A wrap-around mortgage is a unique financing arrangement that allows a seller to extend a loan to a buyer while retaining their existing mortgage. This method can be particularly advantageous in situations where traditional financing options are limited or unavailable. The wrap-around mortgage can facilitate transactions for buyers who may struggle to qualify for conventional loans, while also providing sellers with a means to attract buyers and potentially profit from favorable interest rates. However, like any financial instrument, it comes with its own set of advantages and disadvantages that must be carefully considered by both parties involved.

| Pros | Cons |

|---|---|

| Flexible financing options for buyers | Higher risk of default for sellers |

| Lower closing costs compared to traditional mortgages | Potential for higher interest rates |

| Faster transactions without lengthy lender processes | Buyer assumes risk of seller defaulting on original mortgage |

| Access to homeownership for those with poor credit | Legal complexities and potential for contract disputes |

| Opportunity for sellers to earn passive income | Dependence on seller’s financial stability |

Flexible Financing Options for Buyers

One of the primary advantages of a wrap-around mortgage is the flexibility it offers to buyers.

- Easier qualification: Buyers who may not meet the stringent requirements of traditional lenders can often qualify for a wrap-around mortgage. This is particularly beneficial for individuals with poor credit histories or insufficient income documentation.

- Tailored terms: The terms of the wrap-around mortgage can be negotiated directly between the buyer and seller, allowing for customized repayment plans that may better suit the buyer’s financial situation.

- Lower down payments: In many cases, buyers may be able to negotiate lower down payments compared to conventional loans, making homeownership more accessible.

Lower Closing Costs Compared to Traditional Mortgages

Wrap-around mortgages typically involve fewer fees and less paperwork than conventional loans, leading to reduced closing costs.

- Streamlined process: Since there are no banks or other financial institutions involved, the transaction can be completed more quickly and efficiently.

- Avoidance of lender fees: Buyers can save on appraisal fees, loan origination fees, and other costs associated with traditional mortgages.

Faster Transactions Without Lengthy Lender Processes

The absence of a third-party lender in a wrap-around mortgage transaction often leads to faster closings.

- Quick negotiations: Buyers and sellers can negotiate terms directly without the delays often associated with lender approvals.

- Immediate occupancy: Buyers may be able to move into their new homes much sooner than they would through traditional financing methods.

Access to Homeownership for Those With Poor Credit

Wrap-around mortgages provide an avenue for individuals who may have been denied financing through conventional means.

- Increased buyer pool: Sellers can attract a wider range of potential buyers, including those who might not qualify for traditional mortgages due to credit issues or lack of credit history.

- Opportunity for investment: This type of financing can also appeal to investors looking to purchase properties without the need for extensive credit checks or documentation.

Opportunity for Sellers to Earn Passive Income

For sellers, offering a wrap-around mortgage can create opportunities for consistent income generation.

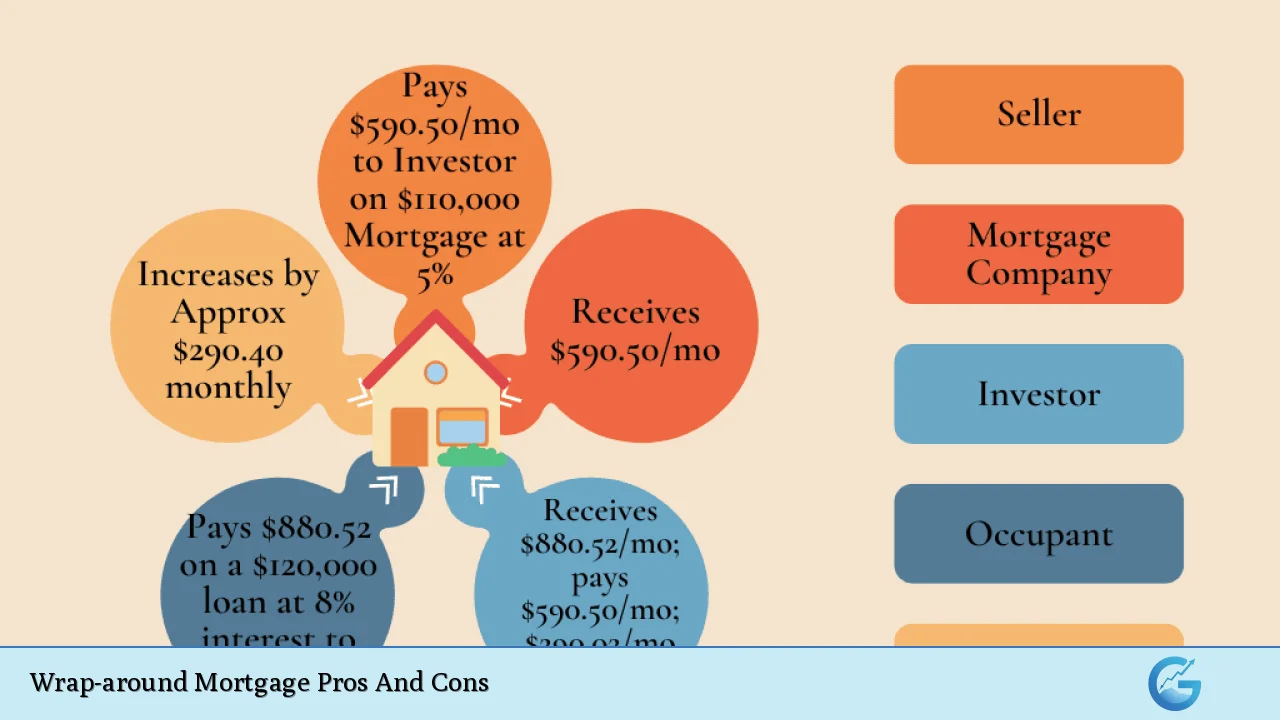

- Interest income: Sellers can charge interest on the wrap-around loan that exceeds their existing mortgage rate, allowing them to profit from the difference.

- Steady cash flow: Monthly payments from the buyer provide sellers with a reliable income stream while they maintain their existing mortgage obligations.

Higher Risk of Default for Sellers

While there are many advantages, one significant disadvantage is the increased risk of default that sellers face in a wrap-around mortgage arrangement.

- Full responsibility: If the buyer defaults on their payments, the seller must still ensure that their original mortgage is paid. Failure to do so could result in foreclosure on the property.

- Potential loss of property: If the seller’s original lender enforces a due-on-sale clause (which requires full repayment upon transfer of ownership), they could lose both the property and any income from the buyer’s payments.

Potential for Higher Interest Rates

Sellers may charge higher interest rates in wrap-around mortgages compared to conventional loans due to the increased risk involved.

- Costlier long-term financing: Buyers might end up paying significantly more over time if they agree to unfavorable interest rates set by sellers looking to mitigate their risks.

- Impact on affordability: Higher monthly payments could strain buyers’ budgets, especially if they were already struggling with credit issues or limited financial resources.

Buyer Assumes Risk of Seller Defaulting on Original Mortgage

One of the most critical risks associated with wrap-around mortgages is that buyers must trust that sellers will continue making payments on their original loans.

- Foreclosure risk: If the seller defaults on their original mortgage, even if the buyer has been making timely payments on the wrap-around loan, they could lose their home through foreclosure proceedings initiated by the original lender.

- Lack of recourse: Buyers have limited recourse if they discover that sellers are not fulfilling their obligations under the original loan agreement, which could lead to significant financial loss and stress.

Legal Complexities and Potential for Contract Disputes

Wrap-around mortgages come with legal intricacies that both parties must navigate carefully.

- Need for legal advice: It is crucial for both buyers and sellers to consult real estate attorneys experienced in these types of agreements to ensure compliance with local laws and regulations.

- Contract enforcement issues: Disputes over contract terms can arise if either party fails to uphold their end of the agreement, leading to potential legal battles that could be costly and time-consuming.

Dependence on Seller’s Financial Stability

Buyers must rely heavily on sellers’ financial stability when entering into a wrap-around mortgage agreement.

- Seller’s ongoing obligations: If a seller experiences financial difficulties or fails to manage their existing mortgage responsibly, it could jeopardize the buyer’s investment in the property.

- Risk assessment challenges: Buyers should conduct thorough due diligence regarding sellers’ financial situations before agreeing to any terms, as this knowledge will help mitigate potential risks associated with defaulting sellers.

In conclusion, while wrap-around mortgages offer unique advantages such as flexible financing options, lower closing costs, and quicker transactions, they also present significant risks including potential defaults and higher interest rates. Both buyers and sellers must weigh these pros and cons carefully before entering into such agreements. Understanding these dynamics is essential for anyone considering this type of financing arrangement in today’s real estate market.

Frequently Asked Questions About Wrap-around Mortgages

- What is a wrap-around mortgage?

A wrap-around mortgage is a type of seller financing where the seller retains their existing mortgage while providing financing to the buyer at a higher amount. - Who benefits most from a wrap-around mortgage?

This arrangement primarily benefits buyers who may not qualify for traditional loans and sellers looking for passive income opportunities. - What are common risks associated with wrap-around mortgages?

The main risks include potential default by either party and complications arising from due-on-sale clauses in existing loans. - Can I negotiate terms in a wrap-around mortgage?

Yes, buyers and sellers can negotiate terms such as interest rates and payment schedules directly between themselves. - How does foreclosure work in a wrap-around mortgage?

If the seller defaults on their original loan, foreclosure proceedings initiated by their lender could affect the buyer’s ownership despite having made all payments. - Are there legal considerations I should be aware of?

Yes, it’s essential to consult legal professionals familiar with real estate law when drafting or entering into a wrap-around mortgage agreement. - What happens if my seller goes bankrupt?

If your seller files bankruptcy, it could complicate your ownership rights and payment obligations under a wrap-around agreement. - Is it possible to refinance a wrap-around mortgage?

Refinancing options may vary depending on individual circumstances; consulting with financial advisors is recommended.