Corporate bonds are debt securities issued by companies to raise capital for various purposes, such as funding operations, expansion, or refinancing existing debt. These financial instruments play a crucial role in the global economy, offering investors an opportunity to lend money to corporations in exchange for regular interest payments and the return of principal at maturity. As with any investment, corporate bonds come with their own set of advantages and disadvantages that investors must carefully consider.

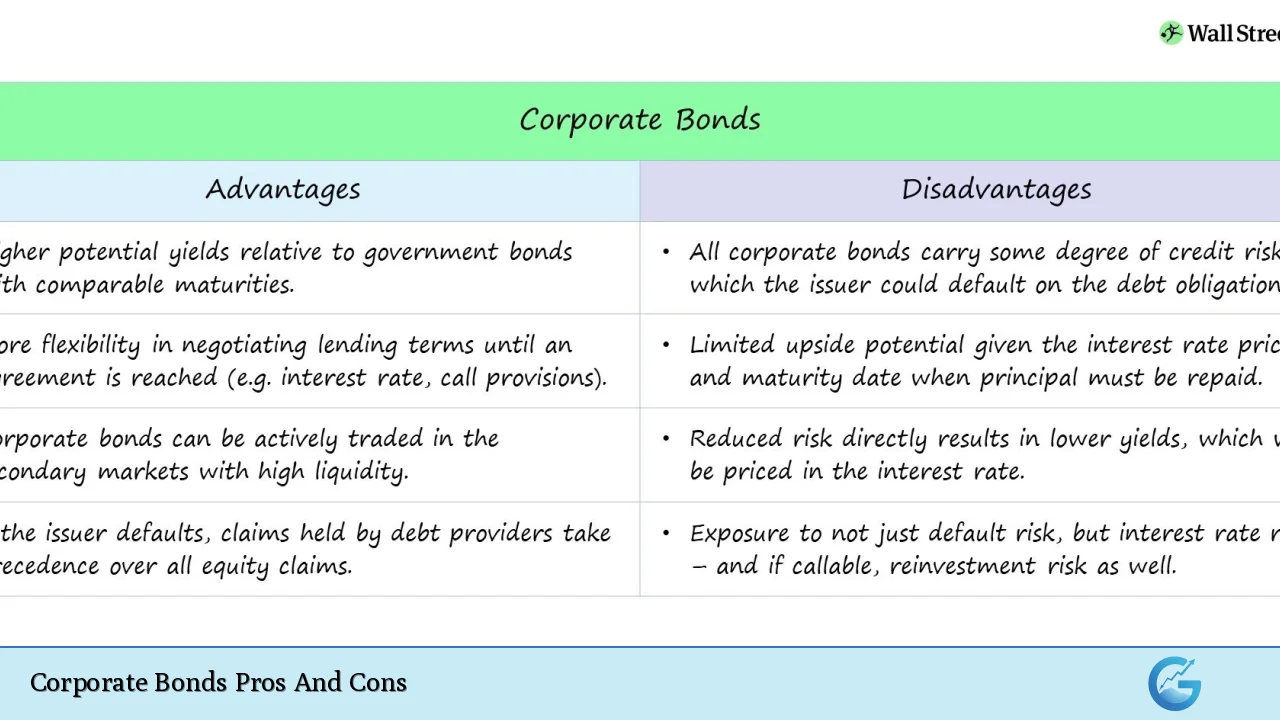

| Pros | Cons |

|---|---|

| Higher Yields | Credit Risk |

| Regular Income Stream | Interest Rate Risk |

| Portfolio Diversification | Lower Capital Appreciation Potential |

| Liquidity | Call Risk |

| Lower Volatility than Stocks | Inflation Risk |

| Variety of Options | Complexity |

| Potential Tax Benefits | Opportunity Cost |

| Capital Preservation | Event Risk |

Advantages of Corporate Bonds

Higher Yields

Corporate bonds typically offer higher yields compared to government bonds or other low-risk investments. This yield premium compensates investors for taking on additional risk associated with lending to corporations rather than governments. The yield difference, known as the credit spread, can vary significantly based on the issuing company’s creditworthiness, market conditions, and the bond’s maturity.

For example:

- A 10-year U.S. Treasury bond might yield 2.5%

- A high-quality corporate bond (AAA-rated) with the same maturity could yield 3.5%

- A lower-rated corporate bond (BBB-rated) might offer a yield of 4.5% or higher

This yield advantage can be particularly attractive in low-interest-rate environments, where investors are seeking ways to enhance their portfolio returns.

Regular Income Stream

Corporate bonds provide investors with a predictable income stream through regular interest payments, typically made semi-annually. This feature makes corporate bonds particularly appealing to income-focused investors, such as retirees or those seeking to supplement their earnings.

Benefits of regular income:

- Helps with budgeting and financial planning

- Can be reinvested to compound returns

- Provides a cushion against market volatility in other asset classes

Portfolio Diversification

Adding corporate bonds to an investment portfolio can enhance diversification, potentially reducing overall risk. Corporate bonds often have a low or negative correlation with stocks, which means they may perform differently under various market conditions.

Diversification benefits:

- Helps balance risk across different asset classes

- Can smooth out portfolio returns over time

- Provides exposure to different sectors of the economy

Liquidity

Many corporate bonds, especially those issued by large, well-known companies, are highly liquid. This means investors can buy or sell these bonds relatively easily in the secondary market without significantly impacting the price.

Liquidity advantages:

- Allows investors to adjust their portfolio as needed

- Provides flexibility to respond to changing market conditions or personal circumstances

- Can potentially lead to better pricing and lower transaction costs

Lower Volatility than Stocks

Corporate bonds generally exhibit lower price volatility compared to stocks, making them a more stable investment option. This reduced volatility can be particularly attractive to risk-averse investors or those nearing retirement who want to preserve capital.

Stability benefits:

- Helps protect portfolio value during market downturns

- Can provide a more consistent return profile over time

- Allows for more predictable financial planning

Variety of Options

The corporate bond market offers a wide range of investment options, allowing investors to tailor their portfolios to specific risk tolerances, income needs, and investment horizons.

Options include:

- Different credit qualities (from investment-grade to high-yield)

- Various maturities (short-term to long-term)

- Fixed-rate, floating-rate, or inflation-linked bonds

- Bonds from different sectors and industries

Potential Tax Benefits

In some cases, corporate bonds may offer tax advantages, although these are generally less significant than those associated with municipal bonds. For instance, certain corporate bonds issued by U.S. companies may qualify for preferential tax treatment on interest payments for non-U.S. investors.

Additionally, investors can potentially manage their tax liability by:

- Holding bonds in tax-advantaged accounts

- Utilizing tax-loss harvesting strategies

- Considering zero-coupon bonds for long-term goals

Capital Preservation

For investors who hold corporate bonds to maturity, there is a high likelihood of receiving the full face value of the bond, assuming the issuing company doesn’t default. This feature makes corporate bonds an attractive option for capital preservation, especially when compared to more volatile investments like stocks.

Capital preservation benefits:

- Provides a degree of certainty for future planning

- Can help protect wealth in uncertain economic times

- Allows for more conservative investment strategies as investors age

Disadvantages of Corporate Bonds

Credit Risk

One of the primary risks associated with corporate bonds is credit risk, also known as default risk. This is the possibility that the issuing company may fail to make interest payments or repay the principal at maturity. While this risk is generally lower for investment-grade bonds, it becomes more significant for high-yield or “junk” bonds.

Factors influencing credit risk:

- Company’s financial health and business prospects

- Economic conditions and industry trends

- Regulatory changes or legal issues

Investors can mitigate credit risk by:

- Diversifying across multiple issuers and sectors

- Focusing on higher-rated bonds

- Regularly monitoring the financial health of bond issuers

Interest Rate Risk

Corporate bonds, like all fixed-income securities, are subject to interest rate risk. When interest rates rise, the market value of existing bonds typically falls, as newer bonds are issued with higher yields. Conversely, when interest rates fall, bond prices generally rise.

Interest rate risk factors:

- Bond duration (longer-term bonds are more sensitive to rate changes)

- Current interest rate environment

- Economic outlook and central bank policies

Strategies to manage interest rate risk:

- Laddering bond maturities

- Investing in floating-rate bonds

- Using interest rate derivatives for hedging (for sophisticated investors)

Lower Capital Appreciation Potential

Compared to stocks, corporate bonds generally offer limited potential for capital appreciation. While bond prices can increase due to factors such as improving credit quality or falling interest rates, these gains are typically modest compared to the potential upside of equity investments.

Limitations on capital appreciation:

- Fixed par value at maturity

- Predetermined interest payments

- Limited upside from company growth or success

Call Risk

Many corporate bonds come with call provisions, allowing the issuer to redeem the bonds before maturity. This feature can be disadvantageous for investors, especially in a falling interest rate environment, as it may force them to reinvest at lower rates.

Call risk considerations:

- Potential loss of higher-yielding investments

- Reinvestment risk in lower interest rate environments

- Reduced price appreciation potential for callable bonds

Inflation Risk

Corporate bonds, particularly those with fixed interest rates, are vulnerable to inflation risk. If inflation rates rise significantly, the real (inflation-adjusted) return on the bond may decrease, potentially resulting in a loss of purchasing power for the investor.

Inflation risk factors:

- Long-term economic trends

- Monetary and fiscal policies

- Global supply and demand dynamics

Strategies to mitigate inflation risk:

- Investing in inflation-linked bonds

- Diversifying across different asset classes

- Regularly reviewing and adjusting portfolio allocations

Complexity

The corporate bond market can be complex, with various types of bonds, credit ratings, and terms. This complexity can make it challenging for individual investors to fully understand the risks and potential returns associated with different bond investments.

Complexity challenges:

- Understanding bond covenants and indentures

- Interpreting credit ratings and financial metrics

- Navigating the over-the-counter (OTC) bond market

Opportunity Cost

Investing in corporate bonds may come with an opportunity cost, especially during periods of strong economic growth or bull markets in equities. The relatively stable returns of corporate bonds might lag behind the potential gains from more aggressive investments, such as stocks or real estate.

Opportunity cost considerations:

- Long-term growth potential of alternative investments

- Individual risk tolerance and investment goals

- Overall portfolio allocation and diversification strategy

Event Risk

Corporate bonds are subject to event risk, which refers to the possibility of unexpected events negatively impacting the issuer’s ability to meet its debt obligations. These events can include mergers, acquisitions, restructurings, or significant changes in the regulatory environment.

Examples of event risk:

- Leveraged buyouts that increase the company’s debt load

- Major litigation or regulatory fines

- Sudden changes in industry dynamics or technology

Conclusion

Corporate bonds offer a unique set of advantages and disadvantages that investors must carefully weigh against their financial goals, risk tolerance, and overall investment strategy. While they can provide attractive yields, regular income, and portfolio diversification benefits, they also come with risks such as credit risk, interest rate sensitivity, and potential complexity. By understanding these pros and cons, investors can make more informed decisions about incorporating corporate bonds into their investment portfolios and potentially enhance their long-term financial outcomes.

Frequently Asked Questions About Corporate Bonds Pros And Cons

- How do corporate bonds compare to government bonds in terms of risk and return?

Corporate bonds generally offer higher yields than government bonds but come with increased credit risk. Government bonds are considered safer due to the backing of the government, while corporate bonds’ risk varies based on the issuing company’s financial health. - Can corporate bonds protect against stock market volatility?

Yes, corporate bonds can help protect against stock market volatility. They typically have lower price volatility than stocks and often move independently of equity markets, providing diversification benefits to a portfolio. - What factors should I consider when evaluating corporate bonds?

Key factors to consider include the bond’s credit rating, yield, maturity date, and the financial health of the issuing company. Additionally, consider the bond’s sensitivity to interest rate changes and any call provisions. - Are corporate bonds suitable for all types of investors?

Corporate bonds can be suitable for many investors, but their appropriateness depends on individual financial goals, risk tolerance, and investment horizon. They are particularly attractive for income-focused investors and those seeking to balance riskier assets in their portfolio. - How does inflation affect corporate bond investments?

Inflation can erode the real returns of corporate bonds, especially those with fixed interest rates. In high inflation environments, the purchasing power of the bond’s interest payments and principal repayment may decrease over time. - What is the difference between investment-grade and high-yield corporate bonds?

Investment-grade bonds are issued by companies with strong credit ratings and are considered lower risk. High-yield or “junk” bonds are issued by companies with lower credit ratings, offering higher yields but with increased default risk. - How can I mitigate the risks associated with corporate bond investments?

Risks can be mitigated through diversification across different issuers, sectors, and maturities. Additionally, focusing on higher-rated bonds, regularly monitoring issuers’ financial health, and considering bond funds or ETFs can help manage risk. - Are there tax advantages to investing in corporate bonds?

While corporate bonds generally don’t offer the same tax advantages as municipal bonds, they may still have tax benefits in certain situations. Interest income is typically taxable at the federal level, but some corporate bonds may offer tax advantages for non-U.S. investors or when held in tax-advantaged accounts.