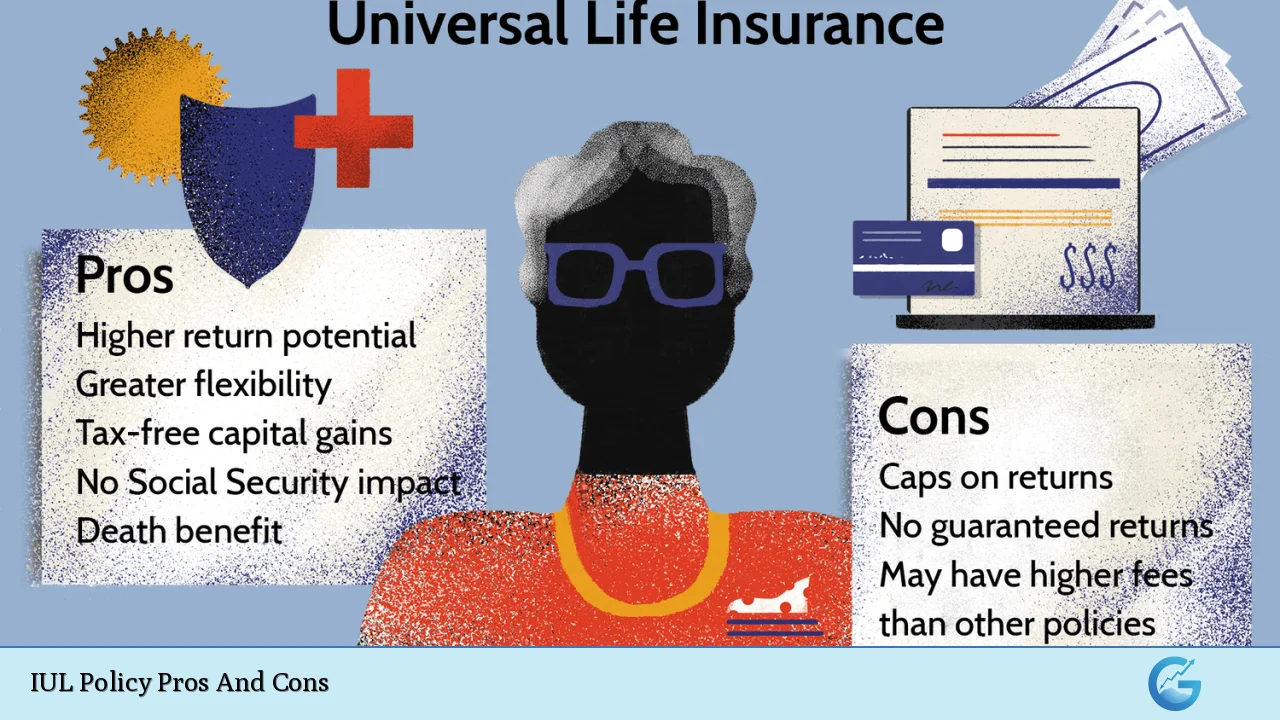

Indexed Universal Life (IUL) insurance policies have gained significant attention in the financial world, offering a unique blend of life insurance coverage and investment potential. These policies are designed to provide policyholders with the opportunity to benefit from market gains while offering protection against market downturns. As with any financial product, IUL policies come with their own set of advantages and disadvantages that potential investors should carefully consider.

| Pros | Cons |

|---|---|

| Potential for higher returns | Complex structure |

| Downside protection | Cap on returns |

| Tax-free growth and distributions | Higher fees and costs |

| Flexible premium payments | Policy lapse risk |

| Death benefit for beneficiaries | Potential for reduced death benefit |

| Access to cash value | Surrender charges |

| No contribution limits | Complexity in choosing indices |

| Potential for long-term wealth accumulation | Requires active management |

Potential for Higher Returns

One of the most attractive features of IUL policies is the potential for higher returns compared to traditional life insurance products. IUL policies allow policyholders to participate in market gains without directly investing in the stock market. The cash value component of the policy is linked to the performance of a specific market index, such as the S&P 500 or the Nasdaq Composite.

- Opportunity to benefit from market upswings

- Potential for greater cash value accumulation over time

- Diversification of investment portfolio within a life insurance framework

However, it’s crucial to understand that while the potential for higher returns exists, it’s not guaranteed. The actual performance of an IUL policy depends on various factors, including the chosen index, market conditions, and the specific terms of the policy.

Downside Protection

A significant advantage of IUL policies is the built-in downside protection. Unlike direct investments in the stock market, IUL policies typically offer a guaranteed minimum interest rate or “floor,” often set at 0% or 1%. This feature ensures that even in years when the market performs poorly, the policyholder’s cash value is protected from losses.

- Preservation of principal during market downturns

- Peace of mind for risk-averse investors

- Stability in volatile market conditions

This downside protection can be particularly appealing for individuals nearing retirement or those with a lower risk tolerance. It provides a level of security that is not available with many other investment vehicles tied to market performance.

Tax-Free Growth and Distributions

One of the most compelling advantages of IUL policies is their tax treatment. The cash value within an IUL policy grows on a tax-deferred basis, and policyholders can potentially access this cash value through tax-free loans or withdrawals. This feature can be particularly beneficial for high-income earners looking for tax-efficient ways to supplement their retirement income.

- Tax-deferred growth of cash value

- Potential for tax-free income in retirement

- No penalties for early withdrawals (unlike some retirement accounts)

However, it’s important to note that to maintain the tax-free status of distributions, the policy must remain in force and not be considered a Modified Endowment Contract (MEC). Proper management and understanding of IRS guidelines are crucial to maximize this benefit.

Flexible Premium Payments

IUL policies offer a level of flexibility not typically found in traditional life insurance products. Policyholders can adjust their premium payments within certain limits, allowing for adaptability to changing financial circumstances. This flexibility can be particularly valuable during economic downturns or personal financial challenges.

- Ability to increase or decrease premium payments

- Option to use cash value to cover premium costs

- Potential to skip payments if sufficient cash value is available

While this flexibility is advantageous, it’s important to maintain adequate funding to keep the policy in force and achieve long-term financial goals.

Death Benefit for Beneficiaries

At its core, an IUL policy is still a life insurance product. It provides a death benefit to the policyholder’s beneficiaries, offering financial protection for loved ones. The death benefit is typically paid out tax-free to beneficiaries, providing a significant financial resource for families in the event of the insured’s death.

- Financial security for beneficiaries

- Tax-free death benefit payout

- Option to increase or decrease death benefit over time

The ability to adjust the death benefit can be particularly useful as financial needs change over time, such as paying off a mortgage or funding a child’s education.

Access to Cash Value

IUL policies allow policyholders to access the cash value that accumulates within the policy. This access can be through policy loans or withdrawals, providing a source of liquidity that can be used for various purposes, such as supplementing retirement income, funding education expenses, or covering unexpected costs.

- Flexible access to accumulated funds

- Potential source of emergency funds

- Option for policy loans at competitive interest rates

However, it’s crucial to understand that excessive loans or withdrawals can impact the policy’s performance and death benefit. Careful management and consultation with a financial advisor are recommended.

No Contribution Limits

Unlike many retirement accounts, such as 401(k)s or IRAs, IUL policies do not have annual contribution limits imposed by the IRS. This feature allows high-income earners or those looking to catch up on their savings to potentially contribute more to their IUL policy than they could to traditional retirement accounts.

- Opportunity for substantial cash value accumulation

- Flexibility in funding strategy

- Potential for high-income earners to save more on a tax-advantaged basis

While the lack of contribution limits offers flexibility, it’s important to structure the policy carefully to avoid it becoming a Modified Endowment Contract (MEC), which could negate some of the tax advantages.

Potential for Long-Term Wealth Accumulation

When properly structured and managed, IUL policies can serve as powerful tools for long-term wealth accumulation. The combination of tax-deferred growth, potential market-linked returns, and downside protection can create a favorable environment for building substantial cash value over time.

- Compound growth potential

- Diversification of retirement savings strategy

- Opportunity for legacy planning

However, achieving significant wealth accumulation through an IUL policy requires careful planning, consistent funding, and a long-term perspective. It’s not a short-term investment vehicle and should be considered as part of a comprehensive financial strategy.

Complex Structure

One of the primary drawbacks of IUL policies is their complex structure. These policies involve intricate mechanisms for crediting interest, calculating policy charges, and determining cash value growth. This complexity can make it challenging for policyholders to fully understand how their policy works and what factors influence its performance.

- Difficulty in comparing different IUL products

- Potential for misunderstanding policy terms and features

- Need for ongoing education and professional guidance

The complexity of IUL policies underscores the importance of working with a knowledgeable financial advisor who can explain the nuances of the policy and help make informed decisions.

Cap on Returns

While IUL policies offer the potential for higher returns compared to traditional life insurance products, they typically come with a cap on the maximum return that can be credited to the policy. This cap limits the upside potential, especially during years of exceptional market performance.

- Limitation on participating in substantial market gains

- Potential for underperformance compared to direct market investments

- Variability in cap rates between different policies and insurers

Understanding the impact of caps on long-term performance is crucial when evaluating an IUL policy. It’s important to consider realistic return expectations rather than focusing solely on best-case scenarios.

Higher Fees and Costs

IUL policies generally come with higher fees and costs compared to term life insurance or some other investment vehicles. These costs can include mortality charges, administrative fees, cost of insurance, and fees associated with optional riders. Over time, these expenses can significantly impact the policy’s cash value growth.

- Potential for reduced overall returns due to fees

- Complexity in understanding all associated costs

- Impact on cash value accumulation, especially in early years

Careful analysis of the fee structure and its long-term impact is essential when considering an IUL policy. It’s important to weigh these costs against the potential benefits and compare them with alternative investment options.

Policy Lapse Risk

One of the significant risks associated with IUL policies is the potential for policy lapse if not properly funded or managed. If the cash value becomes insufficient to cover the policy’s costs and charges, the policy may lapse, potentially resulting in the loss of coverage and tax consequences.

- Risk of losing life insurance coverage

- Potential tax implications if policy lapses with outstanding loans

- Need for ongoing monitoring and management

To mitigate this risk, it’s crucial to maintain adequate funding levels and regularly review the policy’s performance with a financial advisor.

Potential for Reduced Death Benefit

While IUL policies offer a death benefit, certain actions can reduce this benefit over time. Taking loans or withdrawals from the policy’s cash value can decrease the death benefit, potentially leaving beneficiaries with less protection than initially planned.

- Impact of loans and withdrawals on death benefit

- Need to balance cash value access with maintaining adequate coverage

- Importance of regular policy reviews to ensure alignment with financial goals

Understanding how various policy actions affect the death benefit is crucial for maintaining the intended level of protection for beneficiaries.

Surrender Charges

IUL policies typically come with surrender charges, which are fees imposed if the policyholder cancels the policy within a specified period, often ranging from 10 to 15 years. These charges can be substantial, especially in the early years of the policy, and can significantly reduce the cash value available if the policy is terminated prematurely.

- Potential for significant financial loss if policy is surrendered early

- Limited liquidity in early years of the policy

- Need for long-term commitment to maximize policy benefits

Understanding the surrender charge schedule and considering one’s long-term financial plans are crucial when evaluating an IUL policy.

Complexity in Choosing Indices

IUL policies often offer multiple index options for linking the cash value growth. While this can provide diversification, it also adds complexity to the decision-making process. Choosing the right mix of indices requires understanding market dynamics and how different indices may perform under various economic conditions.

- Need for ongoing market analysis and adjustment

- Potential for suboptimal performance if indices are not well-chosen

- Complexity in understanding how different indexing strategies impact returns

Working with a financial advisor who understands both insurance products and market dynamics can be crucial in navigating these choices effectively.

Requires Active Management

Unlike some “set it and forget it” financial products, IUL policies often require active management to optimize performance and ensure they continue to meet the policyholder’s financial objectives. This includes monitoring cash value growth, adjusting premium payments if necessary, managing any loans or withdrawals, and potentially reallocating among different index options.

- Need for regular policy reviews and adjustments

- Importance of staying informed about policy performance and market conditions

- Potential for suboptimal results without proper management

The requirement for active management underscores the importance of working with a knowledgeable financial advisor and being personally engaged in understanding and managing the policy.

In conclusion, Indexed Universal Life insurance policies offer a unique combination of life insurance protection and potential for cash value growth linked to market performance. While they provide several attractive features such as downside protection, tax advantages, and flexibility, they also come with complexities and potential drawbacks that require careful consideration. Prospective policyholders should thoroughly evaluate their financial goals, risk tolerance, and long-term objectives before deciding if an IUL policy is the right fit for their financial strategy. As with any significant financial decision, consulting with a qualified financial advisor is crucial to understanding the full implications of an IUL policy and how it fits into one’s overall financial plan.

Frequently Asked Questions About IUL Policy Pros And Cons

- How does an IUL policy differ from traditional universal life insurance?

IUL policies link cash value growth to market index performance, potentially offering higher returns than traditional universal life. However, they also come with more complexity and potential risks. - Can I lose money in an IUL policy?

While IUL policies typically have a guaranteed minimum interest rate (often 0% or 1%), poor market performance, high fees, or inadequate funding can result in reduced cash value. Proper management is crucial to avoid potential losses. - Are the returns in an IUL policy guaranteed?

No, returns in an IUL policy are not guaranteed beyond the minimum interest rate. Actual returns depend on index performance, policy fees, and how the crediting method is structured. - How do taxes work with IUL policies?

Cash value in IUL policies grows tax-deferred, and withdrawals or loans can potentially be tax-free if managed correctly. However, surrendering the policy or allowing it to lapse can result in taxable events. - Can I adjust my premium payments in an IUL policy?

Yes, IUL policies typically offer flexible premium payments. You can often increase, decrease, or even skip payments, provided there’s sufficient cash value to cover policy costs. - What happens if I can’t pay the premiums on my IUL policy?

If premiums are not paid and there’s insufficient cash value to cover policy costs, the policy may lapse. This can result in loss of coverage and potential tax consequences. - How does the death benefit work in an IUL policy?

IUL policies provide a death benefit to beneficiaries, typically tax-free. The death benefit can often be adjusted over time, but taking loans or withdrawals may reduce it. - Is an IUL policy a good option for retirement planning?

IUL policies can be a useful tool for retirement planning, offering tax advantages and potential for cash value growth. However, they should be considered as part of a diversified strategy rather than a sole retirement solution.