Whole life insurance is a type of permanent life insurance that provides lifelong coverage and includes a savings component known as cash value. While it offers several advantages, such as guaranteed death benefits and fixed premiums, it also has drawbacks, including higher costs and limited flexibility. This article explores the pros and cons of whole life insurance in detail, helping you decide if it aligns with your financial goals.

| Pros | Cons |

|---|---|

| Guaranteed lifelong coverage | Higher premiums than term life insurance |

| Fixed premiums that never increase | Limited flexibility in adjusting premiums or benefits |

| Cash value accumulation with tax-deferred growth | Slower cash value growth compared to other investments |

| Potential dividends from mutual insurers | Loans and withdrawals may reduce policy benefits |

| Estate planning benefits through tax-free death benefits | Complexity compared to term life insurance |

| Ability to borrow against the policy’s cash value | Interest charges on loans against the policy |

| Peace of mind with guaranteed death benefit payout | May not be cost-effective for short-term needs |

Advantages of Whole Life Insurance

Guaranteed Lifelong Coverage

- Whole life insurance provides coverage for your entire life, ensuring that your beneficiaries receive a death benefit regardless of when you pass away.

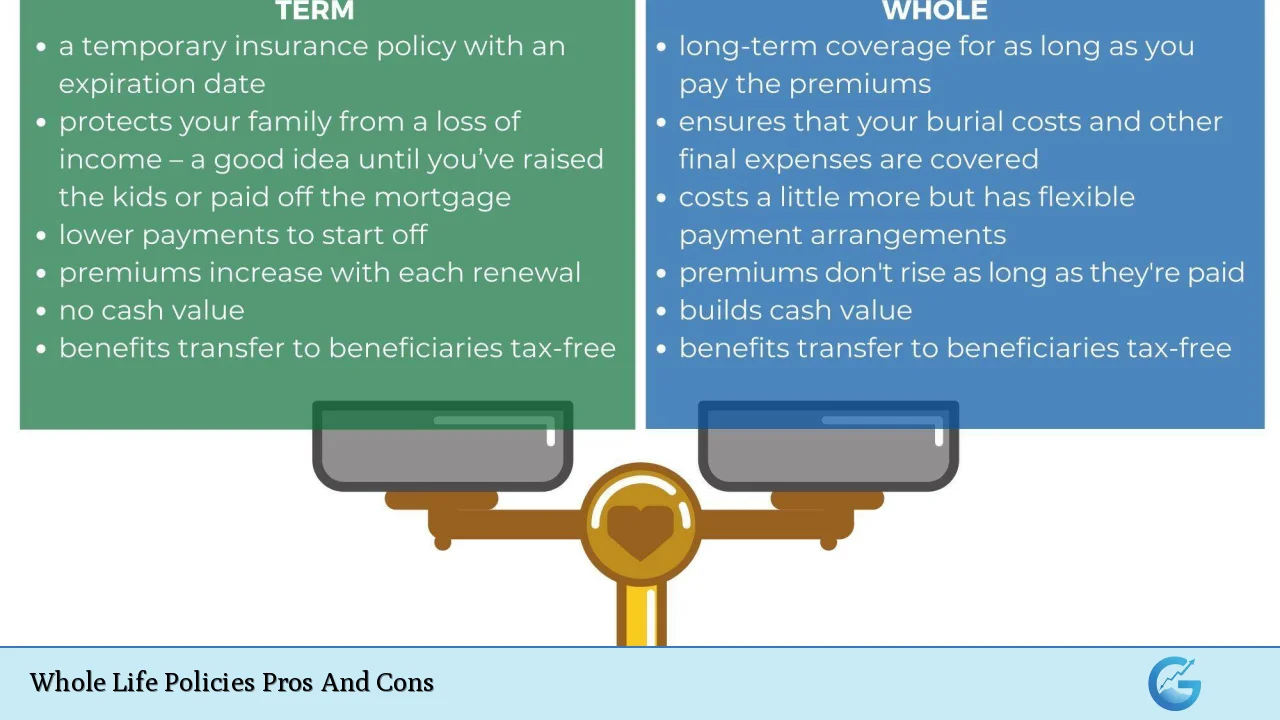

- Unlike term life insurance, which expires after a set period, whole life policies remain active as long as premiums are paid.

Fixed Premiums

- Premiums remain constant throughout the policyholder’s lifetime, allowing for predictable budgeting.

- This stability is particularly beneficial for individuals who want to avoid increasing costs as they age or face health issues.

Cash Value Accumulation

- Whole life policies build cash value over time, which grows on a tax-deferred basis.

- Policyholders can use this cash value for loans, withdrawals, or even premium payments.

Potential Dividends

- Some whole life policies from mutual insurers pay dividends based on the company’s financial performance.

- Dividends can be used to purchase additional coverage, reduce premiums, or be taken as cash.

Tax Benefits

- The death benefit is generally tax-free for beneficiaries, making it a valuable estate planning tool.

- Cash value growth is tax-deferred, offering an additional layer of financial advantage.

Borrowing Against Cash Value

- Policyholders can borrow against the accumulated cash value without undergoing credit checks.

- This feature provides liquidity for emergencies or investment opportunities.

Estate Planning and Legacy Creation

- Whole life insurance can help cover estate taxes or equalize inheritances among beneficiaries.

- It ensures financial security for dependents or funds special needs trusts.

Disadvantages of Whole Life Insurance

Higher Premiums

- Whole life insurance is significantly more expensive than term life insurance due to its lifelong coverage and cash value component.

- For those seeking cost-effective coverage for a specific period, term life may be a better option.

Limited Flexibility

- Unlike universal life insurance, whole life policies do not allow adjustments to premiums or death benefits.

- This rigidity may not suit individuals whose financial needs evolve over time.

Slower Cash Value Growth

- The cash value in whole life policies typically grows at a slower rate compared to other investment vehicles like stocks or mutual funds.

- This makes it less appealing for individuals prioritizing high returns on investments.

Impact of Loans and Withdrawals

- While borrowing against cash value is an option, unpaid loans reduce the death benefit available to beneficiaries.

- Withdrawals may also incur taxes if they exceed the amount paid into the policy.

Complexity

- Whole life insurance is more complex than term life insurance, requiring careful consideration and understanding of its features.

- Misunderstanding the policy terms can lead to financial setbacks.

Not Cost-Effective for Short-Term Needs

- For individuals seeking temporary coverage or those without dependents, whole life insurance may not justify its high cost.

- Term life insurance often provides sufficient coverage at a fraction of the cost.

Frequently Asked Questions About [keyword]

- What is whole life insurance?

Whole life insurance is a permanent policy offering lifelong coverage and a savings component known as cash value. - How does whole life differ from term life insurance?

Whole life provides permanent coverage with fixed premiums and cash value accumulation, while term life offers temporary coverage without a savings component. - Is whole life insurance worth it?

The suitability depends on your financial goals. It’s ideal for estate planning or those seeking lifelong coverage but may not be cost-effective for short-term needs. - Can I withdraw money from my whole life policy?

Yes, you can withdraw funds from the accumulated cash value or borrow against it. However, this may reduce the policy’s death benefit. - Are dividends guaranteed with whole life policies?

No, dividends depend on the insurer’s performance and are not guaranteed. - What happens if I stop paying premiums?

If you stop paying premiums, the policy may lapse unless there’s sufficient cash value to cover them. - Is whole life insurance tax-free?

The death benefit is generally tax-free for beneficiaries. However, taxes may apply to certain withdrawals. - Who should consider whole life insurance?

It’s suitable for individuals seeking lifelong coverage, estate planning benefits, or those who want a stable financial tool with tax advantages.

Conclusion

Whole life insurance offers unique advantages such as guaranteed lifelong coverage, fixed premiums, and cash value accumulation. However, its higher costs and limited flexibility make it less suitable for everyone.

Before purchasing a policy, carefully assess your financial goals and consult with a qualified advisor.

This ensures you choose an option that aligns with your needs while maximizing its benefits.