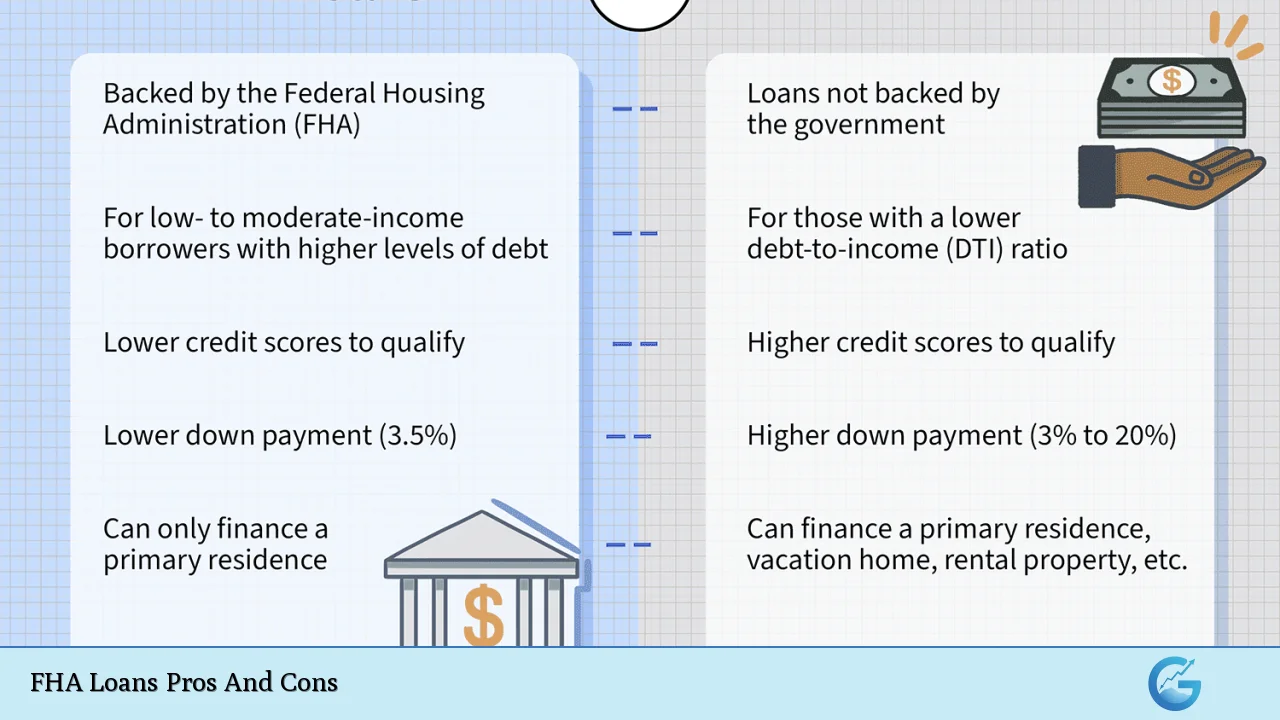

FHA loans, backed by the Federal Housing Administration, provide a pathway to homeownership for many Americans, particularly those with lower credit scores or limited savings. These loans are designed to make purchasing a home more accessible, especially for first-time buyers. However, while FHA loans offer several advantages, they also come with their own set of drawbacks. Understanding both sides is crucial for potential borrowers to make informed decisions about their financing options.

| Pros | Cons |

|---|---|

| Lower minimum credit score requirements | Mandatory mortgage insurance premiums (MIP) |

| Minimal down payment options (as low as 3.5%) | Loan limits vary by county and can be restrictive |

| More lenient debt-to-income ratio standards | Stricter property appraisal standards |

| Potentially lower interest rates for low-credit borrowers | Less variety in loan options compared to conventional loans |

| Assumable loans can be a selling point | Longer processing times due to additional requirements |

| Allows for gifts and grants for down payments | Not suitable for investment properties or second homes |

| Flexible qualification criteria for self-employed individuals | Higher overall costs if you have good credit and a larger down payment |

| FHA loans can be refinanced easily into conventional loans later on | Limited availability of FHA-approved condos and properties |

Lower Minimum Credit Score Requirements

One of the most significant advantages of FHA loans is their leniency regarding credit scores. Borrowers can qualify with a minimum score of 580, which is considerably lower than the typical requirement of 620 for conventional loans. This accessibility allows individuals with less-than-perfect credit histories to secure financing.

- Benefit: FHA loans open doors for many who might otherwise struggle to obtain a mortgage.

- Impact: This feature is particularly beneficial for first-time homebuyers or those recovering from financial difficulties.

Minimal Down Payment Options

FHA loans require a down payment as low as 3.5% of the purchase price, making them an attractive option for buyers who may not have substantial savings.

- Benefit: This lower barrier to entry enables more people to enter the housing market.

- Example: For a $250,000 home, a buyer would need only $8,750 compared to $12,500 or more required by conventional loans.

More Lenient Debt-to-Income Ratio Standards

FHA guidelines allow for higher debt-to-income (DTI) ratios than many conventional lenders. Borrowers can qualify with DTI ratios up to 43%, and in some cases, even higher if compensating factors are present.

- Benefit: This flexibility can help borrowers manage existing debts while still qualifying for a mortgage.

- Consideration: It allows individuals with student loans or other debts to pursue homeownership without being overly constrained.

Potentially Lower Interest Rates

For borrowers with lower credit scores, FHA loans often provide competitive interest rates that are not as heavily penalized as those offered by conventional lenders.

- Benefit: This can lead to substantial savings over the life of the loan.

- Comparison: FHA rates tend to be comparable to VA loan rates, making them an appealing option for eligible borrowers.

Assumable Loans Can Be a Selling Point

FHA loans are assumable, meaning that if you sell your home, the buyer can take over your existing FHA loan under its current terms.

- Benefit: This feature can be advantageous in a rising interest rate environment, making your property more attractive to potential buyers.

- Market Impact: It provides an edge in negotiations when selling your home.

Allows for Gifts and Grants for Down Payments

FHA guidelines permit family members or friends to contribute towards the down payment or closing costs through gifts or grants.

- Benefit: This support can significantly ease the financial burden on first-time buyers.

- Flexibility: It enables buyers to leverage community resources and family support in their home purchasing journey.

Flexible Qualification Criteria for Self-Employed Individuals

Self-employed individuals may find it easier to qualify for an FHA loan than a conventional one due to more flexible income verification requirements.

- Benefit: This is particularly helpful in industries where income can fluctuate significantly.

- Documentation: While documentation is still required, it tends to be less stringent compared to conventional options.

Mandatory Mortgage Insurance Premiums (MIP)

One of the primary disadvantages of FHA loans is the requirement for mortgage insurance premiums (MIP). Borrowers must pay an upfront premium at closing and monthly premiums throughout the life of the loan.

- Cost Implication: This adds significant costs over time, especially if you have good credit and could qualify for better terms elsewhere.

- Long-Term Expense: MIP can last for the life of the loan unless specific conditions are met.

Loan Limits Vary by County

FHA loans come with maximum loan limits that vary by county based on local housing market conditions.

- Limitation: In high-cost areas, these limits may restrict borrowing capacity compared to conventional financing options.

- Example: In some metropolitan areas, buyers may find that they cannot purchase their desired home within FHA lending limits.

Stricter Property Appraisal Standards

Properties financed through FHA loans must meet specific health and safety standards as determined by an FHA-approved appraisal.

- Challenge: This requirement can limit available properties and complicate purchases of homes needing repairs.

- Outcome: Buyers may need to invest additional time and resources into ensuring properties meet these standards before closing.

Less Variety in Loan Options Compared to Conventional Loans

FHA loans offer fewer options regarding loan types compared to conventional mortgages.

- Limitation: Borrowers looking for adjustable-rate mortgages or unique financing structures may find limited choices.

- Impact on Buyers: This lack of variety could hinder those looking for tailored mortgage solutions that better fit their financial strategies.

Longer Processing Times Due to Additional Requirements

The application process for FHA loans often takes longer than that of conventional mortgages due to stricter documentation and approval processes.

- Frustration Factor: Delays can occur during underwriting as additional information may be required from borrowers.

- Market Timing: In competitive markets, longer processing times could result in missed opportunities on desirable properties.

Not Suitable for Investment Properties or Second Homes

FHA loans are intended solely for primary residences; thus, they cannot be used to purchase investment properties or vacation homes.

- Limitation: This restriction excludes potential buyers interested in real estate investing.

- Market Impact: Investors seeking financing options must explore other avenues that allow multiple property purchases.

Higher Overall Costs If You Have Good Credit and a Larger Down Payment

For borrowers with strong credit profiles who can afford larger down payments, FHA loans may end up being more expensive than conventional alternatives due to MIP requirements and potentially higher interest rates.

- Cost Analysis: It’s essential for such borrowers to compare total costs between FHA and conventional options before deciding.

- Long-Term Financial Planning: Evaluating long-term expenses is crucial when considering which loan type aligns best with financial goals.

Limited Availability of FHA-approved Condos and Properties

Finding suitable condos or multi-family units that meet FHA approval criteria can be challenging due to strict guidelines imposed by the program.

- Market Challenge: Buyers interested in condos may face limited choices within their desired locations.

- Approval Process: The process of getting a condo approved by the FHA can be lengthy and complicated.

In conclusion, while FHA loans provide significant benefits that make homeownership attainable for many individuals—especially first-time buyers—they also come with notable drawbacks that potential borrowers should carefully consider. Understanding both the pros and cons will help you make informed decisions about whether an FHA loan aligns with your financial situation and long-term goals.

Frequently Asked Questions About FHA Loans

- What is an FHA loan?

An FHA loan is a mortgage insured by the Federal Housing Administration designed to help lower-income borrowers qualify for home financing. - Who qualifies for an FHA loan?

Borrowers typically need a minimum credit score of 580 and must occupy the property as their primary residence. - What are the down payment requirements?

The minimum down payment is 3.5% if your credit score is 580 or higher; otherwise, it’s 10%. - Are there any income limits?

No specific income limits exist; however, lenders will assess your financial situation based on debt-to-income ratios. - Can I use an FHA loan for investment properties?

No, FHA loans are strictly intended for primary residences only. - What happens if I default on my FHA loan?

If you default, the lender will pursue foreclosure; however, since these loans are insured by the government, lenders are protected against losses. - How long does it take to get approved?

The approval process can vary but typically takes longer than conventional mortgages due to additional documentation requirements. - Can I refinance my FHA loan?

Yes, you can refinance into another FHA loan or switch to a conventional mortgage once you build enough equity.

Understanding these aspects will empower potential homeowners as they navigate their financing options in today’s complex housing market.