Checking accounts are fundamental financial tools that serve as the cornerstone of personal banking for millions of individuals worldwide. These accounts provide a secure and convenient way to manage daily financial transactions, from receiving paychecks to paying bills and making purchases. As with any financial product, checking accounts come with their own set of advantages and disadvantages that consumers should carefully consider before opening an account.

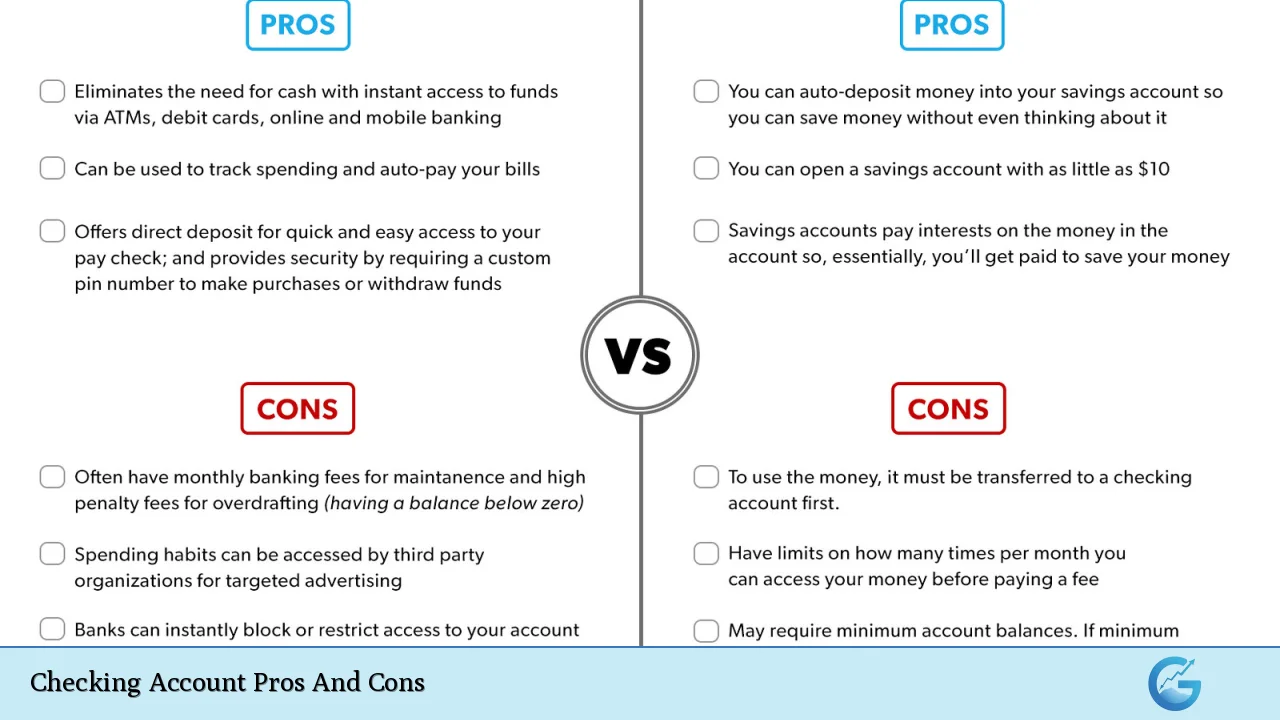

| Pros | Cons |

|---|---|

| Easy access to funds | Low or no interest earnings |

| Convenient bill payments | Potential fees and charges |

| Direct deposit capabilities | Minimum balance requirements |

| Debit card transactions | Overdraft risks |

| Check writing privileges | Limited investment opportunities |

| Online and mobile banking features | Potential for overspending |

| FDIC insurance protection | Identity theft and fraud risks |

| Budgeting and expense tracking | ATM fees for out-of-network withdrawals |

Advantages of Checking Accounts

Easy Access to Funds

Checking accounts provide unparalleled access to your money, allowing for quick and efficient financial transactions.

This accessibility is crucial in today’s fast-paced economic environment, where the ability to manage funds swiftly can make a significant difference in one’s financial well-being.

- Immediate availability of deposited funds (subject to bank policies)

- Multiple withdrawal options including ATMs, debit cards, and electronic transfers

- Seamless integration with digital payment platforms like Apple Pay and Google Wallet

Convenient Bill Payments

The convenience of bill payments through checking accounts cannot be overstated. This feature streamlines financial management and helps avoid late fees and penalties associated with missed payments.

- Automatic bill pay services for recurring expenses

- Online bill payment portals for one-time or variable bills

- Electronic fund transfers (EFTs) for quick payments to individuals or businesses

Direct Deposit Capabilities

Direct deposit is a game-changer for many account holders, offering a secure and timely method for receiving regular income.

This feature is particularly beneficial for those receiving paychecks, government benefits, or other regular payments.

- Faster access to funds compared to paper checks

- Reduced risk of lost or stolen checks

- Potential for earlier access to funds with some banks offering “Early Pay” features

Debit Card Transactions

Debit cards linked to checking accounts provide a convenient alternative to carrying cash, offering both security and flexibility in spending.

- Immediate deduction of funds from the account, aiding in budget management

- Widespread acceptance at merchants and online retailers

- Potential for cashback rewards with certain checking account programs

Check Writing Privileges

While less common in today’s digital age, the ability to write checks remains an important feature for many account holders, especially for certain types of payments or transactions.

- Useful for rent payments, especially with landlords who prefer traditional methods

- Provides a paper trail for important transactions

- Necessary for some government or legal payments

Online and Mobile Banking Features

The digital revolution has transformed checking accounts, with online and mobile banking features offering unprecedented control and insight into one’s finances.

- 24/7 account access for balance checks and transaction history

- Mobile check deposit functionality

- Real-time alerts for account activity and potential fraud

FDIC Insurance Protection

The security provided by FDIC insurance is a critical advantage of checking accounts held at insured institutions.

- Protection of up to $250,000 per depositor, per insured bank

- Peace of mind in the event of bank failure

- Additional coverage available through multiple account ownership categories

Budgeting and Expense Tracking

Modern checking accounts often come equipped with tools that facilitate better financial management and budgeting.

- Categorization of expenses for easier budget creation

- Integration with personal finance software and apps

- Detailed transaction histories for accurate expense tracking

Disadvantages of Checking Accounts

Low or No Interest Earnings

One of the most significant drawbacks of traditional checking accounts is the lack of substantial interest earnings on deposited funds.

This can result in a loss of potential income, especially for those maintaining high balances.

- Interest rates typically well below inflation, leading to a decrease in purchasing power over time

- Opportunity cost of not investing funds in higher-yield accounts or instruments

- Some online banks offer higher interest rates, but often with more restrictions

Potential Fees and Charges

The fee structure associated with many checking accounts can erode account balances and negate any minor interest earnings.

- Monthly maintenance fees, especially if minimum balance requirements are not met

- Overdraft fees, which can be substantial and compound quickly

- ATM fees for out-of-network withdrawals

- Foreign transaction fees for international purchases

Minimum Balance Requirements

Many banks impose minimum balance requirements on checking accounts, which can be challenging for some account holders to maintain consistently.

- Risk of incurring fees if the balance falls below the required minimum

- Potential for account closure if minimum balance is not maintained over time

- Restrictions on how funds can be used to meet balance requirements

Overdraft Risks

The ease of access to funds in a checking account can sometimes lead to overspending, resulting in overdrafts and associated fees.

- High overdraft fees that can quickly accumulate

- Potential for multiple overdraft charges in a single day

- Negative impact on credit score if overdrafts are not promptly addressed

Limited Investment Opportunities

Checking accounts are designed for transactional purposes rather than wealth growth, limiting their potential as investment vehicles.

- Funds in checking accounts do not benefit from market gains

- Inflation can erode the value of static balances over time

- Opportunity cost of not allocating funds to higher-yield investment options

Potential for Overspending

The convenience of debit cards and easy access to funds can sometimes lead to impulsive spending and poor financial habits.

- Lack of friction in spending compared to cash transactions

- Difficulty in tracking multiple small purchases throughout the month

- Potential for exceeding budgeted amounts due to ease of access

Identity Theft and Fraud Risks

While banks employ robust security measures, checking accounts are not immune to the risks of identity theft and fraud.

- Vulnerability to skimming devices at ATMs and point-of-sale terminals

- Phishing scams targeting online banking credentials

- Potential for check fraud, especially with paper checks

ATM Fees for Out-of-Network Withdrawals

Using ATMs outside of your bank’s network can result in fees from both your bank and the ATM operator.

- Cumulative effect of fees can be significant for frequent out-of-network users

- Limited access to free ATMs in certain geographic areas

- Potential for higher fees when traveling internationally

In conclusion, checking accounts remain an essential financial tool for most individuals, offering a blend of convenience, security, and functionality. However, the pros and cons of these accounts highlight the importance of careful consideration and management.

By understanding these advantages and disadvantages, consumers can make informed decisions about how to best utilize checking accounts within their broader financial strategy.

It’s crucial to compare different account offerings, read the fine print regarding fees and requirements, and consider how a checking account fits into one’s overall financial goals and lifestyle.

Frequently Asked Questions About Checking Account Pros And Cons

- What is the main advantage of a checking account over a savings account?

The primary advantage of a checking account is the ease of access for daily transactions. Unlike savings accounts, checking accounts typically offer unlimited withdrawals and transfers, making them ideal for regular spending and bill payments. - Are there any checking accounts that offer high interest rates?

Yes, some online banks and credit unions offer high-yield checking accounts with competitive interest rates. However, these accounts often come with specific requirements such as maintaining a minimum balance or making a certain number of debit card transactions per month. - How can I avoid checking account fees?

To avoid fees, maintain the required minimum balance, use in-network ATMs, opt for electronic statements, and set up direct deposit. Some banks also offer fee waivers for students or seniors, or if you maintain multiple accounts with the institution. - Is it better to have multiple checking accounts or just one?

Having multiple checking accounts can be beneficial for budgeting purposes or separating personal and business expenses. However, managing multiple accounts can be more complex and may increase the risk of incurring fees if minimum balance requirements are not met across all accounts. - What should I consider when choosing between a traditional bank and an online bank for my checking account?

Consider factors such as interest rates, fee structures, ATM access, and the importance of in-person banking services. Online banks often offer higher interest rates and lower fees but may lack physical branch locations for face-to-face interactions. - How does overdraft protection work, and is it worth having?

Overdraft protection links your checking account to another account or a line of credit to cover transactions when your balance is insufficient. While it can prevent declined transactions and NSF fees, it often comes with its own fees and may encourage overspending. - Are there any tax implications for maintaining a checking account?

Generally, checking accounts do not have significant tax implications as the interest earned is typically minimal. However, any interest earned is considered taxable income and should be reported on your tax return. - How secure are online and mobile banking features for checking accounts?

Online and mobile banking features are generally secure when using reputable banks with robust encryption and multi-factor authentication. However, users should practice good cybersecurity habits, such as using strong passwords and avoiding public Wi-Fi for banking transactions.