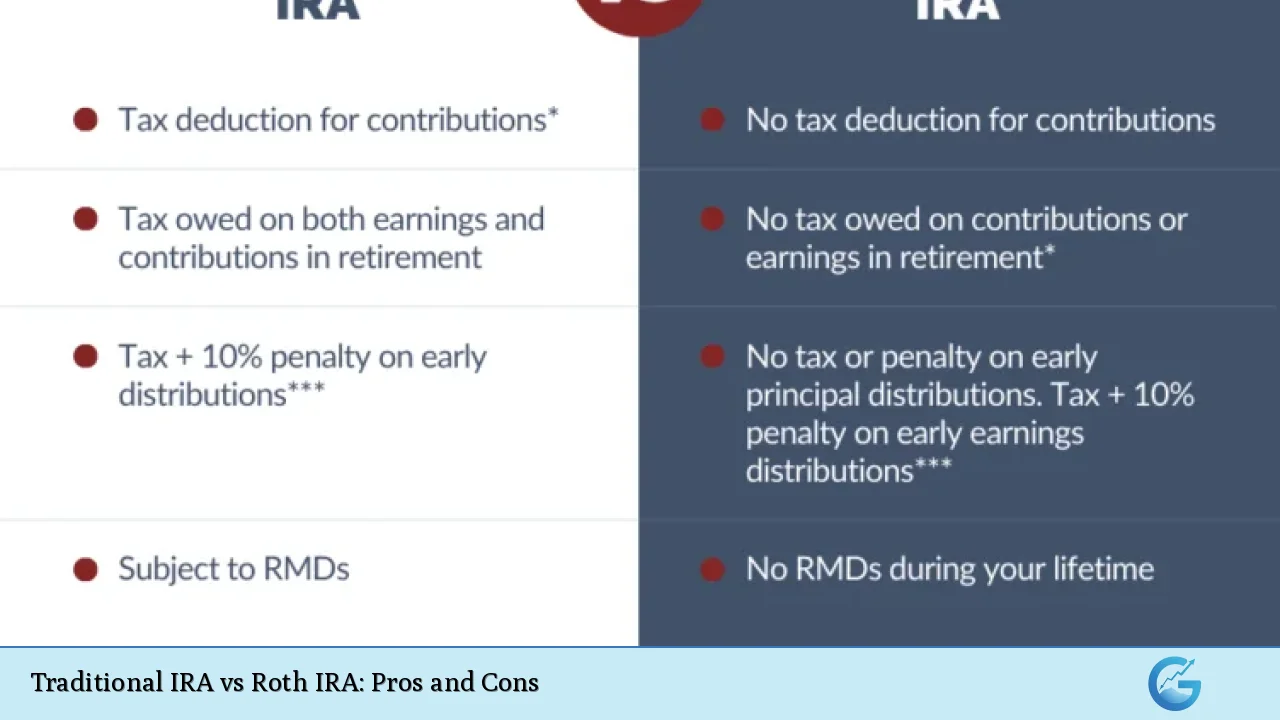

| Pros | Cons |

|---|---|

| Tax advantages: Contributions to a Traditional IRA may be tax-deductible, while Roth IRAs allow for tax-free withdrawals in retirement. | Tax implications: Withdrawals from a Traditional IRA are taxed as ordinary income, whereas Roth IRAs require after-tax contributions. |

| Flexibility in withdrawals: Roth IRAs allow penalty-free withdrawals of contributions at any time. | Income limits: Roth IRAs have income eligibility restrictions that may prevent high earners from contributing. |

| No required minimum distributions (RMDs) for Roth IRAs, allowing for more extended tax-free growth. | RMDs are mandatory for Traditional IRAs starting at age 73, which can impact your tax situation in retirement. |

| Potentially lower taxes in retirement with a Roth IRA if you expect to be in a higher tax bracket later. | Immediate tax benefit is absent with Roth IRAs since contributions are made with after-tax dollars. |

| Both accounts can be used to diversify your retirement savings strategy. | Complexity in managing both accounts can lead to confusion regarding contribution limits and eligibility. |

Tax Advantages

Both Traditional and Roth IRAs provide significant tax advantages, but they operate differently.

Traditional IRA

- Tax Deduction: Contributions may be fully or partially deductible from your taxable income, depending on your income level and whether you or your spouse are covered by an employer-sponsored retirement plan.

- Tax-Deferred Growth: Your investments grow tax-deferred until you withdraw them during retirement. This means you won’t pay taxes on dividends or capital gains while the money remains in the account.

Roth IRA

- Tax-Free Withdrawals: Contributions are made with after-tax dollars; therefore, qualified withdrawals during retirement are entirely tax-free. This includes both the contributions and any earnings.

- No RMDs: Unlike Traditional IRAs, Roth IRAs do not require you to take minimum distributions during your lifetime, allowing your investments to grow tax-free for as long as you want.

Flexibility in Withdrawals

The rules governing withdrawals can significantly affect your financial planning.

Traditional IRA

- Withdrawal Penalties: Early withdrawals (before age 59½) typically incur a 10% penalty plus regular income taxes on the amount withdrawn. There are exceptions for specific situations like first-time home purchases or education expenses.

- Mandatory Withdrawals: At age 73, you must start taking required minimum distributions (RMDs), which can impact your taxable income during retirement.

Roth IRA

- Penalty-Free Access to Contributions: You can withdraw your contributions at any time without penalties or taxes since those contributions were already taxed.

- No Required Distributions: You are not required to take distributions at any age, which provides greater flexibility in managing your retirement funds.

Income Limits and Eligibility

Eligibility criteria vary significantly between the two types of accounts.

Traditional IRA

- No Income Limits for Contributions: Anyone with earned income can contribute to a Traditional IRA regardless of their income level. However, the ability to deduct contributions may phase out at higher income levels if covered by a workplace retirement plan.

Roth IRA

- Income Eligibility Restrictions: For 2024, single filers must have a modified adjusted gross income (MAGI) below $161,000 to contribute fully. Married couples must have a MAGI below $240,000. Contributions phase out at higher income levels.

Long-Term Tax Implications

Your expected future tax situation plays a crucial role in deciding which account is better suited for you.

Traditional IRA

- Lower Taxes Now: If you expect your current tax rate to be higher than your rate during retirement, a Traditional IRA may be beneficial since it allows for immediate tax deductions on contributions.

- Taxed Withdrawals: All withdrawals will be taxed as ordinary income during retirement. If you find yourself in a higher bracket than anticipated, this could lead to larger-than-expected tax bills.

Roth IRA

- Higher Future Taxes: If you anticipate being in a higher tax bracket during retirement due to increased earnings or other factors, paying taxes upfront with a Roth IRA could save you money in the long run.

- Tax-Free Growth and Withdrawals: Since all qualified withdrawals are tax-free, this account can provide significant savings if managed wisely over time.

Investment Strategy Diversification

Both types of IRAs can play distinct roles within an overall investment strategy.

Combining Both Accounts

Many investors choose to maintain both types of accounts as part of their strategy:

- Tax Diversification: By contributing to both a Traditional and a Roth IRA, individuals can hedge against future tax increases and manage their taxable income more effectively during retirement.

- Flexibility in Withdrawals: Having access to both pre-tax and post-tax funds allows retirees to better manage their cash flow needs without incurring unnecessary taxes.

Closing Thoughts

Choosing between a Traditional IRA and a Roth IRA ultimately depends on individual circumstances such as current financial status, expected future income levels, and personal preferences regarding taxes.

Understanding the advantages and disadvantages of each account type is essential for effective retirement planning. By carefully considering factors like tax implications, withdrawal flexibility, eligibility requirements, and long-term financial goals, individuals can make informed decisions that align with their unique financial situations.

Frequently Asked Questions About Traditional IRA vs Roth IRA

- What is the main difference between a Traditional IRA and a Roth IRA?

The primary difference lies in when you pay taxes; Traditional IRAs offer upfront tax deductions while Roth IRAs allow for tax-free withdrawals later. - Can I contribute to both types of IRAs?

Yes, individuals can contribute to both accounts as long as they meet eligibility requirements for each type. - What happens if I withdraw money early from my Traditional IRA?

Withdrawals before age 59½ typically incur a 10% penalty plus ordinary income taxes on the amount withdrawn. - Are there contribution limits for both types of IRAs?

The contribution limit for both accounts is $7,000 per year (or $8,000 if you’re over 50) for 2024. - Do I have to take required minimum distributions from my Roth IRA?

No, there are no required minimum distributions from a Roth IRA during your lifetime. - How do I know which type of IRA is better for me?

Your decision should be based on factors like current income level, expected future earnings, and personal preferences regarding taxes. - Can I convert my Traditional IRA to a Roth IRA?

Yes, conversions are allowed but will require paying taxes on any pre-tax amounts converted. - What happens to my IRAs when I pass away?

Beneficiaries will inherit either type of account; however, inherited Roth IRAs have different rules regarding distributions than inherited Traditional IRAs.

By understanding these key aspects of Traditional and Roth IRAs, investors can better prepare themselves for successful retirement planning.